Rates as of 05:00 GMT

Market Recap

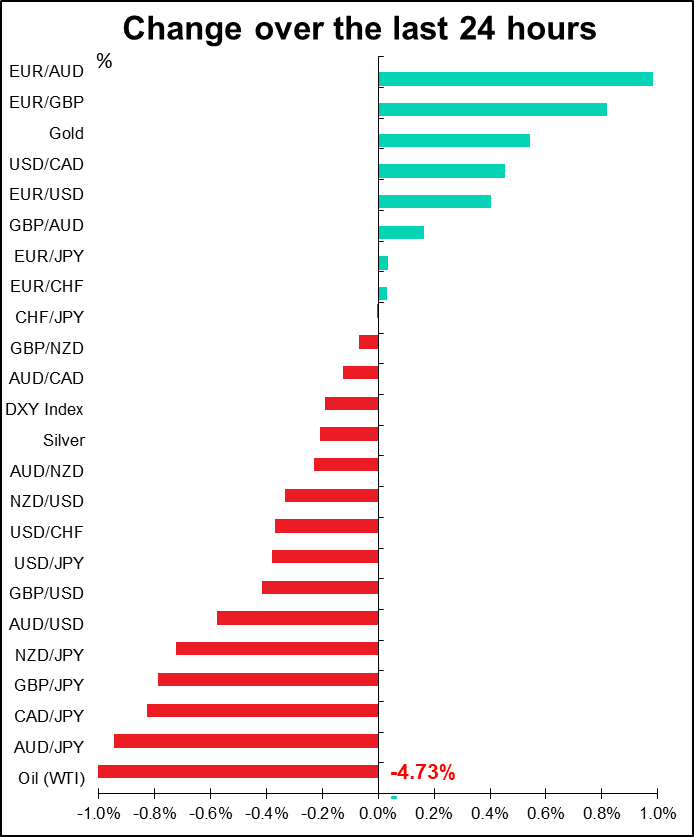

Extremely volatile day, with stocks higher and then lower during the day. Currencies moved far more than usual. Oil, which was down three days in a row, collapsed on the fourth day. It’s now down a bit over 10% in less than a week.

The usual risk-off response – JPY and CHF higher, AUD and NZD lower, gold up, oil down – saw some interesting twists.

EUR was the best-performing currency while USD fell. That goes against the “dollar smile” theory, which says that USD generally benefits during troubled times as the ultimate “safe haven.” As the graph shows, EUR/USD (red line, inverted) largely followed the S&P 500 futures (black line). Or were they both just reflecting the same investor psychology? Even though the virus so far has spread more in Europe than in the US (as far as we know), EUR gained as no one believes Trump’s optimistic assessment nor has any confidence in the Administration’s ability to deal with the problem.

There was also some good news out of Europe. German Finance Minister Scholz suggested suspending Germany’s “debt brake” – the balanced-budget rule in the constitution — to allow the government to help smaller towns and municipalities struggling to service their debts. That would be a major break from Germany’s fiscal orthodoxy. It’s by no means certain that Scholz will be able to do it, as he would need to get a two-thirds majority in the lower and upper chambers to pass the bill. But at least it shows that they are thinking of other ways besides monetary policy to support the economy, as the ECB has begged for years now. This possibility may help EUR to recover somewhat for the time being. Watch to see if it can break through 1.0940 on the upside today.

On the other hand, GBP was the clear loser of the day. There’s been a lot of excitement about the possibility that the new Chancellor Sunak will bring in new spending, which again would mean less reliance on monetary policy to support the economy. However the FT reported that Sunak “will delay some of the government’s biggest decisions on tax, spending and borrowing until the autumn,” because “growth forecast downgrades and the coronavirus outbreak had created a difficult economic backdrop.” So no big fiscal push means that if there’s a slump, the burden of reviving the economy will fall on monetary policy. Also, the Brexit issue is never far away: EU chief Brexit negotiator Barnier reiterated that it will be difficult to get a deal with the UK and that it would require more conditions than those with Canada, because of the UK’s proximity to the bloc and much larger trading volumes. The Johnson administration will release its official negotiating position today in Parliament. That should clarify if any compromise is available. I think it’s likely to highlight the difficulty of reaching an agreement, which could put further downward pressure on the pound.

