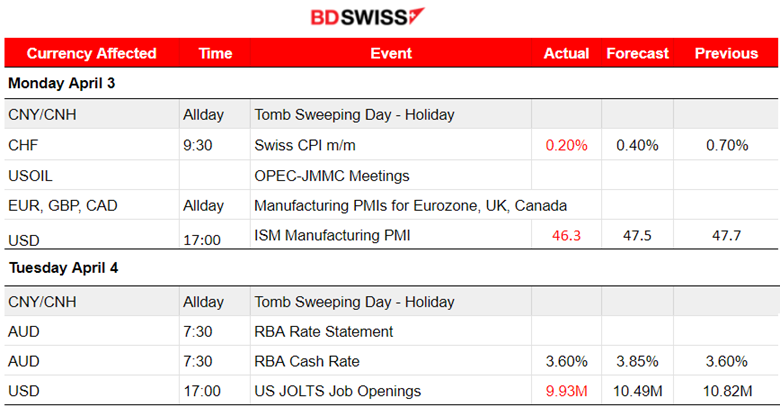

PREVIOUS WEEK’S EVENTS

Announcements:

U.S. Economy

The U.S. ISM Manufacturing Index fell, showing U.S. factory activity contraction in March. Recent market conditions that involve expected rising interest rates, fears of an upcoming recession and tighter lending conditions caused investment activity to drop. Concerns arise about whether manufacturing growth will return back to expansion levels. Employment data indicate contraction as factories stop hiring and laying off workers.

The Bureau of Labor Statistics reported 9.9M less job openings on the last business day of February. Economists were expecting 10.4 million available positions. The February JOLTS report showed that the number of new hires decreased to 6.1 million from 6.3 million.

Services PMI and ADP NF Employment Change figures show weaker-than-estimated economic data. A more-than-expected drop in the U.S. services sector activity, while private payrolls increased only by 145K in March, below estimates. The Fed’s rate hikes are beginning to cool down the labour market and slow down the economy. The data raised concerns about the economy triggering fears of recession.

Source: https://www.bls.gov/news.release/archives/jolts_04042023.htm

Source: https://www.bloomberg.com/news/articles/2023-04-04/stock-market-today-dow-s-p-live-updates

_____________________________________________________________________________________________

Inflation

Canada’s inflation was higher than expected in March for Canada. BOC has paused the rate hikes while its economy is on track to expand. Hard decisions for the BOC are expected soon on rates since on the one hand, they have to fight inflation and on the other, achieve financial stability.

U.S. inflation rose by 0.3% in February, which was less than expected as per the release of the U.S. Core PCE Price Index change on the 31st of March. That was below the 0.4% estimate and lower than the 0.5% January increase. Expected inflation is low, below 4%, thus, Fed might pause rate hikes to prevent further economic slowdown and even a high recession.

The Swiss Consumer Price Index (CPI) increased by 0.2% in March 2023, compared to the previous month. The Swiss National Bank will likely increase interest rates again even though the figures are low. Price pressures are significantly lower in Switzerland than in the rest of Europe. Furthermore, the country’s purchasing managers’ index declined further, below the 50 threshold, indicating contraction. It eventually reached 47 last month.

Source: https://www150.statcan.gc.ca/n1/daily-quotidien/230228/dq230228b-eng.htm

Source: https://www.cnbc.com/2023/03/31/fed-inflation-gauge-february-2023-.html

_____________________________________________________________________________________________

Interest Rates

Australia’s Central Bank paused rate increases just like BOC did. As of the 4th of April, it is keeping the cash rate at 3.6%, the same as the previous figure, in line with a majority of economists and market expectations.

An unexpected interest rate increase of 50 bps took place by the Reserve Bank of New Zealand (RBNZ), as part of its tightening policy to counter inflation. Determined to lower inflation, they increased the Official Cash Rate to 5.25% from 4.75%, exceeding economists’ expectations.

BOC paused rate hikes for now. However, employment change in Canada showed an increase of 34.7K which was way above the estimate. The unemployment rate remained steady at 5%, which is nearly a low record. The high interest rates set by BOC might not have had the desired effect. On the 12th of April, BOC is scheduled to set rates again.

_____________________________________________________________________________________________

Stock Market

The U.S. stock market experienced unusual volatility and rising prices since the 28th of March. The banking sector concerns have brought the indexes down and those increases showed recovery. However, the market was overreacting. Indexes have fallen as stocks reversed when the investor risk-on mood switched off.

