Previous Trading Day’s Events (12.04.2024)

“Overall, consumers are reserving judgment about the economy in light of the upcoming election, which, in the view of many consumers, could have a substantial impact on the trajectory of the economy,” said Surveys of Consumers Director Joanne Hsu in a statement.

One-year inflation expectations increased to 3.1% in April from 2.9% in March, rising just above the 2.3-3.0% range seen in the two years before the COVID-19 pandemic. The survey’s five-year inflation outlook rose to 3.0% from 2.8% in the prior month.

______________________________________________________________________

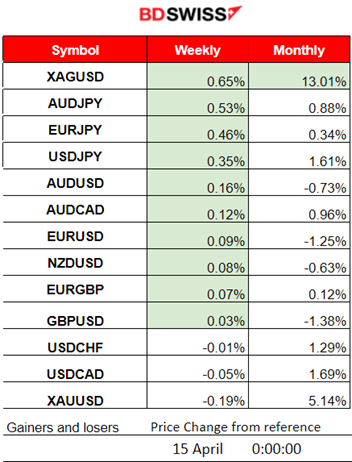

Winners vs Losers

The new week starts with Silver on the top. Silver remains in the lead this month with 13% gains so far. JPY seems to lose a lot of ground against major currencies currently.

______________________________________________________________________

______________________________________________________________________

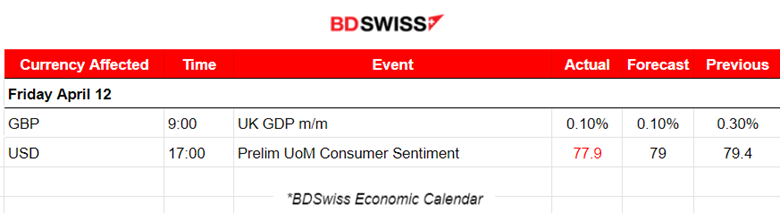

News Reports Monitor – Previous Trading Day (12.04.2024)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled releases.

- Morning – Day Session (European and N. American Session)

Real gross domestic product (GDP) is estimated to have grown by 0.1% in February 2024, following growth of 0.3% in January 2024 (revised up from 0.2% growth in our previous publication). The U.K. entered a technical recession at the end of 2023 after data showed two quarters of economic contraction. Still, the data show that it has grown slightly for the second month in a row, boosting hopes that the economy is escaping recession. No special impact on the GBP at that time.

The Prelim UoM Consumer Sentiment report showed that the Consumer Sentiment Index in the U.S. declined 1.9% in April compared to the month prior. The figure surged 22.3% on an annual level. The Index of Consumer Expectations dipped by 0.5% on a monthly basis but grew 27.1% on a yearly basis, coming in at 77. Year-ahead inflation expectations ticked up from 2.9% last month to 3.1% this month. No major impact was reported in the market.

General Verdict:

__________________________________________________________________

__________________________________________________________________

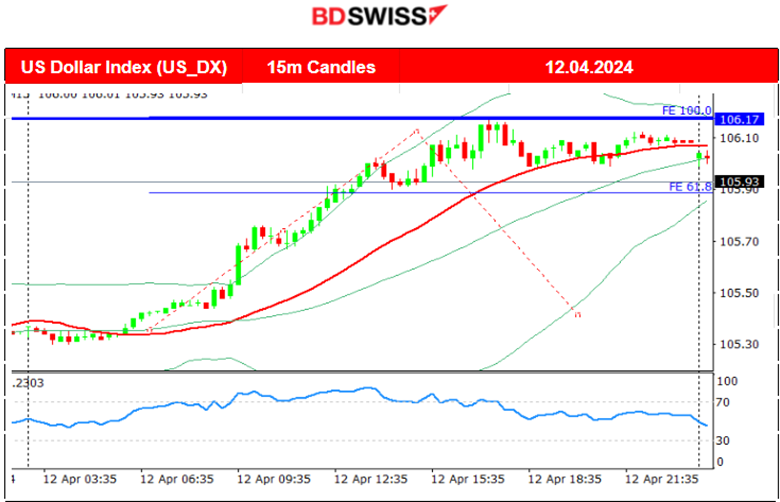

FOREX MARKETS MONITOR

EURUSD (12.04.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair started to dive early but moved steadily to the downside. This path was the result of dollar appreciation during the trading day that lasted until the start of the N. American session and the consumer sentiment (CS) news release. The news was not so good for the dollar however inflation expectations increased as per the report pushing for more future dollar-strengthening expectations. After the CS release the path was sideways around the mean without a full retracement to the 61.8 Fibo that could be seen eventually today.

