Previous Trading Day’s Events (23.05.2024)

Businesses across the globe broadly enjoyed an improved performance this month with activity picking up in the United States and across parts of Asia and Europe.

The global economy is likely to carry its solid momentum for the rest of the year and into 2025, defying earlier expectations of a slowdown.

U.S. business activity accelerated to the highest level in just over two years in May, suggesting that economic growth picked up halfway through the second quarter.

______________________________________________________________________

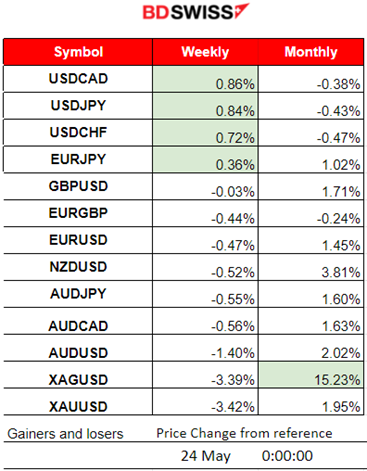

Winners vs Losers

USD pairs reached the top as the U.S. Dollar is moving to the upside due to expectations regarding interest rate cut delays for the Fed. Metals saw a fall but with a potential reversal soon and U.S. stocks experienced a shock yesterday causing a plunge.

______________________________________________________________________

______________________________________________________________________

News Reports Monitor – Previous Trading Day (23.05.2024)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news, no special scheduled figure releases.

- Morning – Day Session (European and N. American Session)

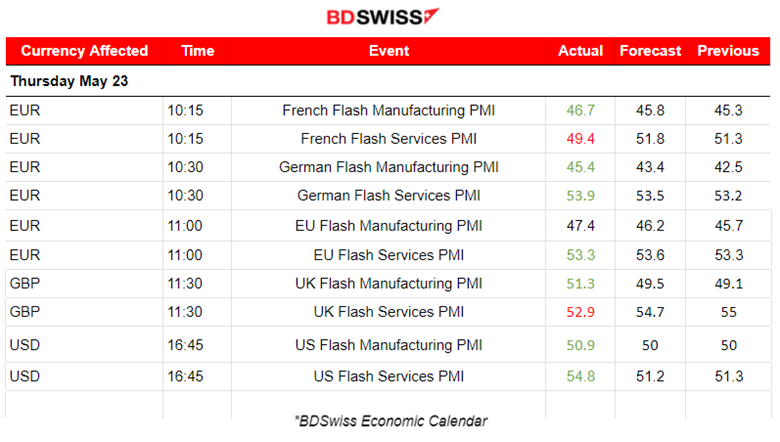

The PMI releases were as follows:

Eurozone PMIs:

In France, the PMI services sector PMI turned to contraction in May after returning to growth at the start of the second quarter.

Germany saw a boost in business activity for the second month and at a faster rate in May. Stronger growth in the service sector with stabilising manufacturing output. Stronger demand and greater optimism towards the outlook. Price pressures meanwhile eased across the eurozone’s largest economy mid-way through the second quarter. Services PMI was reported high at 53.9 points, the highest since June 2023.

In the Eurozone economic recovery gained momentum in May. a. Faster increases in business activity, new orders and employment were all recorded midway through the second quarter. Tates of inflation of both input costs and output prices softened from April but remained above pre-pandemic averages in each case.

U.K. PMIs:

The U.K. PMIs remain in expansion with the services PMI to be reported way worse than expected though. Overall the U.K. registered a solid expansion in May. A resurgence in manufacturing production supplemented a further, albeit slower, upturn in services output.

U.S. PMIs

U.S. business activity growth accelerated sharply to its fastest for just over two years in May—obviously an improved economic performance midway through the second quarter. The service sector led the upturn, reporting the largest output rise for a year, but manufacturing also showed stronger growth.

At 15:30 the Unemployment claims figure was reported lower at 215K showing that the labour market can potentially get hotter again. Unemployment Claims are down and PMIs are up. Remember that the market responded quite significantly with Dollar strengthening yesterday at the time of the U.S. PMI data release at 16:45. Latest data are showing improved figures for business in the U.S. so let’s see what the next week brings to the table as the Fed is betting on cooling inflation upon next release.

