Rates as of 05:30 GMT

Market Recap

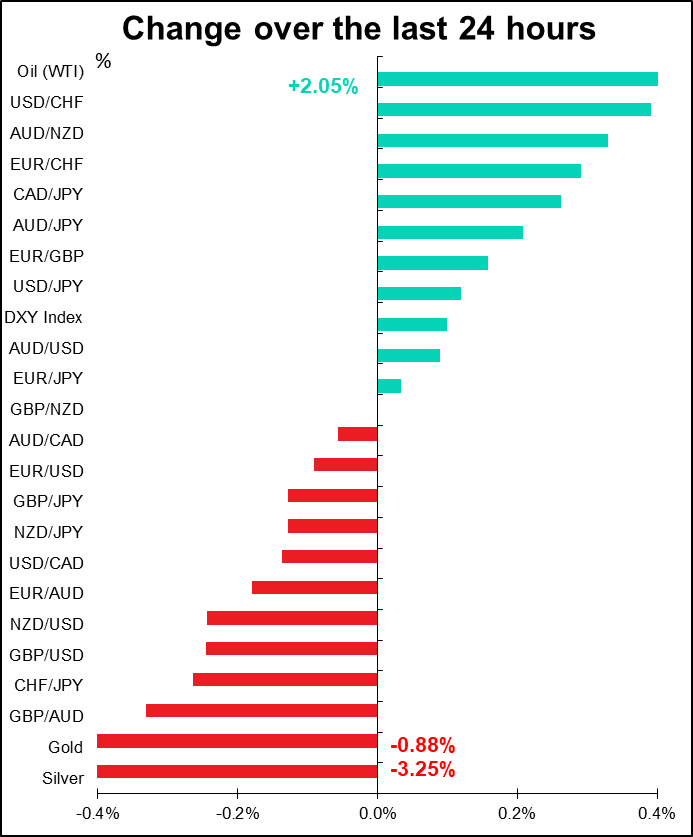

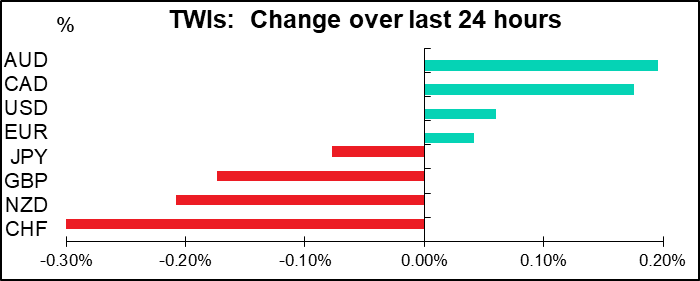

A big – but inexplicable – switch from “risk off” to “risk on.” US stocks up, oil up, gold & silver down, down, down. AUD and CAD up, CHF and JPY down. What I can’t understand is why this happened as news spills out about how much worse the coronavirus is. Headlines this morning on Bloomberg read, “China Death Toll Climbs to 132 as Cases Soar;” “UAE Confirms First Cases of New Chinese virus in Mideast”; “Toyota says halting all China production until Feb 9”, etc. There was a glimmer of good news – Australian scientists have managed to create a lab-grown version of the virus, which will help them to create a vaccine, but it seems a bit early to be breaking out the champaigne based on that alone.

On the contrary, it’s looking pretty bad to me. The number of coronavirus cases in China has now surpassed the total official number of infections during the SARS crisis. That’s pretty dismal, considering that a) the SARS crisis lasted several months, while this one has just begun, and b) each person infected is passing coronavirus to two or three other people on average, according to Reuters. Caixin quoted a prominent Chinese virologist as saying the number of infections could be 10x that of SARS. When you consider that China now accounts for some 16% of world GDP, vs 4% back in 2003, you can see how much worse this incident may be. Of course there’s one other difference: China now has experience dealing with these problems. Its response has therefore been faster and more thorough than it was in 2003. However, given how quickly we got to this point, I think it’s too late to be confident about the success of the government’s efforts. I think this morning’s “risk on” mood is not likely to last for long. I expect it to reverse, perhaps violently.