Source: https://www.bloomberg.com/news/articles/2023-03-30/stock-market-today-dow-s-p-live-updates#xj4y7vzkg

_____________________________________________________________________________________________

Energy Market

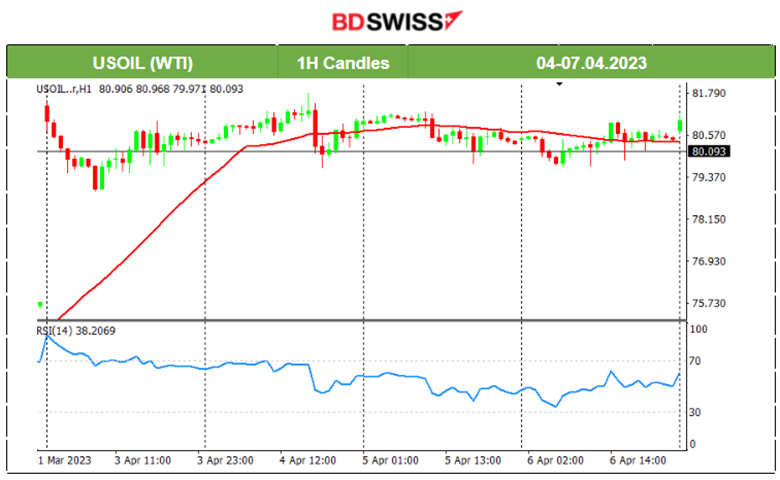

The Organisation of Petroleum Exporting Countries and Allies (OPEC+) unexpectedly announced output cuts, causing a boost in expectations of rising inflation affecting the world economy. Along with Russia, they pledged to make cuts exceeding 1 million barrels a day, taking effect in May. This surprise intervention pushed the price significantly higher. During the previous week, oil paused its upward movement. Its price now trades near 80.50 USD, where it settled after the Organisation of Petroleum Exporting Countries (OPEC) and its allies shocked the market with a surprise supply cut, causing the price to jump nearly 6 dollars on the 3rd of April.

_____________________________________________________________________________________________

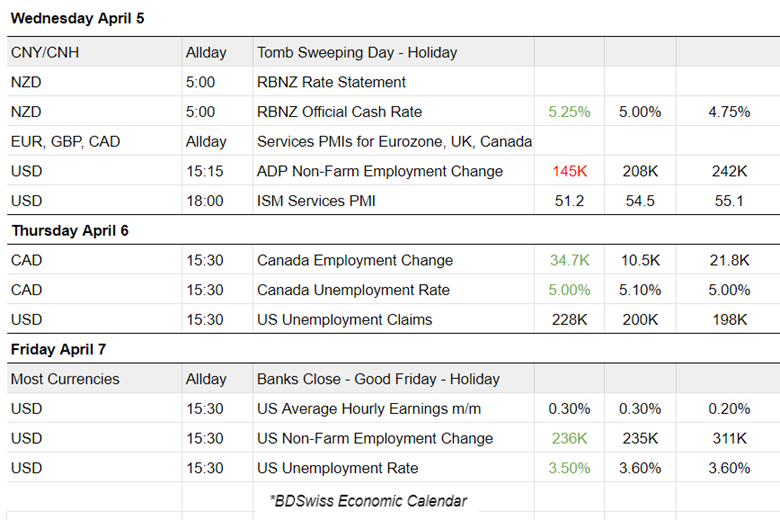

Currency Markets Impact – Past Releases:

_____________________________________________________________________________________________

Summary Total Moves – Winners vs Losers (Week 03-07 April 2023)

_____________________________________________________________________________________________

FOREX MARKETS MONITOR

EURUSD

EURUSD was experiencing a quite volatile path the last few days with the release of very important figures and reports affecting the USD. A downward reversal occurred on the 5th of April, and then another one on the 6th, signalling that volatility was getting lower ahead of the NFP release. 1.088 is significant support that the price did not break fully (leaving a candlestick shadow) with the NFP release. Looking at the EURUSD chart from a distance, it is clear that a head and shoulders pattern emerged, with the neckline taking place at that level. The below chart shows the head and the right shoulder. If the EURUSD eventually moves lower, it might break these significant support levels and drop further.

