Previous Trading Day’s Events (19 Jan 2024)

Any recession could have major implications for Prime Minister Rishi Sunak in a probable election year.

Source: https://www.reuters.com/world/uk/british-retail-sales-slump-32-december-2024-01-19/

Core retail sales, which exclude gasoline stations and fuel vendors and motor vehicle and parts dealers, fell 0.6% in November.

The Bank of Canada (BoC) is expected to hold interest rates steady next week as inflation remains above its 2% target, despite falling from last year’s peak and with signs of slowing growth. Markets and economists expect the BoC to start trimming rates during the first half of the year.

“Although the advance estimate for December suggested a 0.8% increase in sales, we expect that strength to be fleeting given the weakening labour market and the impact of higher interest rates on spending,” said Katherine Judge, an economist at CIBC Economics.

The University of Michigan reported a better-than-expected figure for consumer sentiment on Friday. The overall index of consumer sentiment came in at 78.8 this month, the highest reading since July 2021, compared to 69.7 in December. Consumers’ inflation expectations over the next 12 months were the lowest in three years, good news for the Federal Reserve.

“The economy is not going backwards, it is going forwards at the start of 2024,” said Christopher Rupkey, chief economist at FWDBONDS in New York. “For the first time, massive interest rate hikes have not put a damper on economic growth.”

Easing inflation expectations supports economists’ views that the U.S. central bank will start cutting interest rates in the first half of this year.

“Confidence alone is not a good indicator of where consumer spending is heading, but improved sentiment does reduce the risk that consumers increase their saving drastically this year, which is a key risk to our more upbeat outlook on consumer spending and GDP growth,” said Grace Zwemmer, an economic research analyst at Oxford Economics.

Source: https://www.reuters.com/markets/us/us-consumer-sentiment-rises-solidly-january-2024-01-19/

______________________________________________________________________

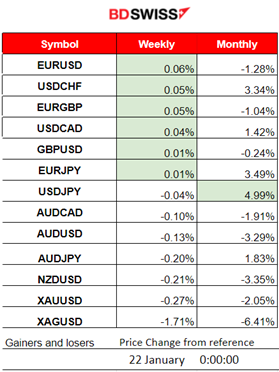

Winners vs Losers

The week just started with EURUSD on the top as it moved steadily upward. USDJPY remains the top gainer this month with 4.99% gains.

______________________________________________________________________

______________________________________________________________________

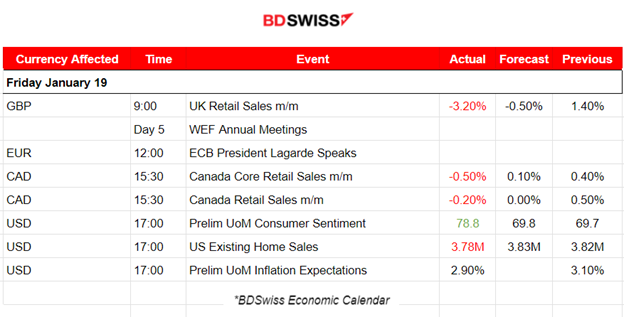

News Reports Monitor – Previous Trading Day (19 Jan 2024)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No major announcements, no important special scheduled releases.

- Morning–Day Session (European and N. American Session)

At 9:00 the U.K. Retail Sales figures were released showing a strong decline. The change in retail sales was recorded -3.20% worse than the expected -0.5% change. December’s decrease was the largest monthly fall since January 2021, when coronavirus (COVID-19) restrictions affected sales. The current interest rate policy obviously affected the markets greatly. The GBP depreciated against other currencies moderately. The GBPUSD dropped nearly 20 pips before retracement. However, the pair continues to drop steadily.

Canada’s retail sales figures were reported negative. Big declines but way more than expected. Retail sales decreased 0.2% in November. Core retail sales—which exclude gasoline stations and fuel vendors and motor vehicle and parts dealers—were down 0.6% in November. A downturn in business activity and sales was also observed in the case of U.K. retail sales and is something expected with the current interest rate policy in place. The impact on the market was minimal from the release. CAD depreciated momentarily with the effect fading soon. Just near 15 pips jump for the USDCAD at that time.

The U.S. Consumer sentiment figure was reported at 78.8 versus the expected 69.8. Confidence surges while the inflation outlook actually dips according to the survey by the University of Michigan. Consumers have grown more confident about the direction of the economy. “Consumer views were supported by confidence that inflation has turned a corner and strengthening income expectations,” Joanne Hsu, the university’s surveys of consumers director, said in a release. No major impact on the market was recorded at the time of the release.

General Verdict:

____________________________________________________________________

____________________________________________________________________

FOREX MARKETS MONITOR

GBPUSD (19.01.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The pair experienced high volatility with deviations from the intraday mean to reach near 30 pips. It moved sideways overall closing the trading day flat. At first, the pair moved early to the downside and deviated strongly from the 30-period MA after the GBP depreciation caused by the retail sales report at 9:00. After finding strong support it reversed to the MA. The pair then moved upwards during the N. American session crossing the MA on its way up and remaining on the path until the end.