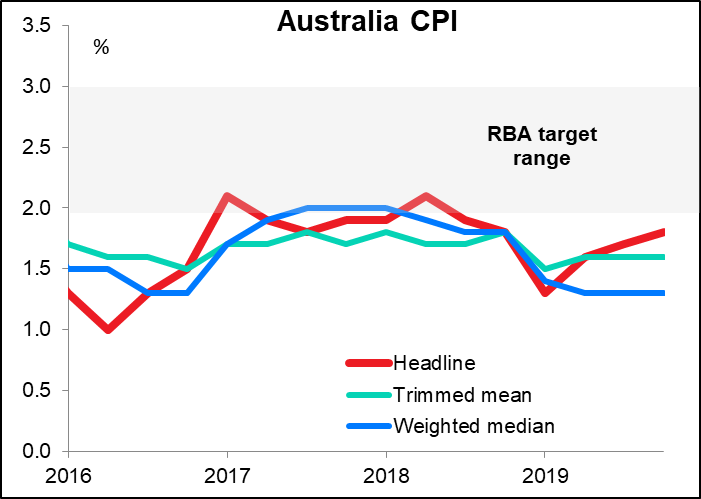

AUD was helped by a slightly higher-than-expected Q4 CPI print (+1.8% yoy vs +1.7% expected, +1.7% previous; core figures also higher than expected). Inflation remains below target so this does not eliminate the chance of a rate cut, but it lessens the need for one any time soon. The odds of a cut at next week’s Reserve Bank of Australia meeting were already zero, but the odds of one by the April meeting fell to 15% from 22%.

The Australia news explains why NZD was down, alone among the commodity currencies. Investors who wanted to buy AUD did so vs NZD, pushing NZD down. NZD may have also gotten a small kick down the stairs when Reserve Bank of New Zealand Assistant Governor Hawkesby said a weaker currency was helping to insulate the nation’s economy.

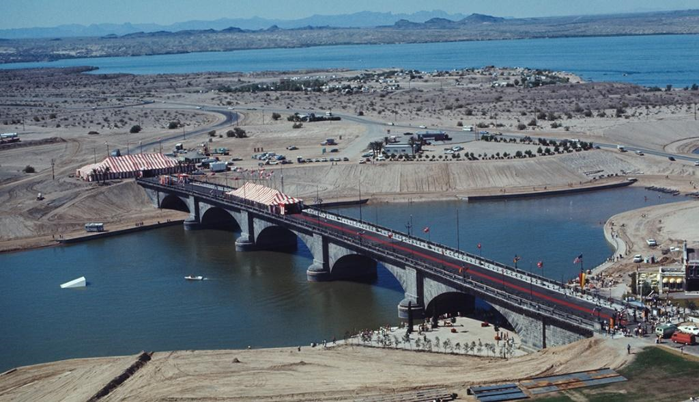

GBP is not necessarily in the “risk on, risk off” firing line. Cable’s correlation with AUD/JPY, the main risk barometer in the FX market, is a low 25%. Rather, it’s mostly moving on domestic UK economics (like tomorrow’s Bank of England meeting) and of course Brexit news. With regards to the latter, I’d like to call your attention to a recent story that said Trump is threatening a damaging new trade war with the United Kingdom after Brexit. To me, this report calls into question the whole logic of Brexit, if indeed there were any to begin with. The idea was that freed from the shackles of EU membership, Britain could forge new and better trading arrangements with its trading partners. Hah! If you believe that, then I have a bridge to sell you… (FYI this is London Bridge, which a US developer actually bought & shipped to Arizona many years ago.)

The problems that Britain will face working out new trade arrangements with almost every country on earth is a major reason why I’m structurally bearish on GBP.

Today’s market

The big event today is obviously the meeting of the US Federal Reserve’s rate-setting Federal Open Market Committee (FOMC).