General Verdict:

__________________________________________________________________

__________________________________________________________________

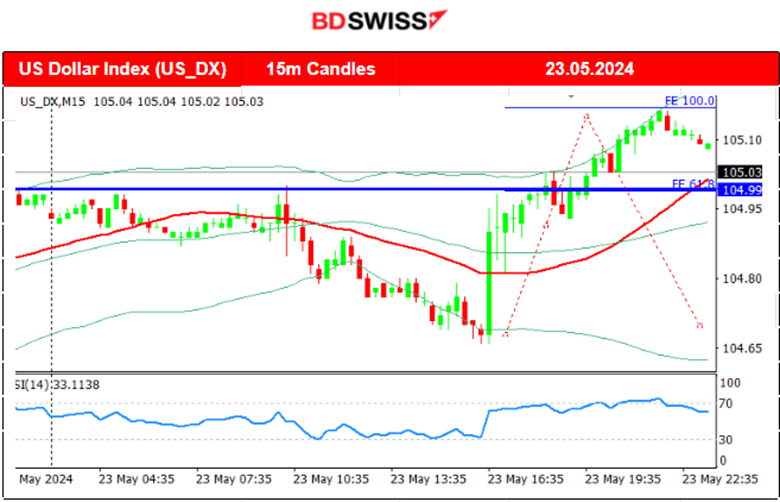

FOREX MARKETS MONITOR

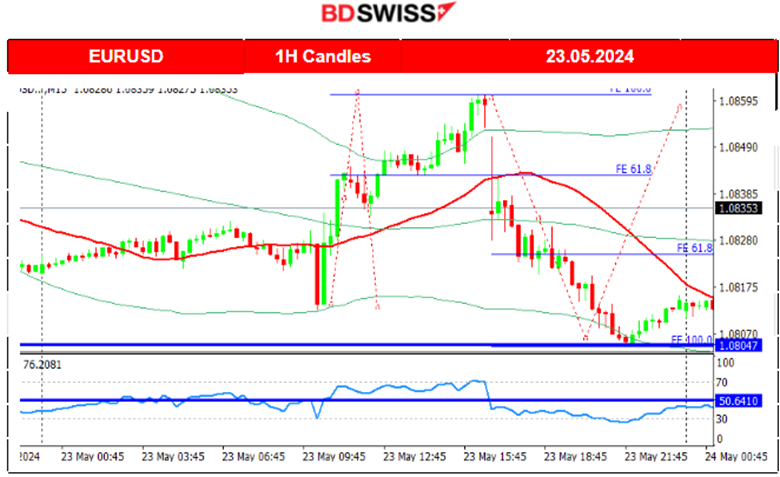

EURUSD (23.05.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair experienced some moderate shocks upon the release of the Eurozone PMIs that showed an overall boost for the Eurozone business sectors. The EUR appreciated and the dollar depreciated significantly after the start of the European session causing the pair to reach the resistance at near 1.086. At 16:45 upon the release of the U.S. PMIs the figures were reported quite high, causing a U.S. Dollar appreciation and causing a heavy drop to the pair until the support near 1.08040, before a retracement took place.

___________________________________________________________________

___________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) Chart Summary 1H

Server Time / Timezone EEST (UTC+03:00)

Price Movement

A jump occurred on the 20th of May with the price reaching 70K as mentioned in our previous analysis. It saw a further increase today with the price reaching a peak at 72K. Retracement also took place as expected and mentioned in our previous analysis back to the MA. Bitcoin settled near 70K USD on the 22nd of May. That changed later with Bitcoin moving rapidly to the downside on the 23rd after 16:00. Many assets including stocks and commodities got affected negatively after that time. The price returned back and settled near the 67K USD level wiping out the gains since the jump on the 20th of May.

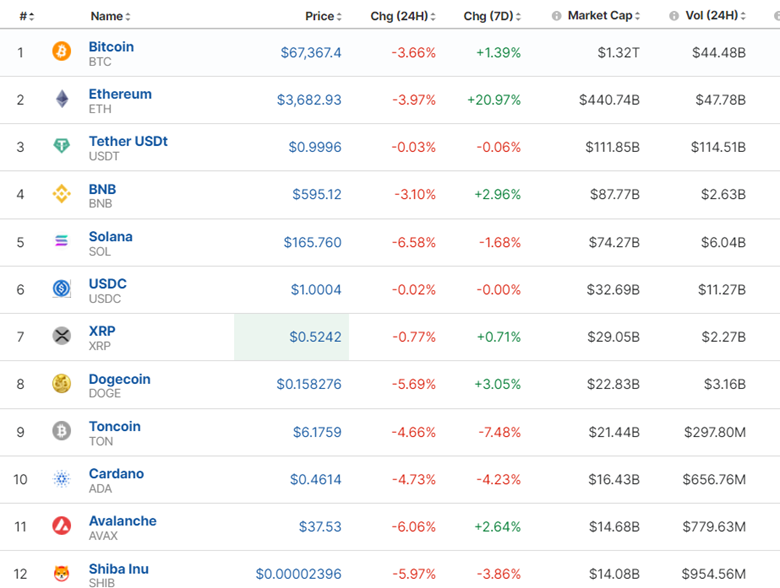

Crypto sorted by Highest Market Cap:

