Rates as of 04:00 GMT

Market Recap

You may remember the song, “I Don’t Need No Doctor,” which I just found out today is by Ray Charles? (I only knew the Humble Pie version, although Netta has made the song famous again recently). I often think of this song first thing in the morning when I turn on my screens and try to figure out what’s happened. Often as not, a doctor is exactly what I need. For FX market participants, the song should be redone as I Don’t Need No Economist. Just tell me what happened with the virus and often as not I can tell you what happened in the market.

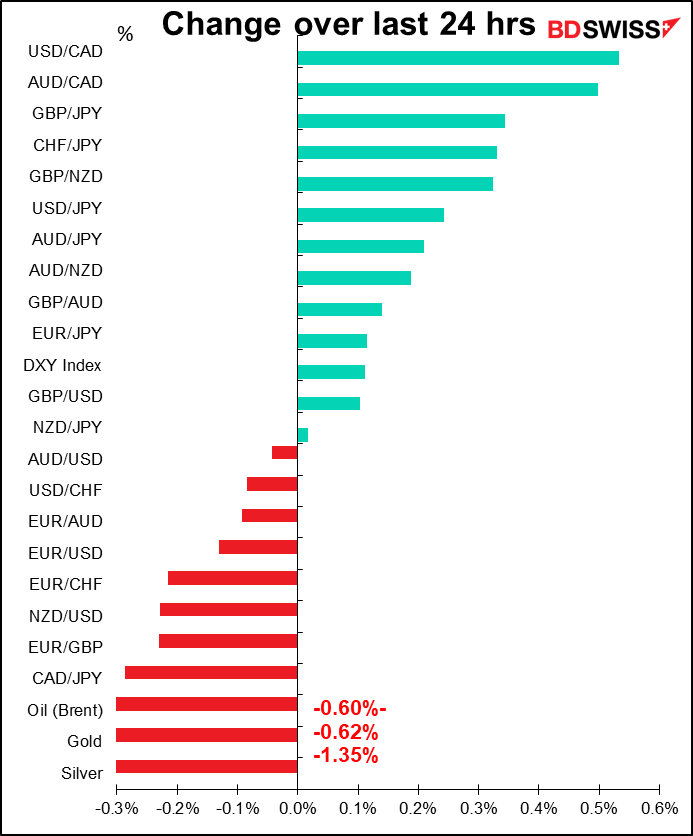

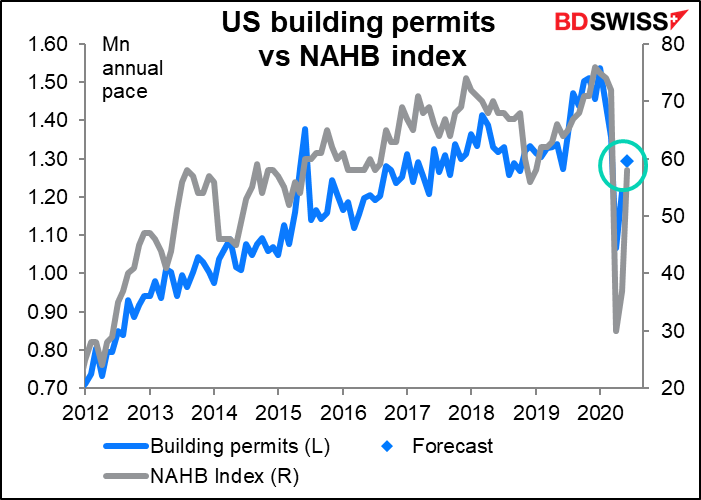

The market was driven by risk-off sentiment as Florida and Texas set new records for virus deaths and there were rumors – denied by the governor – that Texas would enter lockdown again. This news “Trumped” the better-than-expected US economic data, including retail sales beating expectations and much-higher-than-expected National Association of Home Builders’ market index. Jobless claims were slightly lower than expected, but still dreadfully high – your interpretation of them will be an indication of whether you’re a “glass half full” or “half empty” kind of person.

