UnitedHealth Group (NYSE: UNH), boasting the highest market capitalization of $404.91B among the companies set to report earnings this week, is slated to unveil its 2024 Q1 earnings report on Tuesday, April 16, 2024, prior to the market opening. Subsequently, a teleconference will convene at 8:45 a.m. ET for analysts and investors to delve into the outcomes, accessible via webcast on the Investor Relations page of the company’s website (www.unitedhealthgroup.com).

UnitedHealth Group (NYSE: UNH), boasting the highest market capitalization of $404.91B among the companies set to report earnings this week, is slated to unveil its 2024 Q1 earnings report on Tuesday, April 16, 2024, prior to the market opening. Subsequently, a teleconference will convene at 8:45 a.m. ET for analysts and investors to delve into the outcomes, accessible via webcast on the Investor Relations page of the company’s website (www.unitedhealthgroup.com).

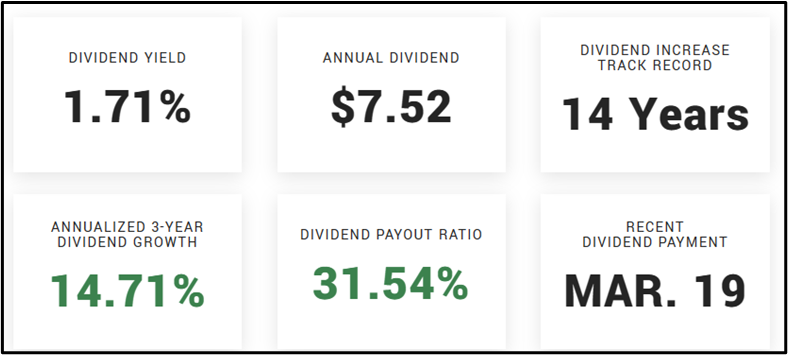

Dividend Update

UnitedHealth Group (UNH) presently offers an annual dividend yield of 1.71%, with an annual dividend per share standing at $7.52. Their latest quarterly dividend amounted to $1.88 per share, with an ex-date of March 8, 2024.

UnitedHealth Group (UNH) presently offers an annual dividend yield of 1.71%, with an annual dividend per share standing at $7.52. Their latest quarterly dividend amounted to $1.88 per share, with an ex-date of March 8, 2024.

2023 Q4 EARNINGS RECAP UnitedHealth Group’s financial performance in the fourth quarter of 2023 demonstrated robust growth across various metrics. Revenues surged to $94.4 billion, marking a significant increase from $82.8 billion in the same period the previous year. Simultaneously, earnings from operations reached $7.7 billion, showcasing notable growth compared to $6.9 billion in Q4 2022. Net earnings attributable to UnitedHealth Group common shareholders also saw an uptick, amounting to $5.4 billion, or $5.83 per share, compared to $4.7 billion, or $5.03 per share, in the prior year.

UnitedHealth Group’s financial performance in the fourth quarter of 2023 demonstrated robust growth across various metrics. Revenues surged to $94.4 billion, marking a significant increase from $82.8 billion in the same period the previous year. Simultaneously, earnings from operations reached $7.7 billion, showcasing notable growth compared to $6.9 billion in Q4 2022. Net earnings attributable to UnitedHealth Group common shareholders also saw an uptick, amounting to $5.4 billion, or $5.83 per share, compared to $4.7 billion, or $5.03 per share, in the prior year.

Looking at the full year 2023, UnitedHealth Group’s financial landscape continued to impress. Total revenues for the year reached a staggering $371.6 billion, reflecting a remarkable 15% year-over-year growth. This surge in revenue was attributed to the outstanding performance of both Optum and UnitedHealthcare, which expanded their services to a larger clientele base. Additionally, earnings from operations for the full year amounted to $32.4 billion, representing a substantial 13.8% increase compared to the previous year.

The medical care ratio for the full year stood at 83.2%, influenced by outpatient care, particularly serving seniors, and business mix. In the fourth quarter, the medical care ratio was slightly higher at 85%. Furthermore, cash flows from operations for the full year amounted to $29.1 billion, demonstrating strong financial health and stability, equivalent to 1.3 times net income.

