Rates as of 04:00 GMT

Market Recap

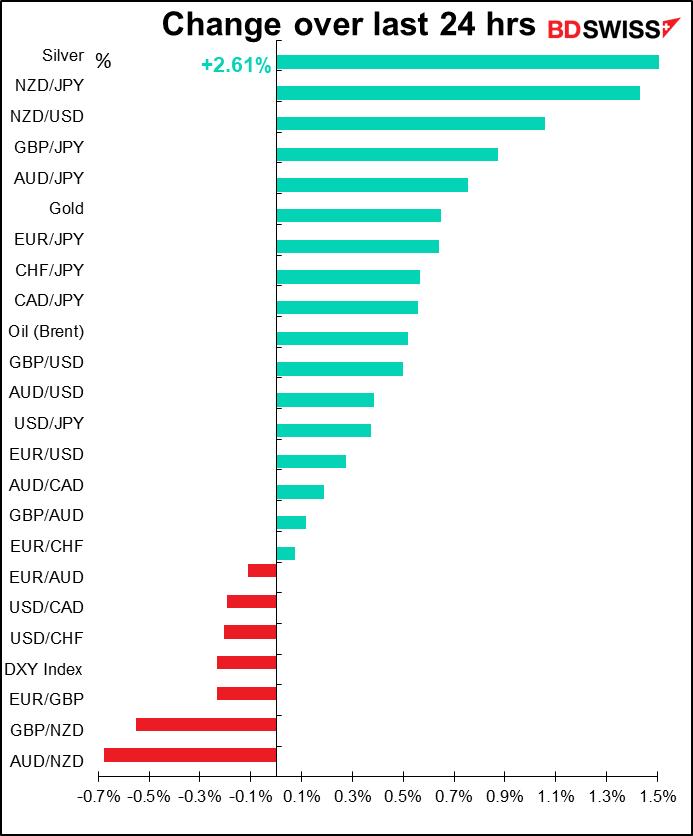

Not so fast! When I wrote this comment yesterday morning, everyone was all excited about the news of a successful test of Moderna’s Covid-19 vaccine. Moderna’s stock price jumped 20% and the company switfly announced it was raising $1.3bn by selling new shares. Then late in the day, a report on medical website STAT saying “Vaccine experts say Moderna didn’t produce data critical to assessing Covid-19 vaccine” called everything into question and US stocks closed down 1.1%. Stocks in Asia are mixed this morning, with most markets higher but China, Singapore and Jakarta lower.

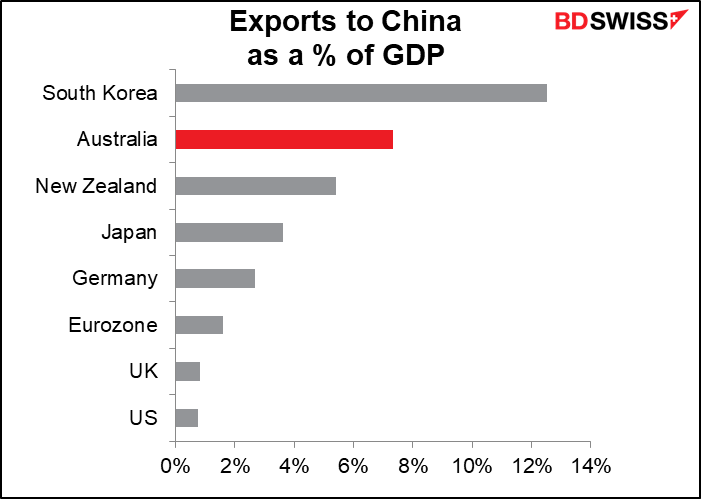

The good performance of the commodity currencies nonetheless was significant, particularly because trade tensions between China and Australia are heating up. China has already barred meat imports from four Australian slaughterhouses for “technical” reasons, and Monday announced import duties on Australian barley. There was a story on Bloomberg saying Chinese officials have drawn up a list of other goods that could be subject to various restrictions, such as stricter quality checks, anti-dumping probes, tariffs or customs delays. The trouble and strife is because of Australian calls for more investigation into the orgin of the pandemic, which of course is embarrassing to the Chinese government. (Spats like this are one reason why the renminbi isn’t a major world reserve currency: politics so quickly spills over into economics.)

Australia’s exports to China are the second-highest in the world as a percent of GDP, and that doesn’t take into account the important tourist trade or education.

