PREVIOUS TRADING DAY EVENTS – 25 August 2023

The overall index of consumer sentiment came in at 69.5 on Friday compared to 71.6 in July. The report saw inflation expectations increasing intra-month. Year-ahead inflation expectations edged up from 3.4% last month to 3.5% this month. The five-year inflation outlook came in at 3.0% for the third straight month.

“While buying conditions for durables and expectations over living conditions both improved, the long-run economic outlook fell back about 12% this month but remains higher than just two months ago,” Joanne Hsu, the director of the University of Michigan’s Surveys of Consumers, said in a statement.

“Sentiment is likely to fall further in the months ahead… as the labour market softens, consumers dip further into excess savings, and the economy enters a period of slower growth,” said Oxford Economics economist Matthew Martin.

Source: https://www.reuters.com/markets/us/us-consumer-sentiment-slips-slightly-august-2023-08-25/

______________________________________________________________________

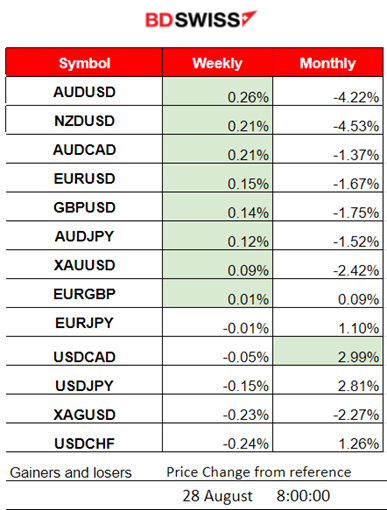

Winners vs Losers

______________________________________________________________________

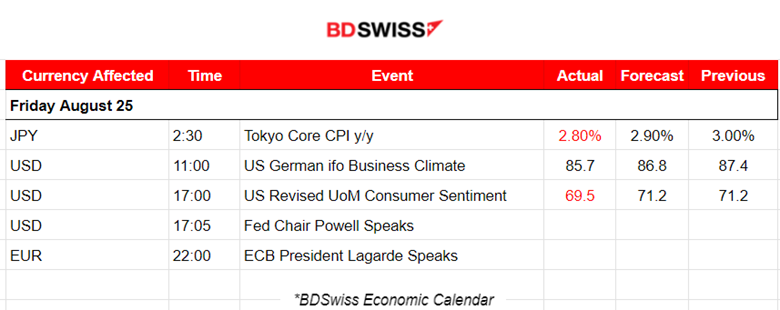

News Reports Monitor – Previous Trading Day (25 August 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

According to the 2:30 report, inflation in Japan’s capital slowed in August to 2.8% versus the previous 3%, staying above the BOJ’s target. The market did not react much to this release.

- Morning–Day Session (European and N. American Session)

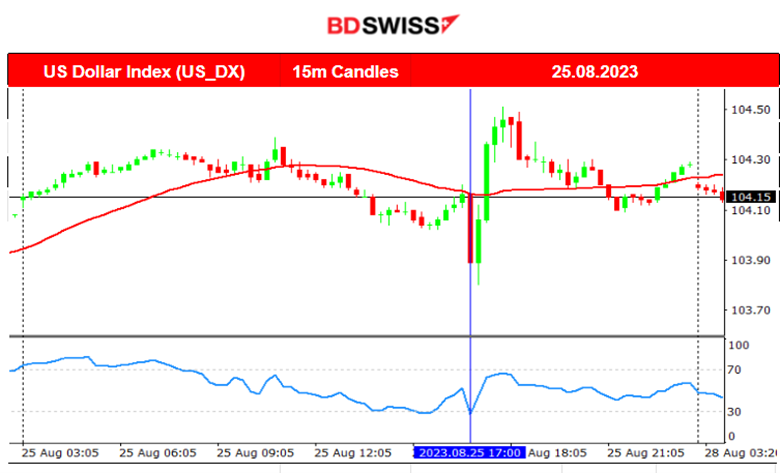

At 11:00, the German Ifo Business Climate could spark some more volatility for the EUR pairs. At 17:00, the U.S. Revised UoM Consumer Sentiment figure had some impact on the USD pairs. The Revised UoM Consumer Sentiment figure was released showing higher UMich inflation expectations while the consumer sentiment was reported way lower, with 60.5 points versus the previous 71.2. This caused a shock in the market with USD experiencing appreciation.

