PREVIOUS TRADING DAY EVENTS – 10 April 2023

Announcements:

The former U.S. Treasury Secretary Lawrence Summers disagrees with the IMF. He suggested last month that the real neutral interest rate is probably in the range of 1.5% to 2%.

“The low level of neutral rates will limit the ability of the Fed and other central banks to stimulate their economies going forward”, the IMF said.

“The effective lower bound on interest rates may become binding again as monetary policymakers are forced to cut rates to about zero to handle future economic downturns”, IMF said.

On Wednesday, the inflation-related report on Core CPI is expected to show a 0.4% monthly increase. Ian Lyngen, head of U.S. rate strategy at BMO Capital Markets, said that the March employment numbers provide “no hurdle for the Fed” to issue a 25 basis point hike in May, although upcoming data could impact the decision.

It’s still unclear when the Fed will start to cut rates, according to Matt Diczok, head of the fixed-income strategy for Bank of America Corp. “The market feels fairly certain it’s going to start happening this year, but we need to see that play out more in the inflation data,” he told Bloomberg Television.

Fears of an economic downturn were also top of mind on Monday.

On Monday, the IMF argued that rates in the U.S. and other industrial countries will revert towards ultra-low levels instead of the 1.5% to 2% real neutral interest rate, former U.S. Treasury Secretary Lawrence Summers has suggested.

______________________________________________________________________

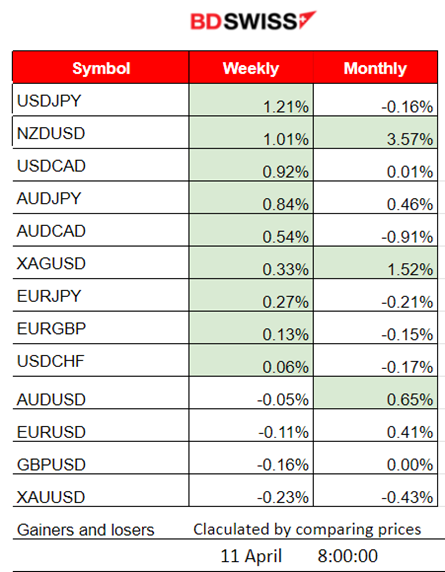

Summary Daily Moves – Winners vs Losers (10 April 2023)

______________________________________________________________________

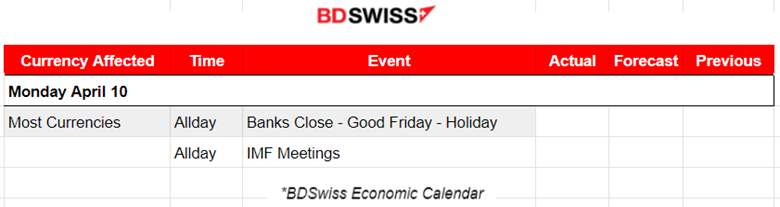

News Reports Monitor – Previous Trading Day (10 April 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No significant news. No important scheduled releases.

- Morning – Day Session (European)

No significant news or any important scheduled releases. Banks were closed in observance of Easter Monday.

The International Monetary Fund (IMF) meeting took place yesterday. It was stated that real interest rates have rapidly increased recently as monetary policy has tightened in response to higher inflation. The IMF argued that rates in the U.S. and other industrial countries will revert, returning to those low levels that were set prior to COVID. The Fund’s estimate of the U.S. neutral rate is in line with that of the Fed’s policymakers.

General Verdict:

______________________________________________________________________

FOREX MARKETS MONITOR

EURUSD 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair shows downward movement in general as it moves around the 30-period MA in the last few days. The U.S. dollar news and figures releases push it lower and lower.

EURUSD (10.04.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The EURUSD experienced low volatility and only after the European Markets’ opening, it started to move more volatile. At around 13:30, it started to move rapidly downwards reversing and crossing the 30-period MA with a deviation from the mean of more than 60 pips. It later returned to the mean.

Trading Opportunities

With no scheduled releases, the downward movement was unexpected and a result of the USD appreciation. Traders could forecast the retracement and set the stop level at the 61.8% Fibo level, as indicated when using the Fibonacci Expansion tool.

____________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NASDAQ – NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

U.S. Stocks remain resilient against dropping. While economists expect that there is going to be a recession, investors keep the risk-on mood. The market is quite volatile though, with big deviations from 30-period MA and huge reversals. NS100 reversed from the downward path on the 6th of April crossing the MA and moving upwards while waiting for the NFP. After the NFP, we see a huge drop on the 10th of April followed by a full retracement.

NAS100 (10.04.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The path is similar to EURUSD, with low volatility during the Asian session and, at around 13:00-13:30, it experiences a huge drop of more than 170 USD. The index retraced after the drop back to the mean where it showed some resistance and then it continued the upward path retracting fully.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

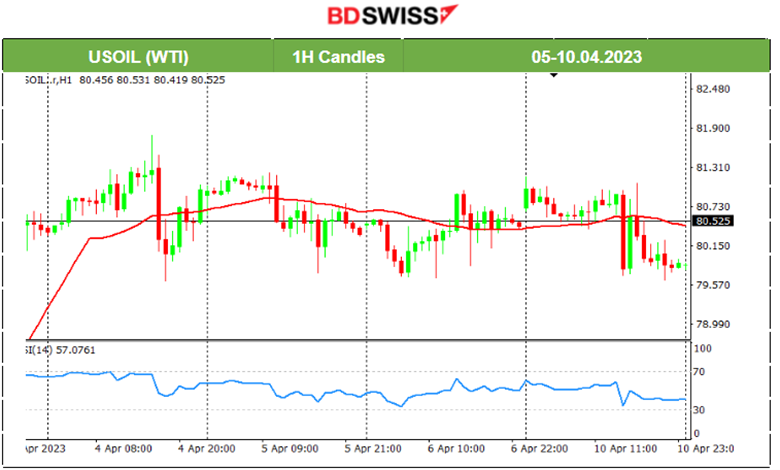

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Crude’s price continues to show low volatility. It moves sideways since the OPEC+ production cut announcement with deviations from the 30-period MA of nearly 1 USD.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Gold was moving higher and higher as the USD depreciated and investors’ mood was more in risk-off mode. It reversed on the 6th of April, following a steady downward path below the MA, experiencing a short-term downward trend. Now, it settles near the 2000 USD level.

______________________________________________________________

News Reports Monitor – Today Trading Day (11 April 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No significant news. No important scheduled releases.

- Morning – Day Session (European)

The markets for major pairs will likely continue to experience low volatility. The USD will probably be affected by statements concerning future monetary policy. During the American session, there might be steady upward or downward movements without high deviations from the mean.

General Verdict:

______________________________________________________________