PREVIOUS TRADING DAY EVENTS – 16 May 2023

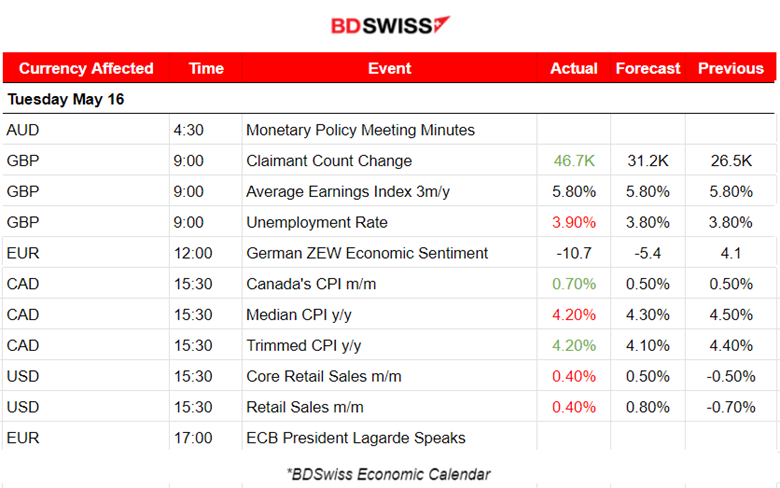

Announcements:

The U.K.’s Claimant Count Change (change in the number of people claiming unemployment benefits) was reported higher and more than expected, 46.7K versus the previous 28.2K figure.

GBP fell against the USD and the EUR at that time, since investors currently expect that the Bank of England may change policy and consider pausing interest rate increases in the next meetings.

“Wage growth is slowing rapidly enough for the MPC (Monetary Policy Committee) to keep Bank Rate at 4.50% at its next meeting on June 22,” Samuel Tombs, chief UK economist at Pantheon Macroeconomics, said.

“The focus now switches to the next set of inflation data, due on May 24, to see if that shows the evidence of inflation persistence required to make the MPC increase rates again,” Martin Beck, chief economic advisor to the EY ITEM Club said in a note to clients.

Source:

https://www.reuters.com/world/uk/uk-jobless-rate-rises-39-q1-2023-05-16/

______________________________________________________________________

Summary Daily Moves – Winners vs Losers (16 May 2023)

- Not much movement yesterday on the upside as most pairs moved sideways. with volatile paths though. The EURGBP was the top gainer with just a 0.24% change.

- The week finds NZDUSD and AUDJPY leading and having nearly 70% gains. They are also the top gainers of the month with 0.99% and 0.85% price change respectively.

_____________________________________________________________________

News Reports Monitor – Previous Trading Day (16 May 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

At 4:30, the RBA Minutes of the Reserve Bank of Australia’s May 2 policy meeting were released. No significant impact on the AUD. Later, news at 5:00 regarding China’s retail sales and unemployment rate caused the AUD to depreciate and AUDUSD to drop nearly 20 pips at that time before retracing.

- Morning – Day Session (European)

At 9:00, the UK’s important figures were released including the average earnings index (3-month moving average compared to the same period a year earlier) and unemployment rate (for the past 3 months). The unemployment rate was reported higher at 3.9% versus the expected 3.8%.

The U.K.’s Claimant Count Change (change in the number of people claiming unemployment benefits) was reported much higher and more than expected, 46.7K versus the previous 28.2K figure.

GBP depreciation followed and GBPUSD started to drop heavily at that time.

At 15:30, important inflation figure releases for Canada took place causing intraday shocks for CAD pairs as CAD appreciated much from higher-than-expected figures. At the same time, retail sales figures were released for the U.S. having a small impact.

General Verdict:

______________________________________________________________________

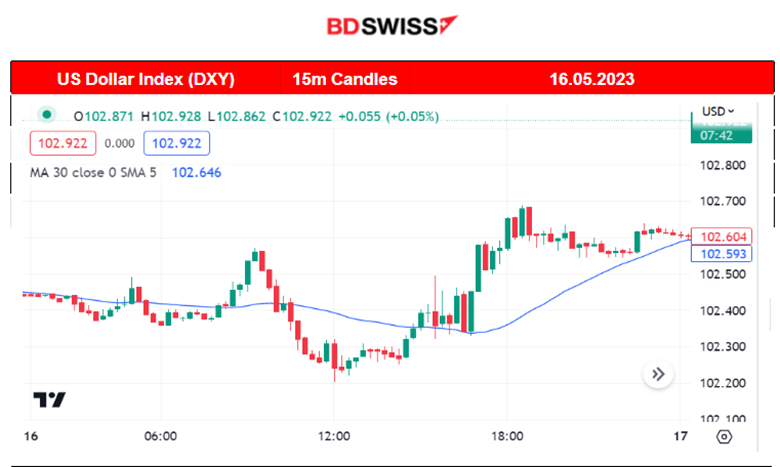

FOREX MARKETS MONITOR

GBPUSD (16.05.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

GBPUSD experienced a shock following the release of the job-related figures at 9:00. The pair dropped nearly 40 pips as GBP depreciated. The pair’s path was sideways but the market conditions were quite volatile. After this morning’s drop, the pair reversed fully crossing the 30-period MA going upwards and finding resistance. Later it dropped with another reversal taking place. The USD news shook the market at 15:30 and caused the pair to further move downwards crossing the MA again and moving below it until the end of the trading day.

