Previous Trading Day’s Events (14 Nov 2023)

“With the market still fundamentally tight at its core, the Bank of England is unlikely to change its course on keeping interest rates high in the near term,” said Yael Selfin, chief economist at KPMG UK.

The number of employees on payrolls rose by 33K in October, defying forecasts for a drop. September’s reading also was revised to show an increase instead of a decline. The claimant count rate of people receiving benefits held at 4% in October.

“The latest batch of jobs data shows why the Bank of England will continue to double down on its “higher for longer” approach to policy. The labour market and pay growth have cooled, but not by enough to leave the central bank confident it can get inflation back to 2% quickly enough.” Said Ana Andrade and Dan Hanson, Bloomberg Economics.

“The BOE will likely be disappointed at the slow pace at which wage growth is moderating,” said Stuart Cole, chief macroeconomist at Equiti Capital in London. “Today’s report adds weight to the arguments being made by the BOE that interest rates will need to be kept on hold at their current elevated level for an extended period of time to ensure that downward pressure on inflationary forces continues to be felt.”

“Our labour market figures show a largely unchanged picture, with the proportions of people who are employed, unemployed or who are neither working nor looking for a job all little changed on the previous quarter,” ONS director of economic statistics Darren Morgan said. “With inflation easing in the latest quarter, real pay is now growing at its fastest rate for two years.”

The lower-than-expected inflation readings reported by the Labor Department’s Bureau of Labor Statistics (BLS) pushed U.S. Treasury yields lower and initiated a strong stock market rally.

According to the reports regarding job and wage growth, it showed cooling in October reinforcing expectations that the economy could avoid a recession.

“The Fed always wants to see more progress, but it is looking like the inflation battle has rounded the corner,” said Christopher Rupkey, chief economist at FWDBONDS. “With any luck, the economy will miss a recession and get lower inflation too.”

Most economists believe the U.S. central bank’s fastest monetary policy tightening campaign since the 1980s is over. However, Powell said last week, “if it becomes appropriate to tighten policy further, we will not hesitate to do so.”

Financial markets are even anticipating a rate cut next May, according to CME Group’s FedWatch tool.

“It’s still premature to call the inflation fight over,” said Will Compernolle, a macro strategist at FHN Financial in New York. “The biggest contributors to October disinflation, falling energy, core goods prices and decelerating shelter inflation are all the outer layers of the Fed’s ‘inflation onion’ that won’t contribute to disinflation forever.”

Source: https://www.reuters.com/markets/us/us-consumer-prices-unchanged-october-2023-11-14/

______________________________________________________________________

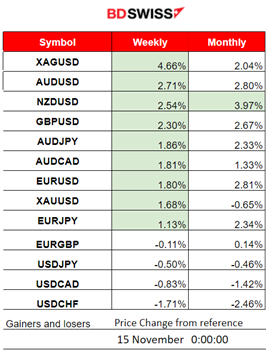

Winners vs Losers

______________________________________________________________________

______________________________________________________________________

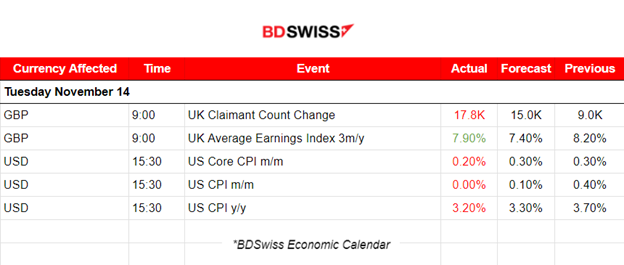

News Reports Monitor – Previous Trading Day (14 Nov 2023)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No major announcements, no special scheduled releases.

