Rates as of 04:00 GMT

Market Recap

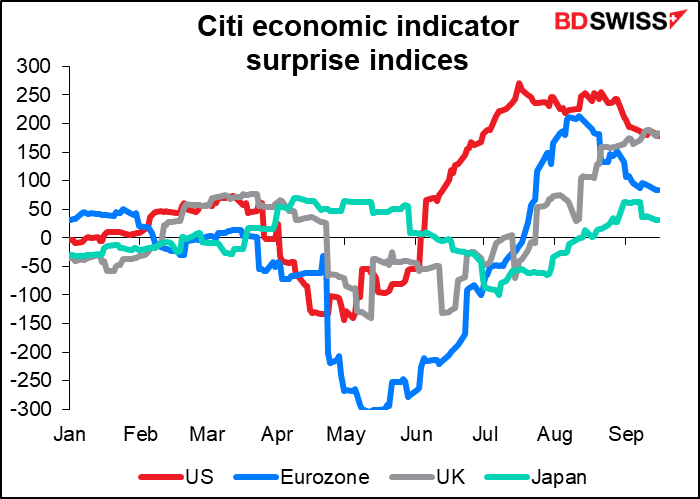

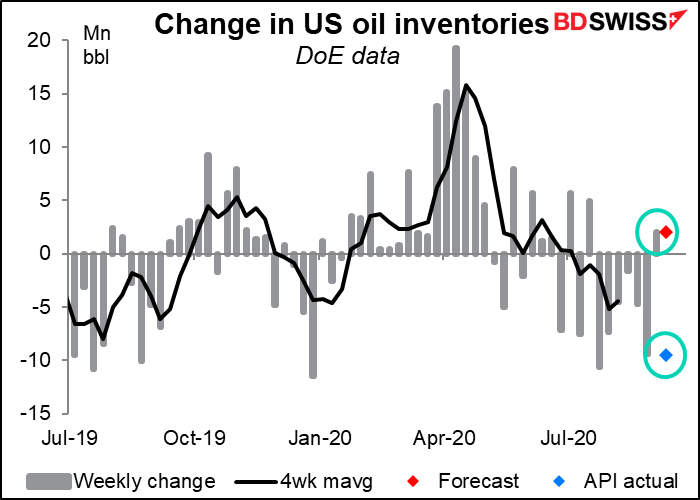

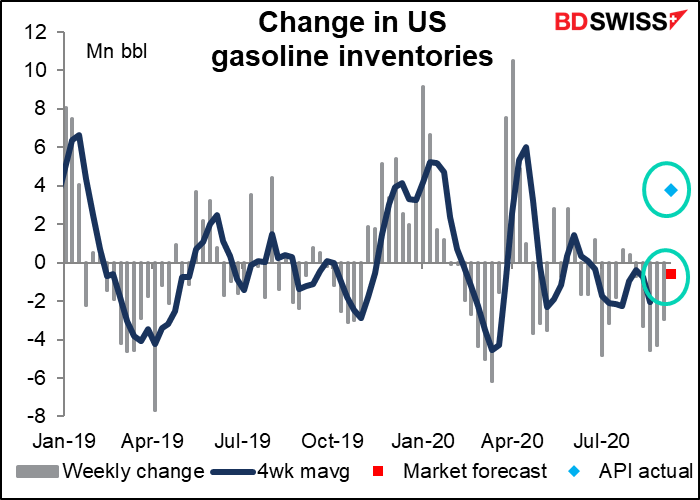

It’s all good! Good news on the global economy followed the sun around the world yesterday as one economic indicator after another beat expectations, keeping risk sentiment rising. First China’s retail sales and industrial production exceeded expectations – with retail sales now +0.5% yoy, the first yoy rise since the pandemic began, and industrial production +5.6% yoy, the Chinese economy has effectively recovered from the virus. Then UK employment fell by less than expected (-12k vs -118k expected). Then the ZEW survey of economists & analysts expectations index jumped to 77.4 from 71.5, instead of falling to 69.5 as expected. It’s only been above 77.4 twice: in 1997 and 2000 (data back to 1991).The Empire State manufacturing index beat expectations too, rising sharply to 17.0 from 3.7 (6.9 expected) (although US industrial production missed expectations, rising only 0.4% mom instead of +1.0% expected). And finally, the American Petroleum Institute (API) announced a steep fall in oil inventories in the latest week instead of the modest rise that was expected (see below).

