Rates as of 04:00 GMT

Market Recap

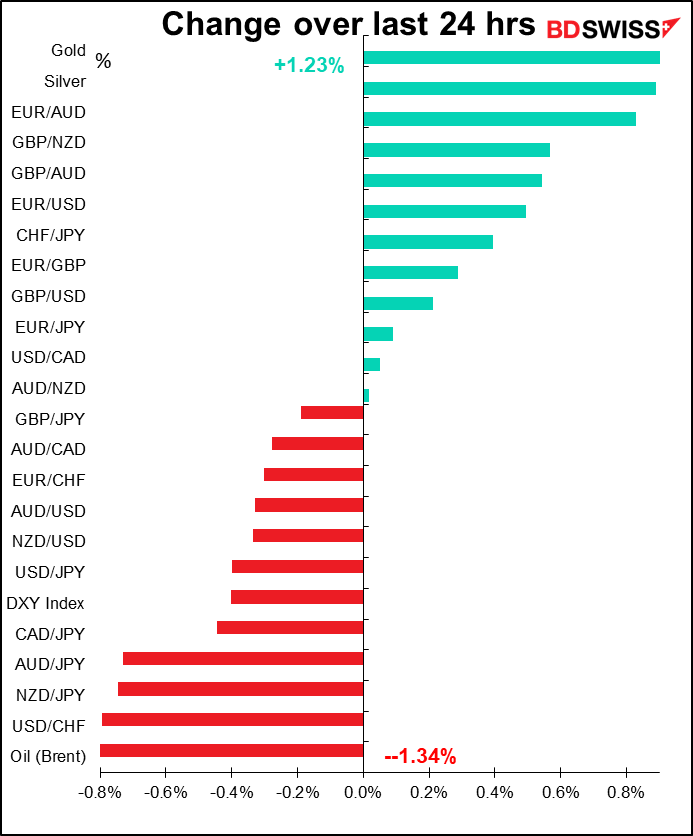

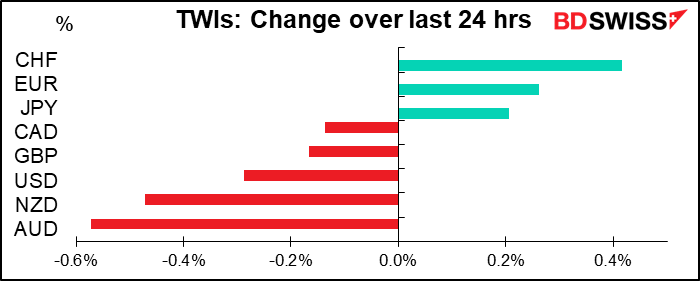

On Monday the world was great. Apparently on Tuesday it wasn’t so great. Investors got nervous ahead of today’s Federal Open Market Committee (FOMC) meeting and reduced risk: stocks fell, Treasuries rose, safe-haven currencies outperformed and the commodity currencies lagged. Gold up, oil down.

EUR/USD rallied to back near the resistance level around 1.1370. EU Finance Ministers discussed the EU’s recovery plan. This was just the first round of talks and was more of an exchange of views rather than a negotiating session. The ministers still don’t agree on the overall size of the fund, the share of grants vs. loans, and the conditionality of the provisions. Nonetheless, German Finance Minister Scholz was optimistic, saying that while the differences among the countries are “not small,” he had the impression that “everyone has the will to reach an agreement within a short time” and that “there were a lot of constructive signals” from Austria, Netherlands, Denmark and Sweden, the so-called “frugal four,” who are opposed to the current proposal. Really? The “signals” may be constructive but the public statements weren’t: Austria’s Finance Minister Bluemel reiterated that the country would not accept the recovery fund proposal as presented – both its size and content are unacceptable, while the Dutch also issued a statement objecting to everything..

Scholz said a recovery fund of EUR 500bn, smaller than the European Commission’s proposed EUR 750bn fund, might be a good solution. However a smaller fund would be a disappointment to the market and would probably see the EUR fall.

