Switzerland: a not-very-effective “currency manipulator”

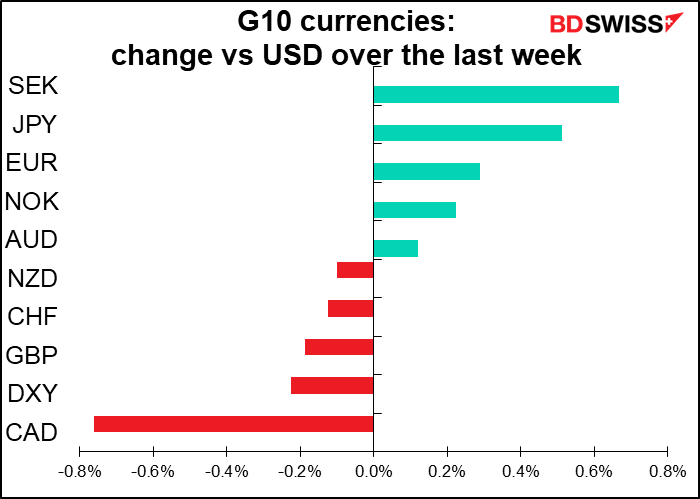

The US Treasury Department Wednesday labeled Switzerland and Vietnam as “currency manipulators” in its quarterly report on Macroeconomic and Foreign Exchange Policies of Major Trading Partners of the United States. The Treasury said that it would like to see the Swiss National Bank (SNB) step back from intervention and allow the CHF to appreciate. The SNB rejected this idea, but I think even their massive intervention can only slow the tides, not stop them. Besides, if the EUR continues to appreciate vs USD, then EUR/CHF can stay the same or even move slightly higher and CHF may well appreciate further vs USD.

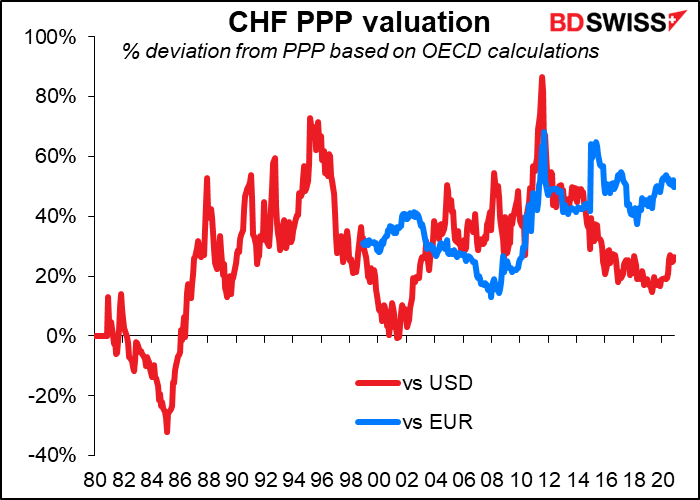

Does Switzerland manipulate its currency? Well, no one can deny that it tries. It has the third-largest stock of foreign reserves of any country in the world, and #1 and #2 are much much bigger economies (China and Japan). However, if it is a currency manipulator, it’s not a very successful one. The Swiss franc has been overvalued vs the dollar on a purchasing-power parity (PPP) basis almost uninterruptedly since around 1987 and vs the euro since the single currency’s inception. Using the widely quoted “Big Mac Index,” it’s the most overvalued currency in the world.

The SNB was unmoved by the US Treasury’s accusation. It denied “any form of currency manipulation” and said it “remains willing to intervene more strongly in the foreign exchange market.” “Foreign exchange market interventions are necessary in Switzerland’s monetary policy to ensure appropriate monetary conditions and therefore price stability,” it added.