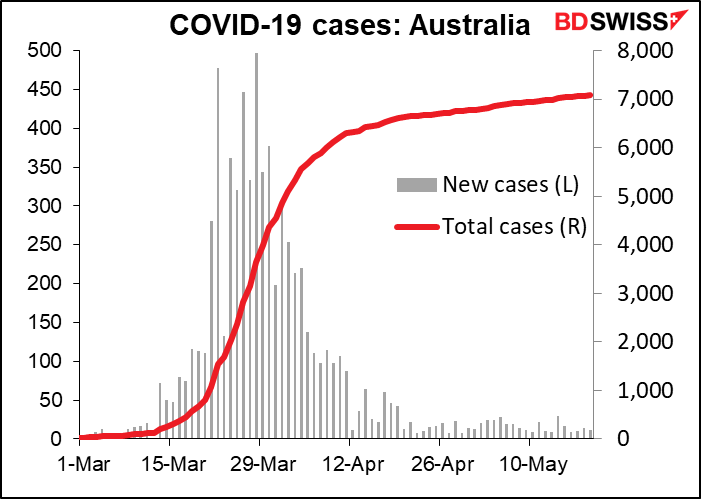

The fact that AUD can rally despite these increasing trade tensions would tend to confirm the idea floating around the market recently that “the virus this year is what trade tensions were last year.” New cases have averaged 14 a day in Australia over the last week, and have even hit single-digits twice. That’s apparently more important nowadays.

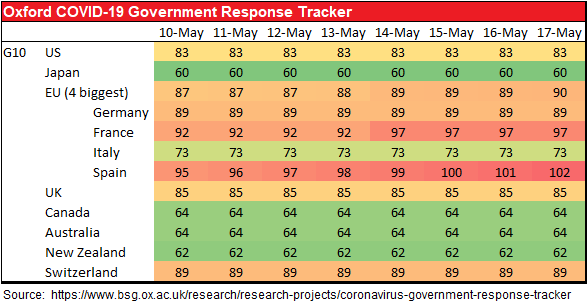

How successful countries are in emerging from lockdown is likely to be the major theme in the markets for the time being. Australia, Canada and New Zealand currently have some of the loosest policies among the G10 and therefore are likely to recover the fastest (assuming no major “second wave” of infections). That should boost their currencies.

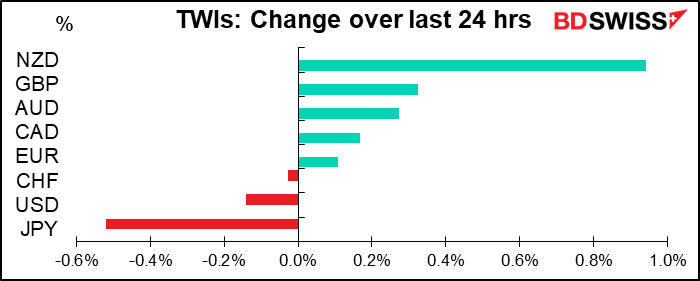

NZD has been under pressure recently after various officials expressed a willingness to consider negative rates, but Deputy Governor Geoff Bascand said the Monetary Policy Committee had made “a clear statement” that rates are on hold until early next year. “We are very conscious that our word matters, and the credibility of what we say is very important to the Reserve Bank. We are confident we won’t be moving to negative interest rates before March next year,” he said. NZD was the best-performing currency on the day, although given the difference in timing between when this statement (and others by Deputy Gov. Hawkesby) came out, it’s hard to say one caused the other – it could be just post hoc ergo propter hoc reasoning.

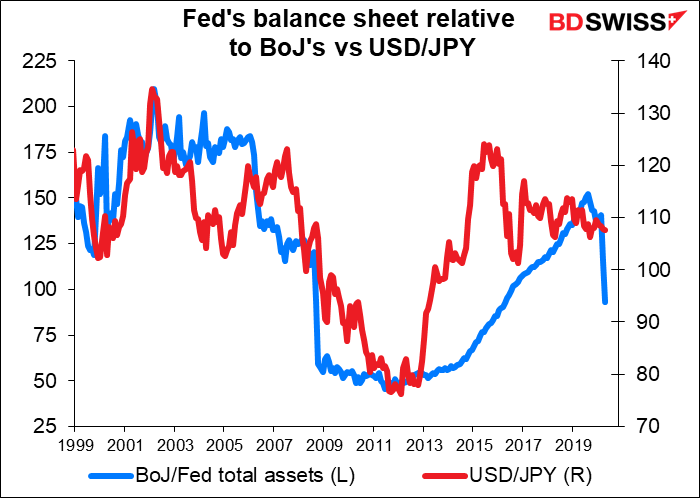

JPY was already weakening in early Asian trading yesterday and got another kick down the stairs after the Bank of Japan announced it would hold an unscheduled Monetary Policy Meeting (MPM) this Friday. The meeting will discuss new measures to provide funds to financial institutions and incentivize relending, as required under a directive that they issued at their 27 April MPM.