There were reports that an in-person summit might be held (possibly 9-10 July) in order secure passage of the fund. I expect the negotiations to drag on for some time. Doubts about the size of the fund or the grants/loan mixture may weigh on the euro periodically.

Despite the stronger EUR, CHF outperformed with EUR/CHF breaking back below 1.08 to hold around its 200-day moving average of 1.0769. EUR/GBP gained however even though Bank of England Policy Board Member Cunliffe expressed skepticism about using negative interest rates.

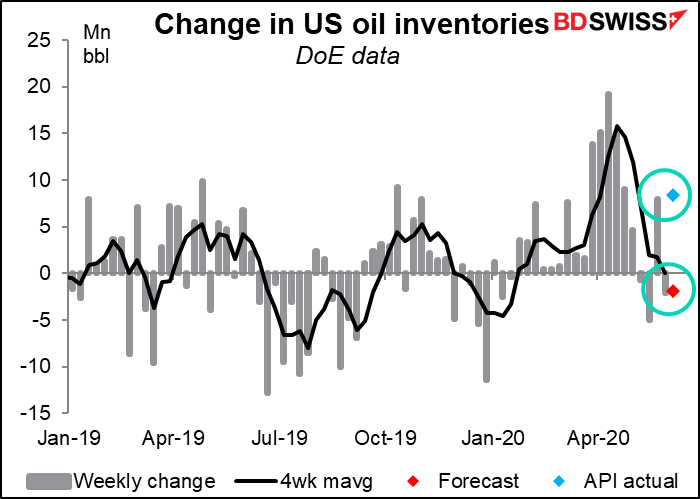

Oil prices fell after the American Petroleum Institute (API) reported an unexpected large rise in crude oil inventories of 8.42mn barrels instead of the 1.9mn barrel decline the market was expected (see below). I was surprised though at how small the fall was, given how large the rise in oil prices has been recently, particularly since the OPEC+ decision over the weekend. I think this shows that oil is fairly well underpinned at current levels even if perhaps the upside is limited.

Today’s market

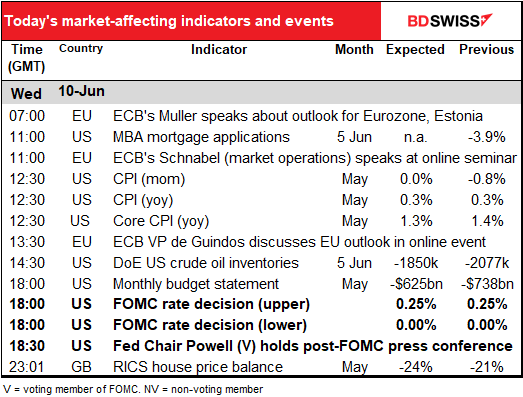

All eyes today will be on the meeting of the Federal Open Market Committee (FOMC), the rate-setting body within the US Federal Reserve. I went through my expectations in great depth and detail in my weekly, which I’m sure you’ve all read – it makes great loo reading. For those who want to re-read it, you can find it here. I’ll just review the main points in this report.

The Fed is widely to keep rates unchanged (in fact, it’s expected to keep rates unchanged for around the next two years).

The focus will therefore be on other points:

- SEP At the March meeting, they skipped the usual Summary of Economic Projections (SEP) Therefore this will be the first expression of their views since the pandemic began. It will establish a baseline for their thinking. From what various members have said recently, I expect that they will predict a pickup in growth starting from the second half of the year, but for the recovery to be tepid and gradual at best.

The problem is though that the SEP only gives numbers, not an explanation. That will have to come largely from Fed Chair Powell’s press conference afterward (see below).