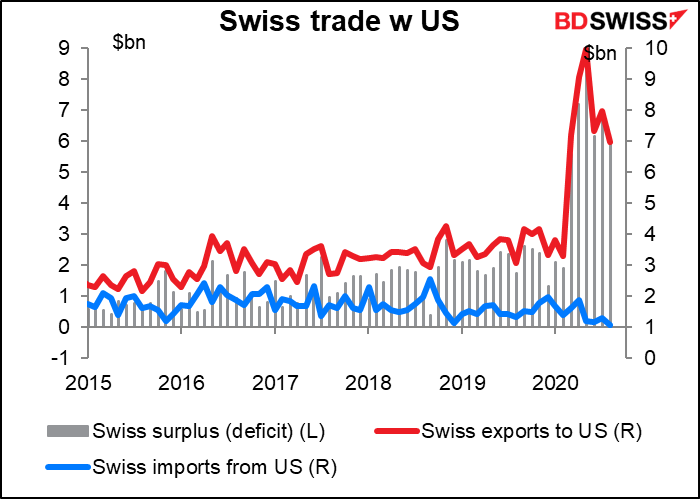

Really, I don’t see why the US is bothering with this. Switzerland is a tiny country that accounts for only 5% or so of the US trade deficit. Furthermore, much of what looks like current account transactions should actually be classified as financial account transactions that the US Treasury should ignore. The report says that the US goods trade deficit with Switzerland “widened notably over the last year…due partially to an increase in Swiss gold exports in the first half of 2020.” This is gold bullion that’s being held as a financial asset. It shouldn’t be included in the current account to begin with, but rather in the financial account, because it’s a financial asset like stocks or bonds. The IMF’s Balance of Payments handbook hasn’t caught up with this issue yet, though. (Britain has the same problem. A year ago it flipped from a trade deficit to a trade surplus one month simply because some bank reclassified the ownership of gold bars stored in its vault in London.) And anyway, appreciation of the CHF won’t make a bit of difference to Swiss gold exports, which are denominated in dollars to begin with.

In fact, let me say: this is just so stupid, it must have come from the Trump administration. The Obama administration never made much of a fuss about Swiss intervention even when the SNB maintained a fixed exchange rate vs EUR. I expect that the whole issue will quietly disappear once the Biden administration comes in.

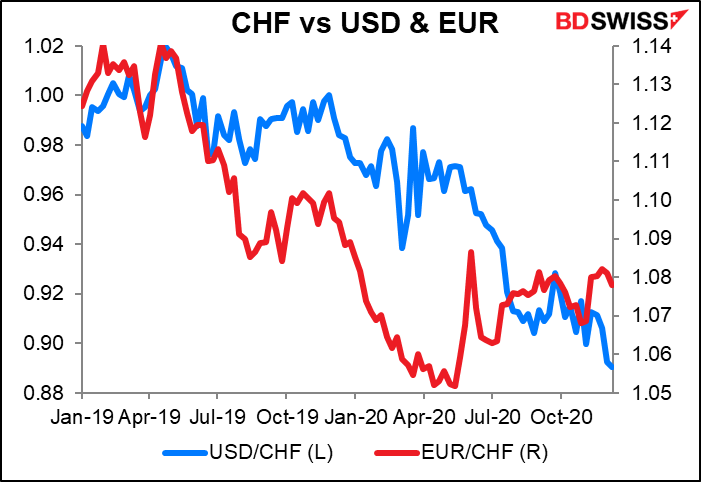

That doesn’t mean I expect CHF to weaken vs USD. The SNB’s intervention is aimed at EUR/CHF, not USD/CHF> As the graph shows, recently EUR/CHF has moved higher (i.e. CHF has weakened vs EUR) even as USD/CHF has continued to move lower (i.e., CHF has weakened vs USD) because EUR has been rallying vs USD. I expect to see EUR appreciate further vs USD in 2021 and therefore we may see more of the same with regards to CHF. EUR/CHF may be relatively stable or gradually move lower, the trend being slowed but not stopped by SNB intervention, while CHF continues to appreciate vs USD.

