Previous Trading Day’s Events (06 Dec 2023)

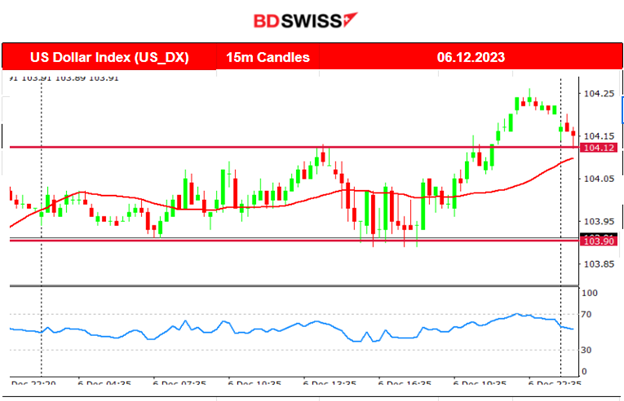

Private employment increased by 103K jobs last month beating the forecast of a 131K increase. The ADP report was published ahead of the NFP release tomorrow. The labor market is slowing down as 525 basis points worth of interest rate hikes took effect, since March 2022.

The labour market conditions are easing and inflation is cooling significantly, leaving financial markets to believe that the Fed’s monetary policy tightening campaign is over and that the U.S. central bank could cut rates as soon as next March.

Source:

https://www.reuters.com/markets/us/us-private-payrolls-miss-expectations-november-2023-12-06/

“Governing Council is still concerned about risks to the outlook for inflation and remains prepared to raise the policy rate further if needed,” the BoC said in an unusually curt, five-paragraph statement. It said it wanted to see a “further and sustained easing in core inflation.”

“Higher interest rates are clearly restraining spending,” the BoC said. Oil prices are about $10 lower per barrel than it had forecast in October. “The slowdown in the economy is reducing inflationary pressures in a broadening range of goods and services prices,” the BoC said, noting that October core inflation was at the low end of a range seen in recent months.

The BoC forecast in October that inflation would hover around 3.5% until mid-2024, before inching down to its 2% target in late 2025.

The BoC will start cutting rates in the second quarter of 2024 as inflation and the economy slow, according to a Reuters poll.

______________________________________________________________________

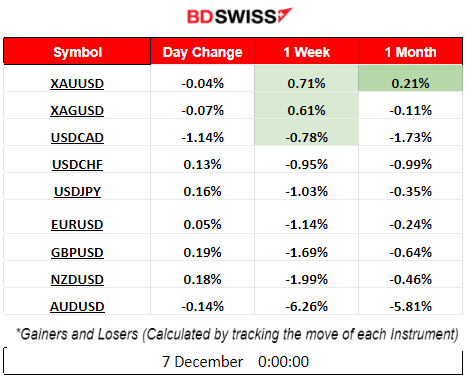

Winners vs Losers

______________________________________________________________________

______________________________________________________________________

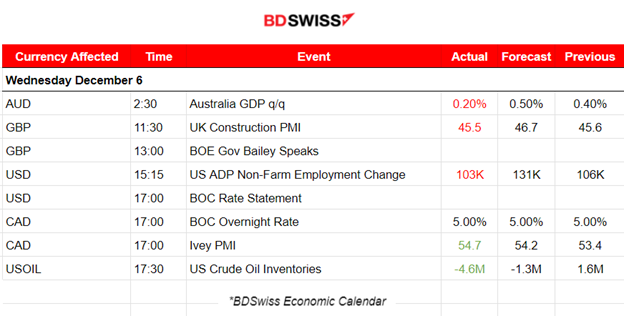

News Reports Monitor – Previous Trading Day (06 Dec 2023)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

GDP in Australia was recorded lower than expected for the 3rd quarter. The impact on the market was minimal. Slight depreciation that soon faded.

- Morning–Day Session (European and N. American Session)

The ADP NF Employment change was reported lower than expected at 103K versus the expected 131K. As an independent measure and high-frequency view of the private-sector labour market it gives a good indication of how the elevated interest rates have negatively affected the labour market conditions. The report also shows that wages experienced their smallest growth in more than two years. The impact in the market was minimal as the USD was not greatly affected.

At 17:00 the Bank of Canada decided to keep rates steady at 5%. This did not cause a significant impact. The CAD was roughly affected since the market participants’ expectations are met and no surprises take place. In addition, significant NFP figures will be released on Friday, when the market will most probably eventually act greatly upon.