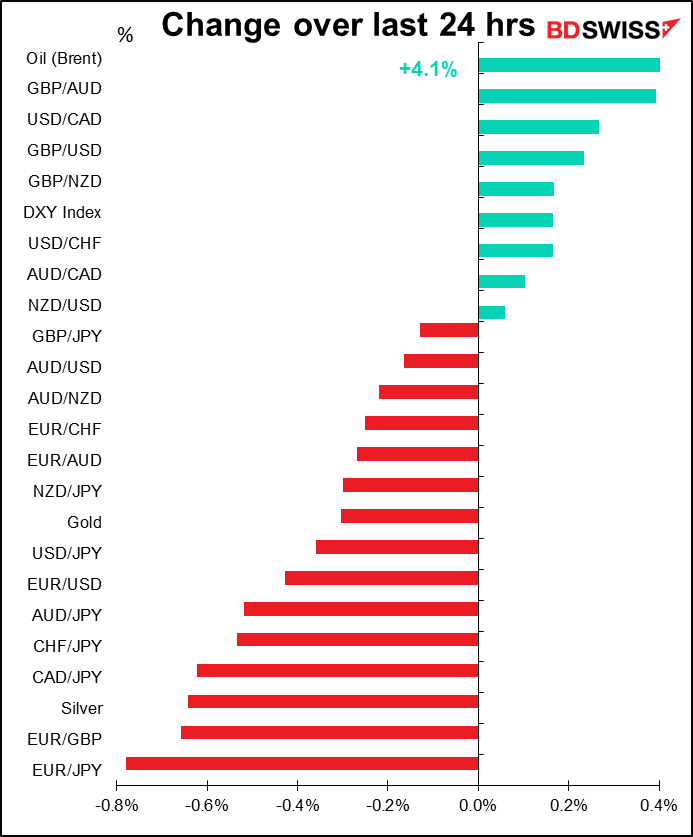

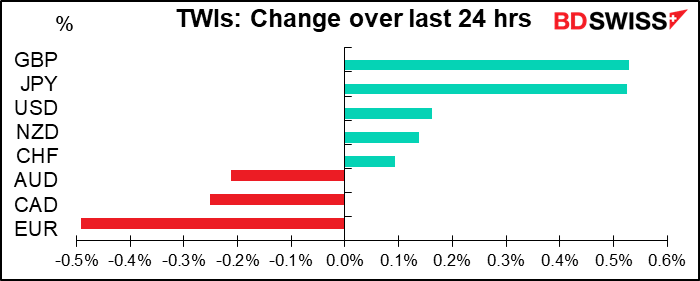

The strange thing though is that the risk-on mood didn’t have the usual impact on the FX market. USD and JPY rose, while two of the three commodity currencies fell — CAD was lower despite a 4% rise in oil prices and the US Trade Representative’s decision not to impose tariffs on Canadian aluminum. This makes me think that there’s a good chance for a rebound in CAD today.

And why was JPY the second-best-performing currency on a “risk-on” day? I wonder if JPY is starting to be used as a surrogate for CNY, instead of the usual CNY substitute, AUD. The People’s Bank of China (PBOC) set the daily reference rate for USD/CNY 0.58% stronger today. The PBOC has been allowing CNY to appreciate; it’s up 4.3% since the end of June, the biggest quarterly gain ever (data back to 1981). So far, the historical correlation is much much better between AUD/USD and USD/CNH (a strong -0.52) than USD/JPY and USD/CNH (a barely significant -0.016). But this could change, at least temporarily, if the recovery in China starts to have more impact on the recovery in Japan.

EUR was the worst-performing currency. EUR’s poor performance may have been in part due to comments by ECB Executive Board member Fabio Panetta, who said “In light of the current outlook for inflation, we need to remain vigilant and carefully assess incoming information, including exchange rate developments.”

