Last Week’s Highlights (September 04-08)

The key driver last week remained the strength of the US Dollar and Treasury yields, and weaker stock markets.

The USD Index rose for an eighth consecutive week, breaking and holding above the 105.00 level buoyed by stronger-than-expected ISM Services PMI data on Wednesday.

The EURO remained on the back foot as weak Service PMI data weighed. EURUSD continues to test the key support at 1.0700.

The RBA kept its cash rate unchanged, as expected, as signs that the economy is slowing continue to increase. (PMIs missed expectations last week and remained in contraction) RBA Governor Lowe reaffirmed that if inflation remains sticky, they will have to tighten more. The AUDUSD weakened to test 0.6350 from over 0.6500 at the start of the month.

Like its antipodean counterpart, the BOC also kept its interest rates unchanged (at 5.00%) and with weaker GDP data the previous week but better job data on Friday the USDCAD posted new 23-week highs over 1.3690, despite a robust Oil market that saw benchmark Brent Crude trade north of $90.00 a barrel.

Sterling & the Japanese Yen were also weaker against most counterparts, but most notably the USD Dollar. Cable breached the highly psychological 1.2500 level and USDJPY touched 147.80, the highest since last October, when the pair hit 150.00, which sparked significant intervention from the BOJ to support the YEN.

The stronger Dollar and rising yields pushed GOLD prices to $1915 lows last week, after rejecting a test of the $1950 zone the previous week. The market settled at $1920 to close the week.

Stock markets closed down last week, the benchmark S&P 500 lost -58.35 points (-1.28%) to 4457, the Dow slipped over 200 points to 34,576 and the tech-heavy Nasdaq100 slumped over 1.13% led by APPLE and Nivida.

Sources: https://www.reuters.com/markets/europe/global-markets-view-europe-2023-09-07/

The Week Ahead (September 11-15)

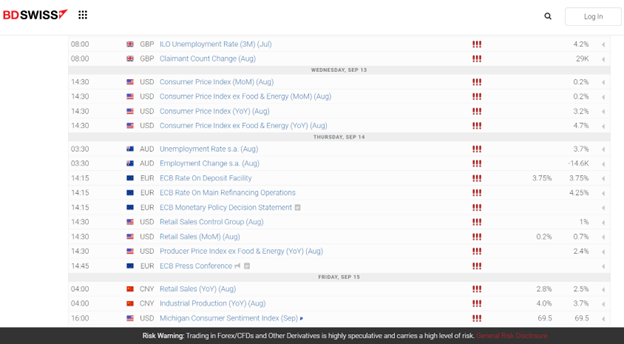

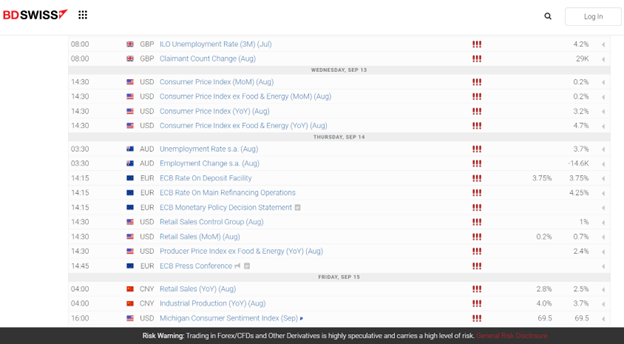

U.S. CPI data on Wednesday and the ECB Rate Decision on Thursday dominate the coming week.

Over the weekend, Chinese CPI missed expectations at 0.1%, compared to 0.2%, but was better than last time when it registered -0.3%. PPI was also not as poor as last time, although still weak, at -3.0% compared to -4.4% and still suggests continued weakness in the world’s second-largest economy.

Tuesday, September 12 – UK Labour Market report, German & Eurozone ZEW Economic Sentiment, Apple 2023 Product Launch.

The U.K. Unemployment Rate is expected to rise to 4.3% vs. 4.2% last time. However, it is the wages data which is expected to be unchanged at 7.8%, excluding Bonuses and Average Earnings incl. Bonus at 8.2%. That could be market moving for Sterling & the FTSE100.

The German ZEW Economic sentiment is likely to suggest more woes for the largest Eurozone economy, with the index slipping to a nine-month low of -15.0 from -12.3 in August. The wider Eurozone ZEW reading is also expected to decline to -6.2 from -5.5.

APPLE is expected to release its latest iPhone 15, a new range of Apple Watches, AirPods and a suite of software upgrades at its annual product event.

Wednesday, September 13 – U.K. GDP, U.S. CPI.

U.K. M/M GDP is expected to decline to a four-month low of -0.2% from 0.5%. However, recent U.K. data has been revised higher so watch Sterling pairs if the GDP reading produces a surprise.

The U.S. Headline CPI Y/Y is expected to rise to 3.6% vs. 3.2% prior, while the M/M reading is seen at 0.6% vs. 0.2% prior. The jump in Headline CPI is due to higher recent energy prices. The Core CPI Y/Y, which excludes the volatile food and energy prices, is expected to fall to 4.3% vs. 4.7% prior, while the M/M figure is seen again at 0.2% vs. 0.2% prior. The sentiment that inflation remains “sticky” is still in play but unless there is a major surprise in this set of data it is unlikely to change the perception that the FOMC will hold rates unchanged at the September meeting. The debate is more about the rest of 2023, and most importantly when the Fed will start to cut rates.

Thursday, September 14 – Australia Labour Market report, ECB Policy Decision, US Jobless Claims, US PPI, US Retail Sales.

Australian Employment change should show a bounce back and growth of 26K jobs compared to the decline in August of -14.6k, with the overall Australian unemployment rate remaining unchanged at 3.7%.

The ECB is expected to keep the deposit rate steady at 3.75%. However, it could be a close call as the rate hike probability has risen to around 60% from 30% at the beginning of the month. EZ data has been surprising to the downside lately and the deterioration has been significant and rapid. Paradoxically though inflation and labour market indicators are still strong, and many in Frankfurt have been expressing that it may take too much time to get back to the 2% target. The hawks may have their day but can the fragile EZ economy cope?

U.S. Weekly Jobless claims dropped again last week to 216K from 229K, this week they are expected to rise back to 225K

U.S. Retail Sales are expected to decline m/m to 0.2% from 0.7% in August with the more important Core reading declining to 0.4% from 1.0%

U.S. PPI data is likely to be mixed, in line with the CPI data. The headline figure could see a rise to 0.4% from 0.3% whilst the CORE PPI reading, is seen as being a tick lower at 0.2% from 0.3%.

Friday, September 12 – China Industrial Production and Retail Sales, US University of Michigan Consumer Sentiment.

Chinese Industrial Production Y/Y is expected at 4.0% vs. 3.7% last time, while Retail Sales Y/Y are seen at 2.8% vs. 2.5% prior. Both are potentially positive signs for the Chinese economy after a slew of recent weak data.

The UoM Consumer Sentiment is expected to fall to 69.2 vs. 69.5 previously. The prior final report was revised downwards from the preliminary readings, in line with the big miss in the Conference Board Consumer Confidence report.

https://www.reuters.com/markets/us/wall-st-week-ahead-investor-hopes-us-soft-landing-ride-inflation-data-2023-09-08/