General Verdict:

____________________________________________________________________

____________________________________________________________________

FOREX MARKETS MONITOR

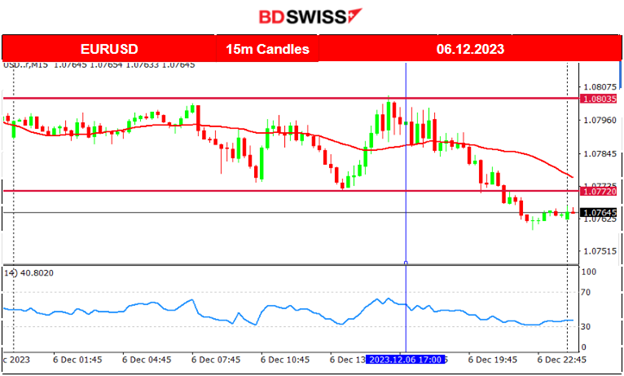

EURUSD (06.12.2023) Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Obviously driven by the USD, the pair experienced a sideways path around the 30-period MA at first and then after the ADP news at 15:15 more volatility picked up, with the USD experiencing appreciation against other currencies and causing the EURUSD to close the trading day lower again.

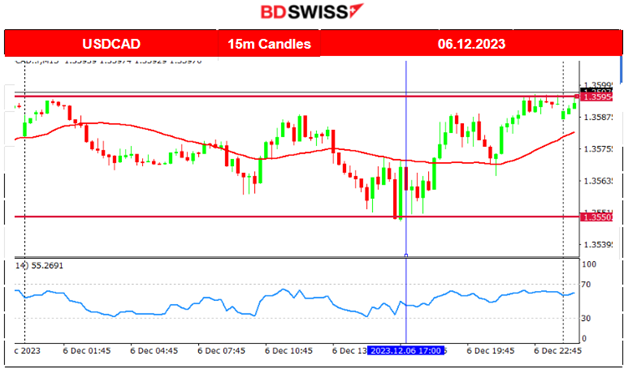

USDCAD (06.12.2023) Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The pair was moving sideways with moderate volatility and kept its path even when the BOC news was released at 17:00. At the time of the BOC Rate announcement the market did not experience any shock but rather higher volatility levels than normal. The pair eventually moved around the 30-period MA and closed higher after the news mainly from USD moderate appreciation against the CAD.

___________________________________________________________________

___________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Bitcoin retraces lower after a series of continuous resistance breakouts. It currently reached the 43K level.

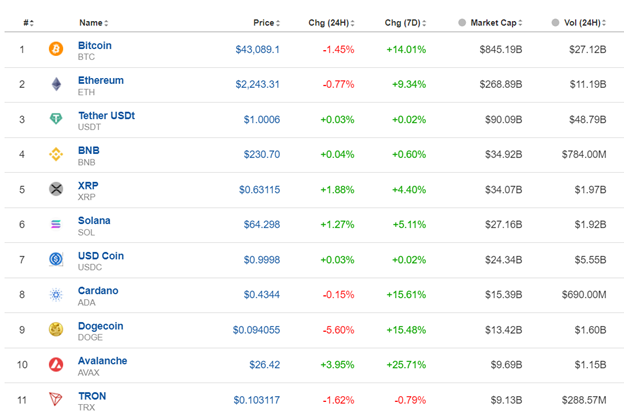

Crypto sorted by Highest Market Cap:

Mixed performance for the Crypto market as the surge has eased and retracements occurred. Bitcoin lost 1.45% the past 24 hours. However, overall for the last 7 days we see remarkable performance for all crypto. Top performer on the list above is Avalanche with 25.7% gains in that period.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4Hour Timeframe Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Currently, the index shows high volatility and moves sideways around the mean as it is apparently depicted on the chart. In general, all benchmark indices are currently in a state of consolidation and the market does not show signals that it is going to move in one direction significantly. We need a breakout for that.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Crude oil is experiencing a big drop in value as it keeps on breaking important support levels. Yesterday it broke the 71 USD/b and moved lower reaching the support near 69.3 USD/b before eventually retracing back to the mean. It currently settles near 70 USD/b. The data do not suggest an immediate reversal, however at some point we should see indications that a reversal will take place eventually.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Gold experienced huge volatility at the beginning of this month, a surge on the 1st Dec and a reversal soon after with no complete retracement to follow on the 4th Dec. Currently Gold moves sideways keeping the path near the mean 2040 USD/oz. This was meant before the surge on the 1st Dec. If we have a strong breakout to the upside, a retracement back to the 61.8 Fibo level might be completed, as depicted on the chart.

______________________________________________________________

______________________________________________________________

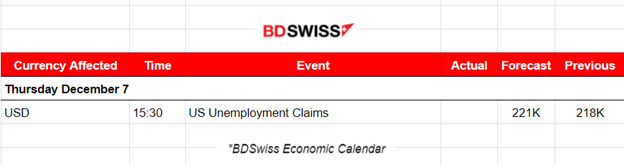

News Reports Monitor – Today Trading Day (07 Dec 2023)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled releases.

- Morning–Day Session (European and N. American Session)

The U.S. The Unemployment Claims figure will be released at 15:30. It is expected to be higher than the previous figure since the high interest rates are currently pushing the labour market to experience cooling. We saw so far this week that Job openings were reported lower and the ADP report for private employment showed a lower number as well, coinciding with the suggested overall effect. A small shock might occur affecting the USD at the time of the release.

General Verdict:

______________________________________________________________