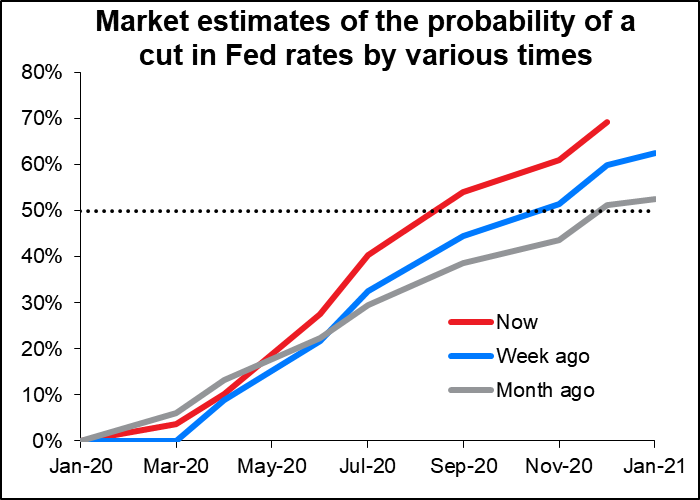

No one thinks the FOMC is going to decide to cut rates at this meeting. In fact, there’s a slightly higher risk priced in of them hiking rates, although that too is minor (12% vs 0%). But what is clear is that the market has gradually been raising the odds of a rate cut this year and bringing it forward. A month ago, there was only a 51% chance of a cut this year; now the market sees a 54% chance of a cut by September.

Personally, I don’t expect any major change in their stance or view at this meeting. Before they entered the blackout period – the two-week period before an FOMC meeting when Fed officials are forbidden from talking about monetary policy – the Committee members largely continued with the same consistent story that they’ve been putting forth for some time. They stuck to their view that policy is right where it should be and that any move in rates, up or down, would require a “material reassessment” of the economic outlook.

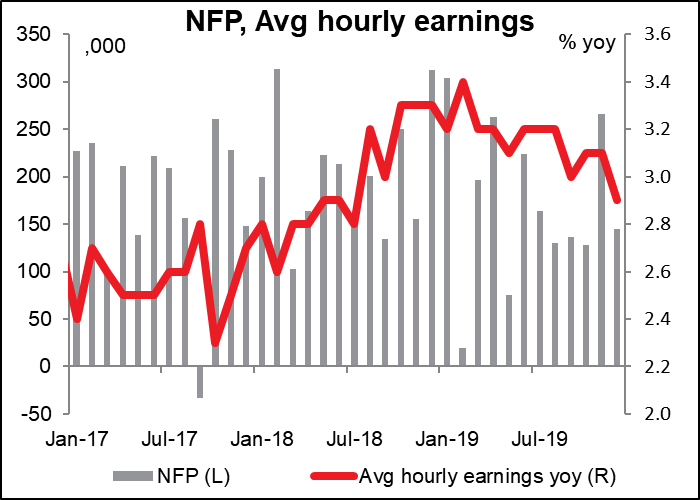

What information have we had since the 11 December FOMC meeting that might cause such a reassessment? With regards to the labor market, we had a modest nonfarm payroll figure, with the US adding only 145k jobs December, while average hourly earnings growth slowed and the number of job openings in the JOLTS report plunged. So the labor market side is still healthy, but starting to show some signs of weakening.

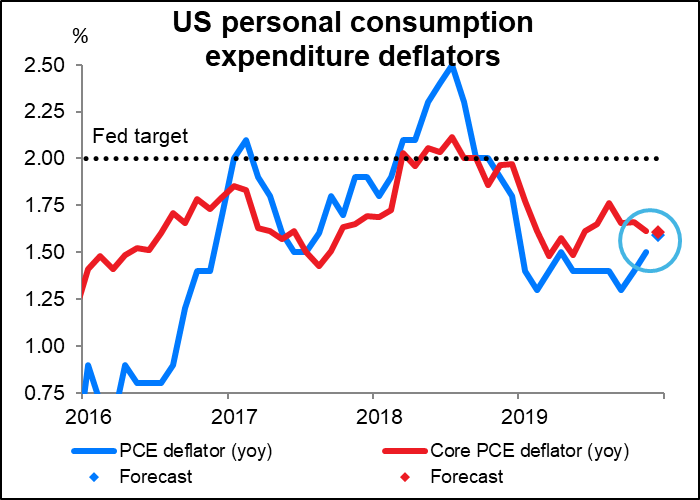

The inflation side also is presenting some problems. The Fed’s favorite inflation gauge is the core personal consumption expenditure (PCE) deflator. That’s actually been trending down recently. Core PCE is forecast to end the year at +1.6% yoy, significantly below the Fed’s target, which is kind of surprising given that the unemployment rate is at a 50-year low and tariffs were imposed on a wide variety of goods. (The December figure will be released on Friday.)

