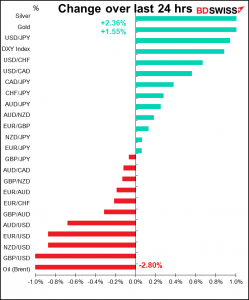

Rates as of 05:00 GMT

Market Recap

Yesterday I included a graph of the Citi inflation surprise indices and pointed out that inflation had surprised on the upside in many countries for months. I therefore thought that a rise in inflation as was expected wouldn’t have that much impact on the dollar, although it could bring forward thoughts of tightening and therefore might boost the currency.

(Citi hasn’t updated the data for yesterday’s CPI yet.)

Yes but I didn’t expect a number like what we got! The headline figure rose +0.9% mom vs +0.6% expected. It was up 6.2% yoy, the fastest pace of growth in 30 years, vs 5.9% expected. Core inflation was up 0.6% mom, 4.6% yoy (0.4%, 4.3% expected).

To say people were surprised would be an understatement. Out of the 70 economists polled by Bloomberg precisely none of them estimated it would be up 0.9% mom. In fact, none of them estimated it would be up even 0.8% mom either!. Estimates ranged from +0.4% mom to +0.7%

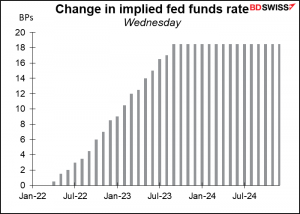

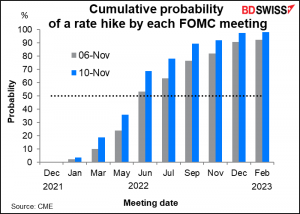

The fed funds futures priced in almost one additional rate hike by mid-2023. They are now in agreement with the rate-setting Federal Open Market Committee (FOMC) with regards to the likely level of fed funds at the end of 2024.

The probability of a rate hike by June – or even before – increased substantially as a result. The odds of a June rate hike are now 69% vs 53% last Friday. June is when the Fed is expected to end its bond-purchase program at the current pace of tapering it down and is therefore the earliest that they could start raising rates. Of course, if they accelerate the tapering process they would finish earlier and could therefore start hiking rates earlier – which may be what’s starting to get priced in as the probability of a hike by May increases.

It’s no surprise then that US equities fell (S&P 500 -0.8%) and bond prices plunged (yields soared). The 10-year Treasury rose 11.4 bps. Even more significantly, the yield on the 2-year Treasury – which is sensitive to expected changes in monetary policy – rose a sharp 9.2 bps.

The rise in yields wasn’t confined to the US – yields around the world rose on the assumption that inflation was proving to be less “transitory” than people had thought.

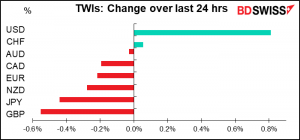

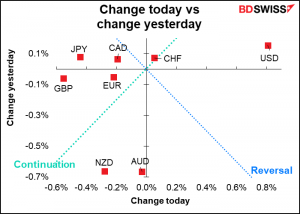

With US rates rising so much faster than other countries’ rates, USD was the main winner on the day. Note that JPY yields didn’t budge at all, which explains why JPY was a big loser on the day. GBP yields on the other hand showed the second-largest rise and yet GBP fell the most on the day. Are the Northern Ireland problems finally starting to affect the pound?

What caused the CPI to rise so much? Some of it was expected, such as prices of goods that have been affected by supply problems. Used car prices, which had fallen in the past two months, moved up again while new car prices rose 9.5% yoy, the fastest yoy pace since 1975.

What was really different this time though was the broader rise in core service prices. Core services prices rose 0.45% on the month, the largest increase since April, buoyed by further rises in housing as well as some special factors that pushed up medical care services. Key in the core services details were gains in rents and owners’ equivalent rents. This isn’t necessarily a result of any supply-chain shortages caused by the pandemic and so challenges the idea that higher inflation is just a “transitory” phenomenon caused by the reopening of the economy.

Those more persistent components came alongside further gains in categories like medical services. However some pandemic-sensitive factors were mixed: hotels rose but airfares fell further. They’re not far from the lows hit during the pandemic.

What’s particularly worrisome is that some of the factors pushing prices up in October appear poised to push them up even more in November and December. In particular, the wholesale data for used car prices point to even larger rises in November and maybe further rises in December as well. While this won’t surprise the Fed anymore – remember that Fed Chair Powell said in his press conference that “our baseline expectation is that supply bottlenecks and shortages will persist well into next year and elevated inflation as well” – it may surprise the markets again. The higher inflation is bullish USD as long as the market assumes the Fed will react to it.

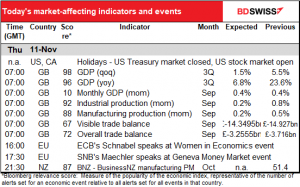

Today’s market

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

We discussed the UK short-term indicators yesterday, so no sense going through them all over again. (Here’s a link to that report.) Besides, they’re probably out by the time you’re reading this.

That’s about it for today. Not much else on the schedule! That’s because today is Veteran’s Day in the US and Remembrance Day in Canada, and Armistice Day in France, etc. In the UK Remembrance Day is on Sunday, but two minutes of silence will be observed today at 11 AM.

Speaking of Veteran’s Day, this is a photo of my late father, who was a veteran of WWII. I’m not a veteran, thanks to people like him who fought so their children wouldn’t have to. Thank you.