Rates as of 05:00 GMT

Market Recap

The Fed surprised the markets with a unanimous inter-meeting 50 bps cut. This followed a conference call among the G7 Finance Ministers and central bank governors in which they basically said nothing (see below).

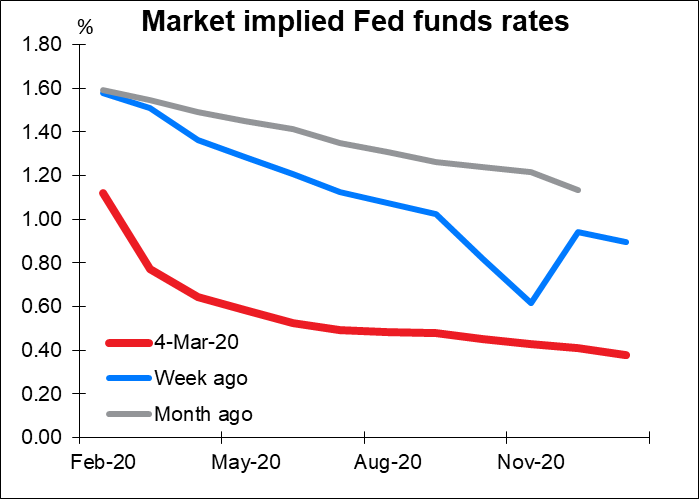

The Fed said in a statement that while the fundamentals of the US economy remain strong, the coronavirus “poses evolving risks to economic activity.” They repeated Fed Chair Powell’s comment from Friday that they were “closely monitoring” the situation and would “act as appropriate to support the economy,” meaning that they could cut further. And in fact the market does expect them to cut another two times at least, perhaps three by the end of the year or early 2021. That would bring the Fed funds rate down to around 50 bps.

Afterward, Powell hosted a press conference in which he said that the Fed is in discussions with other central banks and each will do what makes sense for them.

The Statement of G7 Finance Ministers and Central Bank Governors didn’t say anything specific about what the group would do to combat the economic effects of the virus. The finance ministers simply reaffirmed their commitment “to use all appropriate policy tools” and said they are “ready to take actions, including fiscal measures where appropriate.” As for the central bankers, they will “continue to fulfill their mandates.” What this means is that they left it up to each central bank to do what they think is appropriate for their country, rather than having a round of simultaneous, coordinated cuts as happened back in 2008. But it’s clear from the Fed’s emergency action – an intermeeting cut, and double the usual size at that – that everyone is in an easing mode.

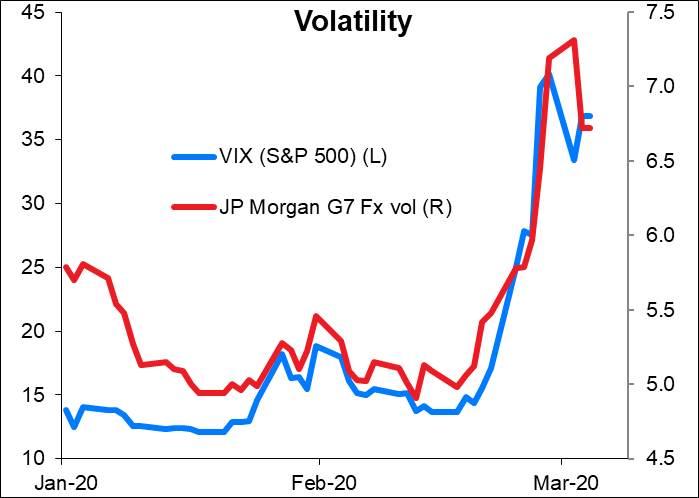

The curious point was of course the stock market’s reaction. It was an incredibly volatile day – the S&P 500 was at one point up 1.5%, then down 3.7%, and closed -2.8% (so up 0.9% from the low).

