Rates as of 04:30 GMT

Market Recap

There’s bad, and then there’s really bad, and then there’s this. This is just a whole new level of bad. The US stock market had its worst day since 1987, How many of you remember 1987? And Europe had an even worse day. Even after yesterday’s collapse, markets are down further in Asia this morning, with some markets showing double-digit declines at some point. Clearly this is going to be a very, very unlucky Friday the 13th!

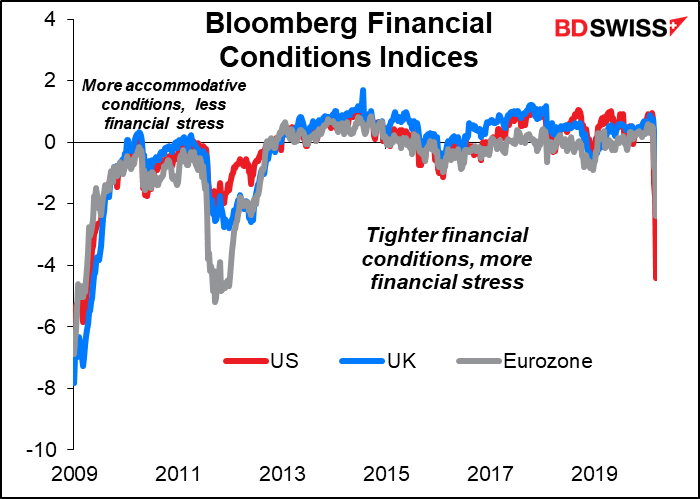

The scariest part of this is not the collapse in the stock markets, even though it’s the fasterst reversal on record from record top to bear market. It’s the drying up of liquidity in the US Treasury market. The US Treasury bond market is supposedly the most liquid of the financial markets (except the FX market). Yet yesterday there were reports that there was diminishing liquidity in important sectors of the market. That’s unprecedented. Also the fact that Treasury yields moved higher even while the stock market collapsed shows a general move into cash, the ultimate “risk-off” move.

Refinitiv Lipper data pointed to record outflows from investment grade bond funds ($7.27bn in the week ending 11 March) as inflows into government money market funds jumped $148bn since 26 February. Gold falling more than oil yesterday just reinforces the feeling that people don’t trust anything any more.

One reason for the rush to liquidity is that companies are drawing down their revolving credit lines from banks, which withdraws money from the banking system, at the same time as many oil-producing countries are having to dip into their dollar reserves to fund their day-to-day government operations, a form of “quantitative tightening.” These two events are helping to push Treasury yields up despite the collapse of the stock markets and are tightening financial conditions – a extremely worrisome development in this situation.

The Fed tried to come to the rescue yesterday for the third time in four days with a huge injection of funds “to address highly unusual disruptions in Treasury financing markets.” It offered to lend $500bn yesterday and $1tn today, plus $1tn a week for the next month – total $5tn!!! This huge amount of money is far more than is necessary – of the $500bn on offer in three-month loans yesterday, only $78bn was taken up. The importance is probably more psychological than functional – it proves that they’re willing to do “whatever it takes” to keep the market functioning. Not that it helped significantly – stocks rebounded somewhat afterwards, but quickly lost all the gains.

The market is now expecting the Fed to cut rates by 100 bps next week, effectively bringing the Fed funds rate down to zero. But what’s left after that? The markets need an effective fiscal response, but we haven’t seen that from any of the major countries yet.