General Verdict:

___________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (25.08.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair experienced some volatility on Friday before the important figure releases. The price moved lower early and then reversed at the beginning of the European session, moving upwards. The German Ifo Business Climate figure was reported worse. Business sentiment in Germany weakened in August for the fourth month in a row and that’s why the EURUSD dropped a bit before reversing at that time. Then, at 17:00, the Revised UoM Consumer Sentiment figure was released showing that UMich inflation expectations jumped in August while the consumer sentiment was reported way lower. This caused the pair to move rapidly upwards at first and shortly reverse with a dive near 70 pips. It eventually returned back to the mean, continuing its sideways path.

___________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The market was recently ranging between 26250 and 25780. This changed on the 23rd of August when the U.S. PMIs were released. The figures were destructive for the U.S. business conditions causing the USD depreciation. This caused Bitcoin to move to the upside, breaking the resistance near 26250 and moving to the next resistance rapidly near 26800 before eventually retracing. It is apparent that the path was mainly driven by the USD. Bitcoin eventually returned to the mean and continued sideways with high volatility and around the MA, settling near the level of 26100 USD. The price of Bitcoin remained on the downside and is currently below the 30-period MA. Will it test the support at 25755? Let’s see.

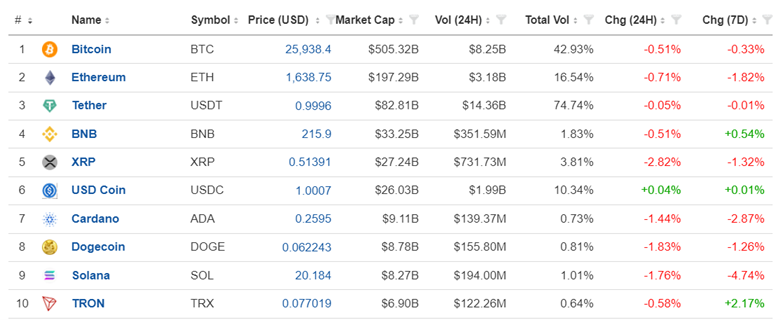

Crypto Sorted by Highest Market Cap:

In the past 24 hours, we have seen a fall in all major cryptos except the USD Coin. The biggest loser of last week was Solana, with a -4.74% price change. On the other hand, Tron was the biggest gainer with 2.17% gains.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

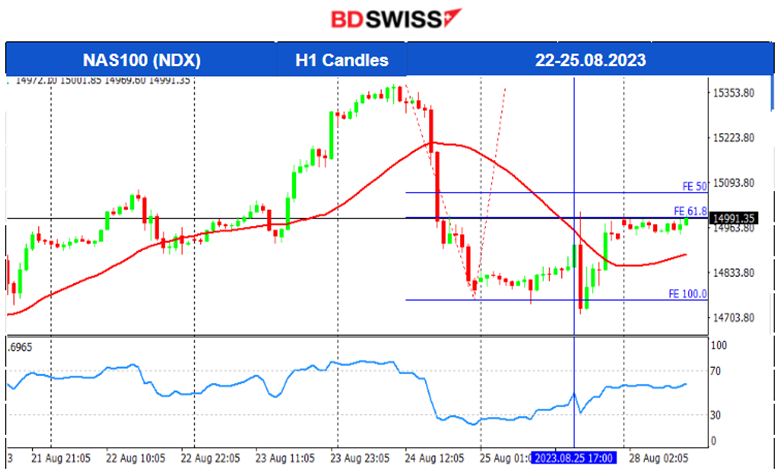

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The index crashed on the 24th of August, crossed the MA on its way down and fell more than 570 USD. It found support near 14715 USD before retracing again. That was a good retracement opportunity there.

