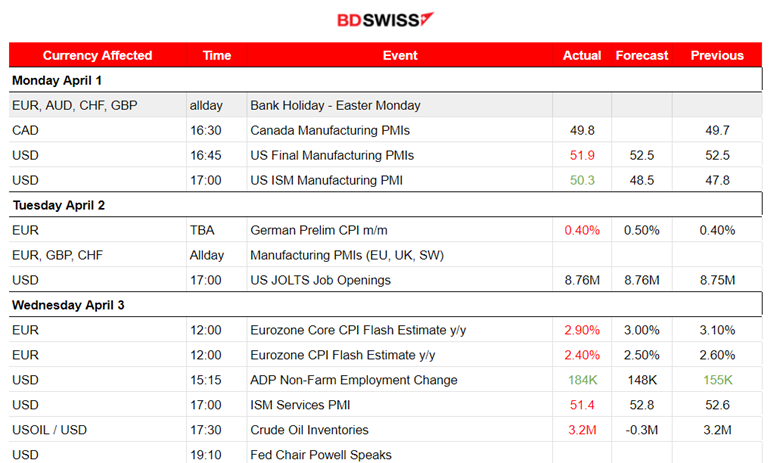

PREVIOUS WEEK’S EVENTS (Week 01 – 05.04.2024)

Announcements:

U.S. Economy

The U.S. manufacturing sector grew for the first time in 1-1/2 years in March as production rebounded sharply and new orders increased. The survey from the Institute for Supply Management (ISM) on Monday suggested the sector was on the mend.

While the manufacturing rebound is a boost for the economy’s growth prospects, the rise in raw material prices suggested goods inflation could pick up in the months ahead.

The ISM said its manufacturing PMI increased to 50.3 last month, the highest and first reading above 50 since September 2022, from 47.8 in February.

The U.S. job openings edged up in February according to the JOLTS report. The JOLTS report showed there were 1.36 vacancies for every unemployed person in February, down from 1.43 in January.

The job openings data are indicative of the demand for labour still being strong relative to supply.

U.S. services sector growth slowed further in March. The Institute for Supply Management (ISM) said that its non-manufacturing PMI fell to 51.4 last month from 52.6 in February. It was the second straight monthly decline in the index since rebounding in January. The PMI remains consistent with an economy that continues to expand, though at a moderate pace.

Global shares retreated on Friday as geopolitical tension kept crude oil prices high. The threat of supply disruptions from prolonged conflict in the Middle East is explaining this upside move.

A cooling U.S. services sector and comments last week from Fed Chair Jerome Powell reinforced the view that rate cuts were likely to commence at some point this year. However, some other Fed officials have taken a more conservative view, saying.. rate cuts might not be required this year if inflation continues to stall.

The U.S. labour market figures released on Friday showed that more workers were hired than expected in March while wages rose, suggesting the economy ended the first quarter on solid ground and potentially delaying anticipated interest rate cuts from the Federal Reserve this year.

Nonfarm payrolls increased by 303K jobs last month, significantly higher than the revised 270K as previously reported. This is well above expectations. So it really shows that this is a very strong economy suggesting less need for the Fed to lower interest rates.

Canada Economy

Canada’s labour market figures surprised the markets showing weak readings. The economy unexpectedly shed a net 2,2K jobs in March, largely in the services sector, while the unemployment rate increased to 6.1%.

______________________________________________________________________

Inflation

Eurozone

According to the CPI reports last week, Eurozone inflation fell unexpectedly last month. Consumer price growth slowed to 2.4% in March from 2.6% a month earlier, defying expectations for a steady rate as food, energy and industrial goods prices all pulled the headline figure lower.

Underlying inflation meanwhile fell to 2.9% from 3.1%, coming below expectations for 3.0%, according to data from Eurostat. Inflation has been on a steady downward path for more than a year but has fallen more quickly since last autumn than many had predicted, shifting the debate to just how soon and how fast the ECB will unwind record rate hikes.

