I had hoped that this week I’d be able to discuss the new Brexit agreement. Alas, the deadline once again got put off, this time till Sunday. So maybe Monday I’ll be able to discuss it. Or maybe they’ll delay it until December 27th, just in time for a December 28 meeting. Or maybe they won’t reach an agreement at all, until the UK crashes out of the EU with no agreement and finds out just how bad that is and tries to reopen talks. No doubt the results of the Brexit talks on Sunday will be the major focus when trading starts up again on Monday…and perhaps for some time afterward.

I was also looking forward to wrapping up my discussion about the new US fiscal package to replace the expiring CARES Act programs, which would be tied in with the catchall funding bill that must pass to avert a government shutdown. They managed to punt that one for one week, until next Friday, but the long-awaited stimulus bill – which I am so, so tired of writing about – keeps receding like the pot of gold at the end of the rainbow. The discussions about this bill (cue Judy Garland) will continue to sway markets during the coming week, probably in a “risk-off” manner due to the impossibility of finding any ground for compromise. Failure to agree on a bill means millions of people will lose their benefits. They’ll have no money to spend, which means millions of others will lose their incomes too – the impact will ripple through the economy with devastating results. Of course, that assumes that consumers are still alive – no guarantee there either in America nowadays.

We had two central bank meetings in the week just ending – the Bank of Canada and the European Central Bank (ECB). The Bank of Canada as expected kept all of its policy measures unchanged. There was no press conference after the meeting, but Bank of Canada Gov. Macklem will be speaking on Tuesday and may elaborate on their decision and how he sees policy developing in the future. The Bank said it doesn’t see rates rising until 2023; that’s a long time to keep policy unchanged.

The ECB unveiled a slew of measures, but significantly they were all “recalibrations” of existing measures, as the Governing Council had said back in October. There were no new programs put into place. Keeping the current programs in place for longer means more support for the economy and therefore a more robust recovery, but it doesn’t necessarily mean more downward pressure on the euro now. Furthermore, ECB President Lagarde noted that the additional funds “need not be used in full,” meaning that there was possibly less than meets the eye here. EUR/USD got a green light to move higher.

What can we look forward to next week? We have four central bank meetings: The US Federal Reserve on Wednesday, the Swiss National Bank (SNB) and the Bank of England on Thursday, and the Bank of Japan on Friday.

Let me say in general that I do not expect any change in policy from any of them. They are likely to be more like the Bank of Canada than the ECB: reviewing what they have done, discussing the outlook, and giving some forward guidance. I can’t see any of them taking even the kind of “recalibration” that the ECB took.

Fed: maybe some change in its forward guidance re asset purchases

When the rate-setting Federal Open Market Committee (FOMC) meets on Tuesday and Wednesday, they will be reviewing the economy and their response. Remember, inflation is no longer the main concern at the Fed, employment is. And there, the signs are bad. Unemployment may well be rising again as soaring virus cases depress economic activity. According to the Household Survey, the number of people with jobs fell by 74k in November, as opposed to the 245k increase reported in the Establishment Survey (i.e. the nonfarm payrolls).

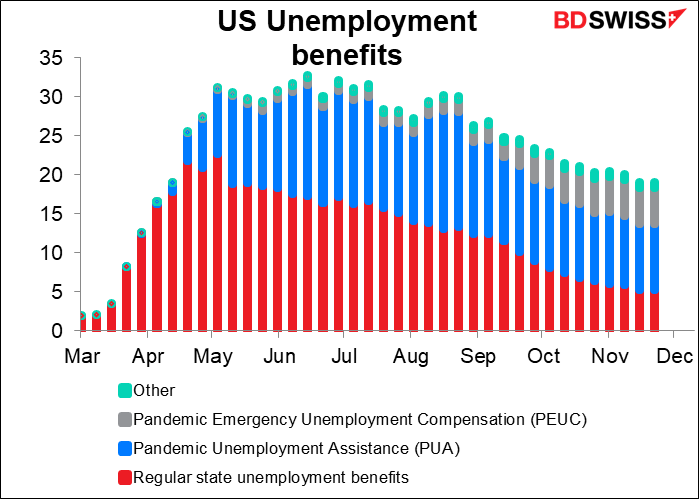

And this week’s initial jobless claims, including Pandemic Unemployment Assistance (PUA) claims, showed the largest rise since May.

