Previous Trading Day’s Events (05.04.2024)

Nonfarm payrolls increased by 303K jobs last month, significantly higher than the revised 270K as previously reported.

TIM GHRISKEY, SENIOR PORTFOLIO STRATEGIST, INGALLS & SNYDER, NEW YORK: “It’s very strong payrolls data… well above the prior month and well above expectations. So it really just shows this is a very strong economy. A strong economy provides less need for the Fed to lower interest rates, and we’ve seen that impact in the stock market over the past several weeks. Fed speak has been more ‘hawkish,’ meaning they are not in any hurry to lower rates. It’s smart. They are keeping their ammunition for when it’s needed.”

CHRIS LARKIN, MANAGING DIRECTOR TRADING AND INVESTING, E*TRADE FROM MORGAN STANLEY, NEW JERSEY: “Today’s big upside surprise in the jobs report may not have closed the door on a June rate cut, but there’s a little less daylight coming through than there was a day ago. This will make next week’s CPI and PPI even more important.”

BEN LAIDLER, GLOBAL MARKETS STRATEGIST, ETORO, LONDON: “This report has piled even more pressure on the two big numbers next week, which is the U.S. inflation report on Tuesday and I think expectations well be for a bad report there. But that certainly has the potential to write to the rescue a little bit.”

ANDREW GRANTHAM, SENIOR ECONOMIST, CIBC CAPITAL MARKETS: “While markets had been pushing back expectations for a first Bank of Canada interest rate cut following strong GDP data to start the year, today’s labour force data should see them pulling those expectations forward again closer in line to our expectation for a first move in June.”

DOUG PORTER, CHIEF ECONOMIST, BMO CAPITAL MARKETS: “It’s a weak one. There’s little debate about that. Even some of the details weren’t great. One of our initial reactions here is we were due for a soft report given the underlying softness of the economy over the past year.”

Source: https://www.reuters.com/markets/view-canada-sheds-jobs-march-unemployment-rate-rises-61-2024-04-05/

______________________________________________________________________

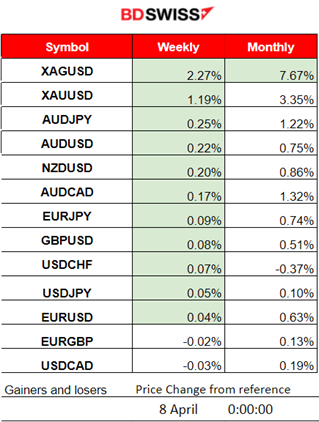

Winners vs Losers

Silver leads with 2.27% weekly gains and remarkably 7.67% gains for the month. AUD has appreciated against other currencies significantly.

______________________________________________________________________

______________________________________________________________________

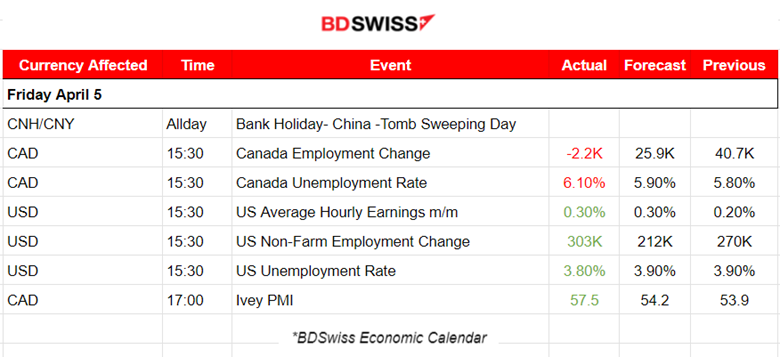

News Reports Monitor – Previous Trading Day (05.04.2024)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important announcements, no special scheduled figures to be released.

- Morning – Day Session (European and N. American Session)

In Canada, employment was little changed in March and it was a decline of -2,2K. The employment rate fell 0.1 percentage points to 61.4%. The unemployment rate rose 0.3 percentage points to 6.1% in March. The market reacted with CAD depreciation during the time of the release.

According to the NFP report, the U.S. workforce added 303K jobs in March, far more than expected and average hourly earnings increased as expected. This shows strong job creation in March coincided with an expanding labour force and moderate wage growth. The U.S. labour market is getting stronger and this could be a strong indication that inflation will be hard to bring down. The Fed might have a hard time after this one. Hiring has remained surprisingly strong despite the Federal Reserve’s attempts to cool inflation by raising interest rates. The USD strengthened during the labour data release and weakened significantly soon after within the trading day.

