Previous Trading Day’s Events (11.04.2024)

The central bank kept its deposit rate at 4.0%, where it has been since September. But, with inflation now close to the ECB’s 2% target, the ECB gave hints about a possible cut at its next meeting.

“If the Governing Council’s updated assessment of the inflation outlook, the dynamics of underlying inflation and the strength of monetary policy transmission were to further increase its confidence that inflation is converging to the target in a sustained manner, it would be appropriate to reduce the current level of monetary policy restriction,” the ECB said.

With Thursday’s decision, the ECB also left the interest rate on its daily and weekly loans for banks at 4.75% and 4.50% respectively.

Source: https://www.reuters.com/markets/europe/ecb-holds-rates-record-highs-signals-upcoming-cut-2024-04-11/

High inflation and persistent labour market strength have prompted financial markets and most economists to push back expectations for an initial Fed interest rate cut to September from June. Policymakers were concerned that progress on inflation might have stalled.

“Producer prices tell us that inflation is not worsening, yet,” said Christopher Rupkey, chief economist at FWDBONDS. “Policymakers can remain vigilant as they await more data on where inflation is heading next. Tamer producer prices may spell some relief for consumers in coming months.”

“Although the pace of disinflation has slowed, fears of a resurgence in inflation look overdone,” said Paul Ashworth, chief North America economist at Capital Economics.

______________________________________________________________________

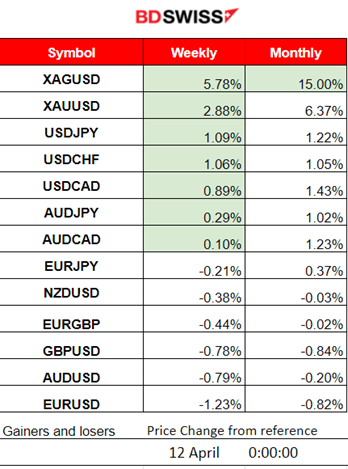

Winners vs Losers

Silver remains on the top of the week’s winners list with 5.78% gains while for the month has performed at 15%.

______________________________________________________________________

______________________________________________________________________

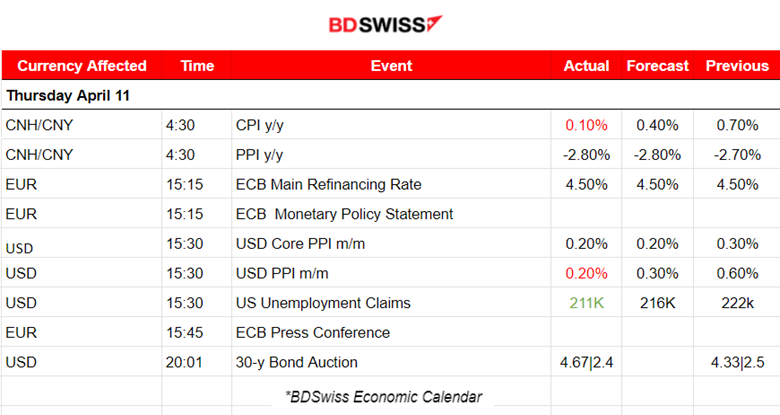

News Reports Monitor – Previous Trading Day (11.04.2024)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

China’s Consumer Price Index (CPI) rose 0.1% YoY in March, down from a 0.7% growth in February. The market forecast was for a 0.4% increase. Chinese CPI inflation came in at -1.0% over the month in March versus February’s 1.0% rise. China’s Producer Price Index (PPI) fell 2.8% YoY in March, compared with a 2.7% drop seen previously. No major impact was recorded at that time. USDCNH was following a slight intraday drop during the release.

- Morning – Day Session (European and N. American Session)

The European Central Bank (ECB) decided to hold interest rates steady for a fifth straight meeting and gave a strong signal that cuts are on the way despite the uncertainty in regards to the Fed’s decisions from now on after strong data in regards to the economy’s labour market, business and inflation. Lagarde: We are not going to wait for inflation to return to 2% before we make the ‘necessary decisions’. At the time of the release, the impact was not great but eventually, the result was EUR depreciation and dollar appreciation bringing the EURUSD down. The dollar index moved to the upside.

Producer Price Index (PPI) data reports for the U.S. showed that prices for final demand rose 0.2 percent in March. Final demand prices moved up 0.6% in February and 0.4 % in January. The producer price index increased less than the 0.3% estimate from the Dow Jones consensus. Excluding food and energy, core PPI also rose 0.2%, meeting expectations.

Unemployment claims were reported lower at 211K confirming a stronger labour market and coinciding with the hot NFP report.

General Verdict:

__________________________________________________________________

__________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (11.04.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair was moving with low volatility sideways until the start of the European session was near. After that volatility levels started to get higher the the pair moving below the 30-period MA until the ECB news. After the news the EUR experienced slight depreciation causing the pair to drop but only momentarily. It soon reversed and stayed close to the intraday mean without any significant deviation. The decision was already priced-in. However, after the press conference, it was quite clear that the ECB gave strong signals of cuts taking place soon causing further EUR weakening while on the other hand, the dollar gained strength as Fed cuts delays are more probable, thus the current fall of the EURUSD.