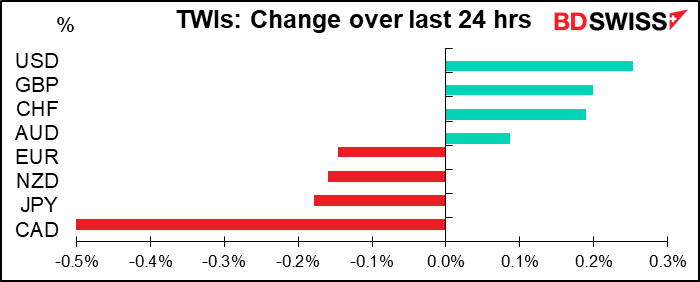

Elsewhere, the main changes seem to be simply the reversal of Wednesday’s move. On Wednesday JPY outperformed CHF and CHF/JPY was the biggest loser; today, even though it was a “risk-off” day, CHF outperformed JPY. (JPY tends not to move by itself very much, so USD/JPY is dominated by moves in USD, which was stronger on the risk-off mood, hence USD/JPY moved higher.)

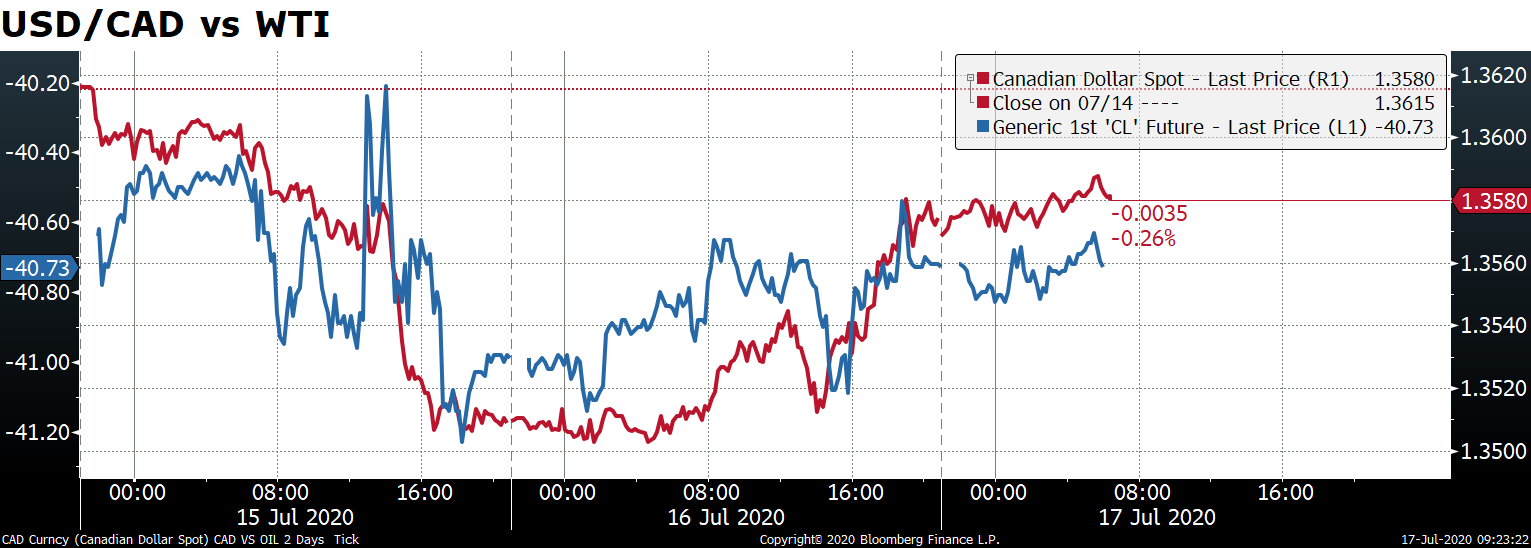

Yesterday morning CAD was the best-performing currency; this morning it’s the worst-performing by far. That appears to be due more to lower oil prices than any reconsideration of the Bank of Canada’s stance. Oil was down as the virus fears and threats of lockdown in major US states caused a reevaluation of the demand picture. I agree that the rally in oil has probably gone as far as it’s going to and with the virus picking up speed in the US, demand is likely to disappoint. That would be a threat to CAD and NOK.