General Verdict:

__________________________________________________________________

__________________________________________________________________

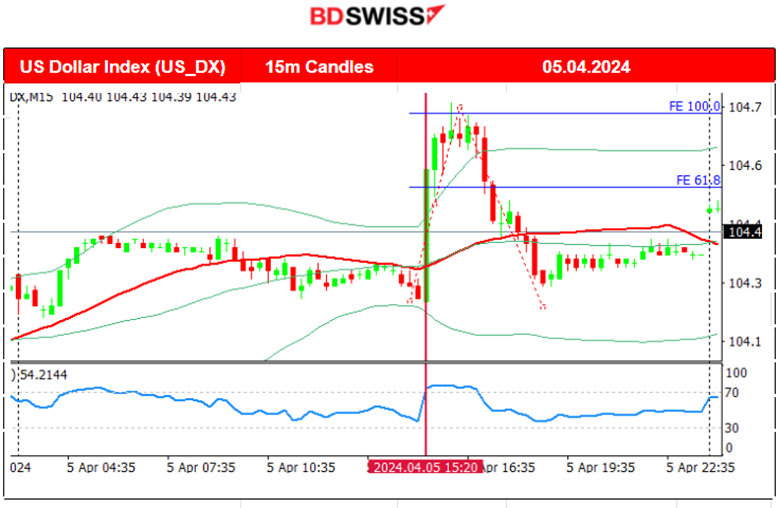

FOREX MARKETS MONITOR

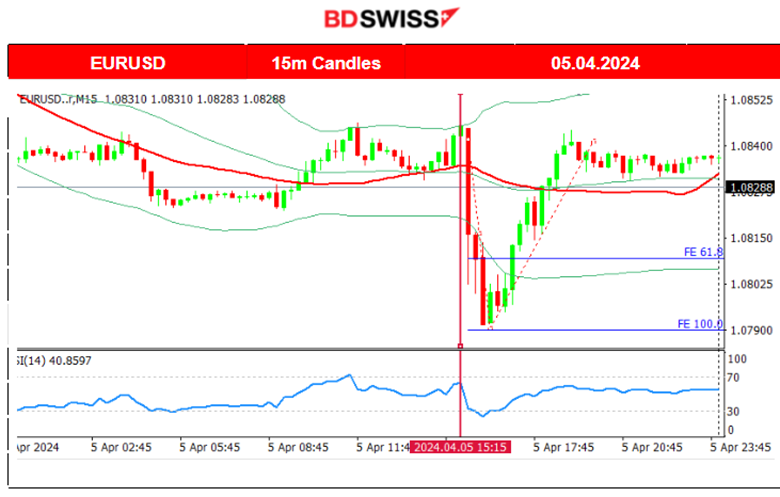

EURUSD (05.04.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair was moving with low volatility around the intraday mean within a range of 15 pips before the U.S. labour market news release. At the time of the NFP report and unemployment rate figure release the USD saw appreciation against other currencies causing the EURUSD to drop heavily near 50 pips. After the drop a reversal took place as the USD experienced strong depreciation, leading the pair to the upside back to the intraday mean level.

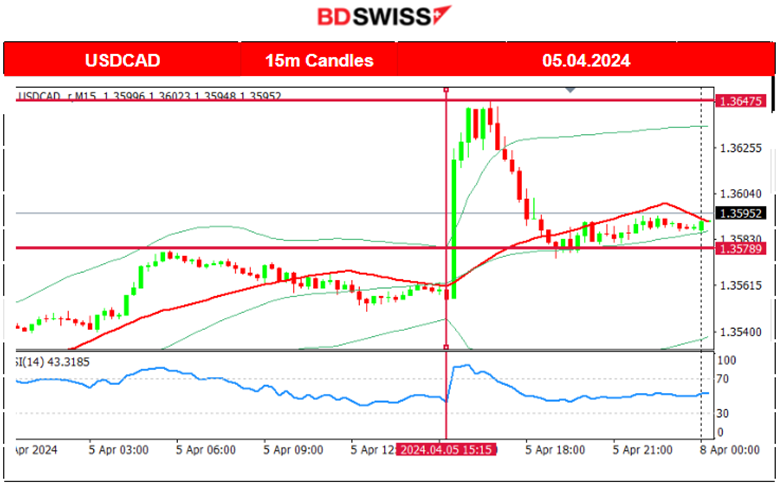

USDCAD (05.04.2024) 15m Chart Summary

USDCAD (05.04.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair was moving with low volatility as the CAD and the USD were not affected greatly but only after the employment data release at 15:30. At the time of the release the weak employment data for Canada caused its depreciation, while the strong NFP data and lower unemployment rate figure for the U.S. caused strengthening of the U.S. dollar. These two forces caused a jump of the pair to higher levels. The pair reached the resistance near 1.36475 and then reversed to the downside as the U.S. dollar suddenly started to weaken significantly. The pair reversed to the 30-period MA and remained close it it until the end of the trading day.

