PREVIOUS WEEK’S EVENTS (Week 21 Aug – 25 Aug 2023)

Announcements:

U.S. Economy

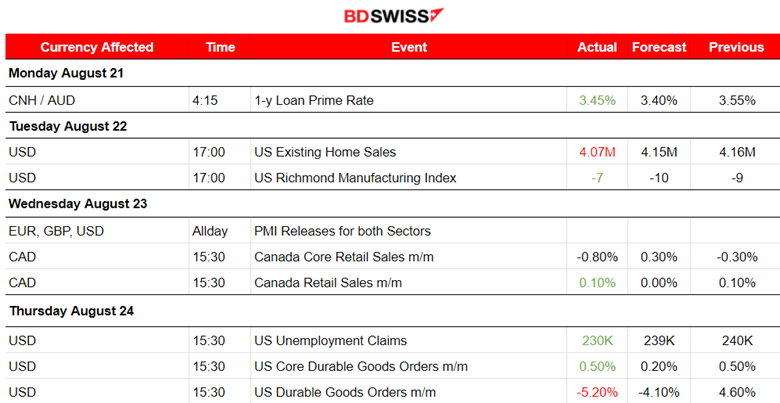

Fifth District manufacturing activity remained slow in August while the Richmond Manufacturing Index showed improvement from -9 in July to -7 in August.

The U.S. Unemployment Claims were reported lower than expected at 230K. The figures were lower for a second straight week. This is against the economists’ expectations of a downturn in the labour market. The labour market is continuing to defy expectations despite the aggressive rate hikes from the Fed.

A rise in new orders for key U.S.-manufactured capital goods in July was reported last week. In general, we have a combined slowdown in inflation and a relatively resilient job market.

According to the University of Michigan sentiment survey, U.S. consumer sentiment fell modestly in August, at 69.5 compared to 71.6 in July, reporting that short- and long-term inflation expectations worsened. The report saw inflation expectations increasing intra-month. Year-ahead inflation expectations edged up from 3.4% last month to 3.5% this month. The five-year inflation outlook came in at 3.0% for the third straight month.

PMIs Eurozone, United Kingdom, U.S.

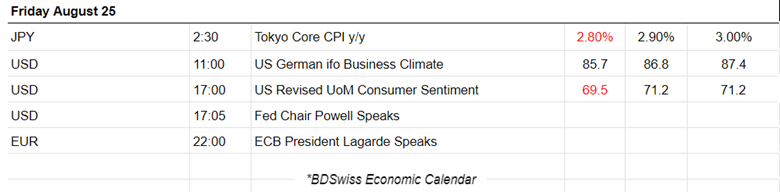

According to the reports and figures, the PMI data was devastating for all regions.

Business activity declined heavily for the Eurozone, which was far more than expected in August, with a particularly fast slide in Germany. The PMI data will test the ECB since further fall of these figures will be a disaster.

The data suggests that business activity in the services industry declined significantly for the first time this year and the contraction in manufacturing output continued, although there were some higher than previously reported figures for factory activity.

Business activity in Germany, Europe’s largest economy, contracted at the fastest pace for more than three years as a deepening downturn in manufacturing output was accompanied by a renewed contraction in services. In France, the dominant services sector contracted as well.

Outside the European Union, Britain’s economy looks on course to shrink in the third quarter and risks falling into a recession; a result of the high interest rates set by the central bank to counter its huge inflation rate.

China Economy

China’s central bank, the People’s Bank of China (PBOC), lowered the one-year Loan Prime Rate (LPR or benchmark lending rate) to 3.45% from the previous 3.55% in an attempt to stimulate credit demand. However, it surprised markets by keeping the five-year rate unchanged, the five-year LPR was left at 4.20%.

The yuan became one of the worst-performing Asian currencies.

The central bank stated that it will optimise credit policies for the property sector while coordinating financial support to resolve local government debt problems.

_____________________________________________________________________________________________

Source:

https://www.reuters.com/world/us/us-jobless-claims-fall-labor-market-remains-tight-2023-08-24/

https://www.reuters.com/markets/us/us-consumer-sentiment-slips-slightly-august-2023-08-25/

_____________________________________________________________________________________________

Currency Markets Impact – Past Releases (Week 21 Aug – 25 Aug 2023)

