PREVIOUS TRADING DAY EVENTS – 15 May 2023

Announcements:

House Speaker Kevin McCarthy said on Monday that there’s been “no progress” on debt ceiling talks. A meeting is scheduled again on Tuesday at the White House, just one day before he leaves on a trip. Biden will travel to Japan on Wednesday for a G7 summit, then to Australia.

Yellen: “We have learned from past debt limit impasses that waiting until the last minute to suspend or increase the debt limit can cause serious harm to business and consumer confidence, raise short-term borrowing costs for taxpayers, and negatively impact the credit rating of the United States.”

“If Congress fails to increase the debt limit, it would cause severe hardship to American families, harm our global leadership position, and raise questions about our ability to defend our national security interests,” she said.

Source:https://www.reuters.com/markets/us/new-york-factory-activity-slumps-may-ny-fed-2023-05-15/

______________________________________________________________________

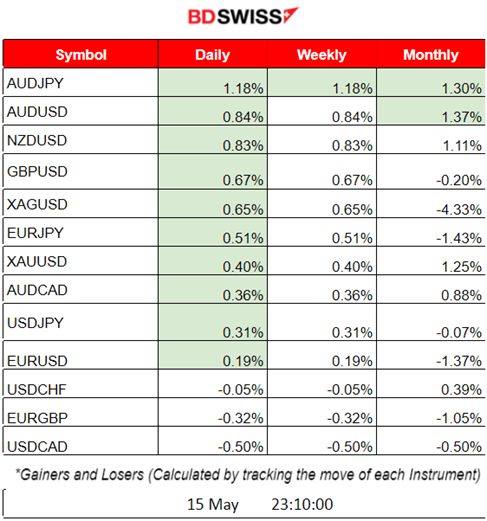

Summary Daily Moves – Winners vs Losers (15 May 2023)

- AUDJPY took the lead gaining 1.18% yesterday.

- AUDJPY and AUDUSD are on the top of the month’s winner list with a 1.30% and 1.37% price change, respectively.

______________________________________________________________________

News Reports Monitor – Previous Trading Day (15 May 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No significant news announcements, no important scheduled releases.

- Morning – Day Session (European)

No significant impact on the EUR. The EURUSD moved steadily, almost sideways, around the mean.

At 15:30 the Empire State Manufacturing Index figure was reported lower than expected, suggesting that business activity fell sharply in New York State, according to firms responding to the survey for May 2023. It had a low impact on the USD causing depreciation at that time, yet not a significant shock.

General Verdict:

FOREX MARKETS MONITOR

EURUSD (15.05.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

With the absence of important scheduled figures, the EURUSD has been experiencing low volatility, moving around the mean but with a steady upward direction as the USD was experiencing depreciation during the trading day. At 15:30 the Empire State Manufacturing Index figure was released causing a small shock for the pair at that time, thus the shadow on that candle.

This was the price path for most major pairs having USD as quote currency since USD was the main driver.

____________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

NAS100 stocks have been moving upwards since the 10th of May when the U.S. CPI figures were released. Investors are waiting for a pause in rate hikes as per the Fed statement. The upward trend was interrupted on the 12th of May when the index fell sharply during the stock market opening after finding intraday resistance. However, the market shows again its resilience in dropping and reverses back to the mean the next trading day and at the start of the new trading week.

The S&P500 index is showing high volatility but a more sideways path around the 30-period MA. The index is forming a channel with price deviations from the mean reaching 30 USD. No clear trend here either.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The oil price has settled around the mean 71 USD after dropping since the 10th of May when the U.S. inflation-related figures were released. Yesterday’s movement signals the end of the short-term trend downwards since the price reversed, crossing the 30-period MA and continuing to move upwards above the MA.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Gold experiences low volatility after a volatile downward movement since the 10th of May. It settles near the 2015 USD level. Even though it is moving over the 30-period MA, it is not expected to stay at that path. It experience more volatility afterwards with sideways movement around the MA. Any important scheduled releases might cause it to deviate much from that path though. Especially the USD-related ones.

______________________________________________________________

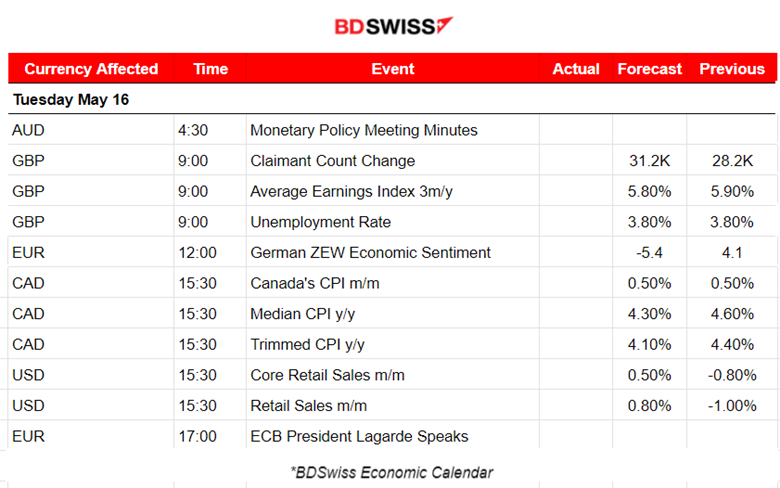

News Reports Monitor – Today Trading Day (16 May 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

At 4:30, the RBA Minutes of the Reserve Bank of Australia’s May 2 policy meeting were released. No significant impact on the AUD. Later, news at 5:00 regarding China’s retail sales and unemployment rate caused the AUD to depreciate and AUDUSD to drop nearly 20 pips at that time before retracing.

- Morning – Day Session (European)

At 9:00, the UK’s important figures were released including the average earnings index (3-month moving average compared to the same period a year earlier) and unemployment rate (for the past 3 months). Unemployment rate was reported higher at 3.9% versus the expected 3.8%.

The U.K.’s Claimant Count Change (change in the number of people claiming unemployment benefits) was reported much higher and more than expected, 46.7K versus the previous 28.2K figure.

GBP depreciation followed and GBPUSD started to drop heavily at that time.

At 15:30, important inflation figure releases for Canada are taking place expecting intraday shocks for CAD pairs. At the same time, retail sales figures will be released for the U.S. and will probably cause intraday shocks also for USD pairs.

General Verdict:

______________________________________________________________