Personally I don’t think this move should be negative for the yen. On the contrary, by helping to support the economy, this could be seen as a positive. Small- and medium-sized companies account for about 70% of employment in Japan, so getting support to them is particularly important in helping to shore up the economy. But the market hears “expansion of BoJ balance sheet” and buys USD/JPY. It’s true that historically, the relationship between the Fed’s balance sheet and the BoJ’s has been particularly close and has had more of an impact on the two currencies than in some other cases. That relationship was thrown out of whack recently thanks to the unusual global demand for dollars that occurred recently, but traders may still be sensitive to the historical pattern.

Treasury Secretary Mnuchin and Fed Chair Powell’s virtual testimony to the Senate Banking Committee broke no new ground. They both reaffirmed their commitment to supporting the economy (what did I say yesterday about the Gittler Inversion Rule?), said more could be done to support the recovery if necessary and that Fed facilities should be up and running by month-end.

GBP rallied after UK labor market data came in better than expected – quite an unusual event nowadays. The unemployment rate actually fell to 3.9%, significantly lower than the Bank of England’s forecast of 4.6% in 1Q. The 857k rise jobless claims in April, while of course unprecedented, implies an unemployment rate somewhere around 6.5%. That suggests maybe the official forecasts for 2Q are too pessimistic — the BoE is forecasting a peak of some 9% while the OBR sees it hitting 10%.

The UK also laid out its post-Brexit tariff regime, which is expected to remove tariffs for approximately GBP 30bn of goods and will lead to 60% of trade to come into the UK tariff-free, up from 47% currently. Hope that Brexit won’t prove to be a disaster on the trade front could outweigh the debate currently swirling in the UK about negative interest rates and boost GBP.

Today’s market

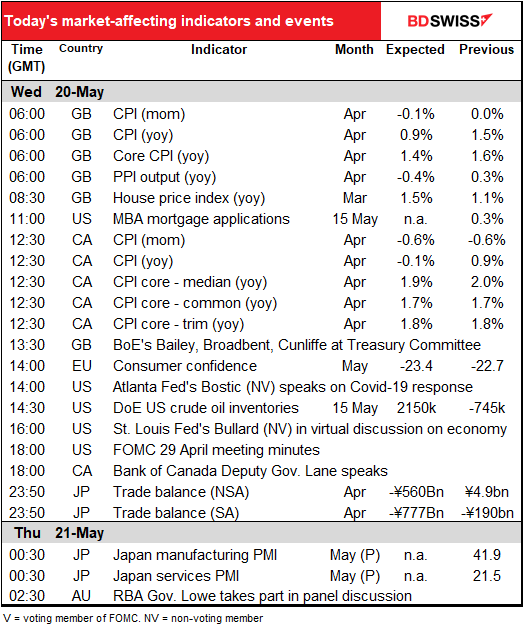

As usual, the day starts with a much-too-early UK indicator, this time UK CPI, which I’m sure is already out by the time you read this.

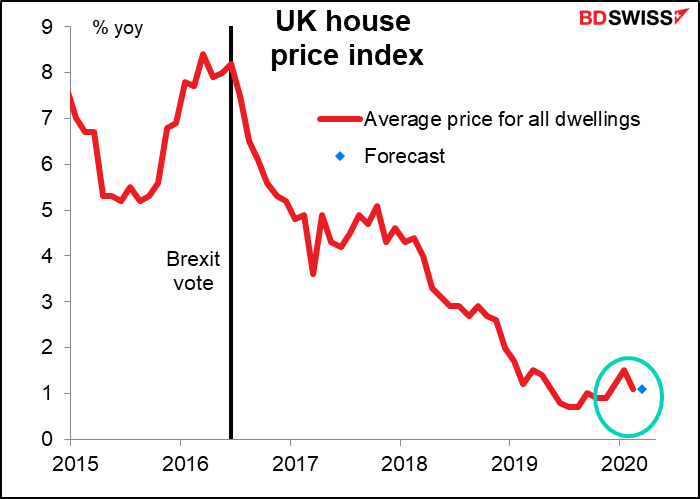

The UK has more measures of real estate prices than any other country I know, and as I remember from my time living there, house prices are a major topic of interest to everyone. The one out today, the average price for all dwellings by the UK Land Registry, isn’t particularly market-affecting since it lags well behind the others – it’s for March — but it is complete and official, so I include it just FYI.

