1. Safe Havens Rally as China Gives US Ultimatum

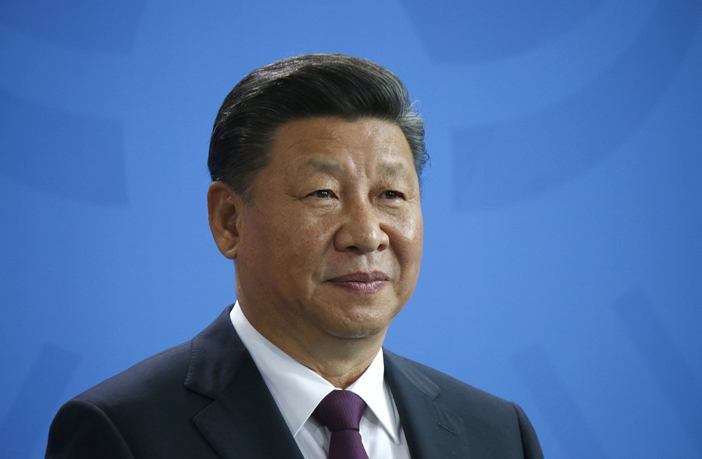

China published a white paper which makes it very clear that the US is to blame for the negative turn in the trade talks and that concluding that in order for China to return to the negotiation table the hefty tariffs on Chinese imports and the ban on Huawei need to be lifted. The paper also says Trump’s decision to raise tariffs on $200 billion of Chinese goods on May 10 was a breach of an agreement reached by Trump and President Xi Jinping. China’s move sent risk assets lower and caused safe havens to rally on Monday. Risk aversion will continue to prevail today with risk assets recording further losses on worries on the US China trade war and the latest threat by US president Donald Trump that he plans to impose a 5% tariff on all Mexican imports in the near future and specifically: until “illegal immigration finally STOPS”.*

2. Forex Preview: Yen and Swiss Franc Gain

The yen climbed to a more than four-month high against the dollar on Monday and the Swiss franc rose as trade concerns stoked demand for safe-haven assets. Meanwhile the dollar recovered a bit from its weakness last Friday and will be eyeing the ISM and Markit numbers out of the US this afternoon. The EUR is also under pressure, after the head of the German SPD Nahles stepped down and possibly even putting the ruling big coalition into jeopardy. Today’s EU PMIs came in flat and are not expected to provide much support for the common currency. Elsewhere, the GBP was able to correct a bit on USD weakness seen on Friday but still very much at risk to drop lower on no resolution in the Brexit Drama.**

3. Oil Prices Drop, Gold Breaks Above $1,300

Oil prices came massively under pressure with about 20% down from its peak this year and possibly heading further lower. On Monday morning, brent and crude dipped more than 1% this morning, extending losses of over 3% from Friday, amid stalling demand and as trade wars sparked fears of a global economic slowdown. Gold prices rose on Monday to their highest in more than two months as global concerns and a weaker dollar drove investors to seek refuge in safe-haven bullion. Gold traded above the key $1,300 mark and might be extending its climb on further safe haven demand.***

You can find and trade CFDs on all of the above mentioned assets on BDSwiss Forex/CFD platforms.

Sources:

*Bloomberg Jun 3, 2019 2:48 AM ET

**CNBC Jun 3, 2019 3:53 AM ET

***FXStreet Jun 3, 2019 03:07 AM ET