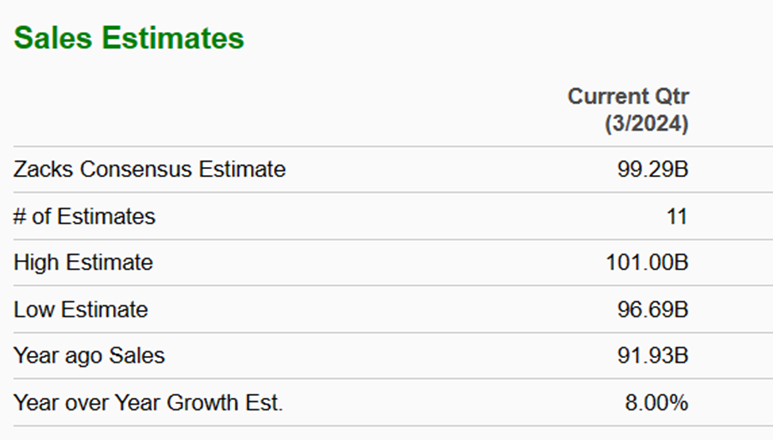

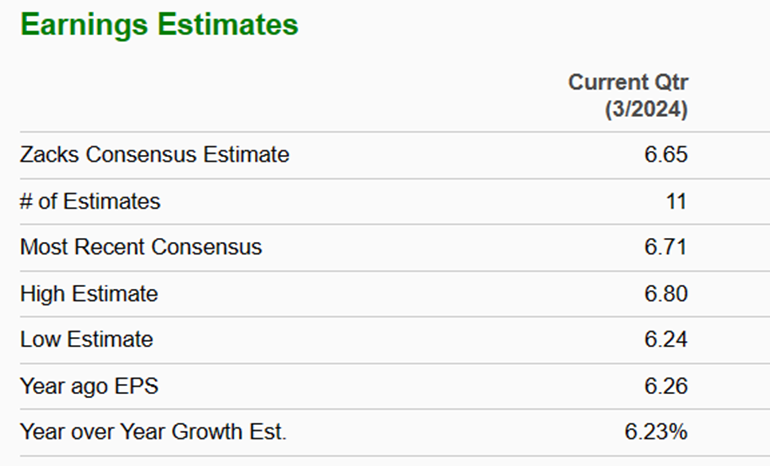

2024 Q1 Earnings Analyst Forecast:

In the current quarter of 2024, Zacks Consensus Estimate predicts sales to reach $99.29 billion, with 11 estimates contributing to this forecast, while for earnings per share (EPS), the estimate stands at $6.65. The high estimate for sales is $101.00 billion, whereas for EPS, it’s $6.80. Conversely, the low estimate for sales is $96.69 billion, while for EPS, it’s $6.24. Compared to the previous year, where sales were $91.93 billion and EPS was $6.26, the year-over-year growth estimates are 8.00% for sales and 6.23% for EPS, respectively.

In the current quarter of 2024, Zacks Consensus Estimate predicts sales to reach $99.29 billion, with 11 estimates contributing to this forecast, while for earnings per share (EPS), the estimate stands at $6.65. The high estimate for sales is $101.00 billion, whereas for EPS, it’s $6.80. Conversely, the low estimate for sales is $96.69 billion, while for EPS, it’s $6.24. Compared to the previous year, where sales were $91.93 billion and EPS was $6.26, the year-over-year growth estimates are 8.00% for sales and 6.23% for EPS, respectively.

Investing.com expects UnitedHealth Group (NYSE: UNH) to disclose its first-quarter earnings before the market opens on April 16, 2024. The anticipated earnings per share (EPS) is estimated to be $6.62, alongside an expected revenue of $99.26 billion.

Investing.com expects UnitedHealth Group (NYSE: UNH) to disclose its first-quarter earnings before the market opens on April 16, 2024. The anticipated earnings per share (EPS) is estimated to be $6.62, alongside an expected revenue of $99.26 billion.

According to TradingView.com, UnitedHealth Group (NYSE: UNH) is poised to disclose its first-quarter earnings before the market opens on April 16, 2024. Projections indicate an anticipated earnings per share (EPS) of $6.61, alongside expected revenue of $99.23 billion.

According to TradingView.com, UnitedHealth Group (NYSE: UNH) is poised to disclose its first-quarter earnings before the market opens on April 16, 2024. Projections indicate an anticipated earnings per share (EPS) of $6.61, alongside expected revenue of $99.23 billion.

Technical Analysis

According to technical analysis using the 4-hour chart of UnitedHealth Group Incorporated (NYSE: UNH) on TradingView, the stock has been in a downtrend since April 1st, 2024. A downtrend line starting from $495.91 acted as resistance, rejecting the price at $459.79, forming the first lower high after retracing from $449.63. Subsequently, the price declined to $436.54, serving as current support, before retracing to approximately $439.07.

If the support at $436.54 is breached, there’s a higher probability of further downward movement. Conversely, if the current support holds, there’s a higher probability of the price rebounding towards the downtrend line. Breaking above the downtrend line would likely lead to further upward movement.

Conclusion

In conclusion, UnitedHealth Group’s upcoming Q1 2024 earnings report is highly anticipated, scheduled for release on April 16, 2024, before the market opens. Analysts and investors are eager to assess the company’s performance, with expectations and forecasts indicating continued growth in both sales and earnings per share compared to the previous year. Despite recent technical indications of a downtrend in the stock price, the earnings release could potentially serve as a catalyst for a reversal if support levels hold or lead to further downward movement if breached.

Sources

UnitedHealth (UNH) – Market capitalization (companiesmarketcap.com)

UNITEDHEALTH GROUP ANNOUNCES EARNINGS RELEASE DATE – UnitedHealth Group

UnitedHealth Group (UNH) Dividend Yield 2024 & History (marketbeat.com)

UNH – Unitedhealth Group stock dividend history, payout ratio & dates (fullratio.com)

UnitedHealth Group Reports Fourth Quarter and Full Year 2023 Financial Results – UnitedHealth Group

UNH-Q4-2023-Release.pdf (unitedhealthgroup.com)

UNH: UnitedHealth Group – Detailed Earnings Estimates – Zacks.com

UnitedHealth (UNH) Earnings Dates & Reports – Investing.com

UNH Forecast — Price Target — Prediction for 2025 (tradingview.com)