The situation is bound to get worse as the virus spreads unchecked throughout the US, restraining economic activity, at the same time as the special unemployment benefits end at the end of the year and some 13.7mn people lose their benefits (failing any action by Washington).

This is the situation that the Fed faces. One might think that this dire situation would call for further easing, but I doubt it. The commentary that we’ve heard from Fed speakers is that fiscal support is a more appropriate way to aid, in Chair Powell’s words, the “parts of the economy that might need help to get that last span of the bridge in place to get to the other side of the pandemic.”

Indeed, the minutes to the November FOMC meeting show that this topic didn’t get much attention during their discussions. Rather, they seem to be preoccupied with their asset purchases and in particular how to “enhance” their forward guidance on this topic. The minutes said:

The September FOMC statement indicated that asset purchases will continue “over coming months,” and participants viewed this guidance for asset purchases as having served the Committee well so far. Most participants judged that the Committee should update this guidance at some point and implement qualitative outcome-based guidance that links the horizon over which the Committee anticipates it would be conducting asset purchases to economic conditions.

Translated into English, that means they would say that under these conditions or with this level of inflation or unemployment, we’d be ready to start reducing our asset purchases or change their make-up. They said that there was no “immediate” need to change, but they “recognized that circumstances could shift to warrant such adjustments.”

They may discuss making some changes in their asset purchases, such as following the Bank of Canada’s example and reducing the overall amount of purchases while shifting more of them into the long end of the market – same amount of bang for fewer bucks – but I don’t think they will take that step quite yet.

The only way this might influence the FX market that I can see is if it caused Treasury yields to rise or to fall, in which case that could cause a change in portfolio flows. However I think any impact on the Treasury market would be slight because with conditions in the US worsening right now, any talk of tapering or otherwise reducing support for the market is premature.

The meeting will also include an updated Summary of Economic Projections (SEP), which are likely to show improved prospects for the economy as growth has been more resilient than expected to date and vaccines distribution will begin soon.

Bank of England: politics in the driving seat

Now would be an inappropriate, if not bizarre, time for the Bank of England to change its policy stance. On the one hand, the recent data has bee n better than expected. The Monetary Policy Committee (MPC) expects GDP to fall in Q4, but October’s data showed a higher-than-expected 0.4% mom rise, and both industrial and manufacturing production also beat on the upside.

In fact, UK economic indicators have been surprising on the upside much more than in recent years. That doesn’t mean things are good, just that they aren’t as bad as people had expected (yet).

Furthermore, while the near-term outlook may be dim, the MPC expects the economy to improve later on. From the minutes of the November meeting:

Beyond the near term, GDP was projected to recover as the direct impact of Covid on the economy was assumed to wane. Activity was also supported by the substantial fiscal policies already announced and accommodative monetary policy. Spare capacity was expected to be eroded as activity picked up, and a small degree of excess demand emerged over the second half of the forecast period.

So economically, things may indeed turn up, obviating the need for any further easing.

On the other hand…who knows what will happen on Sunday night after the last, final, this-is-it, end-of-the-road deadline for Brexit passes…and they announce the next deadline, probably. Assuming for a moment a successful conclusion to the talks (cue Andy Williams), the pound will rise, the economy will continue to the upside, and no need to lower rates further for the time being. Assuming however an unsuccessful conclusion (cue Jim Morrison), the pound would probably fall, but It’s inconceivable that they would raise interest rates to support the currency just a few days before the economy is going to get an unprecedented kick in the pants. On the contrary, they’ll probably want to wait until January to see how bad the carnage is. Either way, it makes much more sense for them to wait until the 4 February meeting so that they can see how Brexit has developed before taking any action. I would expect another 9-0 decision this time to keep everything on hold for the time being and wait to see (cue Kenny Rodgers) what condition the economy is in at the next meeting.