For more excruciating details and information on this issue, not to mention lots more cool charts (and even a photo of what a Big Mac costs in Geneva!), please see our special report, US Treasury’s complaints about Switzerland are silly, but CHF is likely to appreciate vs USD Regardless

Next two weeks: Brexit, US jobless claims & personal spending, plus some Japan data

OK, every week we’ve been talking about Brexit deadlines, but those were always negotiating positions. In the next two weeks they have to come up with something, because they can’t delay the inevitable. At midnight on 31 December – or 00:00 on 1 January 2021, whichever it is – the transition period ends and the UK is utterly totally completely and entirely out of the EU regardless of what condition the negotiations are in.

But now there were twelve strokes to be sounded by the bell of the clock; and thus it happened, perhaps that more of thought crept, with more of time into the meditations of the thoughtful among those who revelled…. And there arose at length from the whole company a buzz, or murmur, of horror, and of disgust.

Edgar Allen Poe, The Masque of the Red Death

Poe’s story of course has new relevance for our time owing to the pandemic. I think though that it can offer some insights to Brexit as well. I think many people who were enthusiastic about Brexit originally will feel horror and disgust when they discover what it actually involves.

Nonetheless, the talks are still floundering over fishing rights, apparently. UK officials insisted the EU offer on fisheries and the fair competition level playing field remained “unacceptable” and accused member states of not showing enough “flexibility” (“member states” = France). The European Parliament Sunday warned that it will now refuse to vote on any agreement before the end of the year. This means Brussels will have to explore legal stopgap solutions if it wants a deal to take effect on time – assuming that one can be reached in the first place. Some UK officials are now saying that they want the issue settled before Christmas. That implies MPs and MEPs would have to approve it in the six days between Christmas and 31 December in order for it to take effect before the transition period ends. That would add another source of risk, because some MPs might be hesitant to vote for it without adequate time to examine it closely.

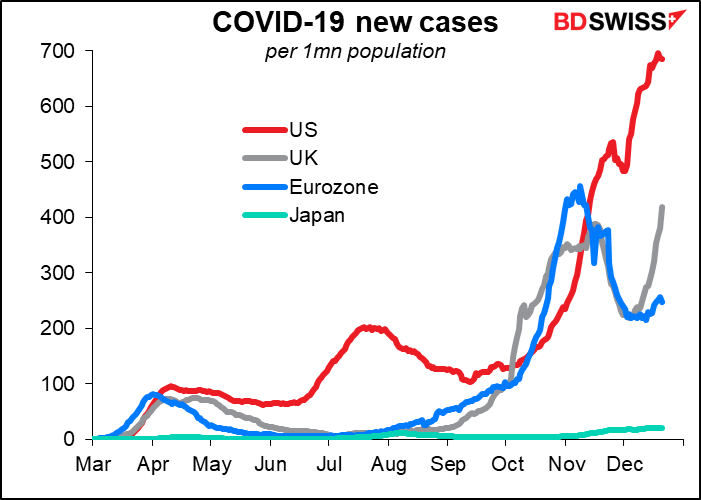

Meanwhile, a more virulent mutant strain of the virus that was discovered in London has caused many European countries to cut all incoming traffic from the UK. The UK government canceled plans to allow families to see each other over the holidays as the government warned that the new, more easily transmitted strain of the virus was “out of control.”

The combination of the two is a worst-case scenario for GBP.

I think the virus crisis will force UK PM Johnson to compromise on Brexit. A Brexit disaster coinciding with this virus disaster is just too many disasters at the same time. On the other hand, he might reason that raising nationalistic fervor against the perfidious EU would be a good way to deflect anger away from his disastrous handling of the virus.

In any case, the next time I write a weekly I’ll be talking about what happened with Brexit, not what’s likely to happen. Four years of speculation, finally over.