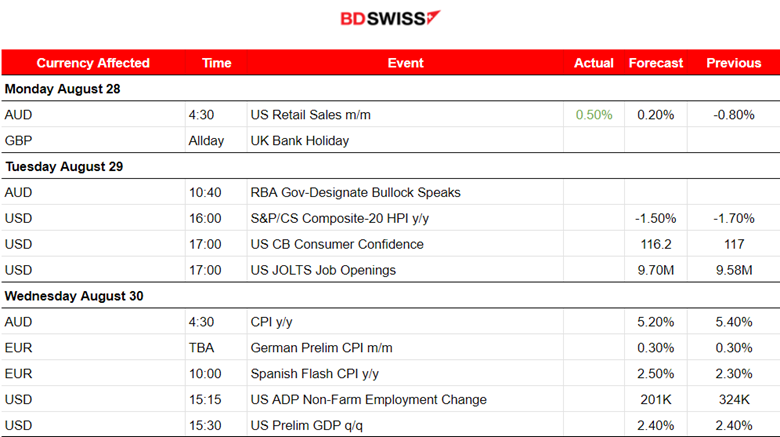

Eurozone PMIs:

France: France suffers as economic activity worsens through the third quarter with a fall in services activity. The index shows 46.7 points against the previous 47.1. Both manufacturing and services figures are in the contraction area. The manufacturing sector showed 46.4, somehow improved indication of business.

Germany: 39.1 points for manufacturing, almost unchanged from the previous figure and a downfall for the services sector that looks almost scary, with the index down to 47.3 for services from 52.3. German business activity fell at the fastest rate since May 2020.

Eurozone: The Weak PMIs suggest that the economy is suffering from a great risk of recession. The services PMI figure is the most worrying since the index went below 50, the level that separates contraction from expansion.

The market reacted heavily during the Eurozone’s PMI releases as they had a great impact on the EUR pairs. After 10:30, the EURUSD started to fall rapidly more than 50 pips before reversing.

U.K. PMIs: Devastating PMIs for both sectors in the U.K. as well. The U.K. private sector firms suffered a downturn in business activity in August ending a six-month period of expansion. A result of worsened domestic economic conditions and higher borrowing costs. Inflationary pressures continued to moderate in August. U.K. inflation is still high and more rate hikes could cause greater harm than what is expected for the economy.

During the PMI releases, the GBP suffered depreciation against other currencies. GBP dropped more than 130 pips before reversing.

Canada’s retail sales data release showed a rise of 0.4% in July, beating June’s estimate. The monthly increase was 0.1%, unchanged from the previous month. The core retail sales figure was reported as negative, although 0.8%.

U.S. PMIs: The figures are also grim for the U.S. Business activity, which fell for both sectors and growth, was reported at its weakest since February as demand for new business in the vast service sector weakened. S&P Global said its flash U.S. Composite PMI index fell to a reading of 50.4 in August from 52 in July, the biggest drop since November 2022.

_____________________________________________________________________________________________

FOREX MARKETS MONITOR

DXY (US Dollar Index)

Overall, the Dollar experienced strength again last week. DXY now settled around 104 USD. It is clear that on the 23rd, the index suffered depreciation because of the devastating PMIs during the released figures. However, it continued the upward trend. On the 25th, another shock to the downside occurred from the Consumer Sentiment report but again the price reversed quickly.

EURUSD

Obviously, the USD is driving the pair path. As the USD shows strength, the EURUSD moves to the downside at roughly the same pace. We see the shocks on the 23rd of August, the dive of the pair since the EUR depreciated from the grim PMIs and then the U.S. upward movement. PMIs were followed by a reversal as the USD grew stronger. In general, the pair remained on the downside below the 30-period MA.

_____________________________________________________________________________________________

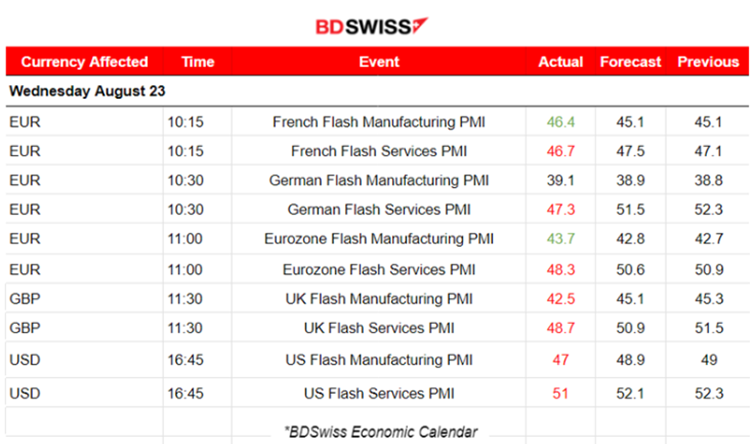

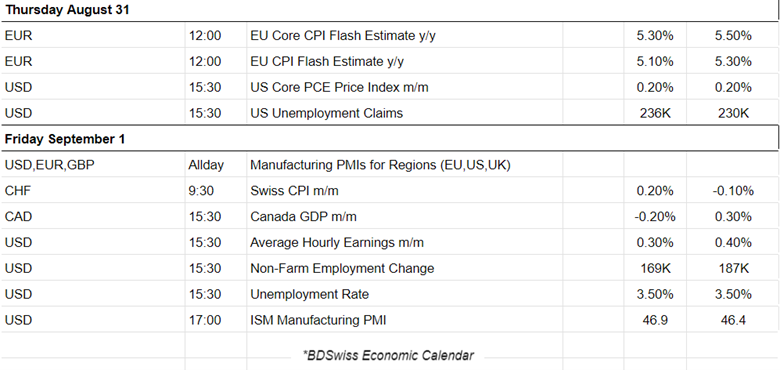

NEXT WEEK’S EVENTS (Week 28 Aug – 01 Sep 2023)