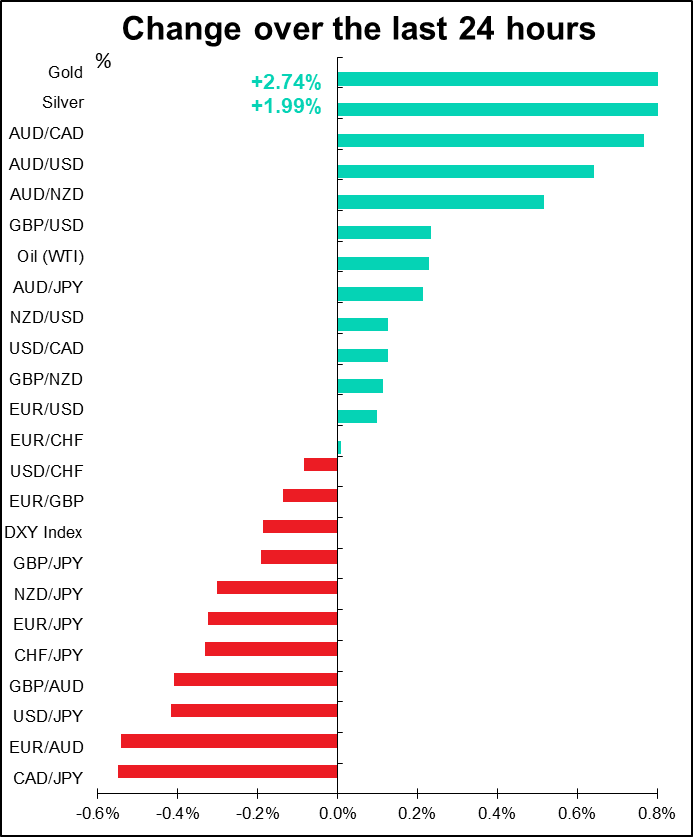

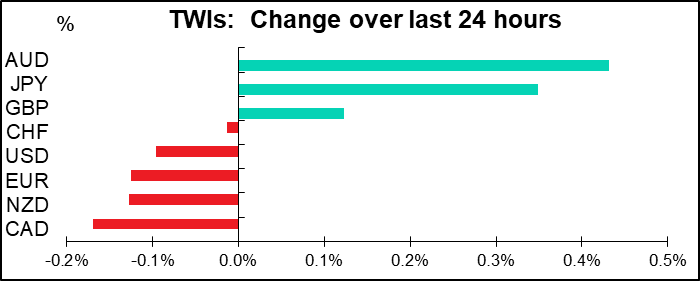

Why did the stock market (and the dollar) fall when the Fed took such strong action? After all, AUD managed to rally after the Reserve Bank of Australia cut rates. Why not USD?

Probably this is due to two reasons. One, the suspicion that things might be much worse than they seem. If the situation is so dire that the Fed has to cut 50 bps in between meetings, then it must be bad. Of course, this is a “damned if they do, damned if they don’t” response, because what would the markets have done if the G7 had held such a conference call and no one acted?

Secondly is indeed the “damned if they don’t” side of that assessment. The Fed was the only central bank to act after the call. That’s a rather tepid response compared to what happened in 2008. Furthermore, there were no announcements on the fiscal side anywhere. The Fed can’t rescue the global economy by itself. And indeed in a demand shock like this – when the problem is that people are going to be sitting home watching Netflix instead of going out and spending money – a fiscal policy response is much more appropriate than monetary policy. But the finance ministers were MIA. US Treasury Secretary Mnuchin applauded the Fed’s decision and said “all of our tools are on the table,” but he didn’t say which ones he might pick up and start using. On the contrary, he said the Trump regime isn’t planning a temporary payroll-tax cut or a reduction of the tariffs on Chinese imports, either of which they could do quite quickly.

Part of the problem in the US is that Trump et. al. are maintaining that the COVID-19 virus is simply a scare that the Democrats have invented to hurt Trump’s re-election campaign, so for them to argue that it’s a big deal and needs Congressional budget action would run counter to their story. (For more information on just why they might want to do such a stupid thing, read “Trump Has Sabotaged America’s Coronavirus Response” in Foreign Policy magazine. “…the government has intentionally rendered itself incapable (of responding to a pandemic). In 2018, the Trump administration fired the government’s entire pandemic response chain of command, including the White House management infrastructure… If the United States still has a clear chain of command for pandemic response, the White House urgently needs to clarify what it is — not just for the public but for the government itself, which largely finds itself in the dark.”

