Previous Trading Day’s Events (26.04.2024)

“The currency takeaway is certainly disappointment from the lack of guidance from the bank,” said Rodrigo Catril, senior FX strategist at National Australia Bank in Sydney. “To me the currency market is telling us it believes that the BOJ policy is too loose and hence why the currency is so weak. The Bank has the ability to do something about that by changing its policy, and if it’s not going to change the policy, then we shouldn’t expect the yen to strengthen.”

BOJ maintained its short-term interest rate target at a range of 0-0.1% as expected.

“That’s not to say we need to wait until the outcome of next year’s wage talks become clear,” Ueda said at a press briefing after the meeting. “If we can predict such an impact, we could change policy.”

The yen briefly jumped against the dollar after Ueda’s briefing ended, with traders on high alert for signs of intervention by Japanese monetary authorities. It was not immediately clear whether authorities actually stepped in.

The projections for “core core” inflation, which is closely watched by the BOJ as an indicator of the broader price trend, for 2024 and 2025 were unchanged from January.

“The forecast, very clearly in the upper 2% range, opens the way to future rate hikes given, of course, that the ‘virtuous circle’ stays intact,” said Naomi Fink, global strategist at Nikko Asset Management.

______________________________________________________________________

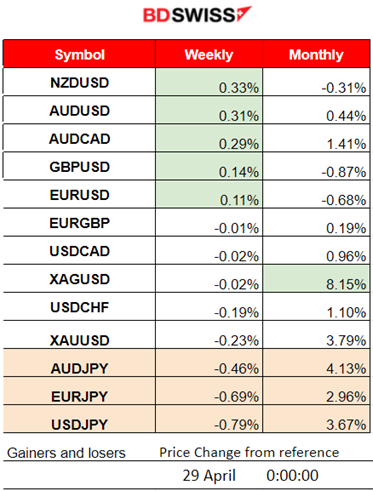

Winners vs Losers

New week starts with NZDUSD on the top having 0.33% gains. USD pairs climbed to the top as the dollar continued to appreciate. The JPY has lost a lot of ground and all pairs with JPY as currency have gone to the bottom of the list. Silver remains the top gainer for the month with 8.15% performance.

______________________________________________________________________

______________________________________________________________________

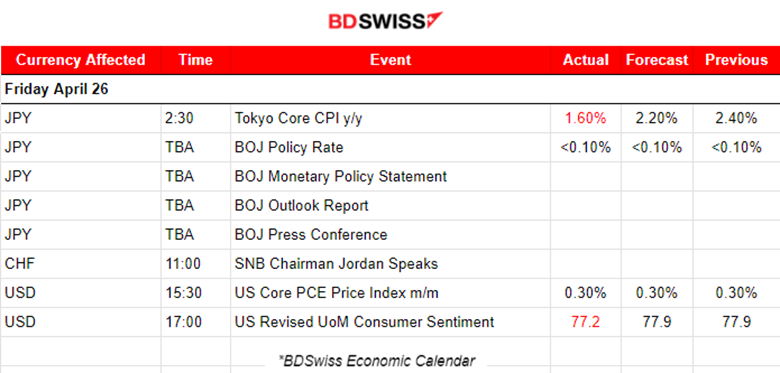

News Reports Monitor – Previous Trading Day (26.04.2024)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

Tokyo inflation slowed for the 2nd straight month according to the report released at 2:30. The actual figure was reported as 1.6% versus the expected 2.2%. The market did not react to the news as they were waiting for the BOJ news first. Core inflation fell below the central bank’s 2% target, complicating its decision on how soon to raise interest rates.

Bank of Japan interest rate decision: Unchanged at 0%-0.10%. This follows the first rate hike since 2007, which was implemented in March. While the move was expected, this comes after Tokyo’s April inflation came in lower than expected. JPY depreciated heavily and the USDJPY jumped. JPY is expected to weaken further unless there is BOJ intervention soon.