Trading Opportunities

The pair experienced a significant reversal during the European Session when there was lots of activity. After finding resistance around noon, it retraced back to the mean as shown in the chart when using the Fibonacci expansion tool.

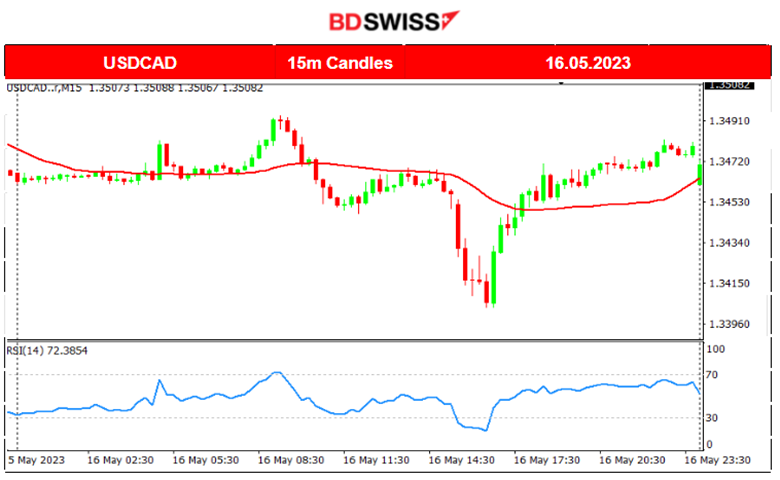

USDCAD (16.05.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair experienced a volatile sideways path yesterday. It moved with low volatility around the mean until 15:30 when the CPI figures were released causing it to drop heavily near 50 pips. The CPI figures showed higher-than-expected inflation. After finding significant support at 1.34030 it reversed, fully going upwards and crossing the 30-period MA.

____________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The upward trend was interrupted on the 12th of May when the index fell sharply during the stock market opening after finding intraday resistance. However, the index showed its resilience in dropping and reversed back to the mean the next trading day. Since then it has been following an upward trend again. Yesterday, in the market opening the NAS100 jumped near 100 USD before retracing.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The oil price reversed on the 15th of May signalling the end of the short-term trend downwards. Currently, it experiences higher-than-normal volatility but it is on a sideways path.

Important levels:

Support: 69.35 USD/b.

Resistance: 71.70 USD/b.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Gold has been experiencing low volatility after a volatile downward movement since the 10th of May. Important scheduled releases took place yesterday such as the U.S. retail sales affecting the USD. This caused it to deviate much from the mean, diving nearly 20 dollars. Its path is explained also by the latest risk mood as investors have been preferring more risky assets, such as stocks, instead. Metals are having a strong comeback this month. Silver fell by more than 5% so far.

______________________________________________________________

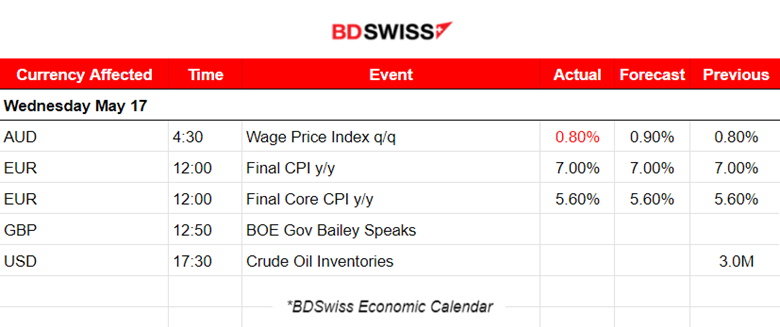

News Reports Monitor – Today Trading Day (17 May 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

At 4:30, Australia’s Wage price index figure was released. The change in the price businesses and the government pay for labour, excluding bonuses, was lower than expected. WPI rose 0.8% this quarter and 3.7% over the year. The AUD was affected but not much with depreciation at that time before retracing soon.

- Morning – Day Session (European)

Final CPI figures for the Eurozone were released at 12:00. They were as expected and no significant intraday shocks took place, nor high volatility.

At 17:30, we are expecting the Crude oil (WTI) inventory figures to be released. These will give an idea of why crude has been experiencing resistance in dropping. Analysts anticipate a negative change, -1.3M while the previous figure was 3M. This expectation is in line with what we see on the WTI chart.

General Verdict:

______________________________________________________________