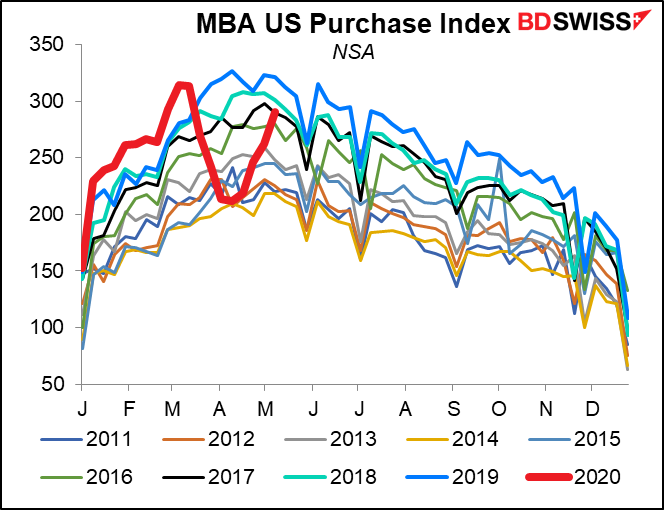

Speaking of houses, yesterday’s US housing starts for April were a disaster, falling by the most on record in percentage terms (-30%) (data back to 1959). That followed a pretty big 19% drop in March. Building permits also plunged. So all told it looks like US housing is in the doldrums. But fear not! The weekly MBA mortgage application figures show that demand is bouncing back. I don’t usually look at these numbers as they’re quite volatile on a week-by-week basis, but overall what they show is that demand for mortgages did indeed plummet in March and April but has since bounced back. There’s never any forecast for this number, which is one reason why I don’t usually cover it, but it could be market-affecting if it shows a solid rise.