Given the abysmal state of the US response, the government’s lack of preparedness, and the dreadful US health service, I think the virus is likely to prove negative for USD. Of course it will hit other countries, too, but most other countries have national health services that will take care of the public. This virus will hit the US particularly hard, because so many millions of people have no sick days and no health insurance and therefore cannot afford to take a day off work and get tested for the virus, much less get hospitalised or even quarantined if they do have it. Simply put, they can’t afford to take basic health measures even if such measures were available, which they’re not at the moment. This suggests the virus may spread more virulently throughout the US than in other countries, which could hurt USD.

Today’s market

We get the final version of the service-sector purchasing managers’ indices (PMIs) today. Usually there isn’t much change in them, but this time could be different – things might have looked very different to the last few people to fill in their surveys. To my surprise, the EU manufacturing surveys were generally revised up, although the UK and US surveys were revised down. I wouldn’t be surprised to see the service-sector PMIs revised down a bit.

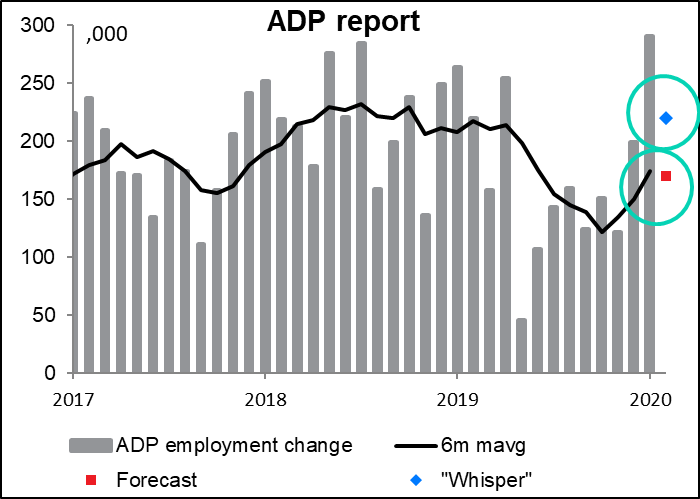

The day really starts when the US comes in and we get the closely watched ADP employment report. Automated Data Processing Inc. (ADP) is an outsourcing company that handles about one-fifth of the private payrolls in the US, so its client base is a pretty sizeable sample of the US labor market as a whole. It’s therefore watched closely to get an idea of what Friday’s US nonfarm payrolls figure might be. One point to note: the ADP adjusts its figures to match the final estimate of NFP, not the initial estimate that we get this Friday. So while it’s one of the best guides to the NFP that we have, it’s not perfect by any means – in fact, neither is the NFP figure itself, since it’s always revised.

The market consensus forecast is for the report to show an increase in jobs of 170k. The six-month average for the series is…174k. Is it a coincidence? The estimates range from 140k to 250k (only one guy is there – the next-highest is 192k, so the 250k guy is a real outlier). 170k is the median, but 168k is the average, so they’re pretty much the same – meaning the consensus among economists is for the figure to be in line with the recent trend. That would tend to be neutral for the markets.

Note though that the “whisper” – the average guess of Bloomberg subscribers who take the trouble to register their guesses – is 220k, meaning that traders may be looking for a higher number (although that’s only 15 people’s view.) What that means is that the market’s response to a lower-than-expected figure would be greater than its response to a higher-than-expected figure.

Of course, that assumes any response at all. But nowadays the virus count is more important than the job count for Fed policy, meaning this indicator may not have much impact at all.

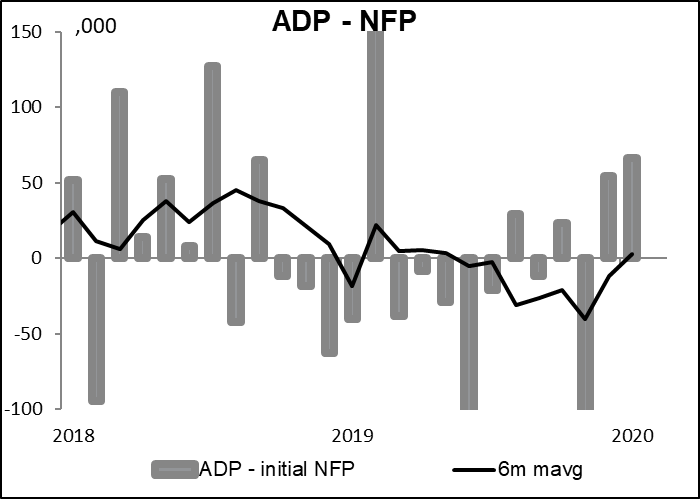

The ADP report minus the initial NFP figure is quite variable. There isn’t even any pattern to which is higher or lower on any given month – that seems random too. The absolute values of the differences over the last six months have averaged about 55k or 32% of the size of the NFP figure. Being ±32% right is barely being right at all.