___________________________________________________________________

___________________________________________________________________

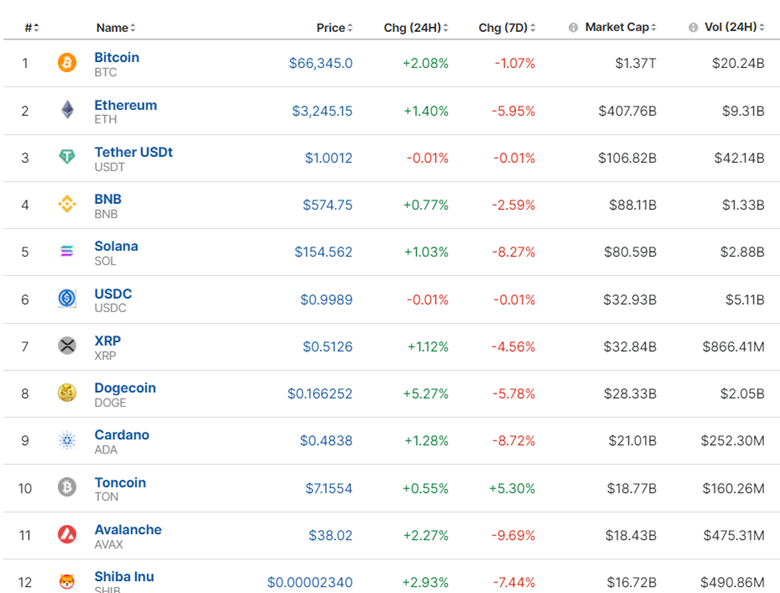

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) Chart Summary 1H

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Bitcoin is trading below 71K USD which was the peak last week on the 12th of April. Since then the price of bitcoin fell rapidly during the weekend reaching the lowest support near 60,280 USD level before retracing to the 30-period MA. Currently, the price crossed the 30-period MA suggesting the end of the short-term downtrend with hopes that volatility would turn to higher levels and potentially cause the price to reach the 71K USD level again soon.

Crypto sorted by Highest Market Cap:

Crypto sorted by Highest Market Cap:

The outlook does not seem good so far regarding any Crypto asset improvement in gains. For the last 7 days, we still see losses. The market recovered for 2 consecutive days so far but still has a long way to go. Currently, the short-term movement seems to be leaning more towards the upside.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

S&P500 (SPX500) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

A higher-than-expected inflation figure for the U.S. was released. This means that borrowing costs will remain high for a long time, causing a drop in U.S. indices on the 10th of April. The index found support near the 5,135 USD level before retracement took place. On the 11th of April, the index eventually saw a sharp movement upwards reaching the resistance at near 5,215 USD without retracement taking place. On the 12th of April, volatility continued being high and the index suffered a huge drop breaking the support at 5,135 USD, reaching the next level at 5,100 USD before eventually retracing to the 30-period MA. The RSI shows currently bullish signals even though it is not so clear.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Following Iran’s weekend attack on Israel, the price actually dropped flirting with the 84.3 USD/b again. That seems a critical support and its breakout could cause a significant drop. On the 12th of April, Crude oil experienced a sudden drop after 18:00 and the start of the N. American session.

The alternative scenario will depend on the main fundamental factors such as Israel’s reaction to the attack which will be key to global markets in the days and weeks ahead. Significant and longer-lasting price effects for a price increase instead would require a material disruption to supply.

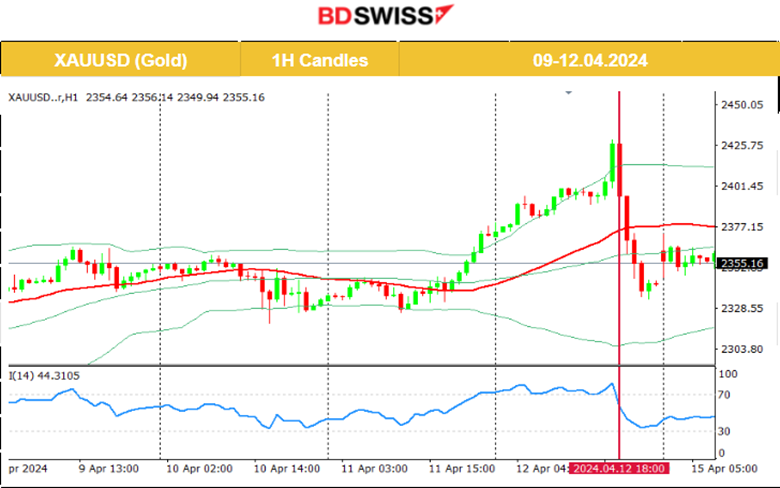

XAUUSD (Gold) 4-Day Chart Summary

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

It has been a long time since Gold has been quite resilient to the downside, even when we have news releases that cause the dollar to strengthen. The NFP data release did not manage to bring it down. The U.S. inflation report caused a heavy dollar strengthening but again Gold was not affected by a heavy drop, but rather kept its resilience. Currently, the U.S. dollar strengthening is in place and metals see more demand kicking in causing prices to rally. However on the 12th of April, Gold experienced a sudden drop after 18:00 and the start of the N.American session just like the price of oil. It seems that positions on these commodities have been closed ahead of the weekend, perhaps due to increased uncertainty.

______________________________________________________________

______________________________________________________________

News Reports Monitor – Today Trading Day (15 April 2024)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled releases.

- Morning – Day Session (European and N. American Session)

Retail Sales figures for the U.S. will be released at 15:30 today. These figures will be vital in understanding if eventually, sales will coincide with the strong labour market data and business data. They are expected to see growth again with the core figures expected to show more growth than previously reported. USD pairs could be affected by an intraday moderate shock.

General Verdict:

______________________________________________________________