Rates as of 04:00 GMT

Market Recap

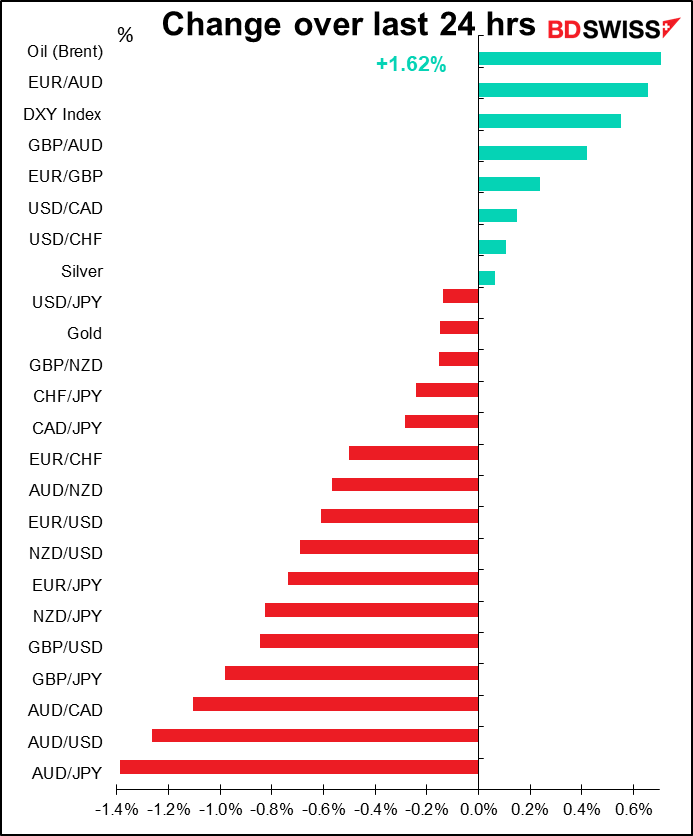

I wonder what the P&L would be if you just operated by a simple rule: if AUD/JPY is higher when you start trading in the morning than it was 24 hours before, just sell it. If it’s lower, buy it. It seems to me that we have an abundance of what I’ve called “Matthew markets,” following on from the line in Matthew 20:16: “So the last shall be first, and the first last.”

Today’s tip from euphoria to horror in the FX market was caused by a number of stories:

● A COVID-19 outbreak in Beijing causes the city to close all schools (but not factories or offices) while encouraging people to work from home. China had been the optimistic virus story, with its apparent FIFO (first in, first out) trajectory: it was the first to encounter the virus, but appeared to be the first to get over it and get back to normal, too. A “second wave” there means the possibility of a second wave anywhere.

● Elsewhere in China, the country had a “violent face-off” with India on the two countries’ border in the Himalayas.

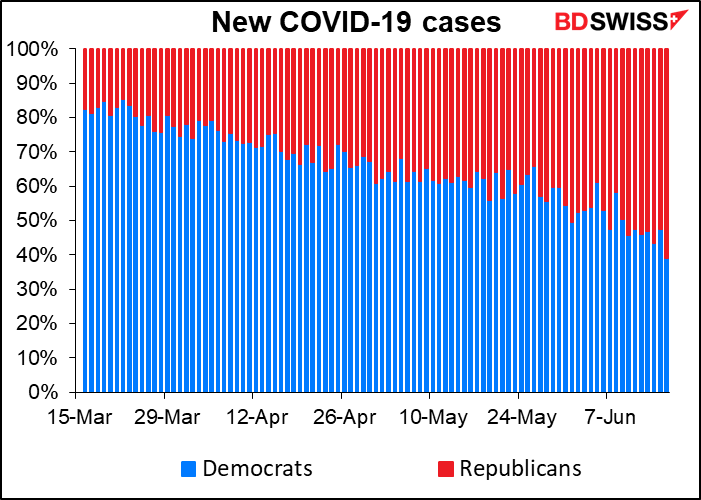

● The growth rate for confirmed virus cases continues to climb in several US states, notably Florida, Texas and Arizona, where the rate of increase has gone exponential. (Cases continue to climb in California but the rate of growth does not seem to be increasing.) The epidemic seems to have shifted decisively to Republican-led states: 15 of them have higher virus cases than a week ago vs 11 with lower, whereas only 9 Democrat-led states are higher and 17 are lower (I’m including Puerto Rico and Washington DC as Democrat-led areas). The majority of new cases are now in Republican-led states. Maybe they’ll now realize that people who believe “Government is not the solution to our problem, government is the problem” (Ronald Reagan’s 1981 inaugural address) may not be the best people to run a government when there are problems that need solving.