USDCAD (19.01.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The pair started to show higher levels of volatility after the start of the European session. It moved fairly downwards, not deviating a lot from the 30-period MA, but at the time of the Retail Sales report the CAD depreciated for some time causing the pair to steadily move to the upside, crossing the MA on its way up. It soon found resistance and reversed back to the MA, only to cross it again on its way down, and continue with an aggressive downwards path.

___________________________________________________________________

___________________________________________________________________

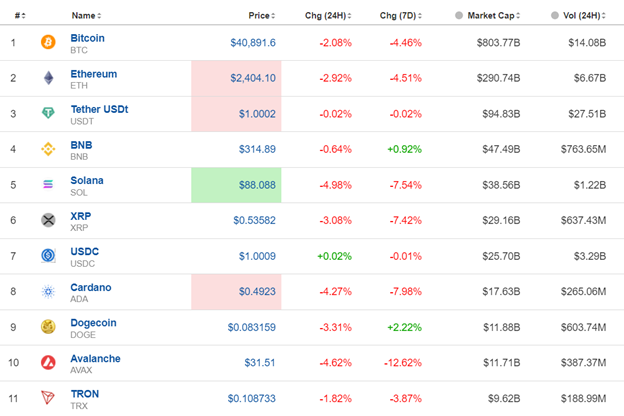

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) Chart Summary 1H Timeframe

Server Time / Timezone EEST (UTC+02:00)

Price Movement

After the Spot Bitcoin ETF approval from the SEC, Bitcoin saw an unusual fall in value. On the 18th Jan, it dropped heavily until the support near 40600 USD. Retracement followed but on the 19th it saw another drop to 40200 USD. On the same day, it recovered fully and on its way up it crossed the 30-period MA showing strength, settling at near 41600 USD. During the weekend the price experienced very low volatility but on the 22nd Jan, the price dropped heavily again reaching and testing the 40600 USD support once more. It is currently settled around that level.

Crypto sorted by Highest Market Cap:

The whole market is obviously suffering as most Crypto show high losses. Bitcoin has lost nearly 9000 USD in just 10 days.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4Hour Timeframe Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

All benchmark U.S. indices moved to the upside quite rapidly in the past few days, particularly since the 17th Jan. The uptrend is clear with some retracements taking place every day, however not being complete as the path is quite strong to the upside. The 4H chart below shows why this is clear. Volatility levels are higher than usual. I am expecting a retracement soon. Upon NYSE opening it would be more clear if the index will move further to the upside or break the intraday support and eventually retrace to the 61.8 Fibo level as per the chart.

______________________________________________________________________

______________________________________________________________________

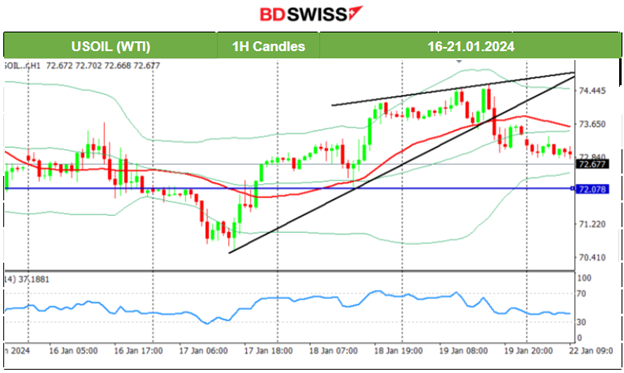

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Crude oil experienced a short-term upward trend from the 17th to the 19th Jan. After the reversal to the upside on the 17th it crossed the 30-period MA on its way up and found strong resistance near 74.5 USD/b before reversing again to the downside heavily. It crossed the MA on its way down showing signs that the uptrend ended and a more probable sideways but volatile movement is following next. 72.5 USD/b seems to be the support at the moment that could drive the price back to the MA.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The price broke the support at near 2017 USD/oz on the 17th Jan, moving to the next at 2001 USD/oz. This short-term downward trend found an end as the price eventually retraced significantly. On the 18th Jan, the price moved to the upside, crossing the MA on its way up reaching the 61.8 Fibo level, as depicted on the chart. Seemingly, preference for Gold increased as currently the dollar value remains stable against other currencies. The upward movement found resistance on the 19th Jan near 2041 SUD/oz and the price reversed to the MA. The price continues sideways with high volatility around the mean currently.

______________________________________________________________

______________________________________________________________

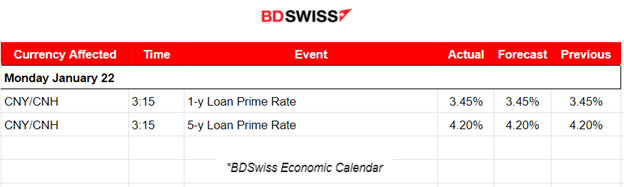

News Reports Monitor – Today Trading Day (22 Jan 2024)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No major announcements, no important special scheduled releases.

- Morning–Day Session (European and N. American Session)

No major announcements, no important special scheduled releases.

General Verdict:

______________________________________________________________