About the US response to the virus: (you can skip this part if you’re just interested in market commentary – I’m just writing it because it gets me so angry.) The Most Stable Genius held a press conference about the coronavirus in which he barely said anything, but most of what he said was wrong (that’s a polite way of saying “a lie”). He put VP Pence in charge of the country’s response. Great! Pence doesn’t have a medical background. In 2000, he wrote an op-ed stating that smoking doesn’t kill people. When he was the governor of Indiana he helped create a small HIV epidemic by diverting funding earmarked for HIV prevention towards his pet project of so-called “gay conversion therapy.” (I think Trump wants Pence to fail so that he can get rid of him and run with his daughter Ivanka as his VP, thereby clearing the path for her to take over as President one way or another.)

This is a photo of the guy in charge of the US response to the virus:

Contrary to what Trump said, Nancy Messonnier, the director of the US Centers for Disease Control (CDC) National Center for Immunization and Respiratory Diseases, told reporters that “it’s not so much of a question of if this will happen anymore, but rather more of a question of exactly when this will happen.” Which person do you believe? The medical professional or the guy who’s documented to have lied approximately five times a day since taking office?

The administration is simply trying to play down the virus scare so that the stock market doesn’t tank and endanger Trump’s re-election. Don’t believe a word they say. Read this article from STAT, a medical website with no ax to grind: Trump’s no stranger to misinformation. But with the coronavirus, experts say that’s dangerous. According to the author, a medical journalist, the administration’s statements “range from false to unproven.” (This article came out before the press conference, but I heard nothing that would change the assessment.)

Another reason that they may be downplaying the threat is to deflect blame from their actions, which have left the US woefully unprepared for this event. Take a look at Trump Has Sabotaged America’s Coronavirus Response in Foreign Policy magazine. The Administration purposely dismantled the entire pandemic response team, apparently for no other reason than that it was formed by President Obama. I guess they think only Democrats will die if there’s another outbreak.

Is it any surprise that the Dow futures turned around and headed south while Trump was talking?

By contrast, Australia PM Morrison jumped ahead of the World Health Organization and announced that since there’s every expectation the virus will become a global pandemic, Australia is activating an emergency plan to deal with the outbreak.

Today’s market

The day starts with the ECB money supply figures. The days are long gone when the M3 money supply meant anything to the market. But the ECB does watch bank lending to make sure that their measures are feeding through to the economy. No forecasts are available, but watch to make sure that the growth in bank lending isn’t slowing down from the current rate of around 3% yoy.

Then once again we go back to staring sullenly at the stock market screens, calculating minute by minute how much further away into the future our retirement is being pushed – how many more months or even years we’ll have to get up far too early every morning, get dressed, go into work and toil in the salt mines of the mind just because someone thought “gee, I wonder what a bat tastes like” or “hey, I saw in that movie how Spiderman got his start, maybe if I ate a bat I’d turn into Batman” or something like that.

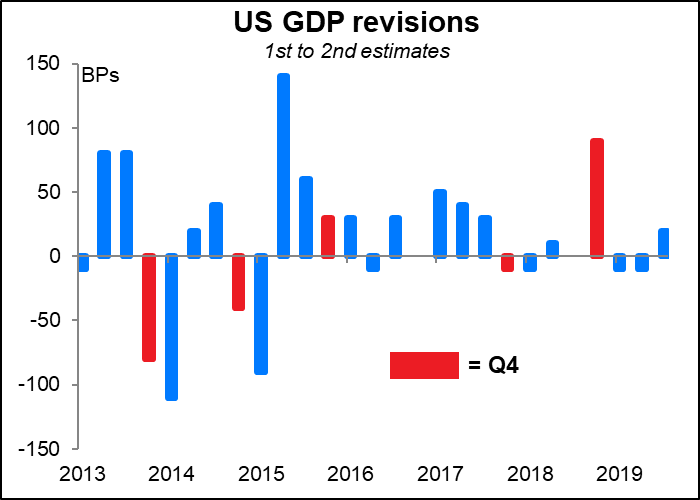

A few hours later, our reverie may be broken by the 2nd estimate of US Q4 GDP. It’s expected to be unchanged from the original estimate. It has indeed been little or unchanged three out of the last four years, so that’s as good a guess as any. If it is or course it would be neutral for the dollar.

US durable goods orders are likely to be more interesting to the market. Although historically the FX market reacts more to the headline figure, given the problems at Boeing I now focus on the ex-transportation equipment number. It’s been pathetic recently – in fact, the six-month moving average of month-on-month changes was only above zero one month last year (October), and it’s since nosedived. Even if today’s figure comes in as expected, it’d still leave the average at -0.1%. Nice to see how the Trump corporate tax cuts have encouraged so much investment! I think yet another weak figure like this would be negative for the dollar.