______________________________________________________________________

https://www.reuters.com/markets/view-canada-sheds-jobs-march-unemployment-rate-rises-61-2024-04-05/

https://www.reuters.com/markets/global-markets-wrapup-1-2024-04-05/

https://www.reuters.com/markets/us/us-job-openings-little-changed-february-quits-edge-up-2024-04-02/

https://www.reuters.com/markets/us/us-manufacturing-sector-grows-first-time-1-12-years-2024-04-01/

_____________________________________________________________________________________________

Currency Markets Impact – Past Releases (Week 01 – 05.04.2024)

Server Time / Timezone EEST (UTC+02:00)

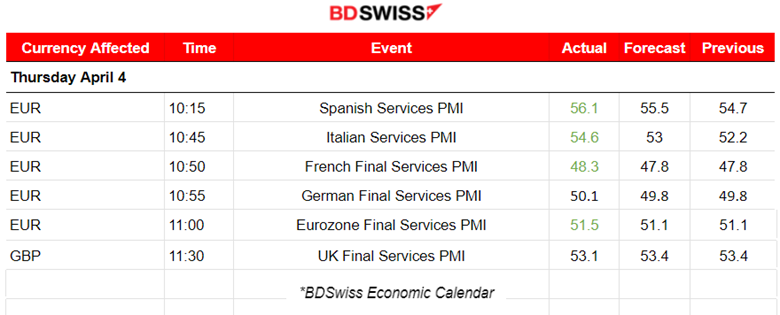

Manufacturing PMIs:

Eurozone:

Moderate growth of the Spanish manufacturing sector was sustained in March with a PMI reported above 50 points, in expansion. Output rose at its strongest pace in a year. Confidence in the future remained positive despite easing a little since the previous month.

The Italian manufacturing sector showed some signs of positivity in March. The PMI turns to expansion with a figure of 50.4 points. Both new orders and output passed marginally the growth territory. Optimism towards the year-ahead outlook increased, and firms recorded the quickest job growth seen for a year. New orders rose only fractionally, and manufacturers continued to cut stocks and downscaled their purchasing activity.

In France, the manufacturing sector endured another month of contraction in March. We have positive signals for the industry as production fell at the weakest pace since the downturn began nearly two years ago and business sentiment was optimistic. However, demand conditions remained challenging. Despite improvement, the PMI was reported at the contraction territory again at 46.2 points.

The German manufacturing sector ended its first quarter still firmly in contraction, with a devastating PMI of 41.9 points. Weak demand conditions, job losses and a sustained draw-down of pre-production inventories. Business expectations towards future output turned positive though in March.

In the Eurozone manufacturing sector output and new orders declined at the softest rates since early 2023. The data though continued to signal contraction. Business confidence rose to its highest level in nearly a year, but growth expectations remained relatively weak, which weighed further on factory employment.

U.K. PMI:

The PMI figure for the U.K. was reported at 50.3 points, a turn to expansion. The sector showed tentative signs of recovery in March, as output and new orders increased following year-long downturns. Rates of contraction in employment and purchasing activity slowing sharply and business optimism about the year-ahead outlook hitting an 11-month high.

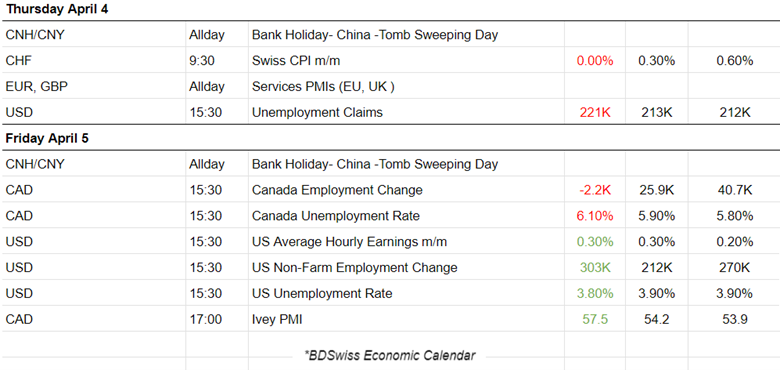

Services PMIs:

Eurozone:

Eurozone:

The Spanish service sector expands at the fastest rate in nearly a year supported by a marked and accelerated increase in new business volumes.

