PREVIOUS TRADING DAY EVENTS – 14 June 2023

Announcements:

“Looking ahead, we continue to expect GDP in Q2 as a whole to be unchanged from Q1,” said Samuel Tombs, chief UK economist at consultancy Pantheon Macroeconomics.

“Public sector strikes have continued to rumble on, and the lost working day for the King’s coronation probably inflicted a 0.2 percentage point blow to GDP in May,” Tombs added.

The government would stick to its plan to halve inflation this year which means that hikes will definitely continue. No pause here.

Source:

https://www.reuters.com/world/uk/uk-economy-shows-02-growth-april-ons-2023-06-14/

The report from the Labor Department also showed that the annual increase in producer inflation last month was the smallest in nearly 2-1/2 years.

As per yesterday’s report at 21:00, the Federal Reserve (Fed) kept interest rates unchanged for the first time since March 2022 when the U.S. central bank started this aggressive monetary policy tightening campaign. In new economic projections, this signalled that borrowing costs will likely rise by another half of a percentage point by the end of this year, because of the economy’s resilience, particularly the labour market.

“There aren’t as many factory price increases in the pipeline waiting in ambush for consumers and that spells relief for the inflation-weary American public,” said Christopher Rupkey, chief economist at FWDBONDS in New York.

“Inflation isn’t finished wreaking its havoc on the economy yet, but we can see the day is coming when inflation will come down to more manageable levels after the pandemic demand surge completely dissipates.”

With the CPI and PPI data taken into account, economists estimated that the core PCE price index rose 0.3% in May after increasing 0.4% in April. The core PCE price index was forecast to advance 4.6% year-on-year in May after rising 4.7% in April.

“Inflation has moderated somewhat since the middle of last year,” Fed Chair Jerome Powell told reporters. “Nonetheless, inflation pressures continue to run high and the process of getting inflation back down to 2%.”

Fed Chair Jerome Powell highlighted the fact that the job market is still strong and the U.S. economy is resilient despite the aggressive monetary policy tightening of the past year. However, it is noticeable that inflation has indeed dropped and these facts indicate that not too much harm has been done from hikes which is good enough. Many Economists and analysts were arguing that a recession is coming but the data do not support this.

The pause was out of caution, Powell said. It allows the Fed to gather more information and see the effects of the previous hikes before taking any further decision to raise rates again. Though Powell repeated the Fed’s standard warning about “upside” risks to inflation, the decision to hold steady at this time was also an effort to try to ease the pace of price increases “with the minimum damage” to the job market.

“Holding the target (interest rate) range steady at this meeting allows the committee to assess additional information and its implications for monetary policy” before taking another step, the central bank’s rate-setting Federal Open Market Committee (FOMC) said in a unanimous policy statement.

Powell said that even as officials have not decided what they will do with rates, the July 25-26 gathering is a “live meeting” which could bring another increase.

Source:

https://www.reuters.com/markets/us/fed-poised-punt-rate-hike-into-summer-wind-2023-06-14/

______________________________________________________________________

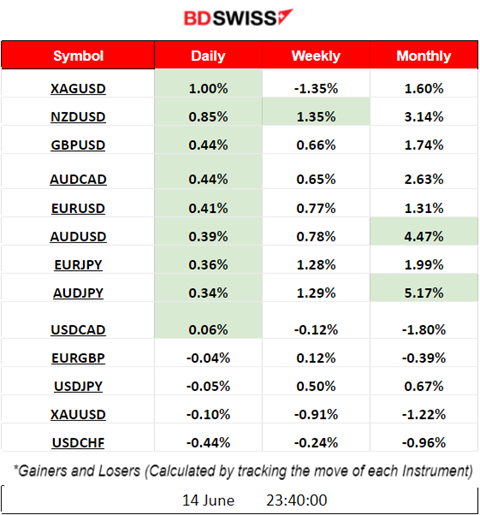

Summary Daily Moves – Winners vs Losers (14 June 2023)

- XAUUSD reached the top yesterday with 1% gains.

- This week NZDUSD is leading with 1.35% price change so far.

- The month finds AUDJPY at the top of the winners’ list with 5.17% price change.

______________________________________________________________________

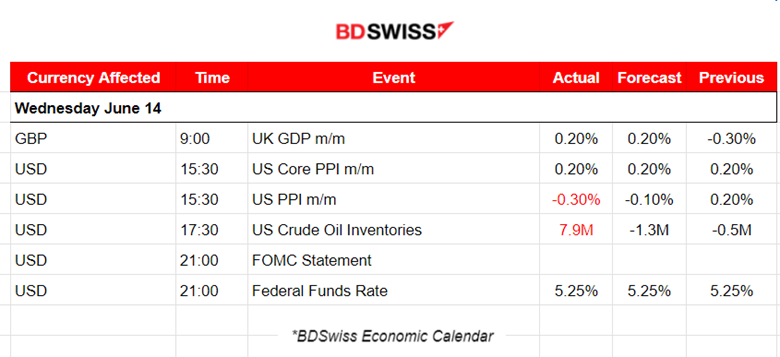

News Reports Monitor – Previous Trading Day (14 June 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No significant announcements, no important scheduled releases.

- Morning – Day Session (European)

Monthly real gross domestic product (GDP) is estimated to have grown by 0.2% in April 2023, after a fall of 0.3% in March 2023. The actual figure matched the estimated one and the market did not react much to this.

At 15:30, the U.S. PPI data were released with the monthly figure to be negative. Quite low changes indicating that prices are significantly falling. The market reacted with a USD depreciation at that time, as expectations of a potential pause in rates were boosted. The USD started to weaken and the DXY was moving steadily downwards.

