PREVIOUS TRADING DAY EVENTS – 13 June 2023

Announcements:

The figures signal even more that the economy is not cooling. The market reacted with GBP appreciation since the data had raised expectations that the Bank of England will raise interest rates again and perhaps several times to bring inflation down. The labour market remains hot and hard to predict.

BoE Governor Andrew Bailey said the data showed the labour market was “very tight”.

“For the Bank of England, wage growth is a big problem – it is simply at too high a level to allow inflation to hit the 2% target,” said Hussain Mehdi, macro and investment strategist at HSBC Asset Management.

“With the possibility of higher-for-longer rates, a UK recession looks unavoidable as tight monetary policy filters into the real economy – including the housing market,” Medhi said.

“As I’m afraid this morning’s numbers illustrated, we’ve got a very tight labour market in this country,” BoE Governor Andrew Bailey told lawmakers on the House of Lords Economics Affairs committee.

The consumer price index, which measures changes in a multitude of goods and services, increased just 0.1% for the month versus the previous month’s 0.4% figure. The yearly CPI figure showed a 4% inflation rate, lower than the previous year’s 4.9%. This is the desired result from the Federal Reserve and signals that it is more probable that it would keep interest rates unchanged today.

“The moderate slowing provides the Fed room to pause its rate hikes this week,” said Kathy Bostjancic, chief economist at Nationwide in New York. “However, if economic data continues to surprise to the upside and inflation remains sticky, the door is open for another rate hike in the coming months, as soon as July.”

President Joe Biden: “While there is more work to do … I’ve never been more optimistic that our best days are ahead of us”.

“We expect a more noticeable deceleration in core prices in the coming months,” said Michael Pugliese, a senior economist with Wells Fargo in New York. “That said, directional progress should not be confused with mission accomplished. There is a lot of ground to cover in the inflation fight, which should keep the Fed from cutting rates until 2024.”

Source: https://www.reuters.com/markets/us/us-consumer-prices-slow-may-core-inflation-sticky-2023-06-13/

______________________________________________________________________

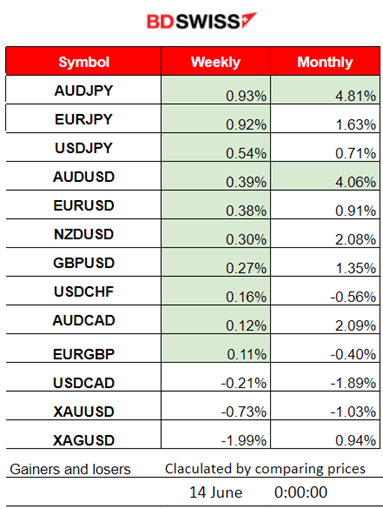

Summary Daily Moves – Winners vs Losers (13 June 2023)

- The pairs with JPY as the quote currency moved quite high yesterday. This week AUDJPY and EURJPY are on the top of the winners list with 0.93% price change.

- AUDJPY is leading this month with 4.81% gains.

______________________________________________________________________

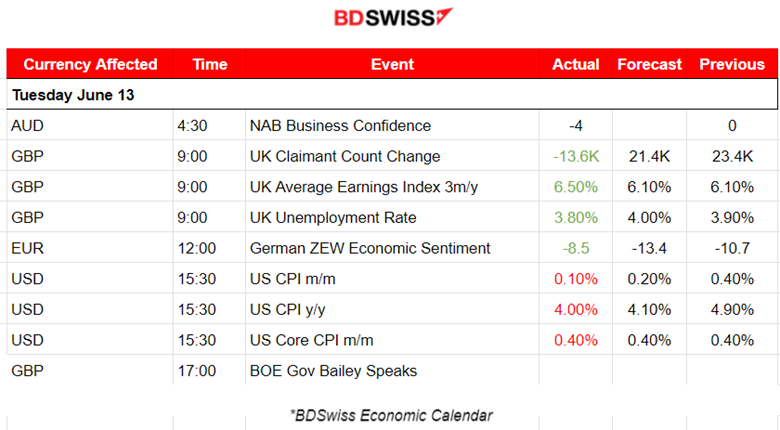

News Reports Monitor – Previous Trading Day (13 June 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

The result of the NAB Business Confidence survey was the -4 figure showing a fall in Australia Business conditions for May with notable declines across the trading, profitability, and employment sub-components.