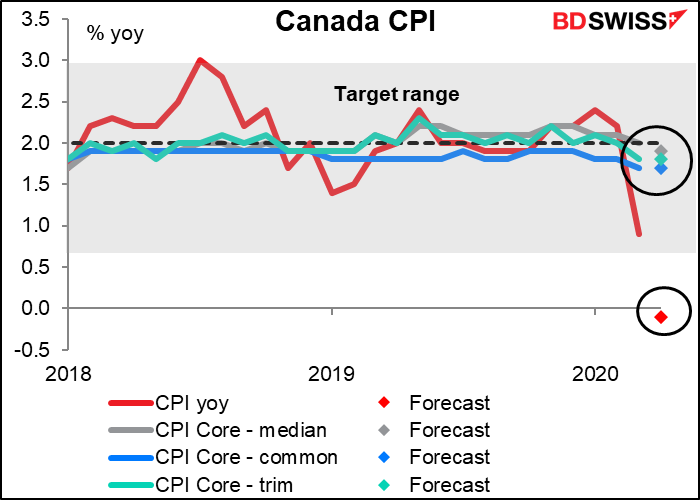

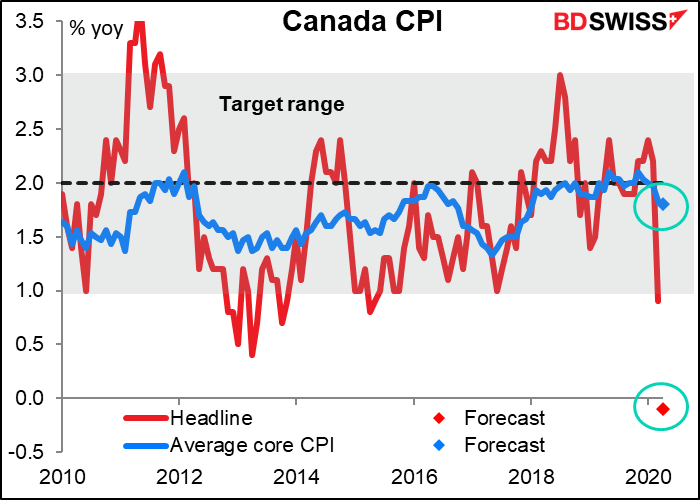

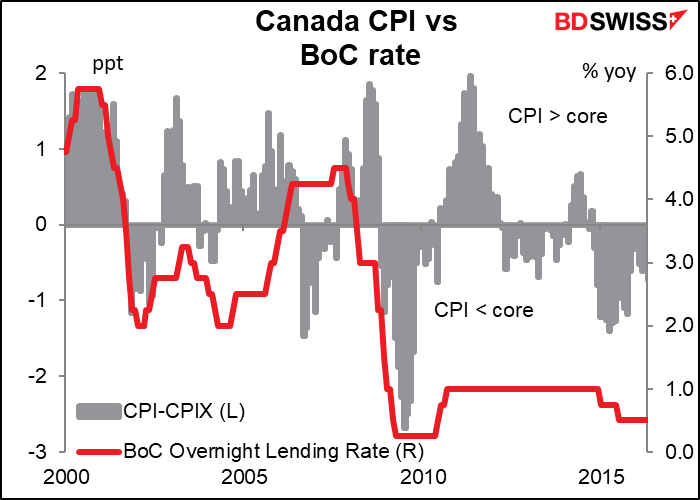

Canada’s inflation data should be interesting – the headline consumer price index (CPI) is expected to slip into deflation on a yoy basis. I’m not sure what policy implications that has – the Reserve Bank of Canada has said that it looks at the three core measures rather than the headline number, since some of the components in the CPI basket are subject to sharp and often temporary price swings that are unrelated to underlying inflationary pressures. Two of those three measures are expected to be unchanged, so from the official point of view there’s no big problem. And yet…

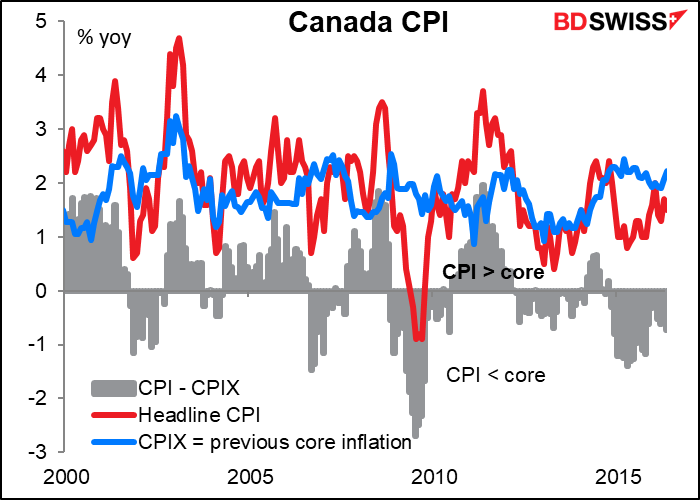

Before then, they used a core measure, CPIX, that excludes eight of the most volatile components of the CPI and the effect of indirect tax changes on the remaining components. That regime was in place from 2001 to 2016. During that time, there were also times when the headline rate was well below the core measure.

That regime was in place from 2001 to 2016. During that time, there were also times when the headline rate was well below the core measure.

As you can see, the times when the headline CPI was farthest below the core CPI were the times when the Bank of Canada’s overnight lending rate was at its lowest, so it may well have been that this may have some impact on Bank of Canada thinking.

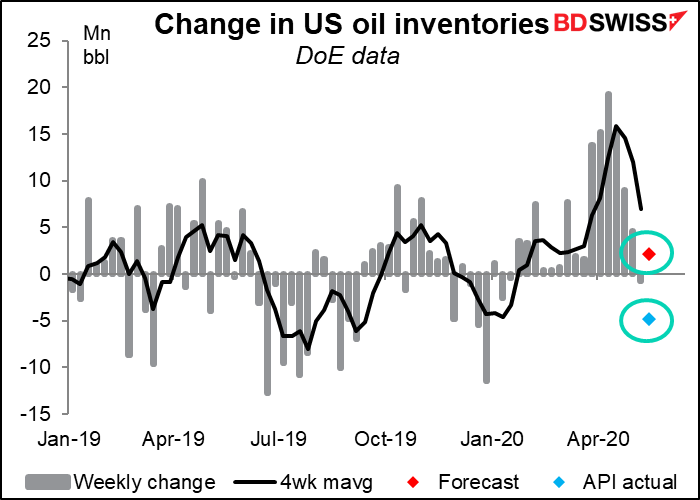

After last week’s astonishing drop in US oil inventories, market participants will want to see if lightning can strike twice – although not around the oil tanks, please. Yesterday’s data from the American Petroleum Institute (API) showed a large drawdown of 4.8mn bbls, in contrast to the market’s expectations for a 2.15mn bbl increase in the DoE figures. Last week, the API reported a 7.58mn increase while the DoE reported a 745k decline. While there are variations in the two on a week-to-week basis, over time the differences tend to even out, so it would make sense that the API this week starts to see the decline that the DoE showed last week.

One positive for oil demand is that as the world emerges from lockdown, people will be less keen on taking public transportation than they were before and more willing to drive, if possible, so as to avoid being in a closed area with other people. So in some areas, gasoline demand could exceed what it was previously (although where all those extra cars will park is another question).

We’ve heard so much from Chair Powell and other FOMC members recently that the minutes of the 29 April FOMC meeting are not likely to add much to our understanding of policy, although they may help us to understand the range of opinions on the Committee..