Relevant TradingView Analysis here:

https://www.tradingview.com/chart/NAS100/zgAVikc2-NAS100-2nd-Attempt-25-08-2023/

______________________________________________________________________

COMMODITIES MARKETS MONITOR

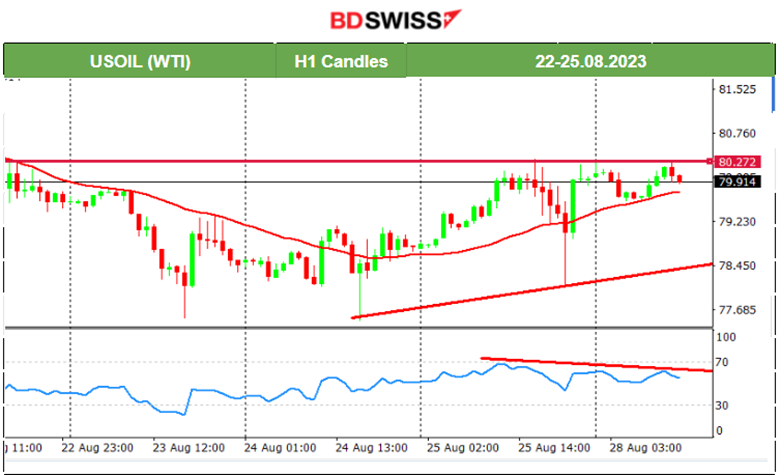

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Crude is moving above the 30-period MA and is slowing down with less and less volatility. It tested the level near 80.3 USD/b but has not broken yet. A small triangle was formed. The RSI shows that the price might be moving to the downside soon for a bit due to bearish divergence, before testing the resistance again.

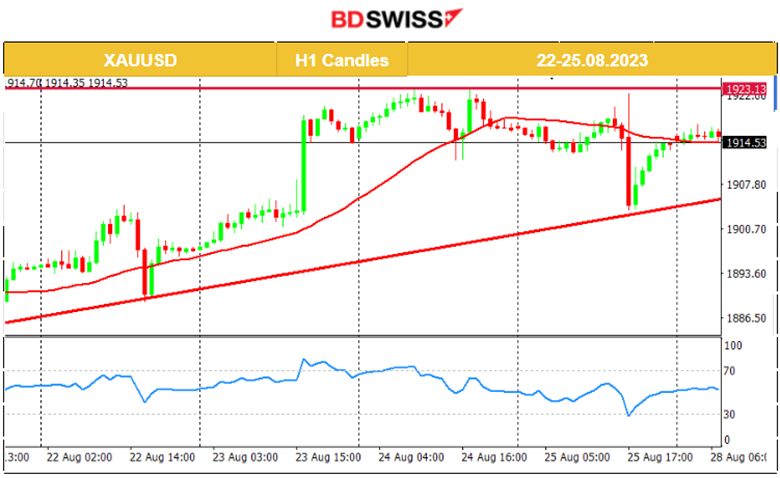

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Gold climbed significantly this week as it broke some important resistance levels. It found good resistance at 1923 USD/oz and did not manage to break it after several attempts. The USD is driving most of its movement. It broke the support at level 1912 on Friday, reaching the support near 1903 after the U.S.-related figure releases, before reversing quickly and heading back to the mean. It currently remains settled at 1915 USD/oz with no apparent signals of the future movement direction.

______________________________________________________________

News Reports Monitor – Today Trading Day (28 Aug 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

Retail Sales for Australia were reported higher than expected at 4:30. This did not have much impact on the AUD pairs at that time.

- Morning–Day Session (European and N. American Session)

No major news announcements or special scheduled releases.

General Verdict:

______________________________________________________________