- Morning – Day Session (European)

The U.K. Claimant Count Change figure was released at 9:00 and was reported remarkably lower, a negative change. This is actually the unemployment claims change. The BOE which wants to see figures of a weakening Labour market must have experienced quite a surprise. The Average Earnings Index 3m/y rose to 6.5% from 6.1% and the 3-month Unemployment rate was reported less, 3.8% against the previous 3.9%. Market reaction to this data was GBP appreciation since market participants are now more confident that hikes will continue.

The CPI figures for the U.S. were released at 15:30. The monthly and yearly CPI change was reported lower beating expectations while the Core CPI change remained unchanged. We see lower inflation data, the result that the Fed wants to see. Reaction to this release was USD depreciation at first followed by USD appreciation that lasted for a short period of time. As per the DXY chart below.

General Verdict:

______________________________________________________________________

FOREX MARKETS MONITOR

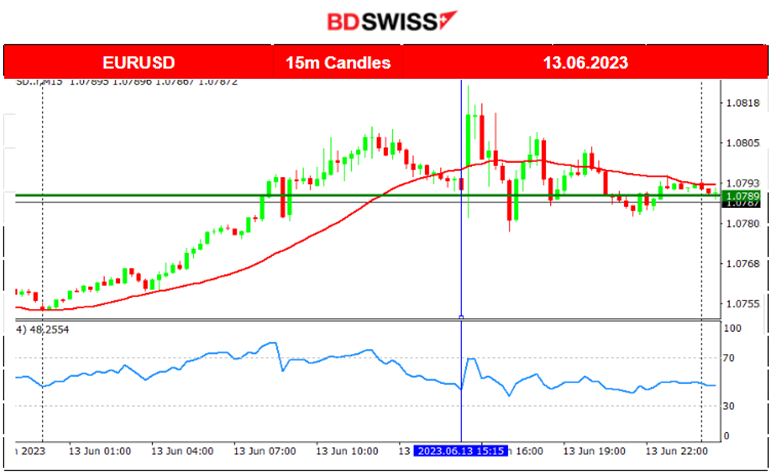

EURUSD (13.06.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

EURUSD started to move upwards even during the Asian session and volatility cooled off at the start of the European Session some hours before the U.S. CPI figure releases. At 15:30 the U.S. inflation data were released and showed a significant reduction in inflation, in line with expectations. The market reacted with a shock, causing up-and-down movements. USD depreciation had taken place at first but soon changed to high appreciation against major currencies with the pair moving lower after that. Volatility was reduced soon after with the pair eventually moving sideways around the 30-period MA. Effects on USD are confirmed by the DXY above.

EURGBP (13.06.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

At the start of the European session, the pair started to move lower. The Labor Market data for the U.K. were released at 9:00 and all were in favour of the GBP appreciation. Figures showed more earnings and a lot fewer Jobless claims. The number of people in employment increased to a record high in the latest quarter. Thus, the pair eventually dropped at a steady pace and remained low.