“Vigilant” is a code word among ECB Board members. It last appeared in the Introductory Statement to the ECB press conference in December 2014, when then-ECB President Draghi said “We will be particularly vigilant as regards the broader impact of recent oil price developments on medium-term inflation trends in the euro area.” The ECB subsequently launched the Public Sector Purchase Programme (PSPP), a further quantitative easing measure, the next month. In the other direction, then-President Trichet used the word in March 2011 (“Strong vigilance is warranted with a view to containing upside risks to price stability”) and the ECB hiked rates 25 bps the next month. He used it again in June (“On balance, risks to the outlook for price stability are on the upside. Accordingly, strong vigilance is warranted.”) and they hiked another 25 bps the following month. Ever since, when ECB members get “vigilant,” the market does too.

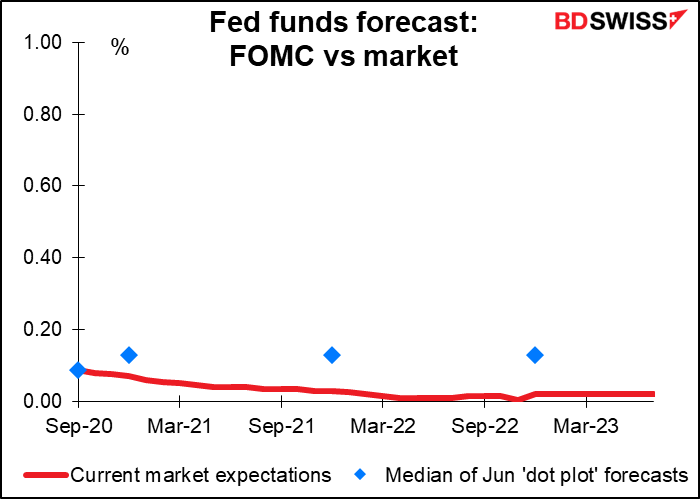

However, Panetta spoke early in the European day and EUR traded higher during most of European trading, in line with higher stock markets, so the speech clearly wasn’t the immediate trigger. Rather, it seems that as the US trading day got underway, attention started to focus on today’s Federal Open Market Committee (FOMC) meeting. This is confusing to me though, as I expect the results of the meeting to be negative for the dollar, if anything – I think the “dot plot” rate forecasts are likely to show that Committee members expect policy to remain unchanged in 2023, which should in theory be negative for USD.

Oil rose sharply on the better-than-expected economic news, followed by a report by the API that oil inventories fell 9.5mn barrels in the latest week, vs expectations for a 2.1mn bbl rise.

GBP was the best-performing currency, partly in reaction to its recent sudden decline and partly thanks to push-back from Conservative Party members to the Internal Markets bill – two voted against the bill and 30 abstained. More opposition is expected at the next reading, with a group said to be insisting on a “Parliamentary lock” on the government’s ability to exercise the powers in the bill to contradict the terms of the Withdrawal Agreement. Any compromise worked out that makes the UK legislation acceptable to the EU would be a big positive for GB.

In Japan, Liberal Democratic Party (LDP) leader Yoshihide Suga was elected Prime Minister, to the surprise of absolutely no one. His term as LDP leader and hence PM will run until September 2021 as he’s serving out the remainder of former PM Abe’s term, but he’s widely expected to call a general election soon to capitalize on his popularity. The next Lower House election has to be held by October 2021.

It’s been reported that Suga will keep Finance Minister Taro Aso in his current position. This emphasizes the “continuity” theme as Aso would probably continue the same kind of relationship with the BoJ that exists now (in Japan, representatives of the Ministry of Finance attend BoJ Monetary Policy Board meetings, although they don’t vote). I expect to hear similar comments from Bank of Japan Gov. Kuroda tomorrow. In other words, the change in PM shouldn’t change anything for the FX market, at least not initially. We’ll have to see how he manages the government’s relationship with the BoJ.

Today’s market

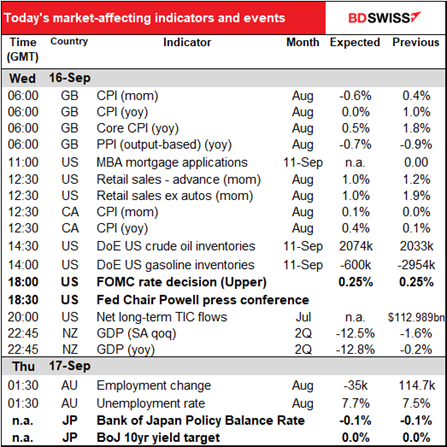

Two central bank meetings and some significant data! A lot on the schedule today.