Important releases include the JOLTS Job openings figures that will give us a picture of the labour market conditions. The ADP report will be released later this week too, after the second most important data release. In the first week of the month, we have the NFP report along with the Unemployment rate for the U.S.

Flash CPI reports will take place indicating how the inflation path in the Eurozone is and the release of the PCE report for the U.S., again inflation-related.

PMIs for the Manufacturing sector will also be released. Last time, we saw how grim the reports were. Let’s see this time.

Currency Markets Impact:

_____________________________________________________________________________________________

COMMODITIES MARKETS MONITOR

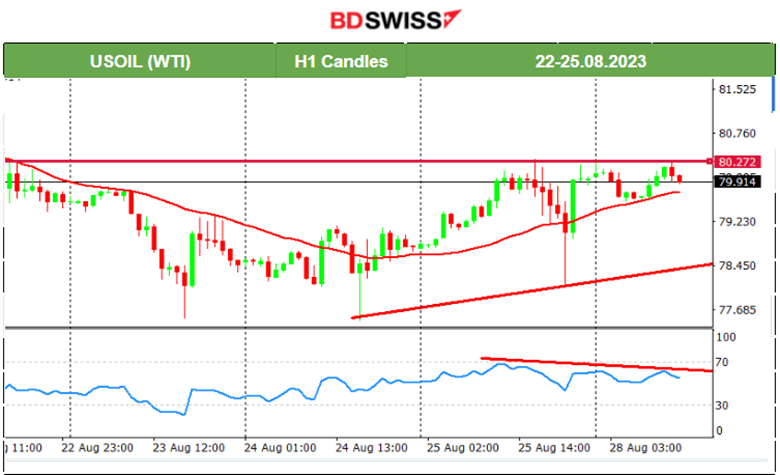

U.S. Crude Oil

Crude is moving above the 30-period MA and is slowing down with less and less volatility. It tested the level near 80.3 USD/b but has not broken yet. A small triangle was formed. The RSI shows that the price might be moving to the downside soon for a bit due to bearish divergence, before testing the resistance again.

Gold (XAUUSD)

Gold climbed significantly this week as it broke some important resistance levels. It found good resistance at 1923 USD/oz and did not manage to break it after several attempts. The USD is driving most of its movement. It broke the support at level 1912 on Friday, reaching the support near 1903 after the U.S.-related figure releases, before reversing quickly and heading back to the mean. It currently remains settled at 1915 USD/oz with no apparent signals of the future movement direction.

_____________________________________________________________________________________________

EQUITY MARKETS MONITOR

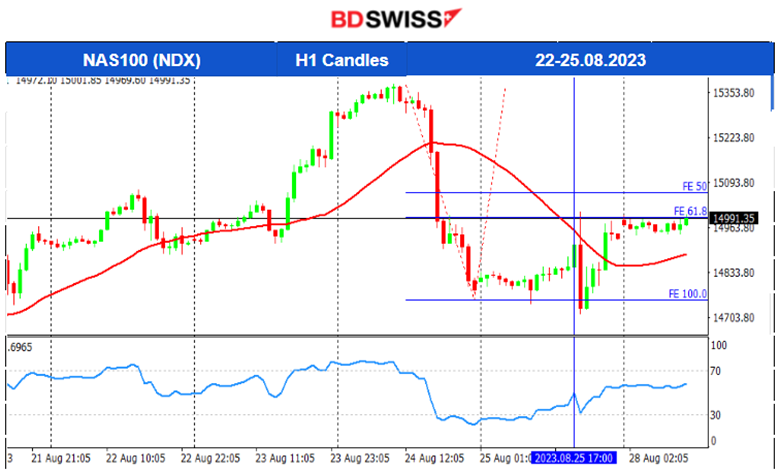

NAS100 (NDX)

Price Movement

The index crashed on the 24th of August, crossed the MA on its way down and fell more than 570 USD. It found support near 14715 USD before retracing again. That was a good retracement opportunity there.

Relevant Trading View Analysis here:

https://www.tradingview.com/chart/NAS100/zgAVikc2-NAS100-2nd-Attempt-25-08-2023/

______________________________________________________________