EUR was relatively unmoved. The European Central Bank (ECB) meeting went largely as expected, with no change to any rates or programs.

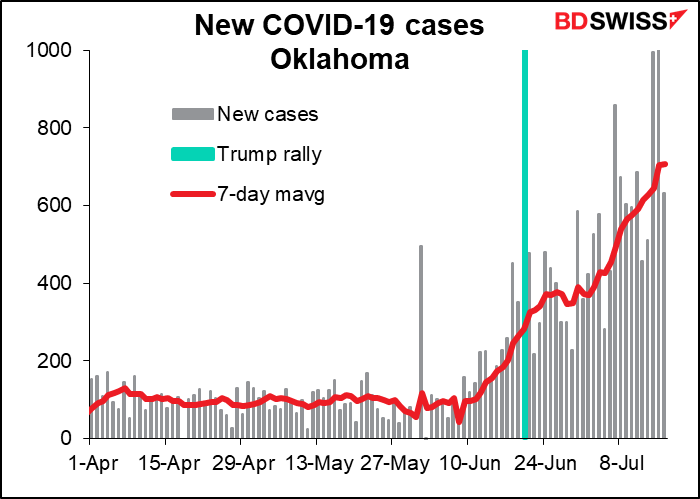

Oklahoma Virus Update

Remember some time ago that I said we would start tracking virus cases in Oklahoma after Trump held a rally there? Well, Oklahoma Gov. Kevin Stitt, who attended that rally has tested positive for the virus. I really wonder sometimes if Trump isn’t either a Russian agent (likely) or a secret Democrat (unlikely) because he seems intent on killing as many Americans as possible with a particular focus on Republicans.

Sitt denied he got the virus from the rally, which he said was too long ago (25 days). His diagnosis came on the same day that Oklahoma reported a record-high number of new infections.

Someone posted on Twitter, “A mask is not a political statement. It’s an IQ test.” I agree, but apparently many of my fellow Americans don’t.

Today’s market

The big excitement today is the start of the two-day extraordinary EU Summit. This will be the leaders’ first in-person meeting since the pandemic broke. The main topic of conversation of course will be the European Commission’s proposal for a EUR 750bn “Next Generation EU” fund, comprised of EUR 500bn in grants & EUR 250bn in loans. They will also discuss the EU’s next seven-year budget framework for 2021 to 2027. There are five major points of disagreement:

● the overall size of the fund

● the split between grants & loans

● the way the fund is allocated to countries

● the contribution of each member to the budget, and

● the rebates that some members get.

Four countries, the so-called “Frugal Four” (Netherlands, Austria, Denmark and Sweden) particularly object to doling out money through grants rather than loans and also want more stringent conditions attached to the loans. Some countries from eastern Europe object to the fact that the main recipients of the funds would be the richer countries such as Italy and Spain, rather than the countries that are hardest-hit by the virus (which I gather is in fact Belgium, on a per-capita basis). There’s plenty to discuss and haggle about.

I expect them to discuss the mix of grants and loans – the “Frugal Four” don’t seem to object to loans that much – and perhaps they will revise the rebates that some countries get for their contributions to the EU budget to allay the concerns of the eastern countries. But no decisions are likely this time. The EU negotiations remind me of a sumo match: the fighters meet, they glare at each other for a while, then retreat to their corners, rinse their mouths out, throw some salt around and come back for another brief staring contest. This goes on and on until time runs out, whereupon they collide.

All 27 EU members have to agree to the recovery fund and the EU’s next seven-year budget framework for 2021 to 2027. With so much money at stake, it will take more time to bridge the differences. I think the most that’s likely to come out of this meeting is probably some sign of goodwill or perhaps some agreement on the next steps. I wouldn’t expect the issues to be resolved until later in the year. I don’t think anyone is looking for an agreement at this meeting and so failure to agree should not be negative for the currency. On the other hand, an agreement doesn’t have to be complete for the market to have a positive reaction to it. Agreement on some issues would probably be seen as progress and therefore positive for EUR. The earlier they reach agreement, the better for the euro – what the market wants to see is growth, and this fund is necessary to ensure growth in the Eurozone. We saw for example how a larger-than-expected budget deficit announcement for Canada last week helped to push CAD higher.