One thing that I won’t have to write about next time: the US government’s new fiscal package. They finally agreed on a package Sunday night, just in time to avert yet another government shut-down. The terms of the package aren’t completely clear yet (the text isn’t available to reporters) but it appears it will provide $600 payments to many people and revive lapsed supplemental federal unemployment benefits at $300 a week for 11 weeks. Both of these amounts are half that of the original stimulus law. It would also continue and expand benefits for gig workers and freelancers and extend federal payments for people whose regular benefits have expired. It’s also expected to extend an eviction moratorium set to expire at the end of the year. That’s important – otherwise the US was looking at millions of people becoming homeless. The fact that they finally agreed on a package that includes extended benefits is a big “risk-on” factor, which unfortunately was offset by news of the new virus strain.

Indicators: lots on Wednesday, not much after that

There are no more major central bank meetings this year, nor are there any noteworthy central bank speakers on the schedule that I could see.

Usually the New Year’s newspapers carry a lot of interviews with the grand and the good, which I would look for.

We have a full roster of economic indicators for the next three days, and then after Wednesday it largely goes quiet for the rest of the year, except for a few Japanese and Chinese indicators, plus the weekly US jobless claims.

There’s nothing worth noting on the schedule for today.

Tuesday we have UK public sector borrowing and the final revision of the UK Q3 GDP figures, plus German consumer confidence. From the US we get Conference Board consumer confidence, existing home sales, and the Richmond Fed manufacturing index. While the market puts more weight on the Empire State and Philly Fed indices – probably because they come out earlier – the Richmond Fed survey is the one that best predicts the Institute of Supply Management (ISM) purchasing managers’ index (PMI), one of the most important monthly indicators. We also get the third and final revision of US Q3 GDP, but revisions should be small and not attract much attention.

Wednesday is the big day: The US releases three important indicators simultaneously: jobless claims, personal spending and durable goods orders.

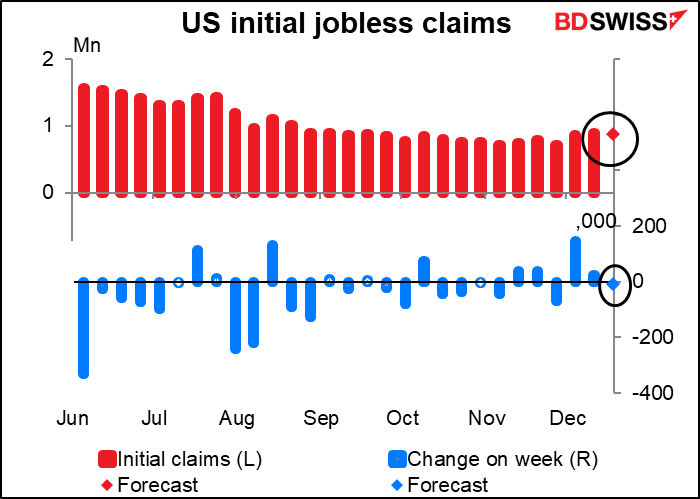

The jobless claims figures are coming out a day earlier than usual. We’ve had two consecutive weeks of rising initial jobless claims, but this week people are forecasting a -10k decline. Does this reflect some data or some hope?