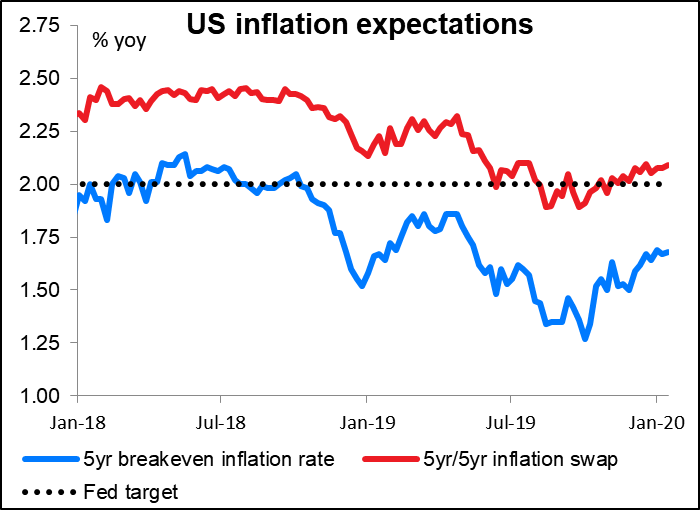

Inflation expectations though are stable (5yr/5yr inflation swap) or trending upwards (5yr breakeven inflation rate), depending on which measure you use to value them. So the Fed probably isn’t worried (yet) that inflation expectations might become disanchored.

In other words, while there are some signs of potential problems on both parts of the Fed’s dual mandate, there’s nothing that would require a “material reassessment” of the economy. I don’t think the annual rotation of regional Fed presidents voting on the Committee will cause any major change in their stance. I think for the market to put a 50-50 probability on a rate cut by September is defensible, although a bit pessimistic. I expect the Committee to stick to their current view and I think the market will, too. USD neutral