Let’s discuss the central bank meetings first, then go through the data releases.

FOMC:

I set out my views on the FOMC meeting in great detail in the weekly, “We know the theory, lets’ see the action.” That pretty much sums it up. After the Committee finished its review of monetary policy and revised its Statement on Longer-Run Goals and Monetary Policy Strategy, people are going to say, “ok, now we know what your new policy is in theory, how does it work out in practice?” The problem is, the changes involved shifting to a flexible average inflation target and an emphasis on achieving “broad-based” labor market gains, rather than keeping the labor market from pushing inflation up. These changes affect how the Fed will react to rising inflation. Until there are some signs that the pandemic crisis is over and they can start normalizing rates, there’s not likely to be much difference. So for all the fuss and excitement, there might not be much change at this meeting. They could tinker with the wording of their forward guidance and asset purchases, but various Committee members have indicated that they’re in no rush to make any changes.

One change that will occur: the Summary of Economic Projections (SEP) will be extended to cover 2023, including the closely watched “dot plot” of FOMC members’ forecasts for the fed funds rate. It’s likely that the members will forecast rates to be on hold in 2023 as well. That could be the trigger for a “risk-on” mood and perhaps some weakness in the dollar.

One topic crying out for some change: Fed Chair Powell has characterized the purpose of Fed’s enormous asset purchases as “stabilizing markets,” but markets seem pretty stable to most observers. Asked about this seeming contradiction at the last press conference, he observed, “we understand, accept and are fine with the fact that those purchases are also fostering a more accommodative stance of monetary policy which would tend to support macroeconomic outcomes. So it’s doing both.” They could change their explanation for these purchases accordingly. However that wouldn’t be any change in substance, just a formal admission of what they’ve admitted already.

Powell also noted that “The programs are not structured exactly like the QE programs were in the aftermath of the last financial crisis. Those were more focused on buying longer run securities. The current purchases are all across the maturity spectrum.” A change in the maturity of their purchases would be a change of substance, but I don’t expect that yet.

Bank of Japan:

I also went through the outlook for the BoJ meeting in detail in the weekly. No change is likely. They might upgrade their outlook for the economy a bit in line with some of the high-frequency data. At the press conference, BoJ Gov. Kuroda is likely to stress that monetary policy is the purview of the BoJ and won’t necessarily change because a new PM comes into office. At the same time, I would expect him to reaffirm the BoJ’s January 2013 pact to “strengthen their policy coordination” with the government to overcome deflation and “achieve sustainable economic growth.” I wouldn’t expect much impact if any on the exchange rate.

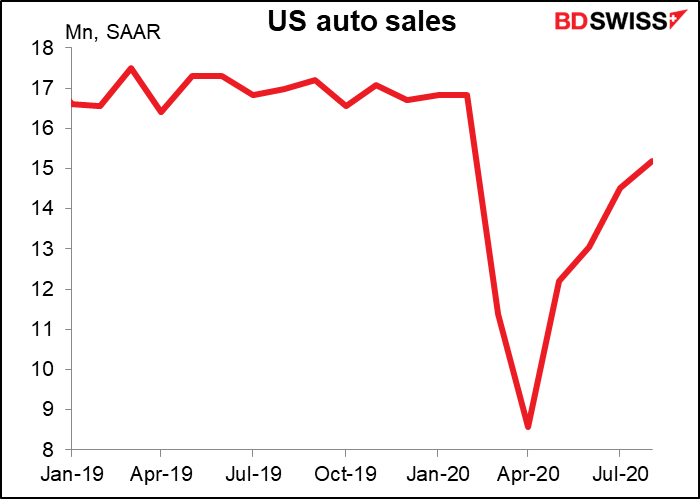

Today’s indicators

US retail sales are always a big one. Sales are expected to rise further, to be some 2.4% above the pre-pandemic level. Pent-up demand for autos is one of the factors boosting sales. People can’t make up for coffee that they didn’t drink in March or April, but someone who wanted to buy a car back then can buy one now. Furthermore, a lot of people have decided to drive instead of taking public transport (a worldwide reaction to the virus).