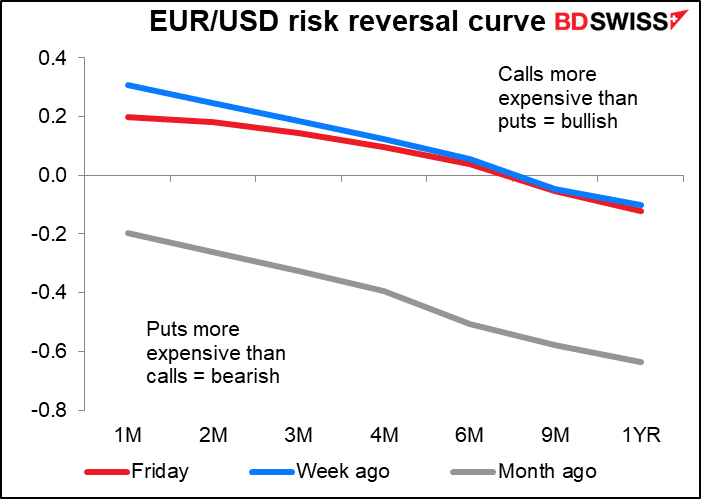

The market does seem to be expecting some measure of success. The near-term risk reversals have turned positive, suggesting that investors expect something to boost the currency in the near future.

Make no mistake about it: the EC”s proposal is potentially a gamechanger for Europe. It would support a synchronized recovery and reduce the risk of a slump among the peripheral countries of southern Europe. It would also be the necessary next step in an “ever-closer union: establishing a central fiscal capacity that can respond to adverse shocks, which would make monetary union more stable, and issuing a large-scale EUR-denominated safe asset, which would make the euro more attractive as a reserve currency.

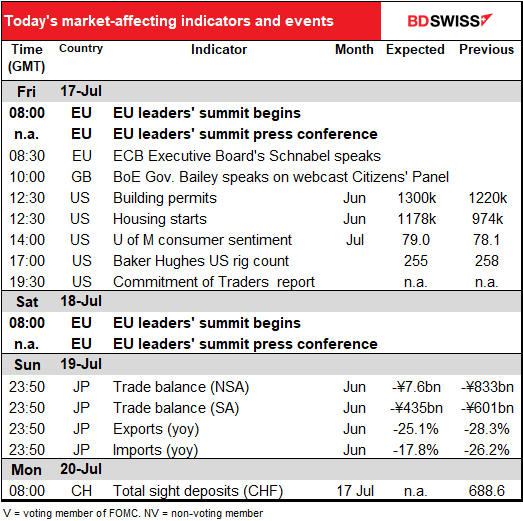

Today’s indicators

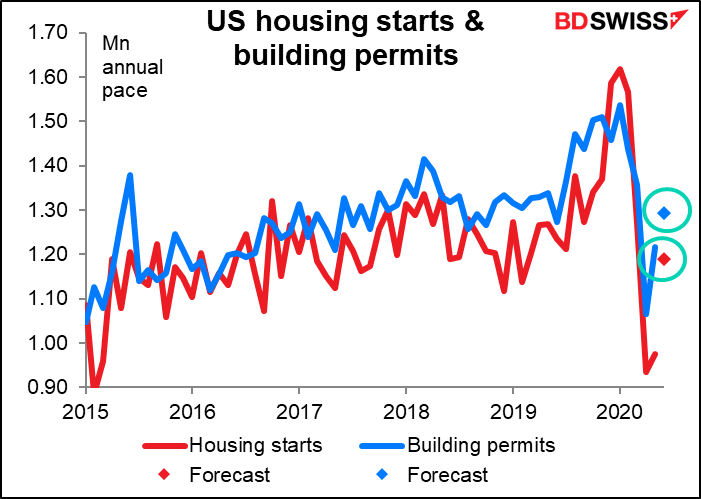

US housing starts and building permits are expected to rebound. Starts fell more sharply and therefore are expected to rebound more. Both are forecast to hit respectable levels comparable to those early last year, when no one was complaining about a weak housing market.