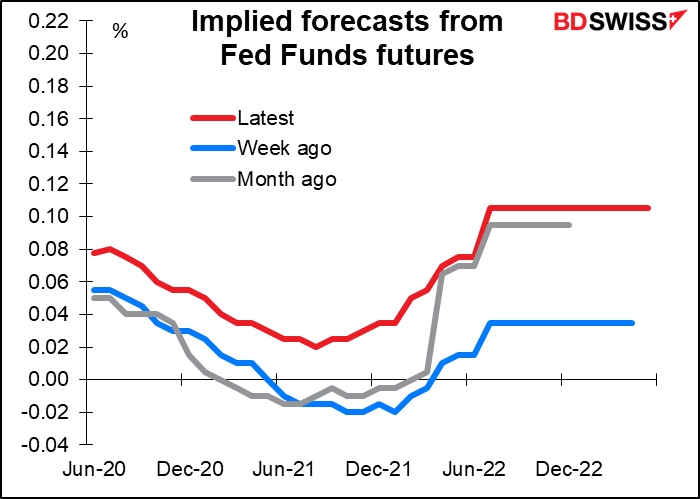

- Dot Plot In March they also skipped the “dot plot” that gives each Committee member’s forecasts for interest rates. Currently the market is forecasting that rates will stay in their current corridor of 0%-0.25% out to spring 2023. I assume that the Committee members will ratify the market’s view. Any deviation from that in either direction will be noted and poured over. A negative dot would especially attract attention, as the Committee normally has an optimistic bias.

- Combination of the two There will be considerable interest in how the SEP and the dot plot go together. For example, if the members see the economy recovering but interest rates remaining at zero throughout the forecast period, then it will show a dovish reaction function. Or if they predict continued below-target inflation or high growth, it could set the stage for further easing in the future.

- Forward guidance The forward guidance from the March meeting was vague. They said, “The Committee expects to maintain this target range until it is confident that the economy has weathered recent events and is on track to achieve its maximum employment and price stability goals.” I think conditions are still too uncertain for them to make any more concrete guidance, such as setting numerical targets for inflation or unemployment that might trigger a rate hike. Several Committee members have expressed fears of a second wave of infections after the country emerges from lockdown; they can’t say anything for certain until they know whether that’s going to happen.

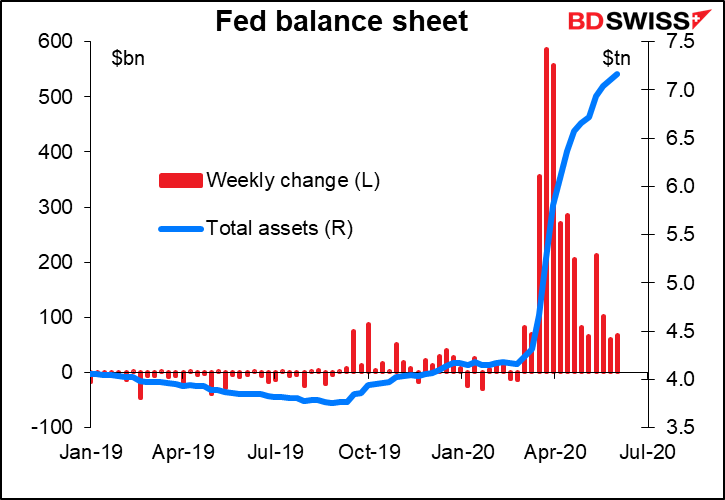

- Asset purchases The Fed has blown up its balance sheet by close to $3tn since end-February. They started off buying $75bn a day but tapered it down as conditions improved. This week it’s scheduled to buy $4bn a day or $20bn a week. The Committee could announce that they will continue at that pace for the time being (= indefinitely). They may also want to clarify the purpose of these purchases. They originally said the purchases were designed to restore orderly markets, not to stimulate the economy as the QE purchases were. In that case, now that financial conditions are back to normal and bond market volatility has fallen, why are they continuing with them? More detail about the amount and purpose of the purchases would be in line with the desire of “several” members “to provide further clarity” about the Fed’s purchases, as stated in the minutes to the April FOMC meeting

- Yield Curve Control (YCC) There is talk in the market that the committee will consider instituting “yield curve control (YCC),” also known as financial repression. This policy – currently in use by Japan and Australia – involves the central bank establishing a target for the long end of the bond market as well as its policy rate at the short end. The WSJ said over the weekend that the Fed was “thinking hard” about the idea but that it was too early to expect any decisions. There are bound to be some questions about it though at the…