- Morning – Day Session (European and N. American Session)

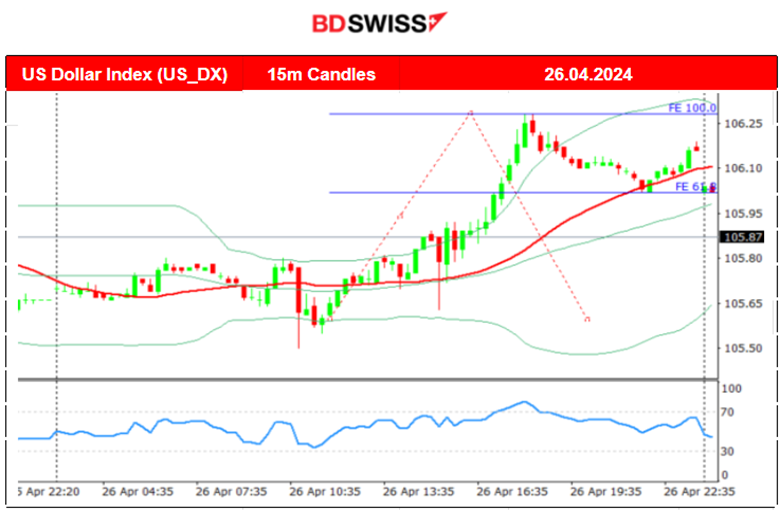

At 15:30 the U.S. Core PCE Price index figure was released steady at 0.3% reinforcing the Fed’s reluctance to cut interest rates anytime soon. It was the third straight month that the index has run at a pace faster than is consistent with the Fed’s 2% inflation target. At the time of the release, there was a sudden dollar depreciation but the effect faded soon with the dollar turning to steady and long intraday appreciation against other currencies.

General Verdict:

__________________________________________________________________

__________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (26.04.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair moved sideways around the mean until the news came out regarding the U.S. PCE Price index. There was a slight jump in the pair followed by an immediate start of a downward path due to a heavy dollar appreciation. The pair reached the support 1.06730 before eventually retracing to the 30-period MA.

USDJPY (26.04.2024) 15m Chart Summary

USDJPY (26.04.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair is obviously driven by the strong JPY depreciation against other major currencies and the USD. We observe these shadows to the downside occasionally but the JPy weakening is quite strong keeping the pair on the upward path.

___________________________________________________________________

___________________________________________________________________

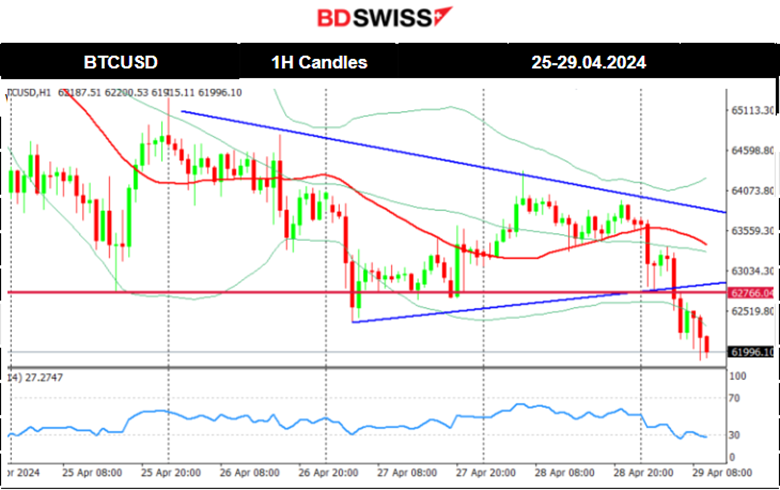

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) Chart Summary 1H

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Bitcoin halving took effect late on Friday 19th of April, cutting the issuance of new bitcoin in half. It happens roughly every four years, and in addition to helping to stave off inflation, it historically precedes a major run-up in the price of Bitcoin.

Currently, things are not looking good for the Crypto coin. A triangle formation has been breached today to the downside causing further Bitcoin price decline. 60K USD support so far away. However, considering its volatility, it is possible for the price to drop to that level, if other fundamental factors remain fixed.