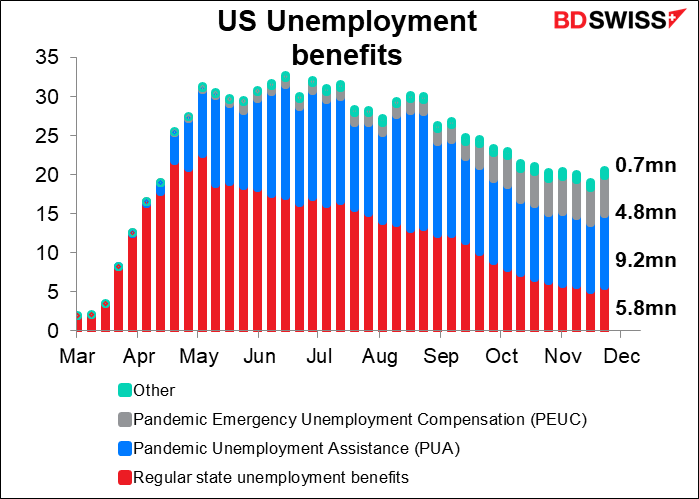

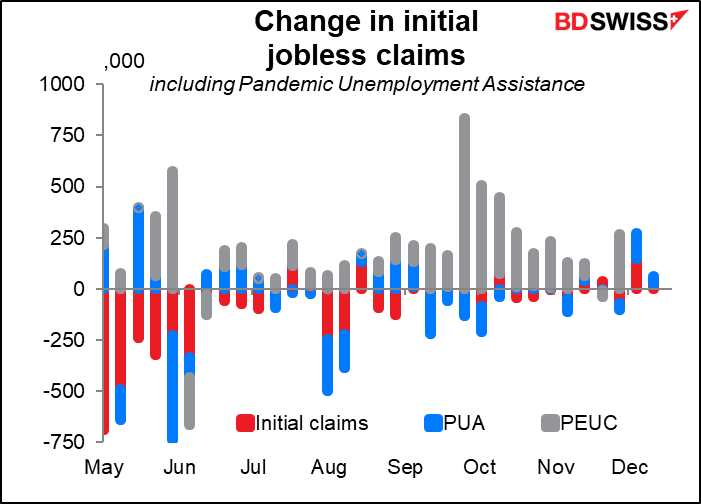

The initial jobless claims are claims for state unemployment benefits. Everyone focuses on these since they’re the most up-to-date figures and are seasonally adjusted. They’re a decent indicator of that week’s change in the number of people who’ve lost their jobs, but the “continuing claims” figure is not at all an accurate estimate of how many people are really on the dole, because state unemployment benefits are only a small (28%) part of the picture. They don’t include the Pandemic Unemployment Assistance (PUA) payments, nor the Pandemic Emergency Unemployment Compensation (PEUC).

PUA provides up to 39 weeks of benefits to individuals not eligible for regular state unemployment compensation, such as the self-employed or people who have exhausted their state benefits. PEUC provides 13 weeks of additional unemployment benefits to qualified individuals whose regular unemployment benefits were exhausted. These two account for 68% of unemployment benefits by the number of people receiving them (I don’t know how much in terms of money paid out.)

That explains why it was so important for Congress to come up with a new fiscal package that would extend those benefits, which it finally did yesterday.

PUA payments have been rising much more than the initial jobless claims – they’re up six out of the last nine weeks. PEUC payments have been rising most of all – in fact, they’ve only fallen in three weeks since the program’s inception.

There will be another jobless claims figure out on Thursday, Dec. 31st, but we won’t be publishing then. That’s about the only US economic indicator of note being released the last week of the year.

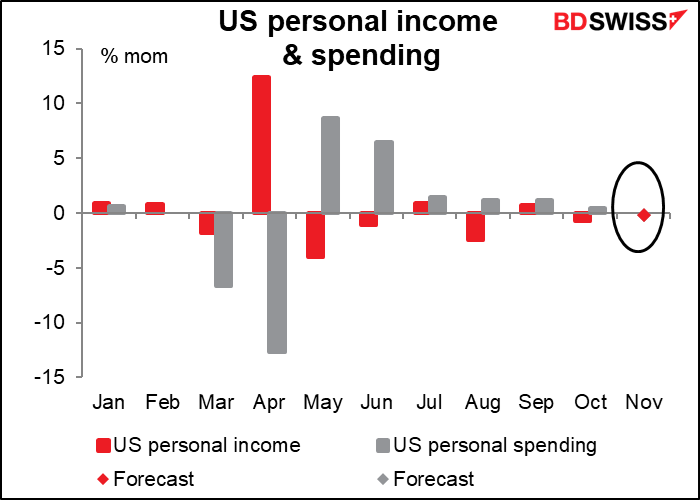

Also on Wednesday we get the crucial US personal income & spending data for November. If you remember, the US retail sales figures for November were pretty disappointing — -1.1% mom, and to make matters worse, the previous month was revised down to -0.1% mom from +0.3%. In other words, it looks like people in the US are cutting back on their spending – a reasonable response to the impending cut-off of unemployment benefits. The wider US personal spending figure is expected to confirm this trend – it’s forecast to be -0.2% mom for November, the first decline since the plunge in April. (The grey personal spending dot isn’t visible in the graph because the forecast for personal income, the red dot, is also -0.2% mom.)

