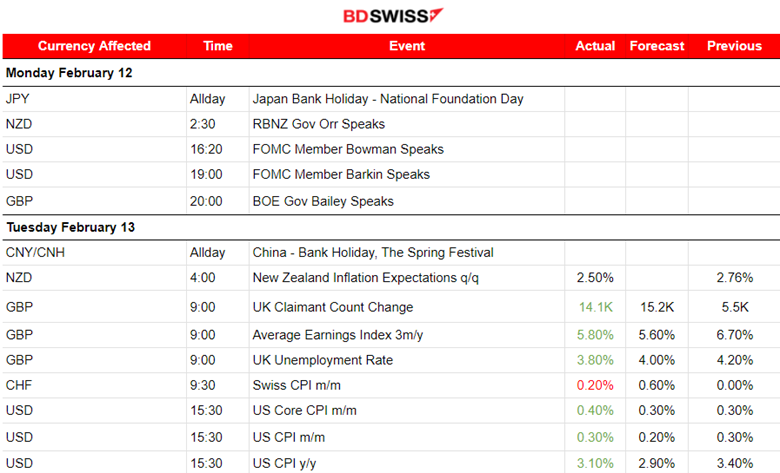

PREVIOUS WEEK’S EVENTS (Week 12-16.02.2024)

Announcements:

U.S. Economy

Retail sales in the U.S. tumbled 0.8% last month, the biggest drop since March 2023, suggesting slowing momentum in consumer spending. This suggests that the economy looks strong but cooling.

However, jobs are added continuously and wage growth remains elevated. Consumer spending is far from collapsing. That should sustain the economic expansion. Economists expect that consumer spending will rise at a solid pace this year.

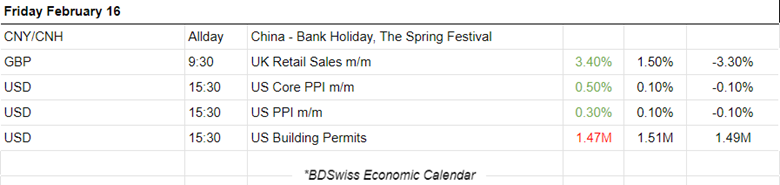

According to Friday’s PPI data releases the U.S. producer prices increased more than expected in January amid strong gains in the costs of services, spreading fear that inflation is picking up after all these months of cooling. The increase was the largest in five months.

Consumer prices in January shifted bets that the Federal Reserve would start cutting interest rates in June instead of May. The data are consistent, that January is causing trouble to inflation.

Services increased 0.6%, the largest rise since July 2023.

U.K. Economy

The U.K. claimant count for January 2024 increased, higher than the previously reported figure. The early estimate of payrolled employees for January 2024 increased by 48,000 (0.2%). British pay grew by 6.2% in the last three months of 2023 compared with the same period a year earlier and the labour market remains tight as businesses struggle to find and retain staff.

The Bank of England (BoE) is probably against a labour market that has not cooled sufficiently to achieve a sustainable return to the 2% inflation target. The BoE is worried that pay might continue to rise too quickly for inflation to fall to its 2% target.

The GDP figures released for the U.K. suggest that the economy fell into a recession in the second half of 2023. Gross domestic product (GDP) contracted by 0.3% in the three months to December, having shrunk by 0.1% between July and September.

Recent data showed that inflation held at a lower-than-expected 4.0% in January, reviving talk among investors about a BoE rate cut as soon as June.

Australia Economy

The labour market data for Australia showed very weak employment growth in January, while the jobless rate climbed to a two-year high, to 4.1%, topping forecasts of 4.0%.

______________________________________________________________________

U.S. Inflation

Inflation in the U.S. was reported higher than expected, at 3.1% versus 2.9%. The consumer price index increased 0.3% last month after gaining 0.2% in December. Global stock market indexes dropped, the 10-year U.S. Treasury yield hit a 2-1/2-month high and the dollar appreciated greatly against a basket of currencies.

All three major U.S. stock indexes fell more than 1% each, and the Dow Jones industrial average posted its biggest daily percentage drop in almost 11 months. The yield on the benchmark U.S. 10-year Treasury note rose 14 basis points to 4.31% after reaching 4.314%, its highest level since Dec. 1.

After the data, expectations rose that the Fed will likely not cut rates until its June 11-12 policy meeting.

Gold prices fell below the key $2,000 per ounce level to a two-month low following the CPI data. Spot gold was down 1.3% at $1,993.29 an ounce, its lowest since Dec. 13th.

U.K. Inflation

The U.K.’s inflation report yesterday showed that it held steady at 4% in January. Unexpected and defied analyst forecasts of a rise. Investors formed expectations that cutting interest rates this year is more likely to take place, with many targeting June.

Services inflation rose slightly to 6.5% but was not as strong as the central bank expected.

______________________________________________________________________

Sources:

https://www.reuters.com/world/uk/uk-inflation-unchanged-4-january-2024-02-14/

https://www.reuters.com/markets/us/us-producer-prices-rise-more-than-expected-january-2024-02-16/

https://www.reuters.com/world/uk/uk-regular-wages-grow-62-3-months-december-2024-02-13/

https://www.reuters.com/world/uk/uk-economy-entered-recession-second-half-2023-2024-02-15

https://www.reuters.com/markets/global-markets-wrapup-1-2024-02-13/

_____________________________________________________________________________________________

Currency Markets Impact – Past Releases (Week 12-16.02.2024)

Server Time / Timezone EEST (UTC+02:00)

_____________________________________________________________________________________________

FOREX MARKETS MONITOR

Dollar Index (US_DX)

The dollar index is moving to the downside steadily despite the higher-than-expected inflation figure released on the 13th Feb and PPI figures released on the 16th. During these events the USD experienced strong appreciation, however, the pressure for the dollar to weaken continued to be strong enough. The Fed’s Interest Rate Cuts will happen, it’s just a matter of time.

