PREVIOUS TRADING DAY EVENTS –17 Nov 2023

US stock markets closed relatively flat for the day on Friday but recorded strong gains for a third consecutive week. The S&P500 breached the key 4500 level for the first time since early September, the 2023 high from July, which pushed briefly over 4600 is the next major resistance area.

The decline in the USD and recovery in US Treasuries continued with the USD index closing below 104, on Friday, again for the first time since early September and recording its largest weekly decline (-1.84%) since July 9. The bellwether US 10-yr Treasury yield closed at 4.441%.

US Oil hit a 4-month low last week under $72.50 before rallying on Friday on rumours of OPEC production cuts. Gold rallied over 2% but failed at $1990 and was well short of the key $2,000 level.

The catalyst last week for the outsized moves was a slew of weaker-than-expected U.S. economic indicators, particularly after an inflation reading that came in below estimates. Markets have priced out the risk of further rate increases from the Fed and indeed today futures are pricing in a 30% chance that the Fed could begin lowering rates as early as March, according to the CME FedWatch tool.

THE WEEK AHEAD

A shortened trading week in the US due to the Thanksgiving Holiday on Thursday and a short working day on Friday, will lead to lower liquidity which in turn can lead to more volatility and sharper moves should news or data events exceed or miss expectations significantly.

Monday – November 20

A light data day but two key Central Bankers have speeches today – BOE Governor Andrew Bailey at 18:45 GMT and new RBA Governor Michele Bullock at 23:00. With markets now bringing forward expectations for interest rate cuts to early 2024, any comments from leading bankers are being watched with greater attention following recent inflation data.

Tuesday – November 21

The highlight of the day will be the FOMC Minutes which will be published at 21:00, although no surprises are expected, the minutes are the official account of the discussions, intentions and voting results of the committee. Earlier in the day (00:30) the RBA Minutes are also published; Canada is expected to show a slowdown in CPI inflation (13:30) and the UK BOE MPC members report to the UK parliament, (10:15) following the publication of the country’s current borrowing indebtedness. ECB President, Christine Lagarde is due to speak at the German Ministry of Finance, in Berlin.

Wednesday – November 22

US Weekly Unemployment Claims and Durable Goods Orders (13:30) are the main economic data of the day. Earlier in the day the ECB will publish their Financial Stability Review and the UK will publish their Autumn Forecast Statement. There are also speeches from the Governors of the RBA, BOC and the President of the German Bundesbank. The week’s PMI data reports also kick off in Australia at (22:00).

Thursday – November 21

Although both Japan & USA are closed and the subsequent lack of liquidity will inevitably impact markets in Europe and the UK, the PMI data reports continue and New Zealand will publish Retail Sales numbers (21:45).

Friday – November 21

US PMI data rounds off the week, with Germany also in focus with GDP data, Ifo Business Confidence and a further speech from Joachim Nagel the President of the Bundesbank (alongside ECB President Christine Lagarde)

Source: https://www.reuters.com/markets/currencies/dollar-back-foot-focus-turns-fed-easing-2023-11-20/

____________________________________________________________________

FOREX MARKETS MONITOR

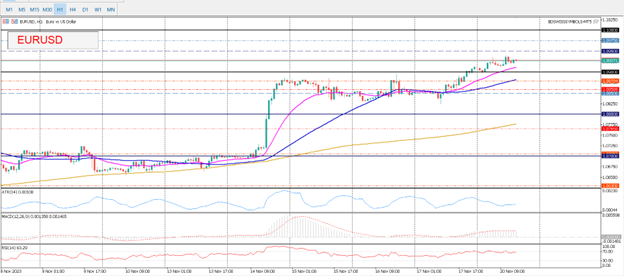

EURUSD (20.11.2023, H1) Chart Summary

Price Movement

The pair continues to gain traction today, having breached the 109.00 level on Friday to post a new 56-day high. The next key resistance levels are the psychological 1.0950, 1.0975 and the key 1.1000. Initial support sits around the 1.0910-00 zone, the 50-hour moving average at 1.0880, 1.0800 and the 200-hour moving average at 1.0775.

___________________________________________________________________

______________________________________________________________________

______________________________________________________________________

EQUITY MARKETS MONITOR

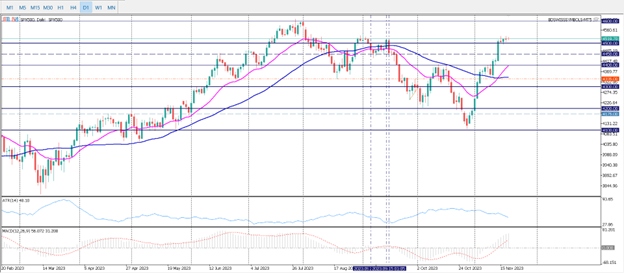

SPX500 – Daily Timeframe – Chart Summary

Price Movement

US stock markets closed relatively flat for the day on Friday but recorded strong gains for a third consecutive week. The NASDAQ gained 1.9%, the USA30 added over 700 points and the SPX500 breached the key 4500 level for the first time since early September. The 2023 high from July, which pushed briefly over 4600 is the next major resistance area. November and December are traditionally positive for stock markets. If the breach of 4500 cannot be maintained, then the next major support is at 4400 and the 50-day moving average at 4335.

______________________________________________________________________

COMMODITY MARKETS MONITOR

XAUUSD – H4 Timeframe – Chart Summary

Price Movement

Last week, the gold price rejected any thoughts of a rally to $2000, having stalled at the key $1990 resistance, decisively. Next support is the 50-period moving average at $1960, the psychological $1950 and the November low at $1930. The higher time frame Daily and Weekly charts are both biased to the downside.