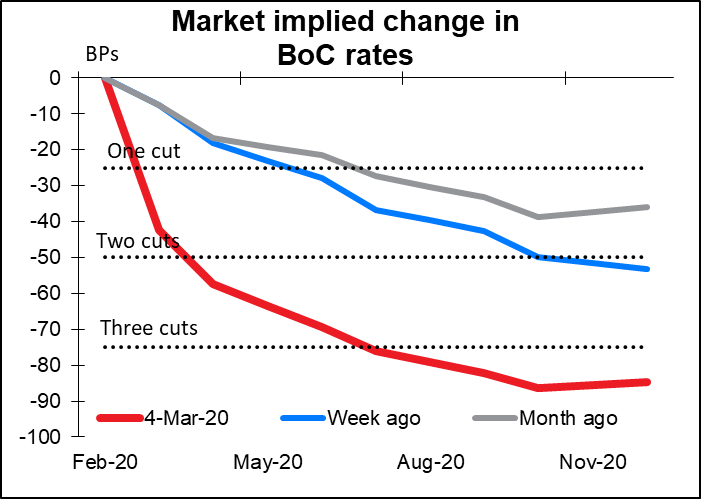

The big event of the day is the Bank of Canada (BoC) meeting. A month ago, the market was discounting one rate cut around July. Then with things getting worse, a week ago that moved up to June, with another cut coming in Q4. Now however, after the Fed’s emergency cut, people are looking for a rate cut today of at least 25 bps and maybe a 50-50 chance of a 50 bps cut.

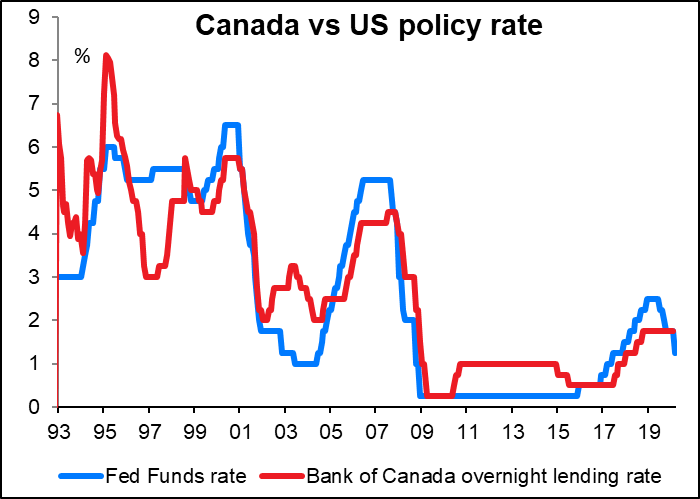

I had a whole big explanation worked out of why they might cut based on what they said last time, but it doesn’t matter anymore. Central banks are now carrying out a round of coordinated cuts because of the COVID-19 virus, and that’s all we need to know. This is unfortunate for me as I spent a lot of time making the graphs etc to explain why they might cut based on their stated criteria — retail sales, housing and investment — but all of that macroeconomic stuff doesn’t matter any more. This is the only graph you need to see: generally speaking, Canadian monetary policy hews pretty close to US monetary policy. Certainly not lockstep, but given the fact that the Bank of Canada was already in a cautious mood, I think it’s likely that they’ll go today. (Although having said that, the Bloomberg “whisper” number is for them to remain unchanged at 1.75%, although this represents only 11 votes.)