Bank of Japan: extending lending

The Bank of Japan (BoJ) has had the peddle to the metal for several years now. Like other central banks, in the wake of the pandemic it instituted various special lending programs to target funds to specific classes of borrowers. However it hasn’t fundamentally changed its monetary stance, probably because it’s approaching the end of the road insofar as further easing measures are concerned.

The question the BoJ now faces is whether to extend its Special Funds-Supplying Operations to facilitate corporate finance in the wake of the pandemic. These operations, which were instituted in March 2020, are set to expire in March. That means they either have to renew them at this meeting or at the 21 January meeting, or not at all. Given that the government just approved its latest stimulus package this week, including extending its interest-free, collateral-free loans, it would be natural for the BoJ to move in line with the government and extend its operations as well. In addition, the government eased the conditions on its policy loans, so the BoJ may want to follow suit there too – perhaps by extending the periods of its loans. These would be ways for the Bank to show that it is coordinating with government policy.

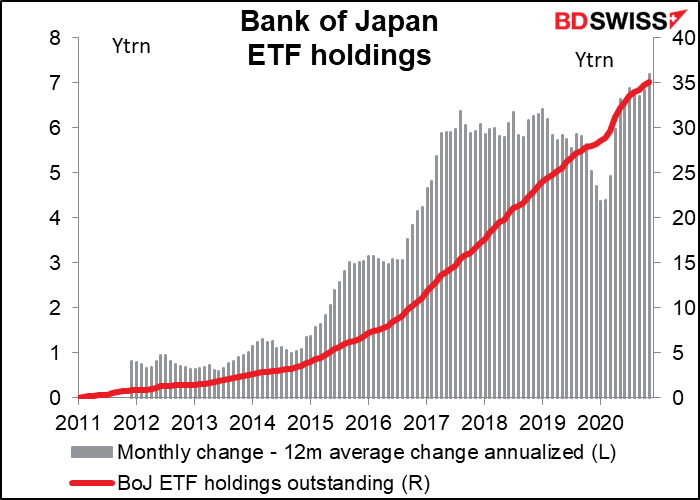

The BoJ may also want to adjust its guidance concerning its aggressive purchases of exchange-traded funds (ETFs). The BoJ says in its Statement on Monetary Policy following each meeting that it “will actively purchase exchange-traded funds (ETFs)” with an upper limit of “about 12 trillion yen” annually. However, the Tokyo stock market has been more buoyant than they had expected and they’re only buying at an annual pace of around ¥7trn. On the other hand, they don’t buy their full target of ¥80tn a year in Japanese government bonds (JGBs) either and that doesn’t seem to bother them, so maybe they’ll just leave the statement alone.