Italy’s service economy expanded during March for a third successive month, supported by a rapid increase in new work. Ongoing recruitment, with firms stating a preference for part-time workers. A faster uptick in demand even when price pressures remained strong. Confidence towards the outlook for activity strengthened.

The French services economy remains in contraction with PMI reported under 50, at 48.3 points. Activity continued to shrink at the end of the first quarter. Sustained weakness in the broader economy weighed on sales performances. Contractions in output and new orders remained considerably softer than those seen in the second half of 2023.

In Germany, the service sector ended the first quarter on a more stable footing. Firms turned increasingly optimistic about the outlook. Sustained job creation amongst service providers amid reports of strategic hiring. Wage pressures continued to drive up businesses’ costs, but the rates of price growth slowed noticeably.

The Eurozone economy returns to growth for the first time since May 2023. Renewed growth in business activity was aided by a stabilisation of demand and continued efforts to clear backlogs of work. Gain in net euro area employment was also recorded amid a continued resurgence in business confidence.

_____________________________________________________________________________________________

FOREX MARKETS MONITOR

Dollar Index (US_DX)

Since the 2nd of April the U.S. dollar was experiencing a strong weakening. There was no significant figure that could push for dollar strengthening last week. The PMIs were actually not showing any improvement in business conditions and the JOLTs and ADP reports seem to not have much impact. The market was waiting for the NFP instead to react heavily. The index dropped below the 30-period MA and continued with a steady downward movement until the 4th of April. Moving towards the 5th of April it actually moved above the 30-period MA and during the NFP report it jumped with the release of the strong U.S. employment data. It soon reversed though to the MA.

EURUSD

EURUSD

The pair moved early last week to the upside following an upward trend. The U.S. dollar had been weakening while the EUR was gaining strength after the release of the improved manufacturing sector data. Apparently, the USD is the main driver of the path. On the 3rd of April, the lower-than-expected inflation figures were released for the Eurozone and it did not have much impact on the market at the time of the release. It should see a significant drop since interest rate cuts from the ECB are more likely to take place soon. Nevertheless, the pair indeed dropped as the U.S. dollar started to appreciate strongly. On the 5th of April at the time of the NFP the U.S. dollar experienced a strong appreciation at first causing the pair to drop near 40 pips before reversing fully and back to the 30-period MA as the effect on the dollar faded.

USDJPY

USDJPY

The pair was moving sideways with low volatility until the 4th of April. It was apparent that since the start of the week, the dollar had been depreciating against other currencies early from the start of the previous week. However, it did not lose to JPY. The USDJPY was following a sideways path. Interest rate differential still plays a role in this. On the other hand, the EURJPY had been moving upwards. The JPY has been on a downtrend despite the Bank of Japan’s decision last month to end eight years of negative interest rates. A non yen-buying intervention by Japanese authorities caused sudden JPY appreciation but the effect faded soon with USDJPY reversing back to the MA on the 5th of April. The USD started to gain aggressively ground against the JPY, after the NFP report release.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD

Bitcoin moves currently on an upward wedge. Will its breakout be enough for the price to jump to higher levels and with a potential movement back to the peak at near 74K USD? The path currently seems to be the apparent one.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