EURUSD

The EURUSD reversed to the upside, correcting from the drop that occurred on the 13th due to dollar appreciation. The pair crossed the 30-period MA on its way up and remained on the upward path. The RSI is however showing signs of slowing down. It would be the case that the dollar might see some strengthening again as expectations have settled towards a more probable June cut.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD

Early on the 14th Feb, Bitcoin climbed again aggressively reaching up to 52,600 USD on the 14th and even reached 52.800 USD on the 15th Feb before retracing. On the 17th Feb Bitcoin fell rapidly reaching the support near 50,550 USD before reversing fully back to the 30-period MA. Since the 17th Feb, it has been on an upward path that forms an upward wedge and is on the way to test more resistance. 52,600 USD seems to be a significant resistance level.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

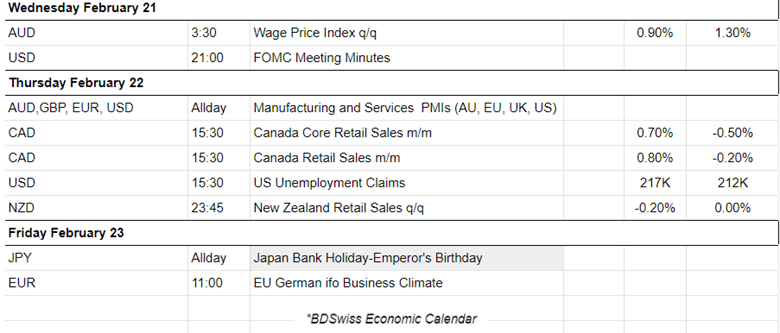

NEXT WEEK’S EVENTS (19 – 23.02.2024)

Coming up: This week we have Canada’s Inflation data release and Retail Sales report.

In addition, on Wednesday the FOMC Meeting Minutes release will give more information to the market regarding the thoughts and intentions of the FOMC.

PMIs of the Manufacturing and Services sector will be reported on the same day.

Currency Markets Impact:

_____________________________________________________________________________________________

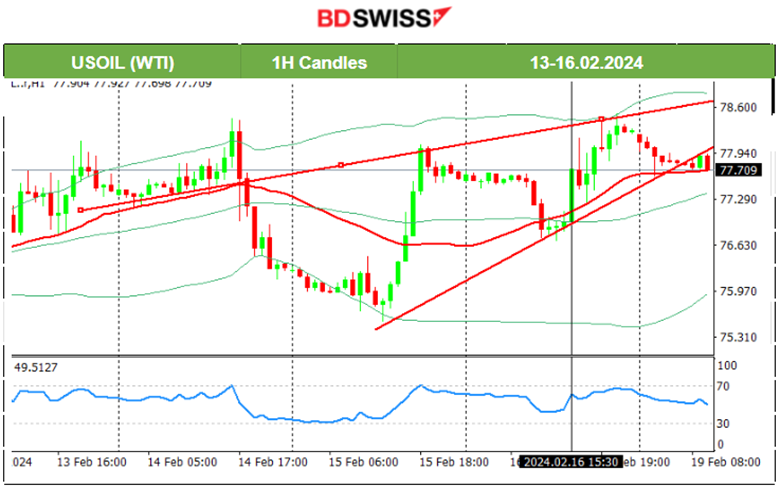

COMMODITIES MARKETS MONITOR

U.S. Crude Oil

On the 14th Feb, the release of the Crude oil inventories report at 17:30 caused a price drop that extended until the end of the trading day, about an 18 USD drop. The reported figure was indeed a high number, 12M barrels, a huge Crude build. U.S. production is back at record highs. On the 15th Feb, correction took place, with the price to reverse almost fully. On the way up, Crude oil crossed the 30-period MA and reached a resistance near 78 USD/b. It soon retraced to the mean on the 16th Feb but bounced back to the upside eventually reaching the resistance at 78.50 USD/b.

Gold (XAUUSD)

On the 13th Feb, after 15:30, the more-than-expected inflation figure caused USD heavy appreciation and a sharp drop for Gold, passing the support at 2000 USD/oz, moving further downwards until the next support near 1990 USD/oz. Surprisingly, on the 14th Feb, Gold remained in consolidation. Retracement eventually took place yesterday back to the upside, supported by the weak sales report for the U.S. and causing the price to reach just above the 2K USD level. On the 16th Feb, the price dropped after the PPI news and USD appreciation, reaching the support at near 1995 USD/oz before reversing to the upside. The USD currently experiences weakness and is one major factor that pushes Gold’s price more to the upside. Currently Gold settled near 2020 USD/oz. No signals for any change in trend currently.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX)

Price Movement

On the 14th Feb and 15th Feb, the index climbed further. All three U.S. benchmark indices experienced the same path. On the 16th the index found resistance at 17,970 USD and immediately dropped with the PPI data release for the U.S. The index found support at that time near 17,660 USD before retracing to the 61.8 Fibo level and later back to the 30-period MA. Another drop followed causing the index to close lower and remain close to 17.700 USD. This signals the end of the uptrend and possible sideways but volatile movement if no breakouts to the downside occur soon.

______________________________________________________________