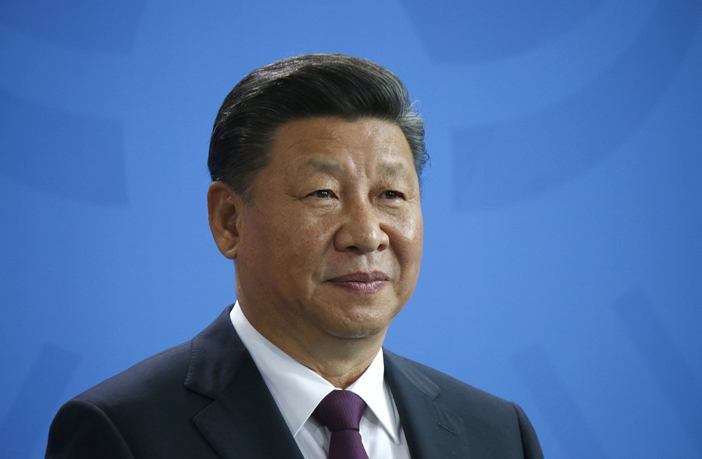

1. Stock Markets Deflate as China Lays Terms for Signing a Phase 1 Deal

Global bourses deflated on Wednesday after posting a 3-day winning streak as investors were disheartened by the latest developments on the US/China trade front. China is clearly making demands that the US must remove tariffs to have the Phase 1 deal signed which was published both by Hu Xijin and the Global times citing the former China Vice Minister of Commerce. China will reportedly also not accept a phase one deal if the US only suspends new tariffs that it has threatened to impose on Chinese goods.

2. Corporate Earnings Point to Recession?

Nearly three-fourths of companies in the S&P 500 have reported their third-quarter results so far. Given the slowing U.S. manufacturing activity contracting in recent months, corporate earnings have thus far been better than expected but are still signalling slowing growth. Overall earnings in the S&P 500 have been down in the third quarter. Based on earnings reported so far, and on estimates for those yet to report, Factset says third-quarter earnings could fall by as much as 2.7% from a year ago. Among those reporting today are Prospect Capital, Wirecard AG, Marks & Spencer, Telefonica, Hugo Boss, Adidas, BMW, Aviva, United Corporations, Expedia and Societe Generale.

3. Forex Preview: EUR & GBP in Focus

A lot of economic data out of Europe is due this morning which should be closely eyed for impact on i.e. the German Dax or the EUR currency. The USD is still supported by yesterday’s strong ISM with renewed strength and could gain some more momentum today if Europe’s data disappoints. The EUR remains at important support at around 1.1080 which if it breaks could send it down back to the 1.10 level. Meanwhile, the GBP may have disappeared from the headlines for now, but do not let the quiet time fool you as tomorrow the Bank of England Interest Rate Decision is due! Don’t miss BDSwiss free BoE webinar, I will be trading the news live and giving real-time insights as we break down this key event. Today, British Prime Minister Boris Johnson will also formally announce that a general election will be held on December 12 in the United Kingdom. He will likely pledge in his announcement to “get Brexit done in the next few weeks,” and his conference could create GBP volatility.

4. Oil Prices Subdued, Gold Steadies

Crude oil prices are still attempting to push through the 200-day MA despite a build last night, if we see another build later today on the EIA the price could get rejected once again at the present important level of $57. Elsewhere, Gold remains subdued by the recent USD strength but has steadied around $1485 creating a potentially attractive dip which could potentially reveal a decent risk/reward ratio to buy back into it.

You can find and trade CFDs on all of the above-mentioned assets on BDSwiss Forex/CFD platforms.

:

CNBC Nov 6, 2019 2:48 AM ET

Investing Nov 6, 2019 7:33 AM ET

Bloomberg Nov 6, 2019 6:45 AM ET

Reuters Nov 6, 2019 05:58 AM ET