The expected decline in personal income is also worrisome. It’s a result of lower government transfers.

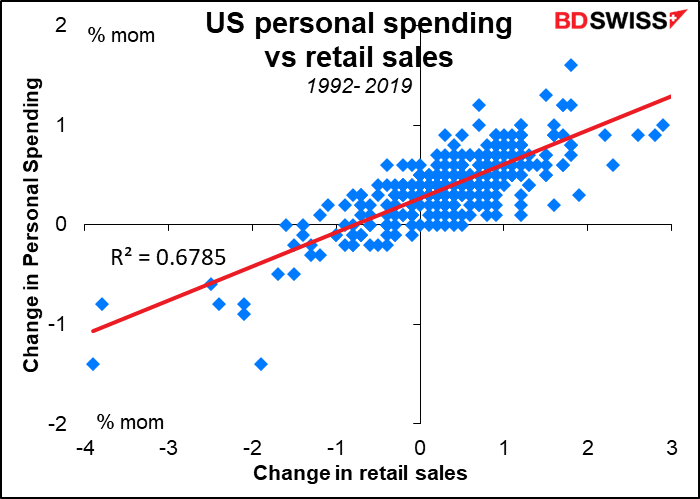

The personal spending figure measures household spending for all goods and services, which comprises roughly 70% of GDP. Retail sales amount to about 30% of personal spending, although it’s hard to put an exact figure on it owing to the different way that auto sales are counted in the two series. The month-to-month change in the two have had about a 68% correlation over the years. Retail sales is obviously the more volatile, because some things – like your rent, internet connect, or food bill – you spend money on regularly every month, but you don’t necessarily go shopping for a new phone every month (but maybe you do every year?. I have a cheapo Moto G7 and am pretty happy with it. I have to admit though it’s my third Moto G phone in as many years, so I’m probably guilty as charged.)

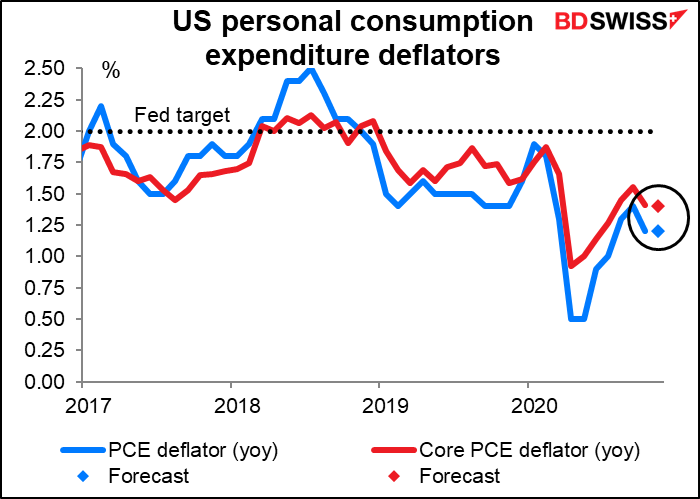

The personal consumption expenditure (PCE) deflators are released at the same time. These used to be a biggie because they’re the Fed’s preferred inflation gauges, but nowadays inflation is slowly joining the trade figures and money supply data on the “dustheap of history” as yesterday’s crucial FX data. Central banks in general and the Fed specifically seem more focused on labor markets than inflation. Rather than fighting inflation, their role has turned around to fighting unemployment.

In any case, the rate of change of both the headline & core PCE deflators are expected to remain unchanged (+1.2% yoy and +1.4% yoy, respectively) so no big deal here regardless.