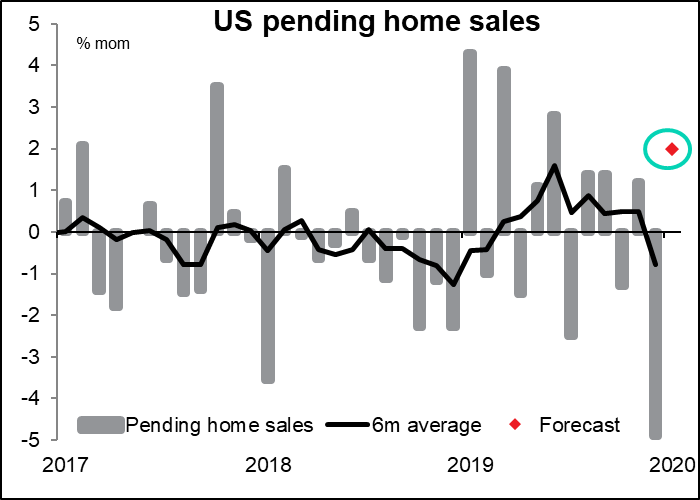

By the time US pending home sales roll around each month, I’m kind of tired of talking about the US housing market. NAHB index, existing home sales, new home sales, and now pending home sales. They all tell the same story: the housing market is doing well as interest rates come down. OK pending home sales plunged last month, but it’s a pretty volatile series and is expected to recover this month. More to the point, yesterday’s blowout new home sales (764k, up sharply from an upwardly-revised 708k and beating estimates of 718k) demonstrates that point.

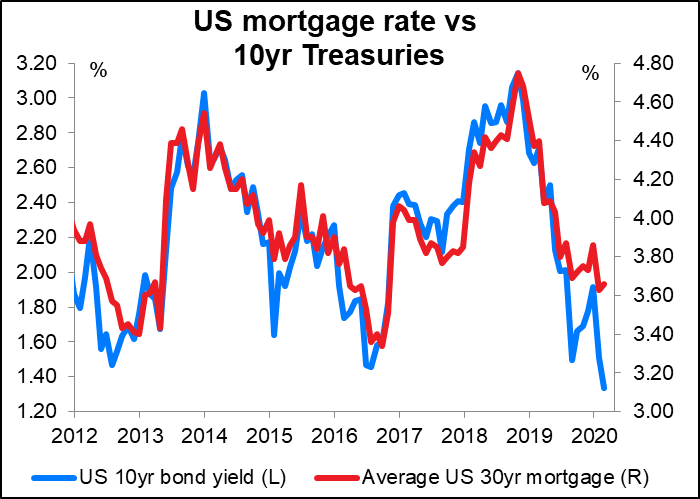

Moreover, with US interest rates continuing to crash, mortgage rates should come down further and housing is likely to continue to do well, assuming that the unemployment rate stays low (and we don’t all die).

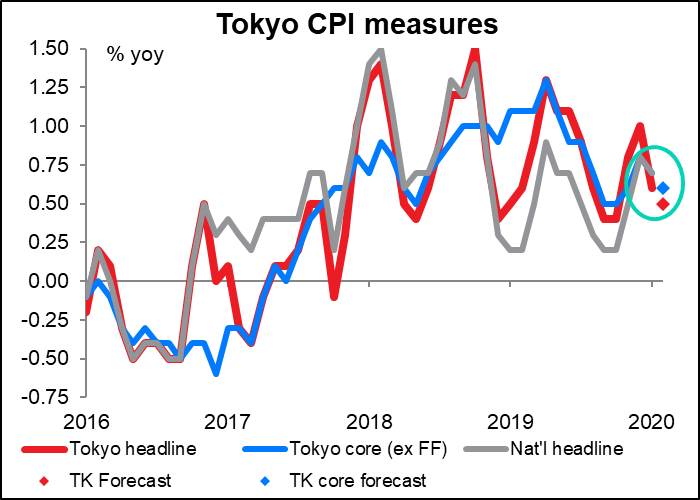

Overnight, Japan releases the Tokyo consumer price index (CPI) for February. The already-low inflation rate is forecast to drop one notch. That probably isn’t enough to get anyone excited and so should be neutral for JPY.

The question is, how much further can inflation slow before the Bank of Japan (BoJ) admits that “momentum toward achieving the price stability target” has been lost and that it needs to take further action, which of course it said it wouldn’t hesitate to do. The market wasn’t discounting any change in BoJ rates over the next year, but since the COVID-19 virus has spread, it’s now pricing in at least one further 10 bps cut in BoJ rates.