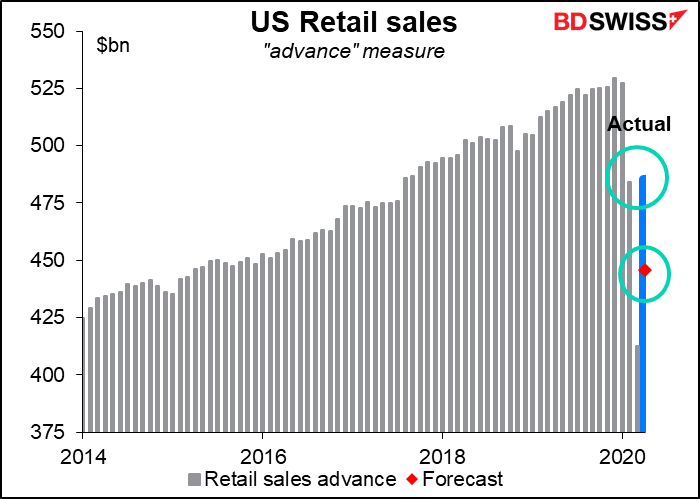

● In his testimony to the Senate Banking Committee yesterday, Fed Chair Powell remained cautious despite the improvement seen in some of the US economic indicators, notably yesterday’s soaring US retail sales. While he acknowledged the improvement, which he attributed to the stimulus checks, he warned again that “the levels of output and employment remain far below their pre-pandemic levels, and significant uncertainty remains about the timing and strength of the recovery.” As usual, he stressed that “Until the public is confident that the disease is contained, a full recovery is unlikely.” About the only new bit in his testimony was that purchases of individual corporate bonds as part of the corporate credit facility may just substitute for purchases of bond Exchange-Traded Funds (ETFs). That would be a disappointment to the market, as the Fed wouldn’t increase the size of the facility.

This “risk-off” mood was only somewhat reflected in US stocks, which gapped open higher on the spectacular retail sales figure but drifted off for most of the day, still closing substantially (+1.9%) higher. But almost all stock markets are lower today in Asia, and S&P 500 futures are indicated -0.2% at the time of writing.

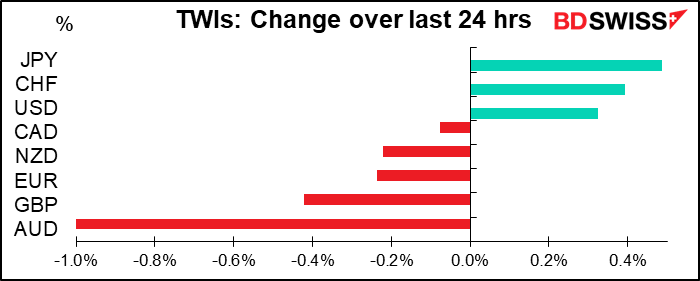

The reversal in currencies included GBP, which fell against both the (stronger) USD and the (weaker) EUR. The pound’s weakness despite much better-than-expected employment data for April (unemployment rate unchanged at 3.9% vs rise to 4.7% expected, employment actually rose by 6k instead of falling by 110k as expected) may reflect continued skepticism about the likely outcome of the Brexit negotiations. Or maybe people focused on the claimant count rate and jobless claims for May, which were fairly bad (claimant count rate: 7.8% vs an upward-revised 6.3%; jobless claims +529k vs upward-revised +1033k).