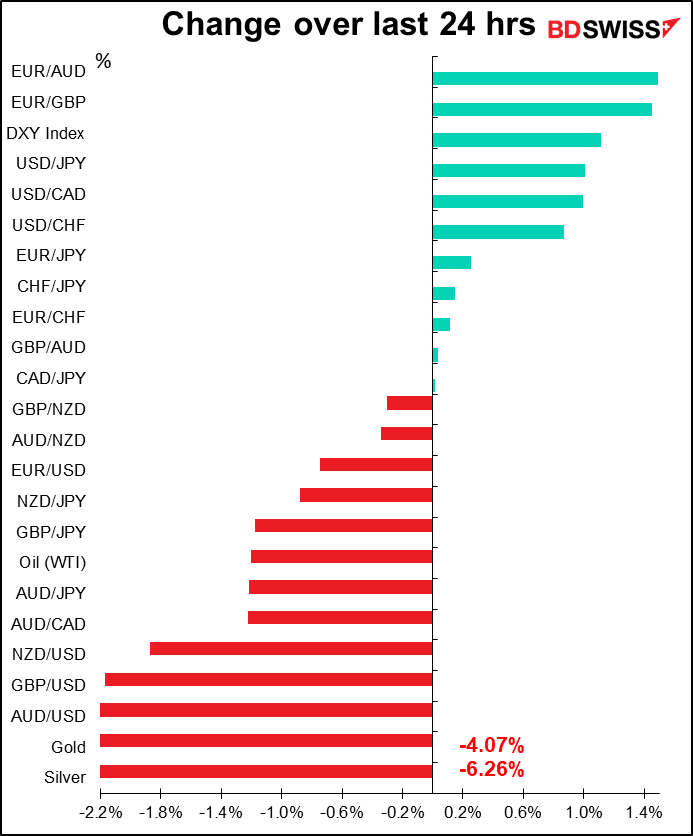

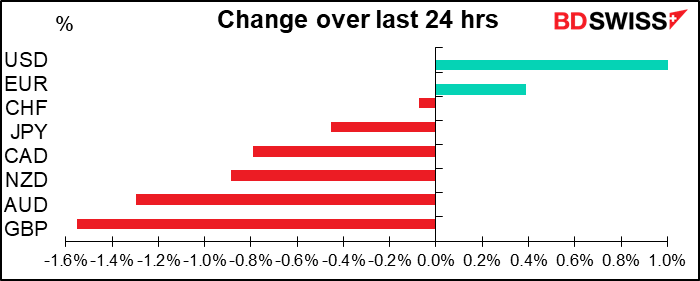

The ECB by contrast failed to overwhelm the markets. It needed to come up with a big surprise, but the biggest surprise was that it held the deposit rate steady at -0.5%. It did lower the required capital ratios for banks and cut the interest rate on its targeted lending operations, two measures that weren’t expected. The additional EUR 120bn of new asset purchases this year was hardly overwhelming though (I had expected about double that). So the package was slightly good news, but any goodwill that created was obliterated later by ECB President Largarde’s press conference afterwards, at which she said “the ECB is not here to close spreads” in government bond markets. Yes well that’s exactly what the Fed is doing, so there’s some disagreement here on the proper role of a central bank in managing market disruption.The widening of spreads in peripheral bond markets hit the EUR and helped send EUR/USD lower.

GBP was the worst hit currency. Probably it’s because the UK government has apparently abandoned efforts to contain the spread of the virus and is simply trying to delay the peak.So far it hasn’t taken measures such as closing schools or banning sporting events, as has happened in other countries. Maybe they think this is a good way to solve their pension crisis? The government is arguing that there’s no point implementing such measures too early, but the markets don’t seem to agree. This seemingly insoucient response follows a Budget package that failed to impress the markets, leaving investors with the feeling that the UK government just doesn’t get it yet. The market thinks that the Bank of England is maybe more on top of things and investors are forecasting another 10 bps cut in the Bank’s base rate next week, which would bring it down to a new low 0.15% or so (it’s now at the record low of 0.25%).

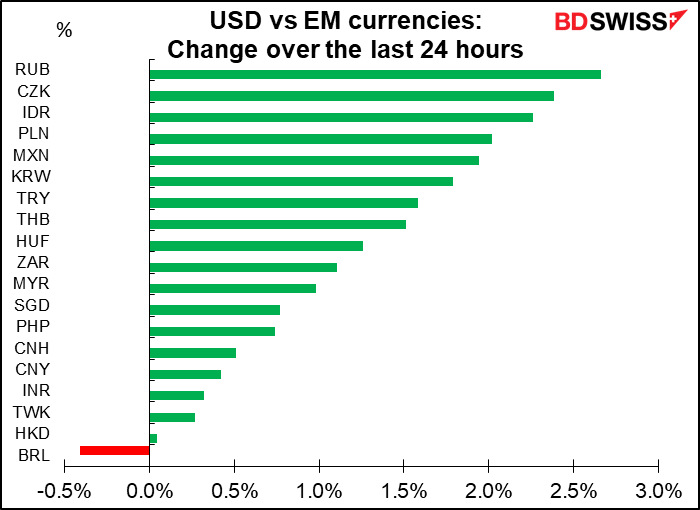

Amidst all this turmoil, USD finally regained its stature as the ultimate “safe haven” currency. The gains were particularly noticeable against emerging market currencies, which fell almost across the board against USD.