USDCAD

Trading Opportunities

The USDCAD has been experiencing an upward trend for days. We saw that it moved upward and was above the 30-period MA, going with a steady pace and low volatility. The CAD was not greatly affected by the USD related figure releases and showed no significantly unusual big deviations from the mean. These were max 30-40 pips

NZDUSD

NZDUSD was moving upwards showing high volatility. The pair continued to move upwards above the MA after the reversal on the 3rd of April. USD news was pushing the pair higher and it seems that it showed resilience in regards to dropping. The RSI indicated settlement after the price retraced fully on the 5th-6th of April. Since then, it has moved below the MA following a downward trend.

DXY (US Dollar Index)

The USD has been declining overall since the 3rd of April. Less volatility was observed after the 6th when it started to reverse slightly after the earlier heavy drop.

_____________________________________________________________________________________________

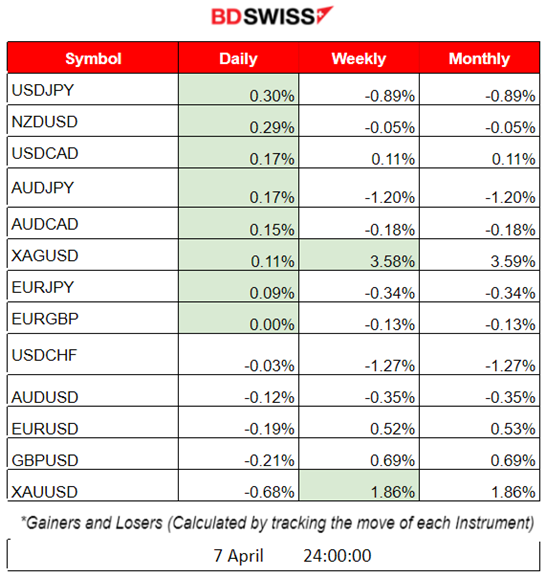

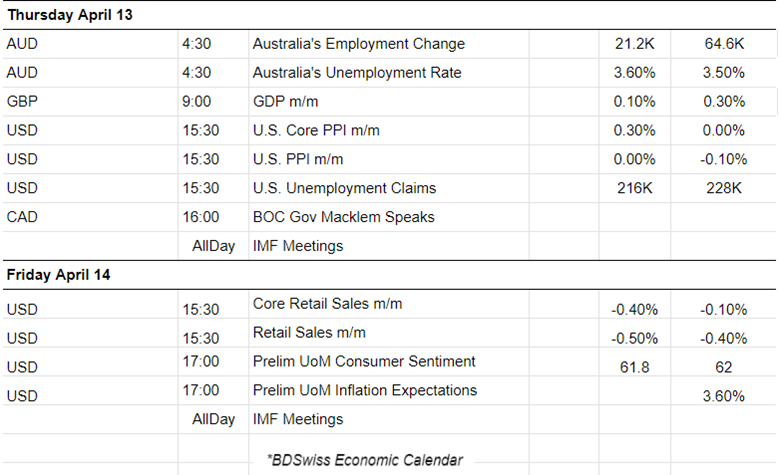

NEXT WEEK’S EVENTS

IMF meetings will take place every day this week. The head of the International Monetary Fund pointed out that central banks around the world should keep fighting inflation with rate hikes despite ongoing concerns about financial stability.

U.S. inflation-related figures will be released, along with the BOC rate with the FOMC statement on the 12th of April. We also have the Labor-related reports for Australia and important PPI figures for the U.S.

Currency Markets Impact:

_____________________________________________________________________________________________

COMMODITIES MARKETS MONITOR

US Crude Oil

U.S. Crude Oil continues its sideways path around the 30-period MA with deviations of only nearly 1 USD from the mean.

Gold (XAUUSD)

Gold was experiencing an upward movement that eventually resulted in a reversal, consistent with the RSI divergence signals. On the 6th of April, it reversed, crossing the 30-period MA and moving further downwards, dropping below the 2000 USD level.

_____________________________________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX)

U.S. Stocks have been reversing from the long upward trend the past week. NAS100 was crossing the 30 period-MA on the 4th of April while moving downwards. The index was affected by the news releases and was pushed even more downwards until the 6th of April, when it finally reversed, crossing the MA and moving upwards amid NFP. The reversal was consistent with the RSI divergence signals. Price: Lower Lows, RSI: High Lows. Now, the index is moving downwards again after the 7th of April, showing volatility. Thus. there is no clear trend.

______________________________________________________________