This would be in line with the recent improvement in the National Association of Home Builders’ (NAHB) market index.

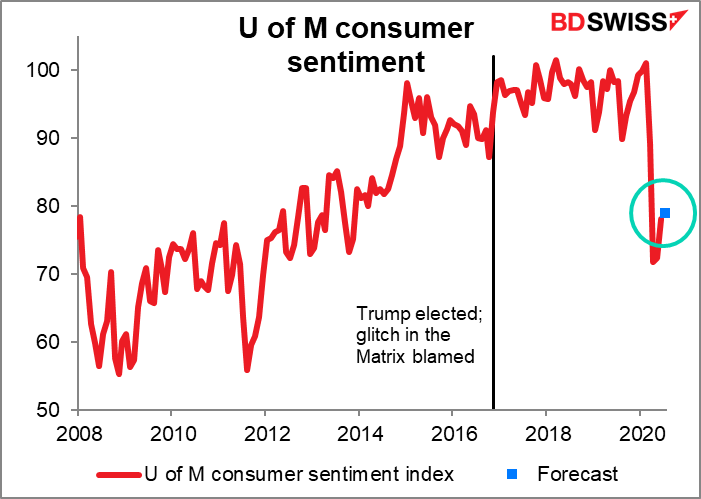

The U of Michigan consumer sentiment index is expected to edge up just a bit. Sentiment hasn’t recovered that far in the US, and no wonder: although the economy has recovered somewhat from April, the month that confidence collapsed, the virus is much worse.

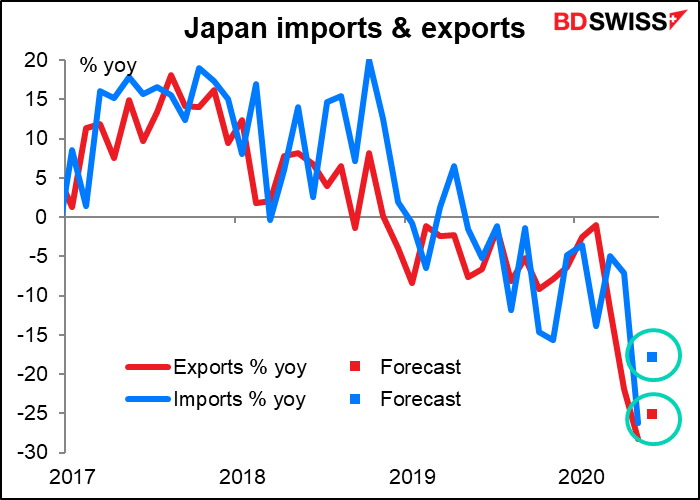

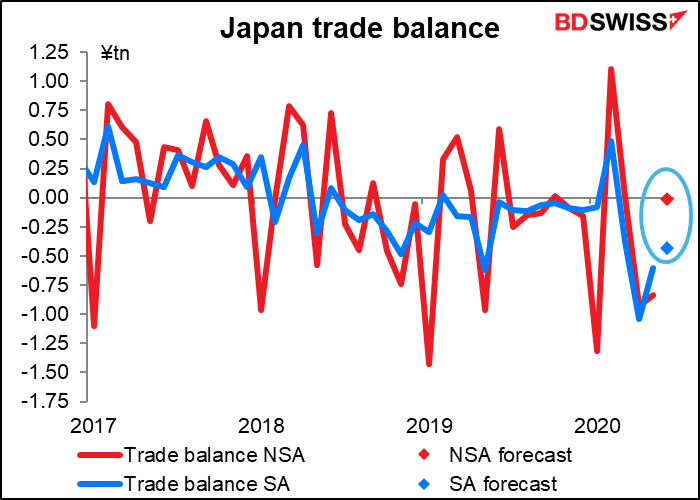

Japan’s trade balance, out Monday morning, is expected to show a narrowing deficit.

But that’s only because imports are expected to collapse at a faster rate than exports – not a good sign for domestic consumption (unless it’s due to lower oil prices).