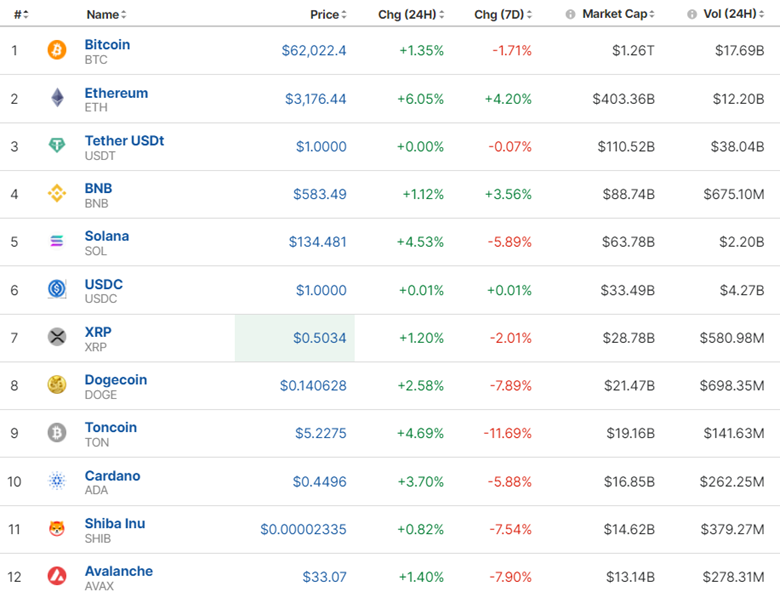

Crypto sorted by Highest Market Cap:

Crypto sorted by Highest Market Cap:

The crypto market does not see improvement. For a 7-day period we see losses and nothing important happening in regards to volume.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

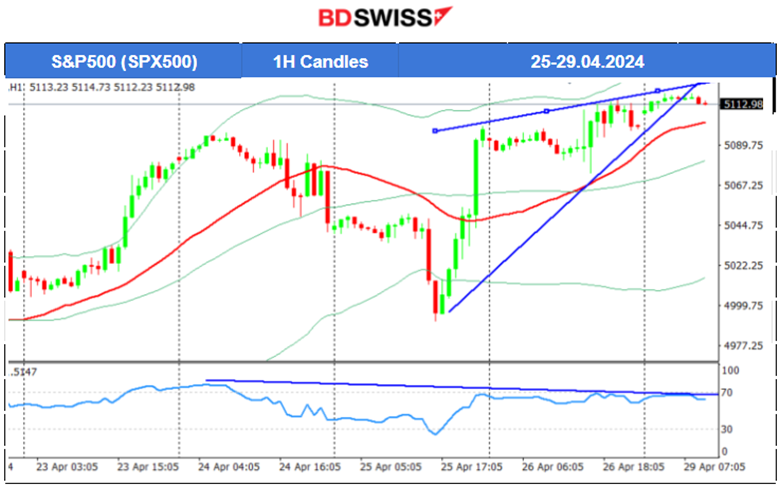

S&P500 (SPX500) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 25th of April, the market experienced a sudden plunge causing the index to drop to the support near 4,990 USD before eventually reversing heavily to the upside. It crossed the 30-period MA on its way up and reached remarkably back to the 5,100 USD level. On the 26th of April, stocks moved higher but the rapid movement to the upside seems to slow down. The RSI is actually pointing at a potential bearish divergence. The downside breakout of the upward wedge/triangle formation is however not clear.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 25th of April, the resistance of 83.5 USD was broken and the price reached higher. On the 26th of April, this breakout even helped the price reach near 84 USD/b. Now an upward channel is apparent indicating the highly volatile market conditions that Crude oil is facing at the moment. The price is moving around the 30-period MA with deviations from the MA up to near 1 dollar. Will the price continue to move to the upside thus following the channel? A breakout below the channel could cause a rapid drop back to 82 USD/b.

XAUUSD (Gold) 4-Day Chart Summary

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 24th of April, the price remained stable. An apparent upward channel was formed with 15-20 dollar deviations from the 30-period MA taking place. The proposed range is 2,300-2,340 USD/oz. It would be unlikely to see a jump to 2,400 USD/oz. For that to take place we should see an unusual increase in demand for metals. The fact that the price currently is below the MA indicates a rather sideways path for now. Breakout of the channel to the downside might spark a dive in Gold’s price to 2,300 USD/oz. Alternatively, the next important resistance is near 2,350 USD/oz which matches the upper band of the 50-period BB indicator.

______________________________________________________________

______________________________________________________________

News Reports Monitor – Today Trading Day (29 April 2024)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

Today Japanese banks are closed in observance of Showa Day. The yen was collapsing and suddenly strengthened heavily this morning. Possible intervention from BOJ. Near 45 pips drop USDJPY after 7:00.

Source: https://www.straitstimes.com/business/yen-drops-past-160-against-the-us-dollar-to-fresh-34-year-low

- Morning – Day Session (European and N. American Session)

We have the release of the monthly inflation data for one of the most important economies in the Eurozone. TBA. EUR should see some more than typical volatility due to the CPI data releases today.

The estimated annual inflation of the CPI in April 2024 was reported at 3.3%, according to the flash indicator prepared by the NSI. At the time of the release, 10:00, the EUR was slightly affected by depreciation but the effect faded soon.

General Verdict:

______________________________________________________________