___________________________________________________________________

___________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) Chart Summary 1H

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Bitcoin moves currently on an upward wedge. Will its breakout be enough for the price to jump to higher levels and with a potential movement back to the peak at near 74K USD? The path currently seems to be the apparent one.

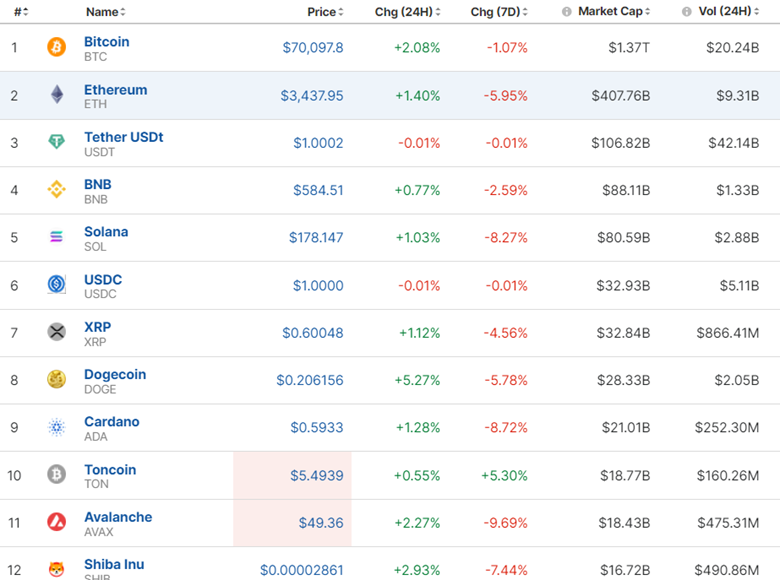

Crypto sorted by Highest Market Cap:

Crypto sorted by Highest Market Cap:

The market has seen some gains in the past few days as the Crypto prices see momentum to take place for the upside. This could help to recover some losses that the market experienced last week.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

S&P500 (SPX500) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 4th of April, the index continued upwards but at some point after 19:00 it experienced a rapid drop. Retracement was quite probable that it would take place as mentioned in our previous analysis. It did not happen immediately but was only completed after the NFP report took place on the 5th of April. The index moved back to the upside crossing the 30-period MA on its way up and eventually remaining close to the MA until the end of the trading day.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

On the 4th of April, the price jumped over 86.5 USD/b and after finding resistance it reversed. During the NFP report, the price remained in consolidation. The market did not react much but only late after 21:00. On the 8th of April, the market opened with a gap to the downside and the price tested the support near 84 USD/b before eventually retracing to the intraday mean. This was a huge reversal from the upside causing the price to get below the MA. It might be an indication of an uptrend halt and the start of a new short-term movement to the downside.

Explanation of such a drop in Crude Oil today: Middle East tensions eased after Israel withdrew more soldiers from southern Gaza and committed to fresh talks on a potential ceasefire in the six-month conflict.

XAUUSD (Gold) 4-Day Chart Summary

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 4th of April, Gold moved lower and crossed the 30-period MA while moving to the 5th of April signalling the end of the uptrend. However, the NFP report on the 5th of April, showed that its resilience to the downside is remarkable. The win-win Gold continues to help bulls perform. If you have watched the live session you could see how the dollar appreciation has no major effect on Gold. In fact, after the NFP, it moved significantly higher, the USD depreciation helped, however. While the technical was suggesting an uptrend halt with the price moving below the 30-period MA, it continued with another uptrend, deviating significantly from the MA to the upside.

______________________________________________________________

______________________________________________________________

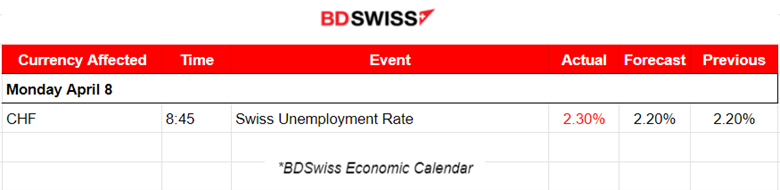

News Reports Monitor – Today Trading Day (06 April 2024)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important announcements, no special scheduled figures to be released.

- Morning – Day Session (European and N. American Session)

No important announcements, no special scheduled figures to be released.

General Verdict:

______________________________________________________________