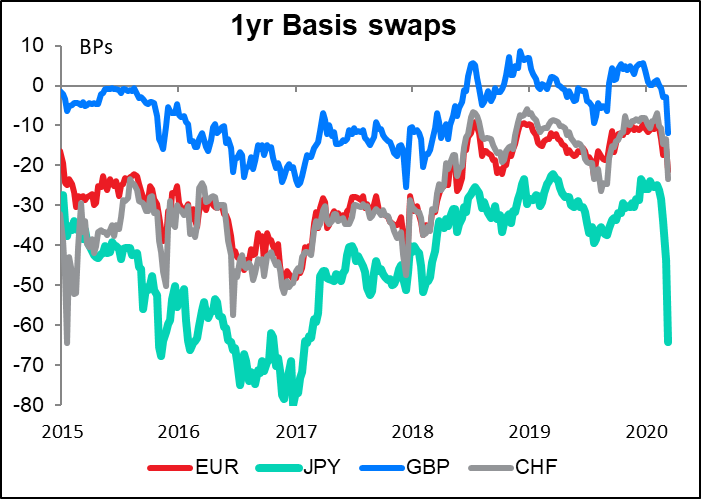

The surge in demand for dollars showed up in a sudden widening of the currency basis swap, the amount that banks are willing to pay to borrow dollars over the theoretical level that they should pay based on interest rate differentials. The Fed’s actions show that they are clearly much more willing to provide liquidity to the markets than the ECB is, which restores the dollar’s traditional role as the “currency of last resort.” The dollar may be supported temporarily by this surge in safe haven demand, although I still feel that the US reaction to the coronavirus is going to be the worst of any of the major countries and USD will get slammed because of that. But who knows? Maybe Britain will do even worse.

Mystery move: There was a sudden shift in sentiment in mid-afternoon in Asia, with USD/JPY and AUD/JPY suddenly climbing and one or two of the stock exchanges turning around. I couldn’t find any reason for it, and it seems to have faded quickly –AUD/JPY is now headed back down.