Today’s market

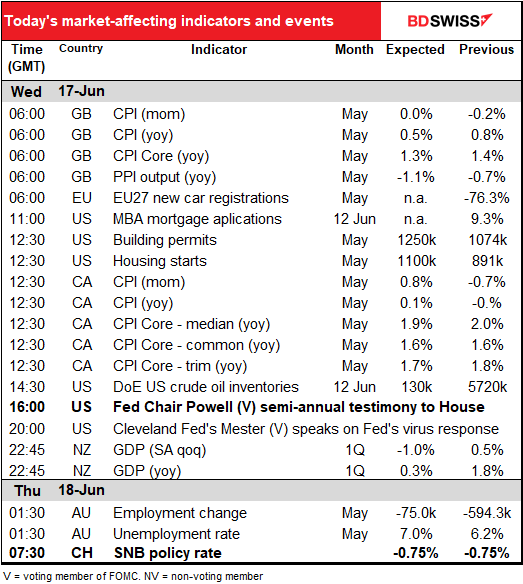

I’ve already dealt with this morning’s European indicators – UK inflation and EU new car registrations — in yesterday’s comment. That lets me laze in bed and peel a few grapes for breakfast instead of rushing out and fighting the traffic to get to my spare room in time to get this out in time.

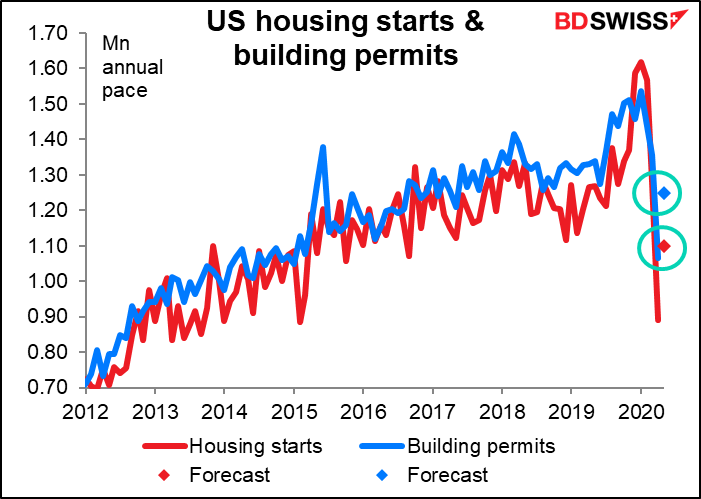

So that leaves us nothing until the US opens for business. The MBA mortgage approvals figure doesn’t have a forecast, and even if it did it wouldn’t do me much good as that’s not the way I graph it. Last week’s figure was well outside the range that we’ve seen for mortgages over the last decade – someone is clearly buying houses. That explains the better-than-expected rebound in the National Association of Home Builders (NAHB) index yesterday (to 58 from 37 (45 expected).

Housing is the one bright spot in the US economy. Low interest rates do seem to be spurring interest in buying a house. Surprising because I had learned that employment conditions were one of the big factors affecting housing demand — unemployed people generally don’t buy a new house. If that’s true, one wouldn’t necessarily expect housing to be booming with a U-6 unemployment rate over 20%. But maybe the other 80% sense a bargain.

We’ll learn more about housing demand a bit later in the day, when US housing starts and building permits for May are released. They’re expected to bounce back substantially to the levels of just a year or two ago – I don’t remember back then people complaining that housing was particularly depressed. The (expected) rebound in permits is particularly encouraging, as it indicates even more housing starts in the months to come.

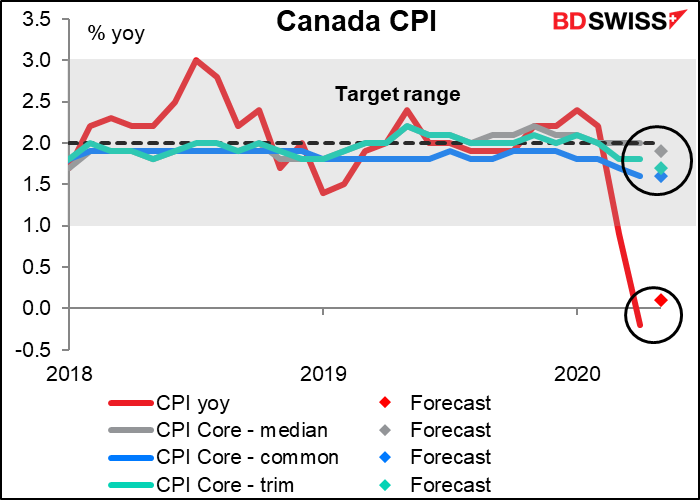

Canada’s headline inflation rate is bumping around zero, but the Bank of Canada focuses on the various core measures that it also publishes. Those have been remarkably steady within the 1%-3% target range even as the headline rate of inflation has collapsed. Nonetheless the Bank is now questioning its inflation measurements. Bank of Canada Gov. Macklem yesterday said in hiOpening Statement before the House of Commons Standing Committee on Finance that