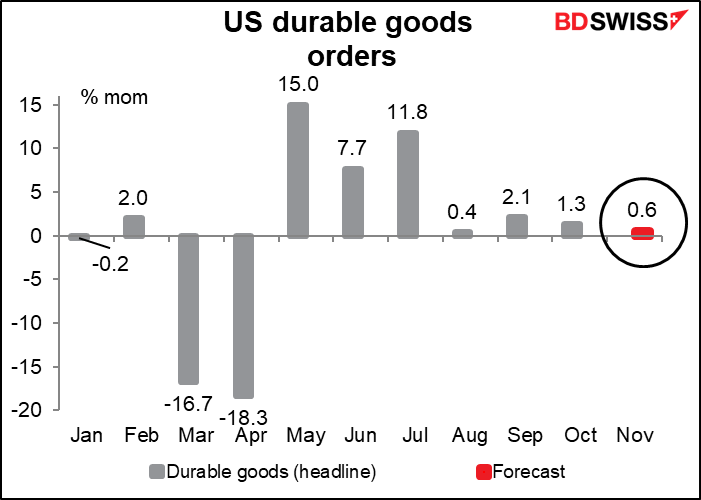

Durable goods are forecast to show only a modest rise despite the expected recovery in Boeing aircraft orders. I think though that people aren’t paying as much attention to durable goods orders nowadays as they used to — the weekly jobless claims are a better indication of where the business cycle is headed.

In case that isn’t enough, the U of Michigan consumer sentiment and US new home sales will also be released.

Nothing major on the schedule for the 24th.

Friday the 25th we get of course the long-awaited Annual Report on Little Boys and Girls. Perhaps the SOX index will soar while coal futures plunge in hectic trading!

Aside from that, it’s a normal workday in Japan and several of the usual end-month indicators come out: Tokyo consumer price index (CPI), unemployment data and retail sales.

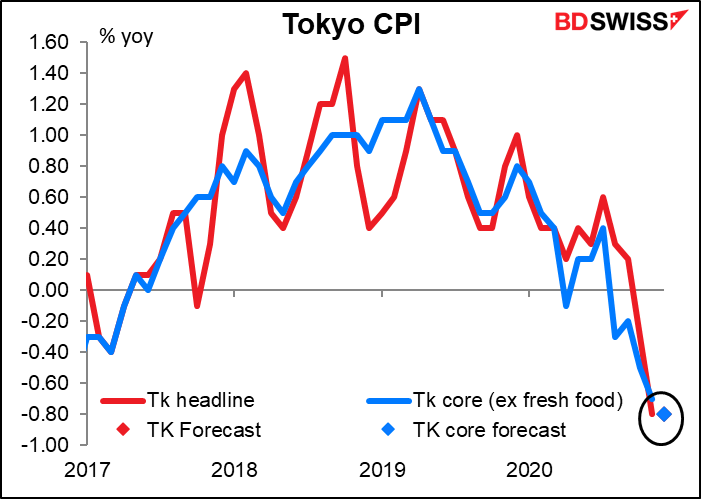

Tokyo CPI is expected to fall further into deflation — both the headline and ex-fresh-foods core measure are forecast to be -0.8% yoy. As I mentioned above though central banks are no longer reacting to inflation, so does it matter? Maybe for the bond market. That’s a possible channel of transmission to the FX market.