Crypto sorted by Highest Market Cap:

After a boost seen on the 20th of May, the market reversed, eliminating the performance gained this week. Some crypto remained positive including Ethereum which saw a remarkable 20% gain for the last 7 days. Ethereum ETFs finally got approved by the SEC. However, Bitcoin (BTC) and ether (ETH) prices declined in the past 24 hours, despite several ether exchange-traded funds being granted approval to list in the U.S.

Sources:

https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

S&P500 (SPX500) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 21st of May, the index remained high and moved to the upside testing the highs for the 3rd time without success. The triangle formation that was highlighted in our previous analysis was broken on the 22nd of May and the index moved downwards to the support near 5,290 USD before a full reversal took place. This high volatility depicted on the chart was taking place during the FOMC meeting minutes release. All U.S. indices experienced a pre-market aggressive movement to the upside and broke the resistance at near 5,330 USD reaching only near the peak at near 5,350 USD. Then, after the stock market opening and the release of the U.S. PMI figures all indices dropped heavily. S&P500 reached support at near 5,258 USD before retracement took place. However, it has more room for upside retracement until the target level of 5,290 USD.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 21st of May, the price stayed below the 30-period MA and moved even lower today forming lower lows. The bullish divergence was valid as mentioned in our previous analysis. The price eventually jumped on the 23rd of May crossing the 30-period MA on its way up and indicating the possible end of the downtrend. However, that changed when the price experienced a sudden drop after the U.S. PMI release. The momentum was so strong that a new downtrend was created. The price broke an important support near 76.40 USD/b and sparked expectations for a further downward movement to the next target level at near 74.90 USD/b.

XAUUSD (Gold) 4-Day Chart Summary

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 20th, the price continued with an upward and rapid movement but after reaching the peak of 2,450 USD/oz and in an overbought territory, the market decided to sell. The 61.8 Fibo level was reached as the price returned to the 2,400 USD/oz level. A triangle formation indicated the important support at 2,400 USD/oz and the potential to move to the downside upon breakout, to the 2,380 USD/oz level. Gold has however shown great potential for an upside movement and trend with a potential to break the triangle to the upside instead and test again that 2,450 USD/oz level in the future. The support on the 22nd of May was broken and the price dropped heavily reaching the support at near 2,355 USD/oz. Retracement has yet to take place fully. The downtrend continued until the price reached an important support at near 2,325 USD/oz on the 23rd of May and the potential for a retracement now is apparent with the target level at near 2,360 USD/oz.

______________________________________________________________

______________________________________________________________

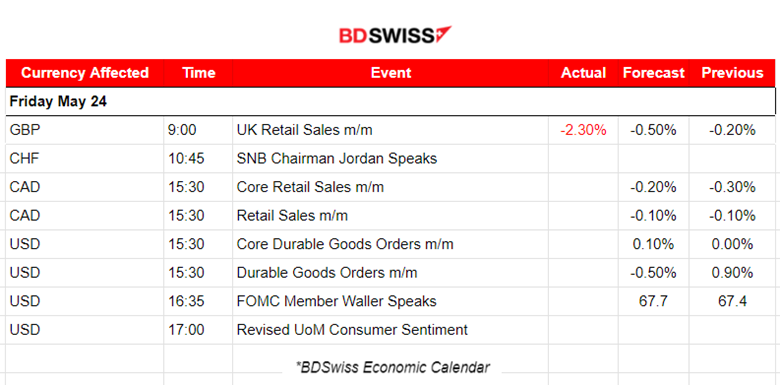

News Reports Monitor – Today Trading Day (24 April 2024)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news, no special scheduled figure releases.

- Morning – Day Session (European and N. American Session)

Retail sales volumes (quantity bought) fell by 2.3% in April 2024, following a fall of 0.2% in March 2024 (revised from 0.0%). Sales volumes fell across most sectors, with clothing retailers, sports equipment, games and toys stores, and furniture stores doing badly as poor weather reduced footfall. The market did not react heavily but only with a slight depreciation of the GBP currency. GBPUSD dropped only near 20 pips at the time of the release and reversed.

Retail Sales for Canada and the Durable Goods orders report for the U.S. will be released at 15:30. The USD pairs and CAD pairs will probably see big movements during the time of the releases. Expectations are mixed.

General Verdict:

______________________________________________________________