While our monetary policy will continue to be grounded in our inflation-targeting framework, we acknowledge that the consumer price index isn’t currently giving an accurate picture of inflation for many Canadians. Buying patterns and prices have changed drastically. We know many people are buying less gasoline and fewer travel services while continuing to purchase food from stores. This makes their experience quite different from the data being reported. Bank staff have been working with Statistics Canada to better understand the implications of these changes in buying patterns. (emphasis added)

Although the core inflation rates are within their target range, I don’t think the Bank can ignore indefinitely a headline rate of inflation at zero. That doesn’t mean it will necessarily take any new measures to get inflation up, but most likely it will refrain from tightening policy until they see some improvement here. The Bank hasn’t made any specific pledges to keep rates unchanged until X or Y happens, but it did make such a pledge with regards to its asset purchases: it said it would continue the purchases “until the economic recovery is well underway.” Gov. Macklem yesterday repeated that interest rates were at “the effective lower bound.” All he said in his prepared statement about the future was that “Any further policy actions would be calibrated to provide the necessary degree of monetary policy accommodation required to achieve the inflation target.”

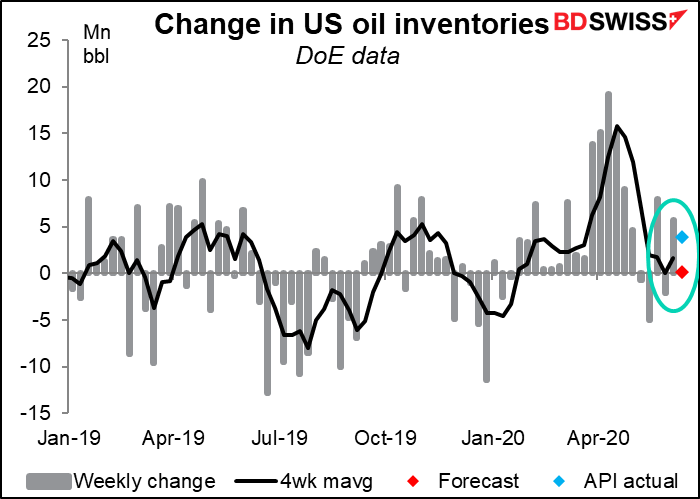

The weekly US Dept of Energy oil inventory figures are forecast to show only a tiny (130k barrel) rise in crude oil inventories, although yesterday’s figures from the American Petroleum Institute (API) showed a much larger 5.7mn bbl increase. This follows last week’s shocking 8.4mn bbl increase (according to API data) or still-alarming 5.7mn bbls (according to the DoE).

Fed Chair Powell speaks again today at the House Financial Services Panel. We didn’t learn that much new from yesterday’s questioning, and we’ll probably learn even less from today’s.

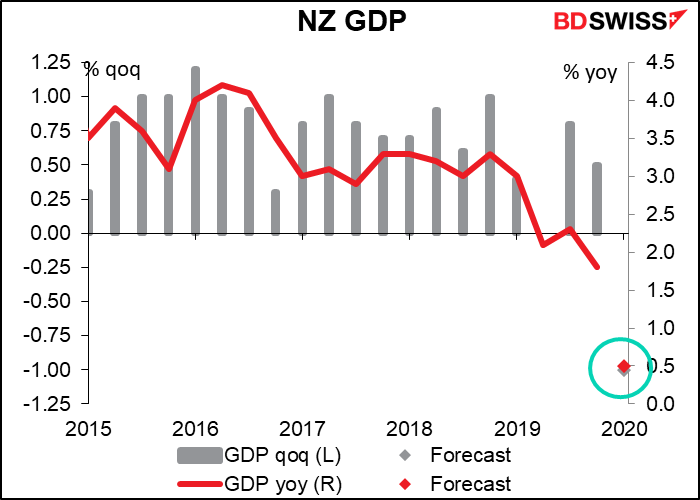

Overnight, New Zealand releases its Q1 GDP. New Zealand is among the last of the industrial world to release their GDP figures every quarter – maybe it takes a long time to count all the sheep? (oops! Not a nice thing to say. Sorry. I like NZ – I went bicycling there once. Marvelous place with amazing scenery, friendly people and a surprising amount of vegetarian food for a place with such a big animal husbandry industry.) The country went into lockdown the last week of the quarter, and even one week is 7.7% of the quarter. That’s enough to send the qoq rate of growth negative. It should be no surprise to anyone, since Q1 growth was disappointing everywhere. But wait till we get the Q2 figure!