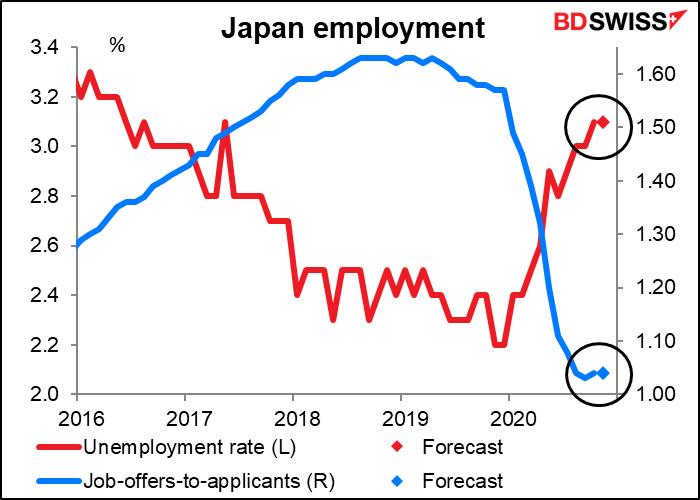

The unemployment rate and the job-offers-to-applicants ratio are both expected to remain unchanged as the number of new job seekers falls and the number of openings picks up a bit. That would be a good sign – unemployment bottoming out. But with the pandemic picking up in Japan, I don’t expect this to last.

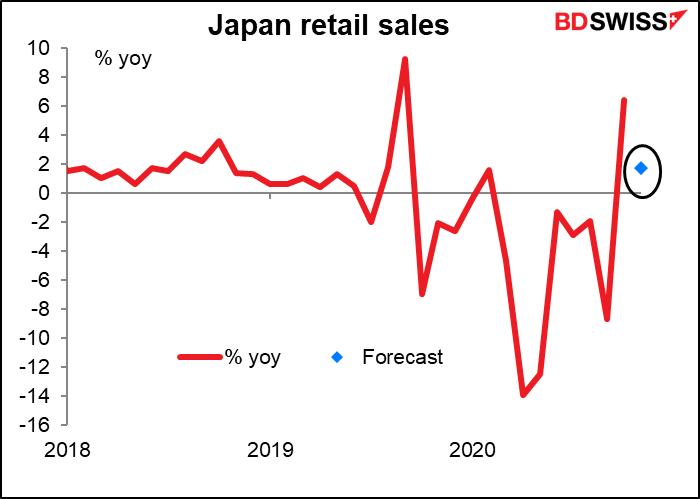

You almost certainly won’t be trading in the middle of the night Christmas eve, but I won’t be writing comments then either, so I thought I’d include a graph of Japan retail sales just for the record. No extra charge. The rate of growth in sales is expected to slow thanks to a slowdown in sales at major department stores in the second half of October, plus weak autos sales.

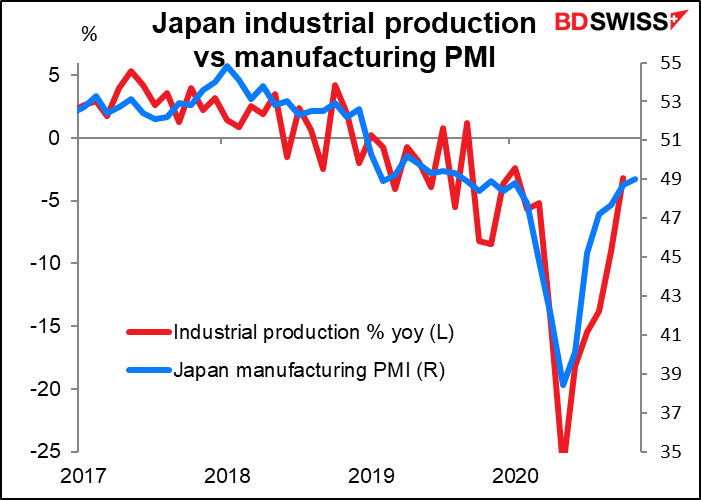

The odds are good too that you won’t be up trading Sunday night, which is Monday morning in Japan, when the country announces its industrial production for November. Good, because there aren’t any forecasts for it yet either. But given the small rise in the manufacturing PMI during the month (to 49.0 from 48.7), not to mention another increase in exports, I would expect some increase in production.

Other significant indicators out during the next two weeks include Canada’s monthly GDP figure this Wednesday and the official China purchasing managers’ indices on Thursday, 31 December.