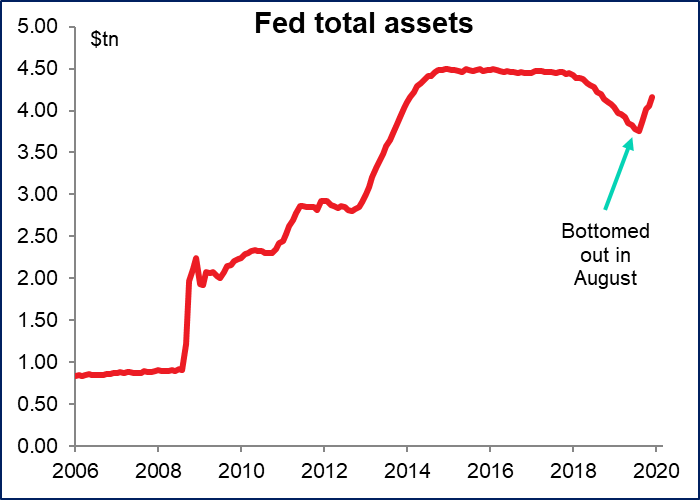

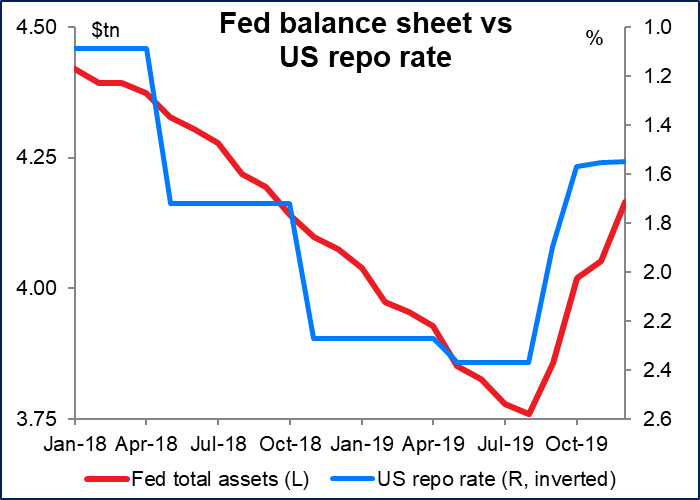

With the Fed on hold and the statement likely to be little changed, the focus will be on the press conference afterward. I expect Powell will simply reiterate his usual mantra, that policy is “well positioned,” the risks have diminished but are still tilted to the downside, and there’s no need for any adjustment in policy except barring the dreaded “material reassessment.” In that case, the questioning is likely to center around their balance sheet and the recent emergency measures they’ve been implementing to relieve the pressure in the repo market. Have they launched a stealth QE? I’d expect reporters to press this issue but for Chair Powell to deny it up and down. Also the persistently low inflation and how it might affect the review of their monetary policy framework. That’s still in the early stages though so I don’t expect Powell will have much concrete to say about it.

There might be some technical adjustment to the interest rate paid on excess reserves, but this would have no market implications.

Ahead of the FOMC meeting, the two US indicators coming out during the day are likely to be given only cursory attention.

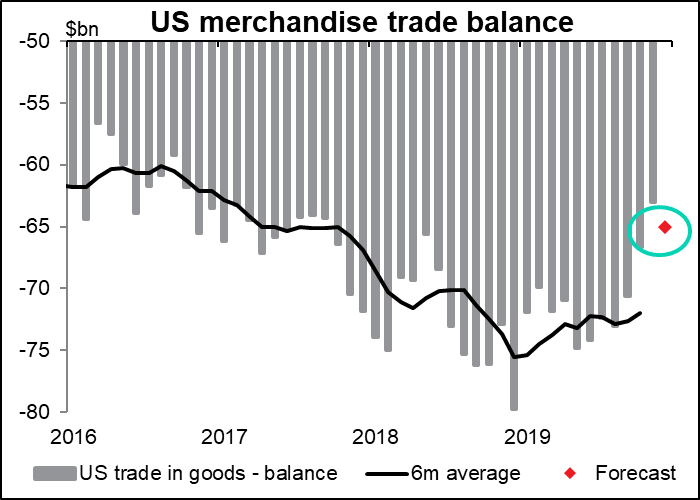

The US merchandise trade deficit is forecast to widen slightly. I’m not sure anyone is going to care about it as long as it remains within the recent range.

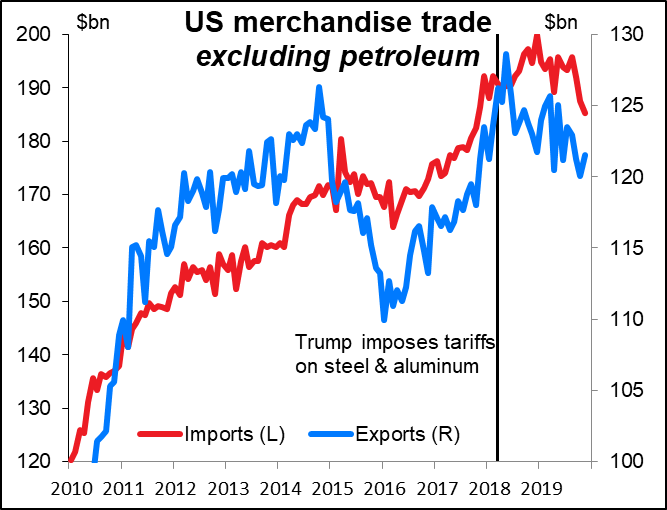

You might think that the recent narrowing of the deficit was a victory for the Trump regime, which has made cutting the deficit one of their major goals. Hah! Fat chance! If you look at the underlying figures, you’ll see that US exports (excluding petroleum) have actually been declining since peaking in May 2018. The main reason for the improvement in the trade balance is the collapse in imports. As you can see, the fall in both imports & exports came shortly after the decision by our favorite Very Stable Genius to impose tariffs on steel & aluminum. Am I criticising him? Heaven forbid! I report, you decide.