Today’s market

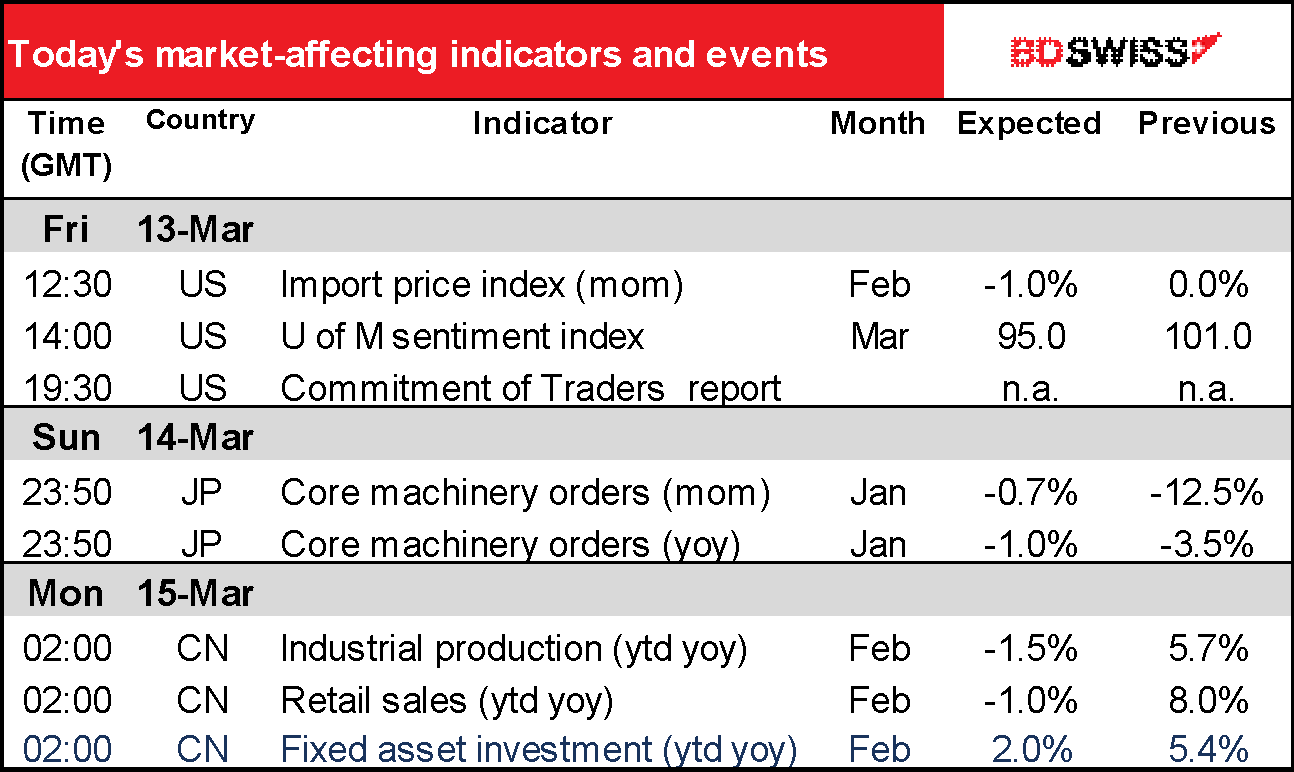

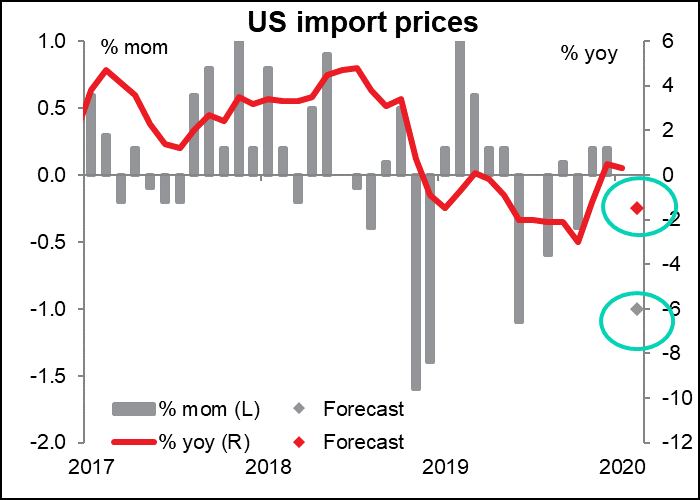

Not much on the schedule today. US import prices aren’t a biggie. As I pointed out yesterday with the producer prices and Wednesday with the consumer prices, inflation just isn’t what’s moving the Fed nowadays. They’re worried about the collapse of Western society, not the price of chickens – or in this case, imported chickens. Or imported whatever. The import price index tends to be a function of the Chinese producer price index, and as we saw on Monday morning, that’s going nowhere (-0.4% yoy, down from +0.1% yoy in the previous month.)

If anyone is indeed paying attention to this indicator, it’s showing less and less upstream pressure on prices, which is probably negative for USD.

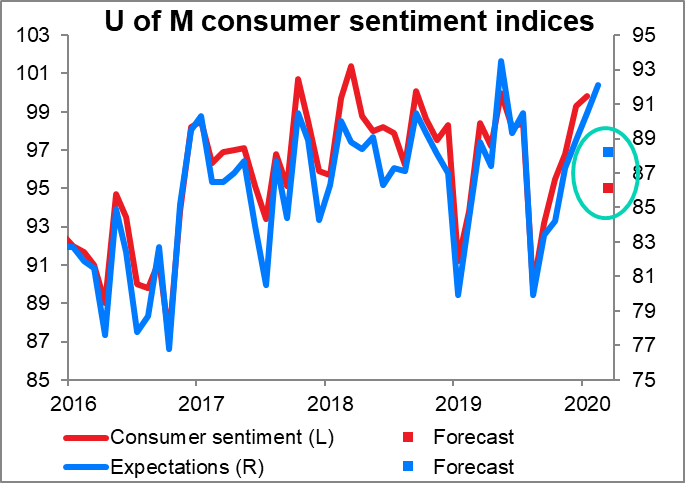

U of Michigan consumer sentiment indices are expected to decline notably but still stay within the recent range. I wonder if this really matters – US sentiment has zig-zaged within a range since The Orange One was elected. It’s expected to be in the middle of that range in February, which is about par for the course – neither good nor bad. In that respect I’d say it’s neutral. I’d wait to see the March figure to see if the virus is starting to depress consumer sentiment before getting worried about this. USD neutral

Over the weekend we get China retail sales, industrial production and fixed asset investment. Because of the Lunar New Year, which sometimes appears in January and sometimes in February, the government doesn’t release yoy figures for January and only releases year-to-date figures for February, as those then include both months. This is the first time that I can see that they’re expected to show a year-on-year decline.

Even looking at the year-on-year data, going back to the beginning of the data series in 1995, this would be the first year-on-year decline in these indicators. Even during the 2008/09 Global Financial Crisis, they were all up vs the previous year (at least, the official statistics said they were). This decline is unprecedented in post-Deng China as far as we know. Of course that would just confirm the plunge in the China purchasing managers’ indices during the month.