So I’ll skip all the details and just summarize what I concluded last week, which is that based on the criteria that the BoC set for another rate cut, a cut this month or next was possible anyway. After the G7 conference call and the Fed’s move, I think it’s inevitable. The only question for me is whether it’s going to be 25 bps or 50 bps, like the Fed. Given that the fundamental background to the Canadian economy might have warranted a rate cut anyway, I think they’re likely to cut 50 bps. Will that weaken CAD or will it strengthen based on the idea that it means a faster recovery? The Fed cut 50 and USD weakened – I think CAD is likely to weaken afterward.

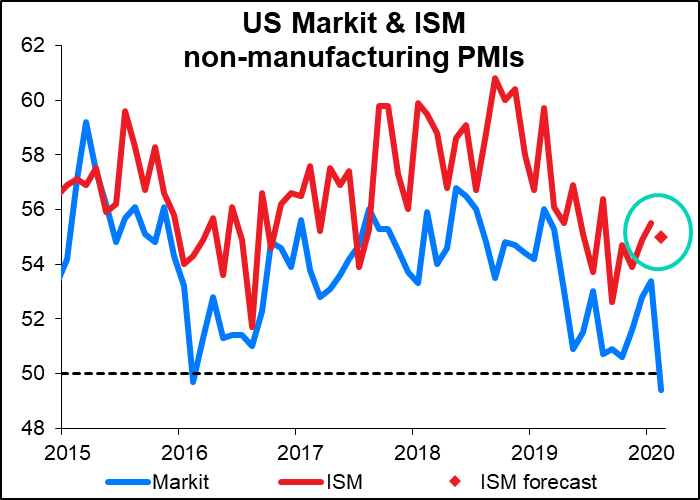

Back in the USA, the Institute of Supply Management (ISM) non-manufacturing purchasing managers’ index (PMI) is expected to be slightly lower but still solidly in expansionary territory. This is a sharp contrast to the Markit version of this indicator, which has already fallen into contractionary territory. Which is correct? That doesn’t matter. The important point is, which does the market pay more attention to? And there I’d say probably the ISM index, even though Markit makes a good case for it being the more definitive index.

The Fed releases the “Summary of Commentary on Current Economic Conditions,” aka The Beige Book (which looks green to me, at least the version you can buy in the store) as always two weeks before the next FOMC meeting. It’s significant for the market because the first paragraph of the statement following each FOMC meeting tends to mirror the tone of the Beige Book’s characterization of the economy. The book doesn’t have any number attached to it that quantifies its contents, but many research firms do calculate a “Beige Book index” by counting how many times various words appear, such as “uncertain.” In any case, the book is largely anecdotal so you’ll just have to watch the headlines as they come out.

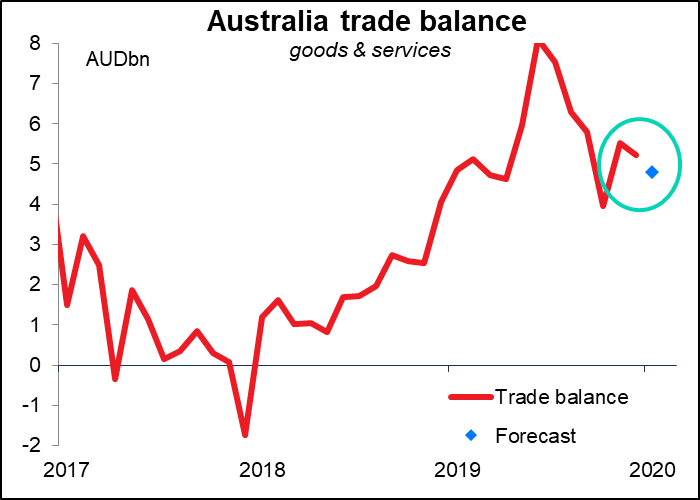

Overnight, Australia releases its trade balance for January. Trade in goods and services is expected to be down slightly but still well in surplus. While there were probably fewer tourists from China, the Australian government didn’t ban Chinese tourists entirely until 1 February, so the effect of that move won’t show up until next month. Other disruptions are likely to be minimal, surprisingly enough — New Zealand for example recorded an increase in exports of goods to China during the month on a year-on-year basis, which is kind of amazing considering that the Lunar New Year was in January this year and February last year. I think a fairly stable trade balance could be positive for AUD, except of course if people lump it together with the “pre-virus” data that’s no longer applicable to today’s world (this is beginning to sound like a movie).