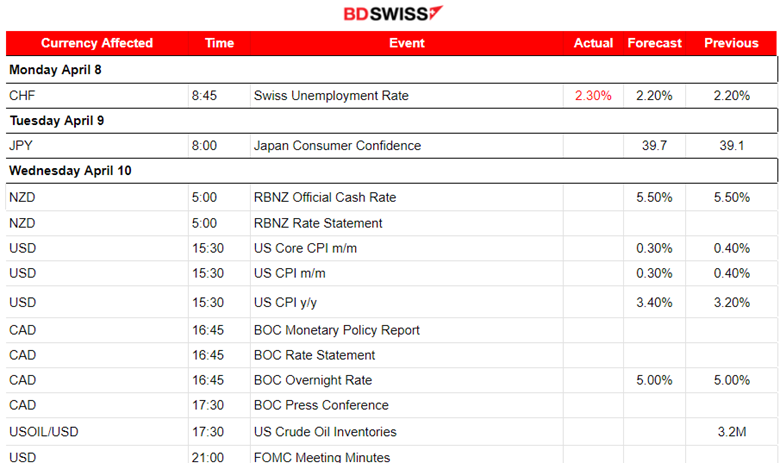

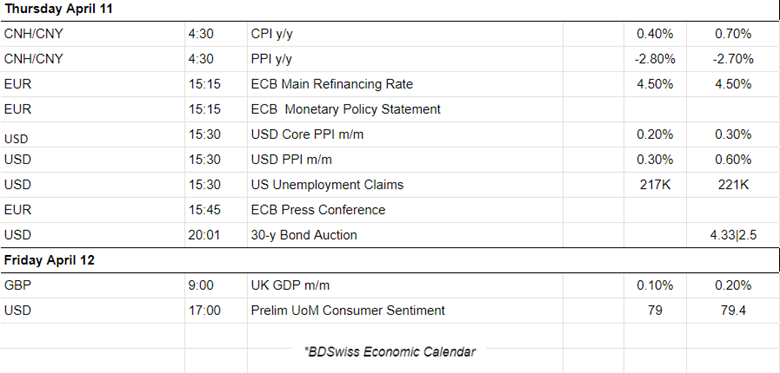

NEXT WEEK’S EVENTS (01 – 05.04.2024)

Coming up:

Interest rate decisions: RBNZ, BOC, ECB

China and U.S. Inflation Report (CPI and PPI)

Currency Markets Impact:

Currency Markets Impact:

_____________________________________________________________________________________________

COMMODITIES MARKETS MONITOR

U.S. Crude Oil

On the 4th of April, the price jumped over 86.5 USD/b and after finding resistance it reversed. During the NFP report, the price remained in consolidation. The market did not react much but only late after 21:00. On the 8th of April, the market opened with a gap to the downside and the price tested the support near 84 USD/b before eventually retracing to the intraday mean. This was a huge reversal from the upside causing the price to get below the MA. It might be an indication of an uptrend halt and the start of a new short-term movement to the downside.

Explanation of such a drop in Crude Oil today: Middle East tensions eased after Israel withdrew more soldiers from southern Gaza and committed to fresh talks on a potential ceasefire in the six-month conflict.

Gold (XAUUSD)

Gold (XAUUSD)

On the 4th of April, Gold moved lower and crossed the 30-period MA while moving to the 5th of April signalling the end of the uptrend. However, the NFP report on the 5th of April, showed that its resilience to the downside is remarkable. The win-win Gold continues to help bulls perform. If you have watched the live session you could see how the dollar appreciation has no major effect on Gold. In fact, after the NFP, it moved significantly higher, the USD depreciation helped, however. While the technical was suggesting an uptrend halt with the price moving below the 30-period MA, it continued with another uptrend, deviating significantly from the MA to the upside.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

EQUITY MARKETS MONITOR

S&P500 (SPX500)

Price Movement

On the 4th of April, the index continued upwards but at some point after 19:00 it experienced a rapid drop. Retracement was quite probable that it would take place as mentioned in our previous analysis. It did not happen immediately but was only completed after the NFP report took place on the 5th of April. The index moved back to the upside crossing the 30-period MA on its way up and eventually remaining close to the MA until the end of the trading day.

______________________________________________________________