- Morning–Day Session (European and N. American Session)

At 9:00 this morning, the Claimant Count Change was reported more than expected. According to the reports, vacancies fell in the quarter for the 16th consecutive period, with vacancies falling in 16 of the 18 industry sectors. It seems that elevated rates are indeed having an impact. Also, annual growth in regular pay (excluding bonuses) in the U.K. was 7.7% from July to September 2023, slightly down on the previous periods, but is still among the highest annual growth rates since comparable records began in 2001.

The market responded with GBP appreciation. GBPUSD jumped near 25 pips before eventually retracing to the mean and soon continued an upward path again.

At 15:30 the CPI data for the U.S. eventually came out and caused high volatility with intraday shocks. FX market, metals and Stocks were all affected by rapid movements in one direction. The dollar depreciated greatly against other currencies, Stocks rallied, Gold reversed to the upside and Crude oil saw a jump in price. The Fed is anticipating that inflation will cool eventually and reach its target. With this report, any chances of hikes are eliminated and the market already responds causing the dollar to weaken.

General Verdict:

____________________________________________________________________

____________________________________________________________________

FOREX MARKETS MONITOR

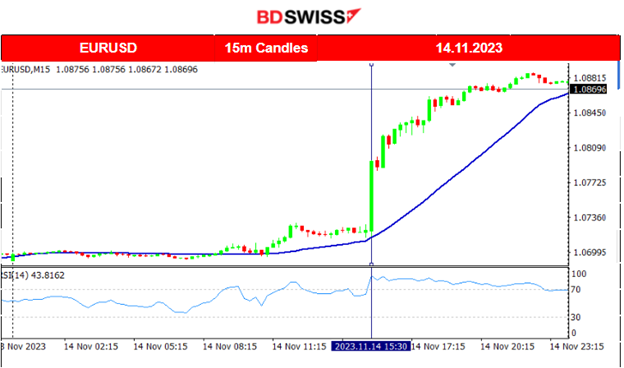

EURUSD (14.11.2023) Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The pair was obviously affected by the news regarding the CPI changes in the U.S. At 15:30, the pair moved to the upside rapidly since the market responded to the lower inflation figure with dollar depreciation. This strong effect has not faded yet since we see no retracement. Resistance is there though apparently. Let’s see if it will hold or if today a retracement will take place. At 15:30 today we also have the PPI data releases that could potentially have the same effect on the dollar.

A similar chart for all USD pairs (USD as quote currency).

___________________________________________________________________

___________________________________________________________________

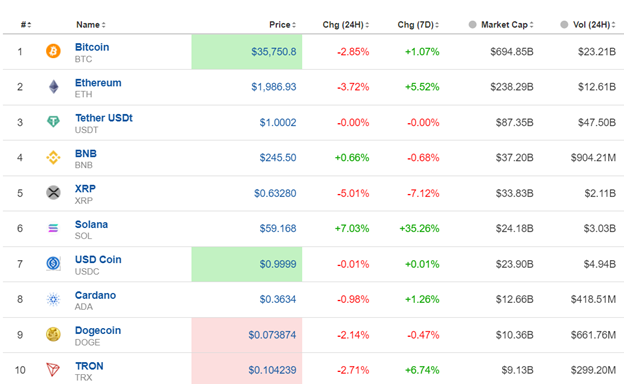

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Bitcoin reverses from the upside. It recently deviated from the 30-period MA to the downside significantly. After it tested the support near 36200 it retraced to the mean. Significant resistance at 37500 was broken after the release of the CPI data report for the U.S. Even though the dollar greatly weakened against a basket of currencies, bitcoin moved to the downside with a large drop, even reaching support near 34500. It eventually retraced to the mean.

