Previous Trading Day’s Events (06 Dec 2023)

“There is no cumulative deterioration yet in the labour market that has caused previous Fed chairs to pivot quickly from rate hikes to rate cuts to support the economy,” said Christopher Rupkey, chief economist at FWDBONDS in New York. “The data will keep the Fed on the sidelines watching carefully with the risks of doing too much or too little roughly balanced.”

The government reported this week that there were 1.34 job openings for every unemployed person in October, the lowest since August 2021.

Wholesale inventories declined 0.4% in October, instead of falling 0.2% as estimated last month.

Financial markets concluded that the Fed’s monetary policy tightening campaign is over and are anticipating a rate cut as soon as the first quarter of 2024, according to CME Group’s FedWatch Tool.

Source: https://www.reuters.com/markets/us/us-weekly-jobless-claims-increase-slightly-2023-12-07/

______________________________________________________________________

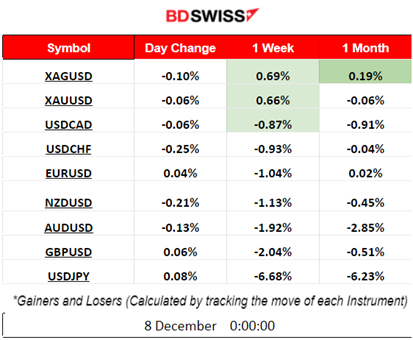

Winners vs Losers

News Reports Monitor – Previous Trading Day (07 Dec 2023)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled releases.

- Morning–Day Session (European and N. American Session)

The U.S. insurance weekly unemployment claims figure was released at 15:30 showing that expectations were roughly met. Not a significant increase but again an indication that all data point to market labour market cooling.

General Verdict:

____________________________________________________________________

____________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (07.12.2023) Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The pair started to experience volatility while moving sideways early during the start of the European session. Most of the path was around the mean until eventually the jobless claims figure caused the USD to depreciate pushing the EURUSD more to the upside. The pair eventually continued the path to the upside closing higher for the trading day as the USD weakened further.

___________________________________________________________________

___________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Bitcoin retraced lower after a series of continuous resistance breakouts. It has currently reached the 43K level and settled there for the time being.

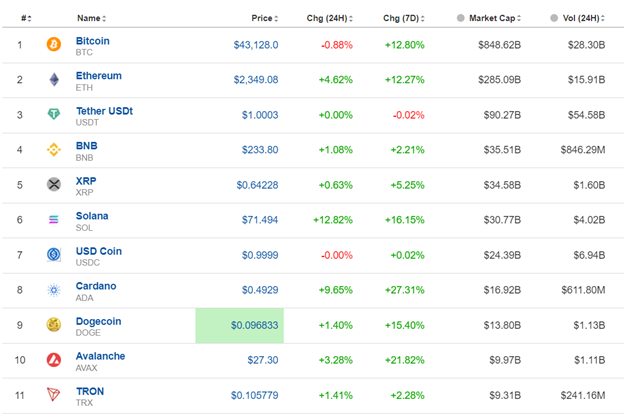

Crypto sorted by Highest Market Cap:

Cryptos remain at high levels. The last 24 hours Solana performance recorded 12.8% gains, as the highest gainer.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4Hour Timeframe Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Currently, the index shows high volatility and moves sideways around the mean as it is depicted on the chart. In general, all benchmark indices are currently in a state of consolidation and the market does not show signals that it is going to move in one direction significantly. We need a breakout for that, the longer markets consolidate the stronger the breakout can be.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Crude oil finally reversed after testing the support near 69 USD/b. It eventually retraced back to the 61.8 Fibo level and settled at near 71 USD/b.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Currently Gold moves sideways keeping the path near the mean 2040 USD/oz. A triangle formation seems to be in place as volatility levels are lowering and the market moves sideways. During the NFP today we might see a huge movement upon triangle breakout.

______________________________________________________________

______________________________________________________________

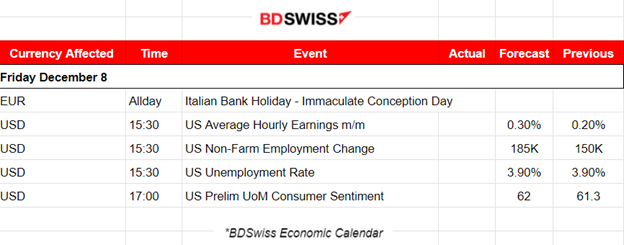

News Reports Monitor – Today Trading Day (08 Dec 2023)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled releases.

- Morning–Day Session (European and N. American Session)

The NFP report is expected to record a higher employment change figure while the jobless rate is expected to remain steady. The USD pairs will probably be affected negatively and an intraday shock is possible.

Consumer sentiment is reported 2 hours later but most of the activity affecting the USD is usually absorbed from 15:30 during the NFP release.

General Verdict:

______________________________________________________________