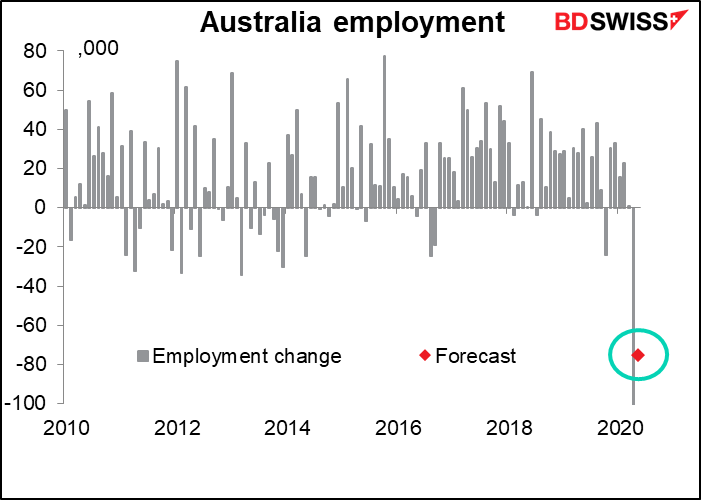

Australia’s unemployment rate is forecast to rise dramatically, but the change in employment is expected to be (6.2% to 7.0%) but the fall in employment is expected to be much less than in April, when it dropped an amazing 594k. The forecast decline of 75k is big but not unprecedented – in fact it fell that much back in November 1992, when the population of the country was 37% less.

The expected 7% unemployment rate is what the country experienced back in the late 1990s. Nevertheless, in the May Statement on Monetary Policy, the Reserve Bank of Australia said that unemployment would perhaps peak “at around 10%,” so this rate will probably not cause them to take any new measures.

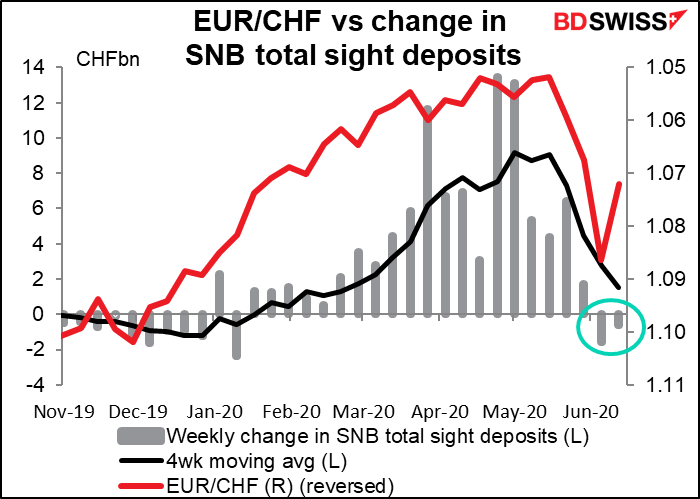

Finally, the big question of the day: will I get the morning comment out in time for the Swiss National Bank (SNB) meeting Thursday morning? I wouldn’t give it more than 50-50 odds. In which case, let’s discuss it here – it won’t take up much space, because I don’t expect much out of them. The SNB hasn’t made any major changes in its policy stance for quite some time and, with rates currently at the lowest in recorded history, is unlikely to do so unless absolutely necessary. EUR/CHF, its main policy goal, was moving in the right direction until recently (= up, or a weaker CHF) and they were able to intervene less in the latest two weeks, so there’s not much reason for the SNB to change now. I’d expect Chairman Jordan simply to reiterate that the SBN will keep its negative rates and stands ready to intervene in the FX market and to “take additional steps to ensure liquidity as necessary.” I wouldn’t expect the announcement to have a major impact on CHF.