PREVIOUS TRADING DAY EVENTS – 18 May 2023

Announcements:

Recent previous claims data boosting the figures upwards were distorted actually by fraudulent applications.

“The labour market is not deteriorating like we had thought as jobless claims were pumped up to recession levels by fraudulent applications for unemployment benefits,” said Christopher Rupkey, chief economist at FWDBONDS in New York.

The USD appreciated greatly against other currencies as investors switched their expectations. Economists widely expect unemployment to climb higher with steeper interest rates.

The Federal Reserve is watching closely the labour market data, assessing the possibility of a hike. Without any relevant statement from policymakers, the market still expects that the Fed will keep interest rates untouched next month for the first time.

“While we expect the Fed to leave rates steady at its June meeting, a resumption of rate hikes can’t be ruled out if labour market conditions don’t ease more significantly,” said Nancy Vanden Houten, lead U.S. economist at Oxford Economics in New York.

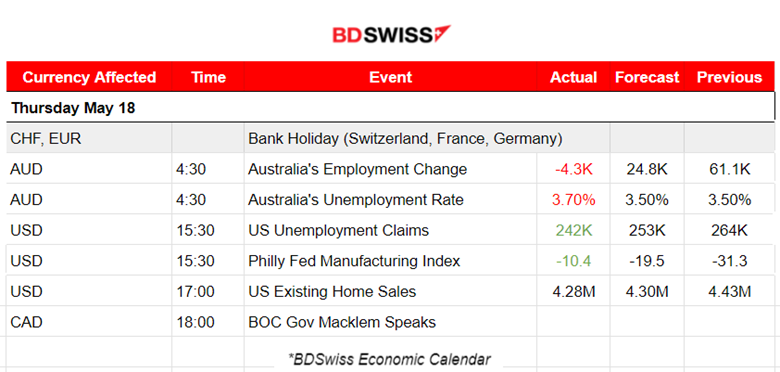

The Philadelphia Fed’s general activity index figure reported a lower negative figure, -10.4 this month, from -31.3 in April. A reading below zero indicates contraction, however the less negative shows signs of improvement.

“Though manufacturers were pessimistic about business conditions in the next six months, they planned to increase employment over that period”, according to the article.

“Re-shoring of supply chains, infrastructure projects and a stabilization in rates and demand could provide support to manufacturing activity over time,” said Rubeela Farooqi, chief U.S. economist at High Frequency Economics in New York.

Source: https://www.reuters.com/markets/us/us-weekly-jobless-claims-fall-more-than-expected-2023-05-18/

______________________________________________________________________

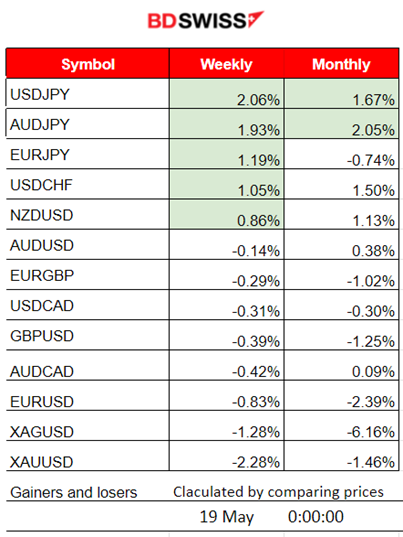

Summary Daily Moves – Winners vs Losers (18 May 2023)

- USDJPY leads this week with a decent gain so far, 2.06% since the USD has appreciated much against most currencies and the JPY recently lost ground.

- The month finds AUDJPY and USDJPY at the top of the winners list with 2.05% and 1.67% price changes respectively.

______________________________________________________________________

News Reports Monitor – Previous Trading Day (18 May 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

At 4:30, Australia’s Employment Change and Unemployment Rate announcements were released. Employment change turned out negative while the unemployment rate rose unexpectedly. AUD suffered depreciation and AUDUSD dropped nearly 30 pips before retracing fully.

- Morning – Day Session (European)

At 15:30, the U.S. Unemployment Claims figure was released and caused an intraday shock for USD pairs as USD appreciated greatly. This shows that the labour market is still hot and expectations for future rate hikes are formed.

The Philly Fed Manufacturing Index figure was released at the same time with a lower-than-expected negative figure, closer to 0 which means that the sector is improving. This adds to the above effect for the USD.

General Verdict:

______________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (18.05.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

It has been days since we talked about the pairs with EUR as the base currency dropping. EURUSD has been experiencing such a price path. The USD has been the main driver as it appreciates every day and pushes the EURUSD further down. The recent labour data for the U.S. show that it is strong and rate hike expectations grow by the hour.

____________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The index continues the upward movement. The index price increase seems to be exponential. Taking into account the recent news and data suggesting that the labour market is still hot it is quite probable that the trend might continue if no further action is taken by policymakers to cool it down. Investors’ risk mood is on, USD is gaining ground and Metals drop. Retracement is possible due to the volatile nature of the index. Its sharp movement upwards should end at some point.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Crude, after breaking the important resistance level of 71.70 USD on the 17th of May, it continued moving nearly 1.5 USD further upwards, finding resistance at near 73.30 USD. It retraced highly and eventually returned back to the mean (30-period MA) and moved sideways after finding support at 71.5 (previous resistance). USD appreciation affects demand for U.S. Oil but other factors from the supply side are also having a great impact, thus the high volatility of the commodity’s price.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Gold continued with its downward movement below the 30-period MA for the 3rd day in a row. Even though the RSI showed bullish divergence, yesterday the USD appreciated greatly pushing gold to drop further settling near 1959 USD/oz.

______________________________________________________________

News Reports Monitor – Today Trading Day (19 May 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news announcements, no scheduled releases.

- Morning – Day Session (European)

At 15:30, the retail sales data for Canada will be released, impacting the currency. We will probably experience an intraday shock for CAD pairs but not so great.

General Verdict:

______________________________________________________________