___________________________________________________________________

___________________________________________________________________

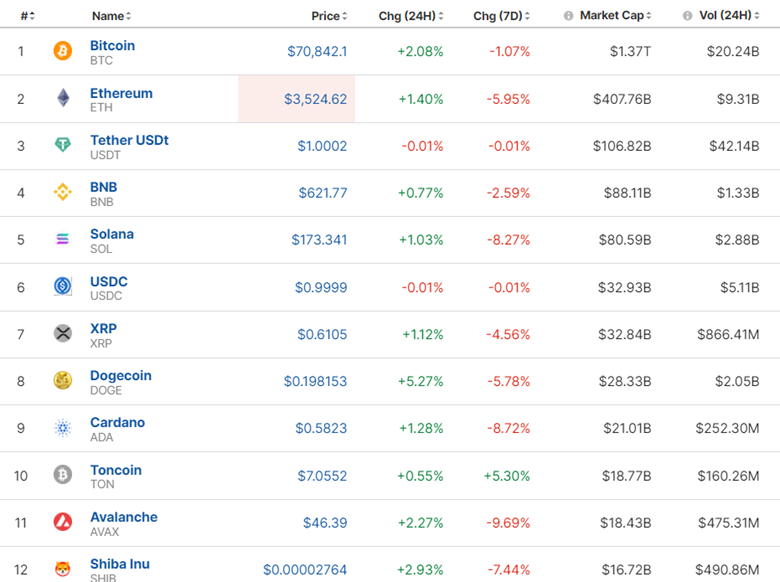

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) Chart Summary 1H

Server Time / Timezone EEST (UTC+02:00)

Price Movement

On the 9th of April, the price crossed the 30-period MA and stayed below it giving a strong signal that the uptrend has stopped. A sideways path was currently in place. Bitcoin experienced high volatility and moved around the 30-period MA and the mean which should currently be around 70K USD. After several attempts to break the resistance at 71,300 USD, it did not manage, but it seems it has pressure to move to the upside.

Crypto sorted by Highest Market Cap:

Crypto sorted by Highest Market Cap:

A volatile market at the moment but sideways. The most recent moves include a recovery to the upside thus the positive figures/gains for the last 24 hours.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

S&P500 (SPX500) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

It was apparent that volatility levels lowered as market participants were expecting the inflation report, in order to react greatly. An upward wedge was formed. Eventually, a breakout of the triangle/wedge formation took place as depicted below with the release of the higher-than-expected inflation figure for the U.S. This means that borrowing costs will remain high for a long time, causing this market reaction. All indices suffered a drop. The index found support near the 5,135 USD level before retracement took place. On the 11th of April, the index eventually saw a sharp movement upwards reaching the resistance at near 5,215 USD where it settled currently without retracement taking place.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Apparently, volatility levels for Crude oil are high, and the price experiences high deviations from the 30-period MA. However, these levels are getting lower and lower with the price moving sideways around the MA. The 84.3 USD/b remained a strong support while the 86 USD/b eventually was reached as mentioned in our previous analysis. The price is currently settled around the 85.2 USD/b mean.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

It has been a long time now since Gold has been quite resilient to the downside, even when we have news releases that cause the dollar to strengthen. The NFP data release did not manage to bring it down. The U.S. inflation report caused a heavy dollar strengthening but again Gold was not affected by a heavy drop, but rather kept its resilience. Currently, the U.S. dollar strengthening is in place and metals see more demand kicking in causing prices to rally.

______________________________________________________________

______________________________________________________________

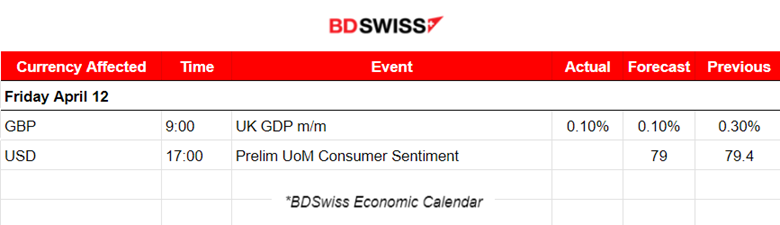

News Reports Monitor – Today Trading Day (12 April 2024)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled releases.

- Morning – Day Session (European and N. American Session)

Real gross domestic product (GDP) is estimated to have grown by 0.1% in February 2024, following growth of 0.3% in January 2024 (revised up from 0.2% growth in our previous publication). The U.K. entered a technical recession at the end of 2023 after data showed two quarters of economic contraction. Still, the data show that it has grown slightly for the second month in a row, boosting hopes that the economy is escaping recession. No special impact on the GBP at that time.

The Prelim UoM Consumer Sentiment will be released at 17:00 and the figure is expected to be reported lower. This is the preliminary release and thus tends to have the most impact. The USD pairs might experience strong movement in one direction if the reported figure is way further than the expected one.

General Verdict:

______________________________________________________________