Swiss National Bank: nothing doing

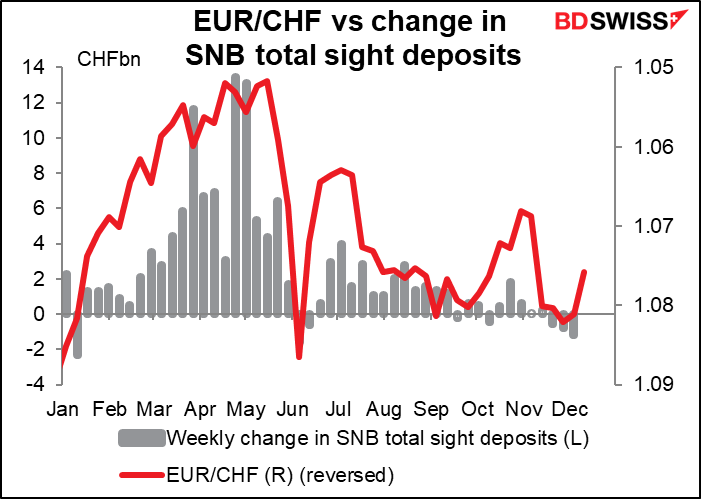

The Swiss National Bank (SNB) is the easiest one to dispose of. The SNB hasn’t changed policy since January 2015, when they cut the interest rate on sight deposits from -0.25% to -0.75%, the lowest rate in history. Since then it’s been all FX intervention. I don’t think anyone expects the SNB to change any time soon. The threat of being labeled a “currency manipulator” by the US Treasury doesn’t’ seem to have deterred them. However, judging from the weekly sight deposit figures they haven’t been intervening for the last three weeks even though EUR/CHF has been headed lower (i.e. the CHF has been appreciating vs their nemesis, EUR). We could get an explanation of their thinking behind this. Then again, we could just get a repeat of the usual boilerplate statement that “In view of the fact that the Swiss franc is still highly valued, the SNB remains willing to intervene more strongly in the foreign exchange market, while taking the overall exchange rate situation into consideration.”

Economic indicators: preliminary PMIs, US retail sales, tankan

Aside from the mad dash for a Brexit agreement, the rush to prevent a US government shutdown, and four central bank meetings, there are a number of key economic indicators next week, too.

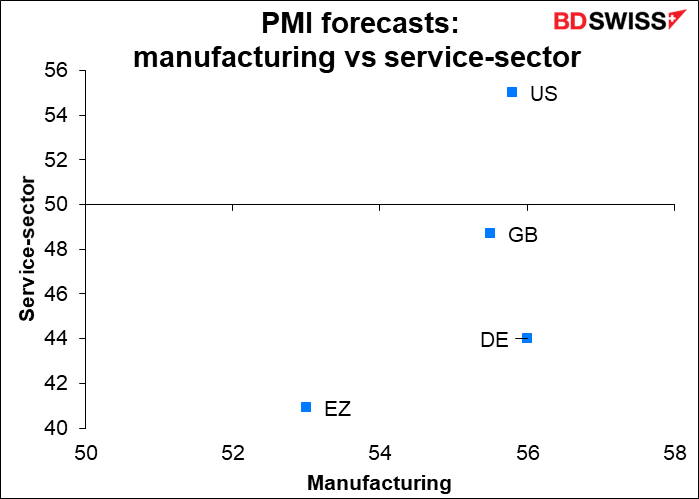

Foremost are the preliminary purchasing managers’ indices (PMIs) for the major industrial economies on Wednesday. They are expected to decline across the board, except for the UK service-sector index. At least the manufacturing PMIs are expected to remain well above the 50 “boom or bust” line, but the service-sector, not so much. The figures could engender a “risk-off” mood that would dampen equity market sentiment and perhaps bolster the safe-haven dollar.

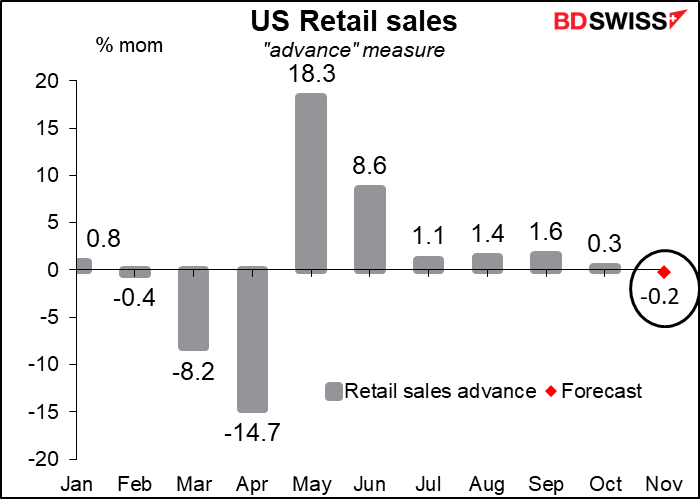

There a number of market-moving US indicators out during the week. Empire State manufacturing survey and industrial production on Tuesday, retail sales on Wednesday and the Philly Fed index and housing starts on Thursday. Within this, retail sales are probably the most important. Sales are expected to be bad: the first mom decline since the plunge in April.

On this forecast sales would still be 4.5% above pre-pandemic levels, but as I’ve mentioned dozens of times, if a few million people lose their unemployment benefits at the end of December, they’re not going to be shopping for anything and sales will fall off a cliff, too.

