PREVIOUS TRADING DAY EVENTS – 19 May 2023

Announcements:

Meetings take place from Thursday through Saturday. Concerns to discuss involve the collapse of Silicon Valley Bank and Credit Suisse’s takeover, the First Republic Bank’s failure, how to strengthen the global financial system and help banks avoid situations similar to the SVB’s collapse, the U.S. debt default crisis, and climate, energy and environmental issues. In addition, discussions for extra measures to support Ukraine or punish Russia. Various sanctions had been in effect so far. Further concerns include world inflation, which remains fairly sticky, and the risks involved around the use of crypto assets.

Source:

“I don’t think we’re going to be able to move forward until the president can get back into the country,” McCarthy told reporters at the Capitol. “Just from the last day to today, they’ve moved backwards. They actually want to spend more money than we spend this year.”

“We have to spend less than we spend this year,” McCarthy said, repeating his bottom-line demand.

On Saturday, Biden stated with confidence that the U.S. government will avoid the default. However, this debt-limit fight could trigger a first-ever U.S. payments default and inflict a great catastrophe globally.

The president is seeking to call the speaker on Sunday morning, Washington time, after the summit concludes. He is scheduled to return to Washington late on Sunday, Japan time.

Source:

“The financial stability tools helped to calm conditions in the banking sector. Developments there, on the other hand, are contributing to tighter credit conditions and are likely to weigh on economic growth, hiring and inflation,” he said as part of a panel on monetary policy.

“So as a result, our policy rate may not need to rise as much as it would have otherwise to achieve our goals,” he added. “Of course, the extent of that is highly uncertain.”

The market was expecting that the Fed will pause hikes starting from the next meeting in June. However, recent monthly inflation data shifted expectations towards a continuation of rate hikes. Powell said that indeed inflation is still too high and could create a lot of harm to the economy. He characterised current Fed policy as “restrictive” and said that future decisions would be data-dependent.

The market reacted with USD depreciation during his speech. U.S. stocks dropped.

Source:

______________________________________________________________________

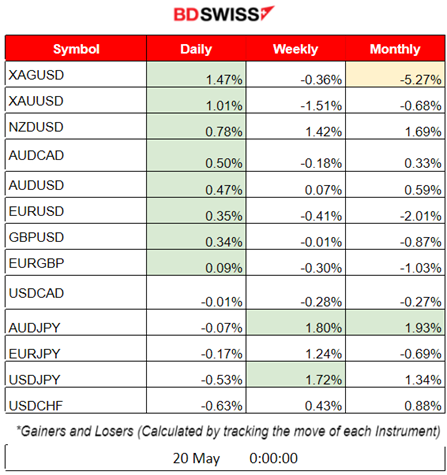

Summary Daily Moves – Winners vs Losers (19 May 2023)

- Metals gained some ground on Friday as USD depreciated. Gold and Silver (XAGUSD) moved upwards, winning a place at yesterday’s top gainers’ list, with Silver having a 1.47% price change.

- The previous week, AUDJPY reached the top with a 1.80% change, followed by USDJPY with a 1.72% change. AUDJPY is leading the gainers’ this month with a 1.93% overall price change.

______________________________________________________________________

News Reports Monitor – Previous Trading Day (19 May 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news announcements, no scheduled releases.

- Morning – Day Session (European)

At 15:30, the retail sales data for Canada were released. Retail sales decreased by 1.4% to $65.3 billion in March. The impact was not great. USDCAD had hardly moved.