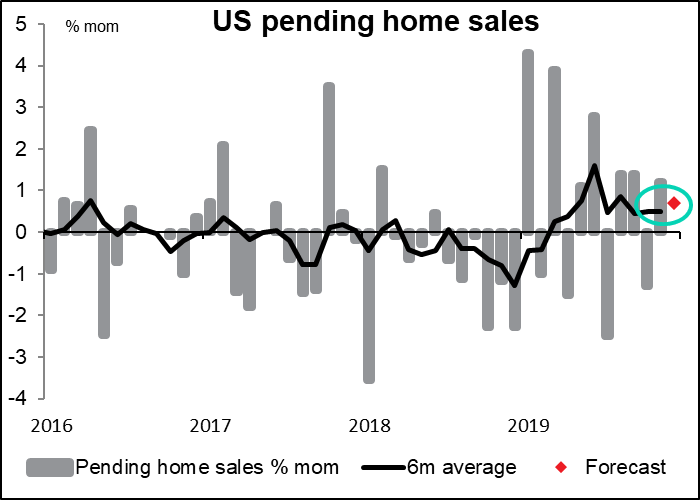

Then we get to US pending home sales. Frankly by this time I’m pretty bored with US housing figures. Other countries have dozens of different CPI definitions. Only the US has new home sales, existing home sales, and pending home sales, not to mention building permits. Why don’t they have cancelled home sales? Rejected home sales? I put a bid in on a house in Canada once, but the buyers rejected it – I suspect they didn’t like my wife, who’s Japanese. I would’ve made a bundle on it – USD/CAD was around 1.50 then, not to mention appreciation of the house itself and rental income. Anyway by the time pending home sales come around, I’ve had enough home sales for the month, generally. This month it’s expected to be right in line with the trend, so no big deal. Snore. USD neutral.

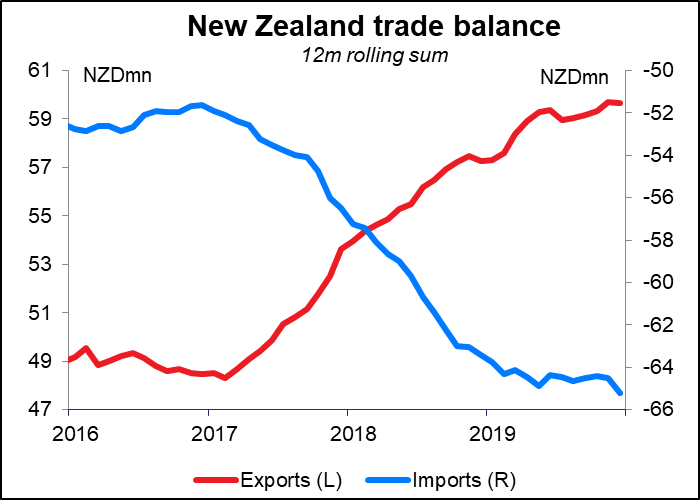

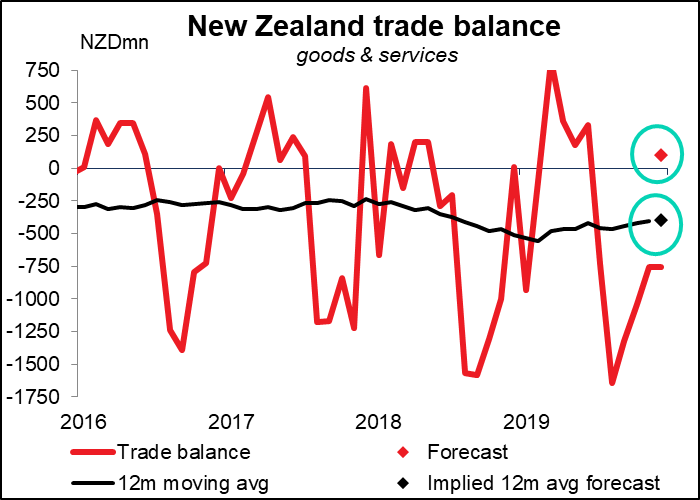

OK now we get to the New Zealand trade figures. This is more interesting. The deficit is forecast to suddenly flip into a surplus. Stunning! Great! But remember that the data aren’t seasonally adjusted. If we look at the 12-month moving average that this implies, it’s just a continued gentle narrowing of the trade deficit. NZD neutral.

In fact if we look at exports vs imports on a 12m rolling sum basis, exports (red line) seem to have peaked, while imports (blue line) have started to turn down again (i.e, imports increasing). Not a good sign. Stay tuned…