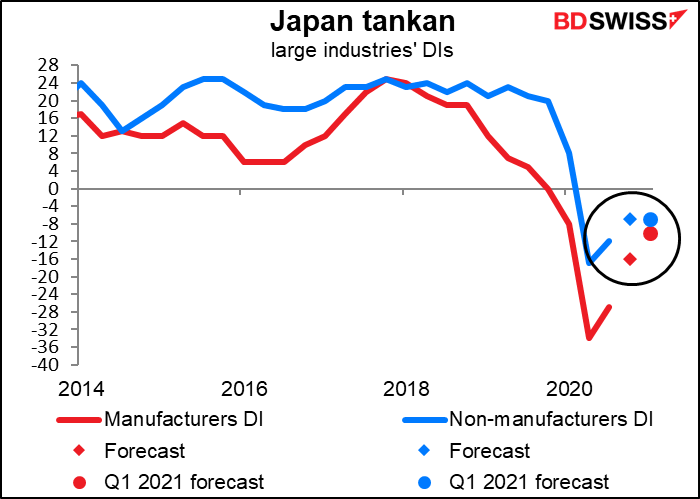

Monday morning, before Europe gets started for the week, Japan releases the all-important Bank of Japan short-term survey of economic conditions, universally known by its Japanese acronym, the tankan. It’s expected to show a significant improvement, particularly for manufacturers, and hopes that the improvement will continue in Q1 next year. Non-manufactures though are expected to improve less and not at all from Q4 to Q1 next year. Nevertheless, I think these results could encourage equity market participants. Whether that’s good or bad for the yen is another question – a “risk-on” mood in Tokyo tends to lead to a weaker yen.

UK employment data is due out on Tuesday and retail sales on Friday, but what with the Brexit deadline approaching and the Bank of England meeting, I think there’s enough elsewhere to keep GBP volatile. Thursday’s better-than-expected GDP and industrial production figures didn’t do anything to help GBP, I doubt if these will have any more impact.

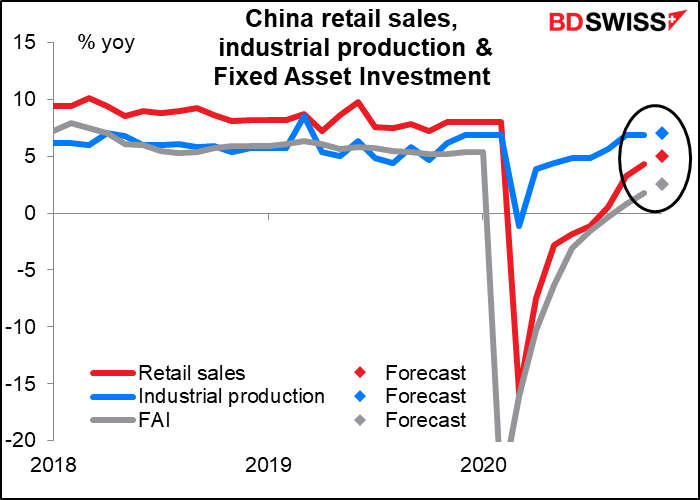

Finally, China announces its usual trio of retail sales, industrial production and fixed asset investment (FAI). The big improvements are over, but each of these indicators is expected to show some marginal improvement still. We’ve seen that good economic performance in China recently can spur a “risk-on” mood that’s good for equity markets and AUD.

Outside of the indicators and other economic news, one last small event to note: the US Electoral College meets on Tuesday to vote for the next president. No surprises as to who’s going to win. That should be the end of the matter, but I’m afraid it won’t be – on January 6, when Congress meets to formally count the votes, some Republicans have said that they’re going to object (as is their right). Their objections won’t have any effect, because they will never get the Democrat-dominated House of Representatives to go along with their nonsense, but the exercise would be a dry run for how a Republican-controlled Congress could prevent a Democratic President-elect from taking office.

That the Republican Attorneys General of 17 states added their names to a legal effort to invalidate the ballots of a majority of Americans shows how frail US democracy has become and how radical the supposedly conservative party in the US is. I thought the Republicans had hit bottom long ago, but we never saw the depths to which they could sink until now.