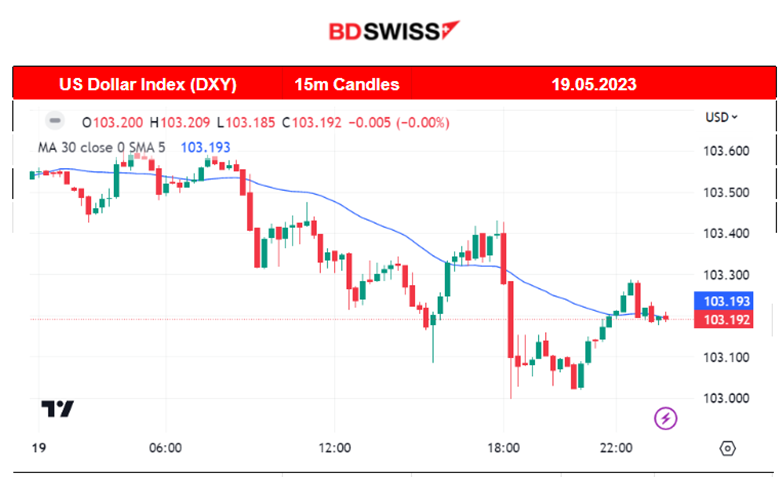

At 18:00, the Federal Reserve Chairman Jerome Powell talked at a panel discussion titled “Perspectives on Monetary Policy” at the Thomas Laubach Research Conference, in Washington DC. There is a debate about whether to hike again or pause at the next meeting. “Bringing inflation down will take some time”, Powell said. USD pairs were affected highly after the event began. The market experienced USD depreciation.

General Verdict:

______________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (19.05.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

EURUSD was experiencing low volatility as there was an absence of important scheduled releases. The USD started to depreciate early, mainly driving the market steadily and pushing the EURUSD higher and higher. At 18:00, Fed talks signalled a pause in rate hikes for now and the USD suffered an intraday and moderate depreciation due to the market’s reaction.

USDCAD (19.05.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair was moving downwards since the start of the trading day, steadily going downwards and moving below the 30-period MA. After the retail sales figures were released, the pair found significant support at 1.34690 and reversed. It started moving upwards, crossing the MA and reaching more than 50 pips rapid upward move until it found strong resistance. Retracement followed, returning back to the mean and the 61.8 FE level as shown by the Fibonacci tool.

____________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Surprisingly, the index continued the movement upwards this week, with an exponential increase rate. However, on Friday, 19th of May, it found strong resistance. The increase was explained mainly because investors have dropped safe-haven assets and are moving towards more risky assets, such as stocks. A possible pause in rate hikes, strong labour data releases and debt-ceiling talks played their part in this. The market eventually found resistance and retraced on Friday.

Trading Opportunities:

The index has experienced an unusual, relatively rapid move upwards. There was no significant fundamental data to support a further rapid rise. It was expected that the index would retrace to the Fibonacci standard levels eventually. It did. As per the chart, the index retraced back to 61.8% of the upward move that started on the 18th of May.

Related analysis on TradingView:

https://www.tradingview.com/chart/NAS100/8ALtHukB-NAS100-Finally-Back-19-05-2023/

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Crude has been moving slightly upwards with high volatility without forming a solid trend. The RSI began to show lower highs while the price formed higher highs. A bearish divergence. On Friday, 19th of May, oil eventually dropped from its peak but also crossed the 30-period MA, moving further downwards, confirming a strong reversal. After finding significant support, it retraced back to the mean. There seems to be no clear direction, only high deviations from the mean during the trading day followed by reversals/retracements.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Gold has been experiencing a downward trend recently as the USD was gaining ground the whole week and investors preferred more risky assets, such as stocks. Gold was already in the oversold territory and, as we said in the previous daily analysis, retracement is almost inevitable. On Friday, 19th of May, Gold moved upwards, crossing the 30-period MA signalling the end of the downward trend. The USD experienced a strong depreciation as talks regarding a rate hike pause are confirming expectations. Debt-ceiling is also an issue that is still to be solved.

______________________________________________________________

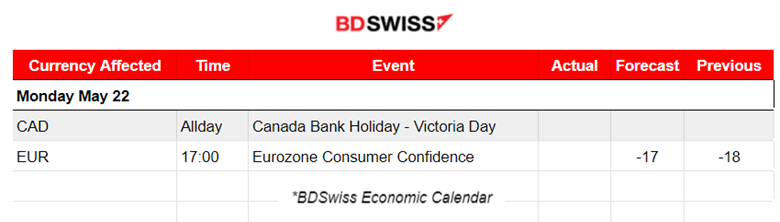

News Reports Monitor – Today Trading Day (22 May 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news announcements, no scheduled releases.

- Morning – Day Session (European)

At 17:00, the Eurozone’s Consumer Confidence Index will be released. So far, it is pessimistic since the level is below 0 but it is expected to show improvement. No significant intraday shock is expected.

General Verdict:

______________________________________________________________