The surge in auto sales has slowed, presumably as that pent-up demand was satisfied. Retail sales growth may be more sluggish in the future as a result.

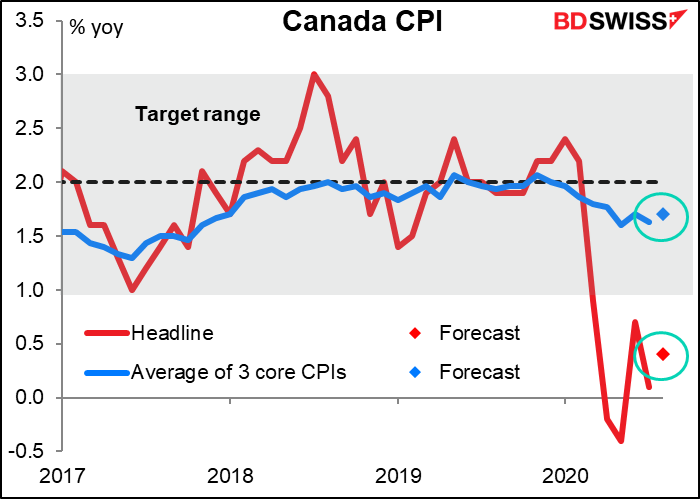

Canada releases its many consumer price indices. Although the Bank of Canada says that they use the three core measures of prices – common, trim and median – no one in the market pays any attention to them, as far as I can discern from the Bloomberg rankings. Instead, most people watch the mom and yoy rate of change of the headline, especially the yoy. So instead of showing you all three core measures I’ve just averaged them together. By design they don’t change that much.

This month the headline rate, which has been flirting with deflation, is expected to rise, in part because of base effects from energy (which isn’t down as much from the same month a year earlier). New home prices are also going up. Regardless, the headline figure is still well outside of the Bank of Canada’s comfort zone.

I’m not sure it matters, though. In its statement last week, the BoC said, “CPI inflation is close to zero…and is expected to remain well below target in the near term. Measures of core inflation are between 1.3 percent and 1.9 percent, reflecting the large degree of economic slack, with the core measure most influenced by services prices showing the weakest growth.” No change from their assumptions so no particular need for the Bank to change policy – not that it would, anyway.

As mentioned above, the API data showed a big drop in crude oil inventories vs market expectations of a small increase. It’s the opposite for gasoline inventories – there, the API announced a 3.8mn bbl increase vs market expectations for a 600k bbl decrease.

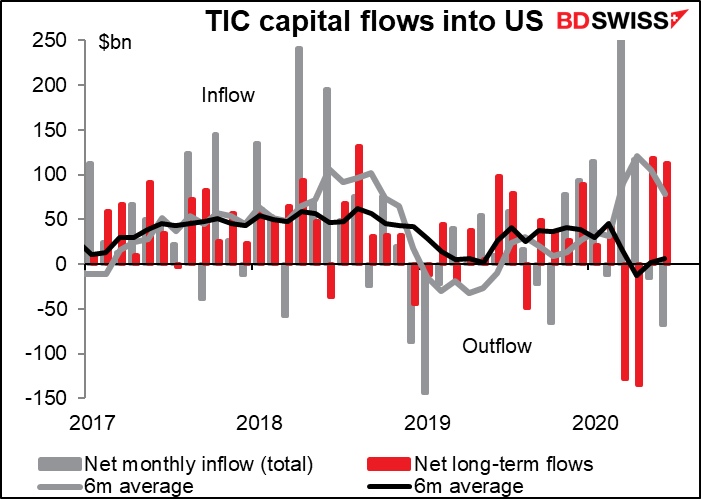

There are no forecasts for the Treasury International Capital (TIC) flows data detailing the flow of money in and out of the US. Over the last six months there’s been a lot coming in (grey line), but that’s mostly “hot” money going into short-term investments; the long-term flows (black line) have been around zero net.