At 21:00 the Fed announced the decision to leave rates unchanged. The market reacted with high appreciation of the USD at that time, causing the EURUSD to drop heavily before retracing back to the mean later on. U.S. Stocks dropped before retracing as well, the same trading day.

General Verdict:

______________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (14.06.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

EURUSD was moving with low volatility during the Asian session and sideways. At the start of the European session, it experienced more volatility and the market was waiting for the news at 15:30 to react. When the U.S. PPI figures were released at that time, the EURUSD steadily moved upwards since the USD was depreciating heavily. The PPI figures were significantly lower, indicating that hikes are probably over. The pair found resistance at 1.08640 and was waiting for the Fed’s Rate decision at 21:00. When the Fed decided to leave the rates unchanged the market reacted with high USD appreciation at first causing the pair to drop sharply and cross the 30-period MA as it moved lower and lower. It eventually found support at near 1.08040 before eventually retracing back to the mean by the end of the trading day.

____________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

U.S. Benchmark indices have been climbing for days. The U.S. Stock market is clearly on an uptrend and the USD has been strengthening all this time. The labour market in the U.S. is strong and resilient, according to the data, but inflation is significantly dropping justifying the continuous hikes from the Federal Reserve. The Fed took all the data into consideration and decided that it has done enough with rates. It expects that the hike effect will eventually show labour market weakening and even lower inflation figures. Leaving borrowing costs unchanged though in such an environment could lead to a risk-on mood causing stocks to lean more to the upside. Yesterday, during the Fed Rate decision, all benchmark U.S. indices fell sharply before eventually retracing by the end of the trading day as it’s been predicted and mentioned during our webinar.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 13th of June, Crude ended the downward movement with a reversal. The price moved upwards, crossing the 30-period MA and stopped at the resistance near 70 USD/b. The next day it continued with a volatile and sideways path around the mean. Crude oil inventories were released yesterday at 17:30 showing a remarkable positive change of 7.9 Million Barrels for last week. Seemingly demand is not high enough and more barrels are stored bringing down the price and explaining somehow its recent path. USD strengthening was also a factor that pushed Crude down. Strengthening of the dollar typically results in a decrease in oil prices.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Gold has been moving almost sideways but with high volatility. Even though the scheduled releases for the USD were affecting its path with high downward deviations from the mean, daily retracements ensured that it would return to the 30-period MA. Recent data releases caused USD to strengthen every day. The risk-on mood has taken the lead recently and investors moved to more risky assets such as stocks. Technically, Gold has broken some support levels that could push it further downwards. However, according to the RSI and the higher lows formed, a more sideways and volatile path is more likely to occur.

______________________________________________________________

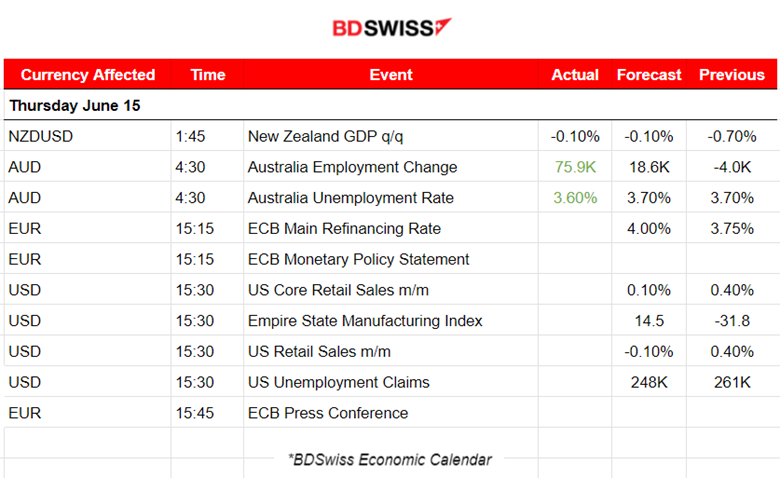

News Reports Monitor – Today Trading Day (15 June 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

The quarterly figure for New Zealand’s GDP is already out. Less negative change. The report came after the previous revised 0.7% decline in the final quarter of 2022. This shows that NZ experiences a Technical Recession, defined as two consecutive quarters of contraction. The NZD depreciated at the time of the release bringing NZDUSD down more than 20 pips.

Australia’s Labor Market Data was released at 4:30. The Employment change figure was reported high at 75.9K versus the previous -4.0K figure. The unemployment rate was reported lower. The market reacted with AUD appreciation. AUDJPY has moved upwards by more than 100 pips since the release.

- Morning – Day Session (European)

At 15:15 the ECB is going to decide on the Main Refinancing Rate and it is expected that the EUR pairs are going to experience an intraday shock. Such releases cause volatility in general and we expect that USD pairs other than EURUSD will be also affected. The ECB policymakers had made it clear that the hike will take place since they are determined to bring inflation down and hence, we do not expect any surprises. The rate is estimated to increase by 25 basis points, reaching 4%.

Various scheduled figures are released at 15:30 and those related to the U.S. Retail Sales and Unemployment claims are the most interesting. The jobless claims are expected to be reported lower. The Fed has its eyes on the Labor Market and closely monitors changes in claims to confirm if the market is actually cooling down. Yesterday, the decision to keep rates unchanged took place as policymakers estimated that a hike is no longer necessary. Shall the figure be reported way lower than the forecast, it will probably cause an intraday shock for the USD pairs and short-term USD strengthening.

General Verdict:

______________________________________________________________