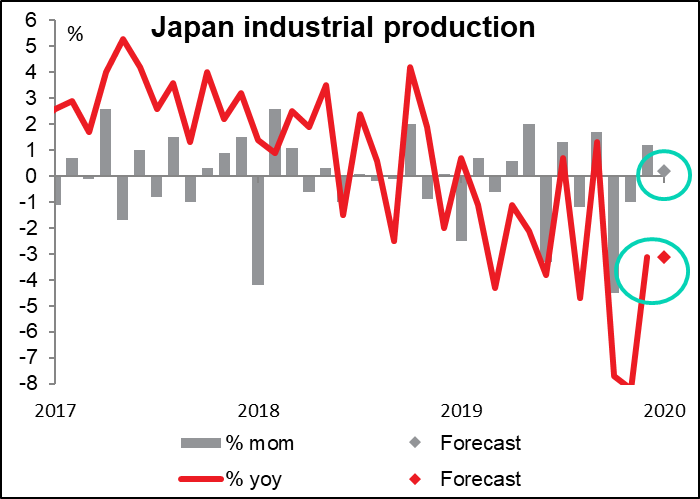

Japan also releases the rest of its usual end-of-month slew of indicators. Along with the Tokyo CPI, the country will announce the jobless rate, job-offers-to-applicants ratio, retail sales, and industrial production. None of them is particularly important for the FX market nowadays, though. If any, I would look at industrial production to see how output was recovering from the post-consumption tax hike before the COVID-19 virus had a chance to bite. Market consensus: not very well. Signs that the economy was already struggling in January anyway would tend to be negative for the yen.

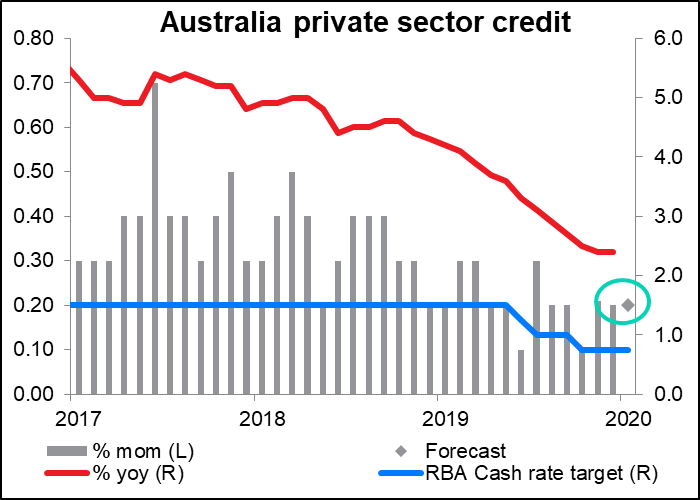

Australian private sector credit growth has slowed considerably – the yoy rate of credit growth at the end of last year, 2.4% yoy, was the slowest since the disastrous year of 2009. However, with two rate cuts last year, it appears that credit growth has started to accelerate again – the three-month annualized pace of growth in December was 3.4%. Today’s figure is expected to show steady growth once again of 0.2% mom. The big question of course will be what happens in February and after, now that the virus has hit. Nonetheless, I think this figure could show that the situation had at least stabilized by January, which would be positive for AUD.

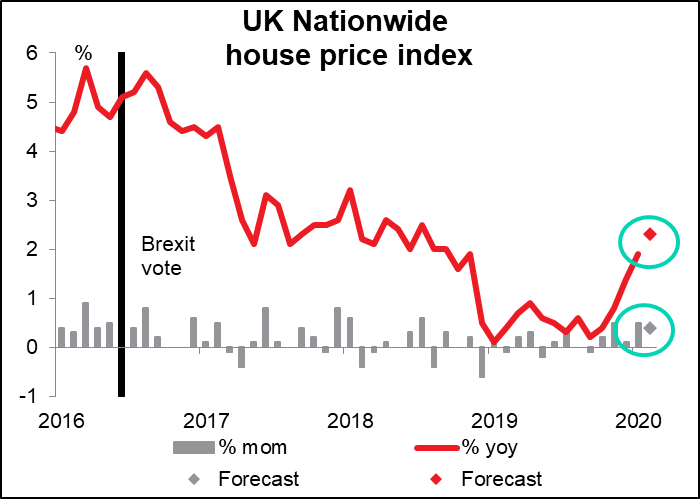

Then, as the European day gets underway, the Nationwide building society releases its house price index. House prices seem to have bottomed out in September and to have resumed their upward trend, albeit still slowly. A continuation of this trend as expected, which demonstrates improved confidence in the UK, would be bullish for sterling.