PREVIOUS TRADING DAY EVENTS – 06 September 2023

Also yesterday, the BOC left rates unchanged at 5.0% and with the weaker GDP data from last week added to the USDCAD continued to rally as the pair touched 1.3675 for a new 23-week high. The Beige book sentiment was subdued and comments from Fed officials added to the sombre sentiment.

Stock markets closed significantly lower on Wednesday, the benchmark S&P 500 lost 31.35 points (-0.70%) to 4465, the Dow slipped -0.57% and the tech-heavy e Nasdaq slumped over 1% led by APPLE (-3.58%) and NVDA (-3.06%). Gold also slipped again to $1915 and is currently traded at $1920. The Oil market like the US dollar remains bid, USOil settled over $87.00 on Wednesday currently during the European session the key commodity trades lower at $86.35.

Sources: https://www.reuters.com/markets/europe/global-markets-view-europe-2023-09-07/

Today, 07 September – Asian markets were weaker again today following the poor performance from Wall Street, and continued worries over the Chinese economy, despite a tick up in Trade data today. The G-20 meeting kicks off today in India but Chinese leader Xi Jinping will be a notable absentee. The Japanese Nikkei 225 closed down -0.75%, and the Hang Seng in Hong Kong lost -1.34%.

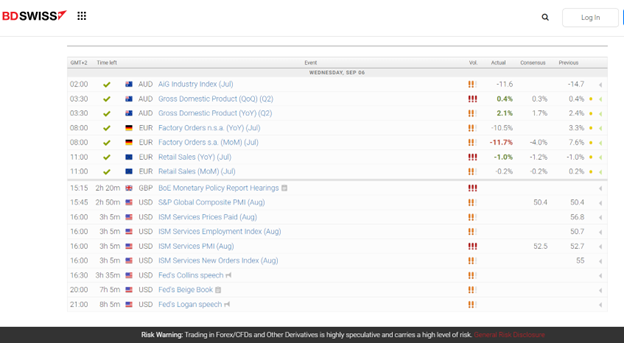

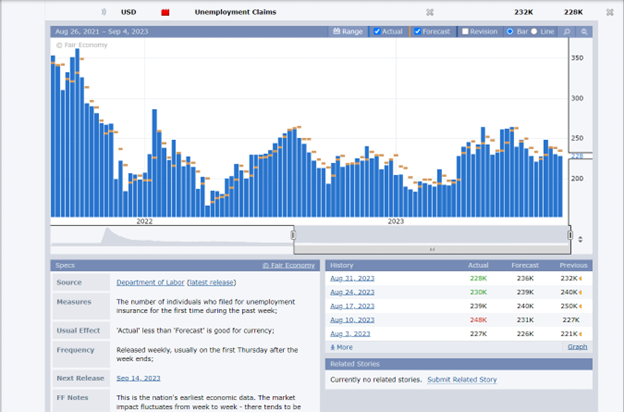

Eurozone (EZ) data continues to weigh, German Industrial production missed expectations and EZ GDP data missed expectations with the seasonally adjusted Q2 declining to 0.5% from 0.6% y/y and the Quarterly data also missing at 0.1% when consensus was for 0.3%. Currently, the Euro50 is flat at 4241.80, with the GER40 up from lows earlier of 15,650, and trading at 15,760 and the GBR_100 also higher at 7450. Still to come today: The U.S. Weekly Unemployment Claims, U.S. Crude Oil inventories from the EIA and a raft of FED speakers ahead of the looming news blackout before the FOMC meetings September 19-20.

___________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (07.09.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The EURUSD remains under pressure and has once again tested the now 64-day low at 1.0705. The daily 21-EMA now sits at 1.0836 from 1.0878 on Monday, and the H4 at 1.0748 from 1.0774 yesterday, and represents today’s key resistance zone. The 21-EMA H1 today is at 1.0720, below here sits the last three-day low at 1.0705 and only 5 pips lower the psychological 1.0700.

Today’s Biggest Mover – GBPNZD

GBPNZD is today’s biggest mover and is registering a -0.58% decline following yesterday’s weak day as pressure builds across Sterling pairs. The TEMA and AMA (H1) crossed yesterday at 2.1360 and the pair closed the day at 2.1290. The low from yesterday (2.1245), was breached earlier and the pair currently trades at 2.1172. Monday’s & Friday’s lows at 2.1148 and 2.1128 respectively could be the next support levels. Resistance to the upside sits at 2.1209 and 2.1270.

COMMODITIES MARKETS MONITOR

GOLD (07.09.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The stronger USD continues to weigh on Gold prices today. The daily 21-EMA is at $1925 and was breached yesterday for the first time in 8-days following the rejection of the $1950 zone last week. Lows today so far are around $1916, 75 cents above yesterday’s low of $1915.15. Currently, the key precious metal holds at the H1 21-EMA at the $1920 zone. Resistance today is the H1 50-EMA and 38.2 Fib zone between $1923-25. The MACD signal line is rising and the RSI is neutral at 49.20. The H1 ATR is $1.79.

___________________________________________________________________