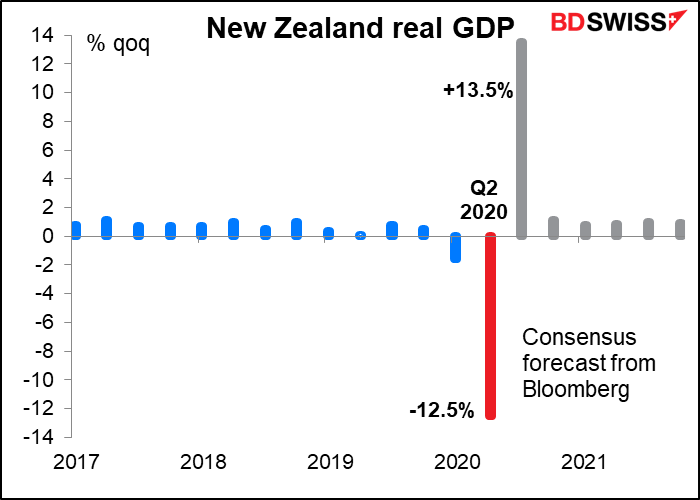

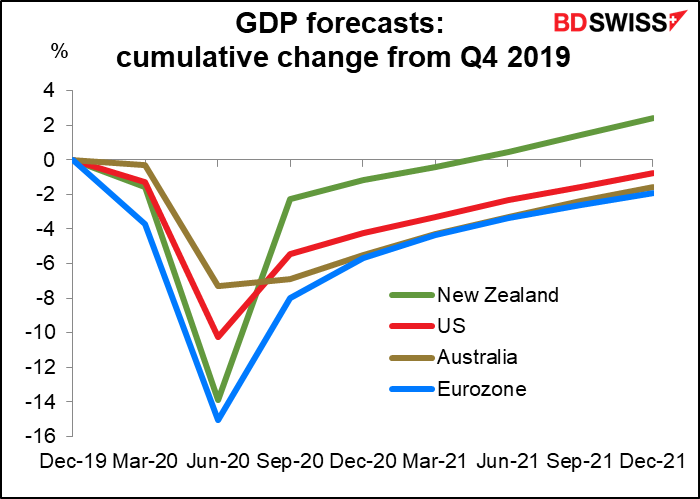

Then it’s time for New Zealand to release its Q2 GDP figures, one of the last countries to do so. I seem to remember making rude jokes about this previously so I’ll refrain from doing it this time. Q2 is expected to be appalling, of course, but what distinguishes New Zealand is that Q3 is expected to be an almost total rebound. If something falls 12.5% and then rises 13.5%, it winds up only 0.7% below where it started.

That would put New Zealand in a better position to recover to its pre-pandemic output level far earlier than most other countries, despite the steep Q2 decline.

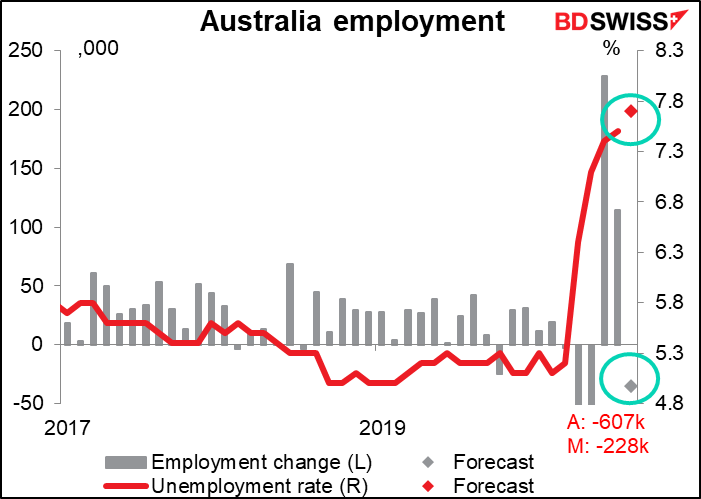

Australia’s August employment data is expected to show a small drop in employment after the sharp rises in June and July as activity recovered (which were in any case nowhere near enough to offset the plunge in April and May, which I truncated on the graph so you could see the rest of the data). Unsurprisingly the unemployment rate is expected to rise as well.