____________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 8th of June, the index reversed and started an upward trend. All benchmark U.S. indices followed the same path recently signalling that the risk-on mood holds as the FOMC meeting is just around the corner. The U.S. CPI news yesterday caused high volatility and an intraday shock that took place around 15:30 during the release. However, the market did not experience a one-way direction. Resistance and Support levels remained strong enough for the index to move sideways. Resilience in falling is too high for stocks. The path remains upward and is roughly the same for all benchmark U.S. indices.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

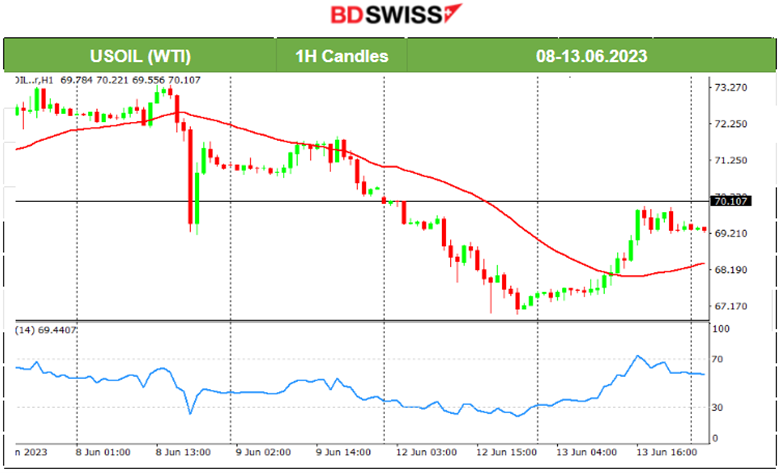

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Crude took the downtrend last week. On the 9th of June, its price experienced lower volatility and a drop overall settling at 70.4 USD/b. Crude experienced a steady fall on the 12th of June and broke the support at 69 USD/b reaching the next support at 67 USD/b without retracing significantly. Retracement and thus reversal took place fully on the 13th of June. An end to the downward move but no confirmation of an uptrend start yet. USD today will be highly affected and the market for Crude will show more volatility as we approach the end of the trading day.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Gold moved sideways with high volatility around the mean. Important news affecting USD had caused no significant deviation from the 30-period MA. On the 12th of June, gold price movement was quite volatile but again sideways. During the day at around 16:00, it dropped near 13 USD and found resistance before retracing back to the mean. The USD had shown high appreciation at that time explaining some of gold’s movement during that period. On the 13th of June, gold continued with testing the resistance at 1971 USD/oz when the U.S. CPI data came out but it reversed soon after that showing a large drop following USD appreciation. It stopped the downward movement near the support level of 1940 USD/oz and started retracing until the end of the trading day.

______________________________________________________________

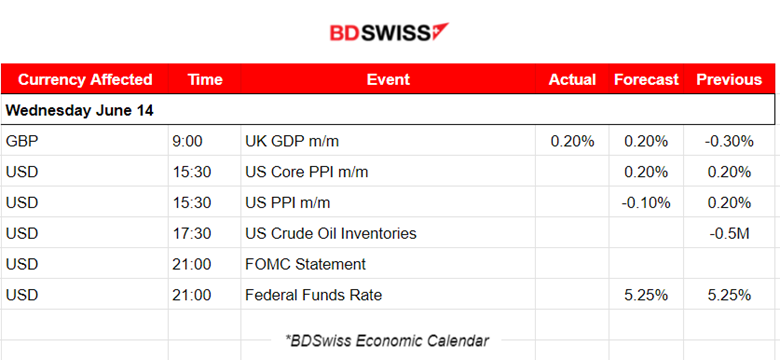

News Reports Monitor – Today Trading Day (14 June 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No significant announcements, no important scheduled releases.

- Morning – Day Session (European)

Monthly real gross domestic product (GDP) is estimated to have grown by 0.2% in April 2023, after a fall of 0.3% in March 2023. The actual figure matched the estimated one and the market did not react much to this.

At 15:30 the U.S. PPI data will be released. They are important due to their relation to inflation and for confirming the Fed’s decision to pause hikes later this trading day. Will it? Let’s see. Yesterday’s data showed lower CPI changes, in favour of a pause. However, the latest U.S. Labour data showed that it is still hot.

The Fed will decide on the Federal Funds rate at 21:00.

General Verdict:

______________________________________________________________