Crypto sorted by Highest Market Cap:

Apparently, the U.S. CPI data releases did not have much impact. The crypto activity remained roughly unchanged. Most cryptos show losses for the last 24 hours.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4Hour Timeframe Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The fundamentals and the current data releases are pushing U.S. indices to the upside. Stocks experienced a rally yesterday after the release of the lower inflation figure for the U.S., preventing a retracement of the previous long upward path that stocks experienced recently. No intraday retracement was recorded. The dollar weakened significantly. Today, the PPI is expected to have the same effect. Let’s see if the index will experience a similar upward path after 15:30.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

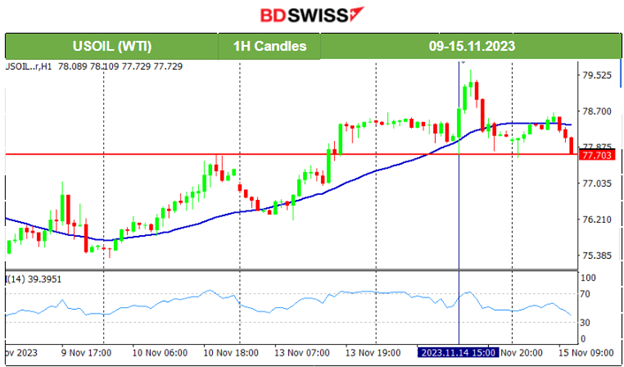

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Crude was following an upward trend but the path was quite volatile. It eventually jumped and found resistance at near 79.60 USD/b when the CPI data was released but soon reversed to the downside. Obviously, there are downward pressures. It currently crossed the 30-period MA on its way down and remained below it, testing the support at 77.70 USD/b. A breakout downwards could cause the price to drop to 77 USD.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Gold was moving lower within a downward channel, experiencing high volatility. Despite several attempts to end the downtrend by crossing the 30-period MA on its way up, it continued eventually lower. However, yesterday on the 14th Nov, its price eventually broke the channel upwards after the U.S. CPI data release and the USD weakening. It moved significantly to the upside reaching strong resistance near 1970. That resistance was eventually broken today to the upside but there was no rapid movement further upwards. The RSI shows lower highs and this might be an indication of a retracement instead if the PPI news at 15:30 will not push Gold higher.

______________________________________________________________

______________________________________________________________

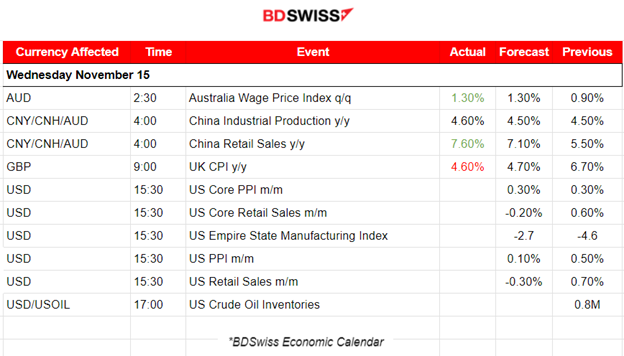

News Reports Monitor – Today Trading Day (15 Nov 2023)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

According to the report released at 2:30, Australia’s wage price index rose 1.3% in the September quarter, matching forecasts and the biggest quarterly rise in the 26-year history of the series. No major impact on the market was recorded.

At 4:00 the report for China showed that Industrial Production increased on a yearly basis by 4.6%, more than expected while retail sales change was reported higher than expected at 7.60% vs expected 7.10%. These releases did not have much impact.

- Morning–Day Session (European and N. American Session)

At 9:00 the CPI data for the U.K. showed a remarkably low inflation rate. It was reported lower than the expected figure, 4.6 % versus the previous figure of 6.7%. That is a great achievement. The BOE managed to lower inflation greatly and see some progress eventually while keeping the interest rates elevated. The market responded with GBP depreciation at the time of the release. The GBPUSD dropped near 30 pips at that time.

The PPI data for the U.S. will be released at 15:30, another inflation-related report. The U.S. retail sales data are going to be reported as well at the same time. It is estimated that the USD pairs are going to be affected by moderate intraday shock and higher-than-normal volatility levels at the time of the release. Retail sales figures are expected to be reported negative to coincide with the recent weak economic reports for the U.S. indicating a slowdown.

General Verdict:

______________________________________________________________