- Press conference Given that the forward guidance is vague and that the economic forecasts are only numbers, it will be up to Fed Chair Powell to flesh out the details of why the FOMC members are thinking what they are thinking. Market participants will particularly want to know his views on when growth will restart and how the recovery is likely to go, particularly after Friday’s surprising fall in the unemployment rate. Of course he’ll say it’s too early to know for sure, but will he be more like the relatively optimistic RBA and BoC or the pessimistic ECB? I think probably the latter. He’ll probably say something like what Fed Vice Chair Clarida said in a speech on 21 May: that there is “extraordinary uncertainty about both the depth and the duration of the economic downturn” and that “it will likely take some time for economic activity and the labor market to fully recover…” Clarida though expected growth to start rising and unemployment to start falling from 2H. Did Friday’s unemployment figure change their view on the length of the downturn?

FX market reaction: weaker USD We saw last week how a bit of optimism from the RBA sent AUD soaring. I would expect the opposite to happen here: despite Friday’s payroll data, I look for a fairly downbeat assessment from the FOMC, particularly concerning the pace of the recovery, plus a dot plot showing no rate hikes even as activity picks up. That’s likely to confirm the Fed’s dovish stance. In today’s generally risk-on environment, the market’s tendency is to sell dollars anyway; this kind of a muted reaction function is likely to confirm that view and bring on more dollar selling.

Today’s data

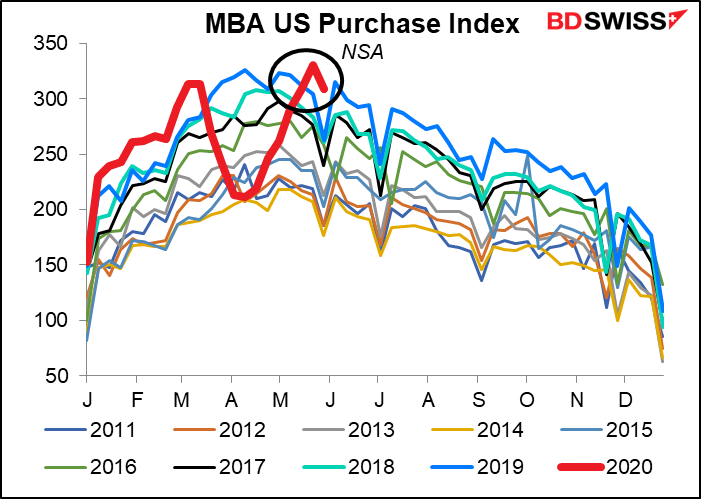

MBA mortgage applications turned down in the week to 29 May, but were still the highest for that week in the last 10 years. This housing is likely to be one of the engines of recovery for the economy.

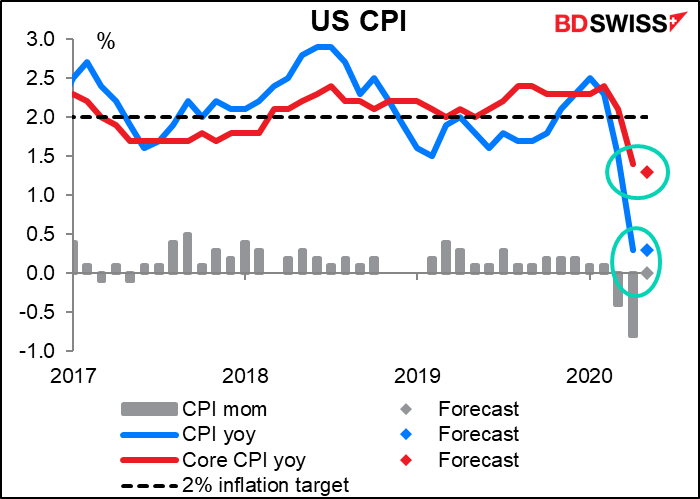

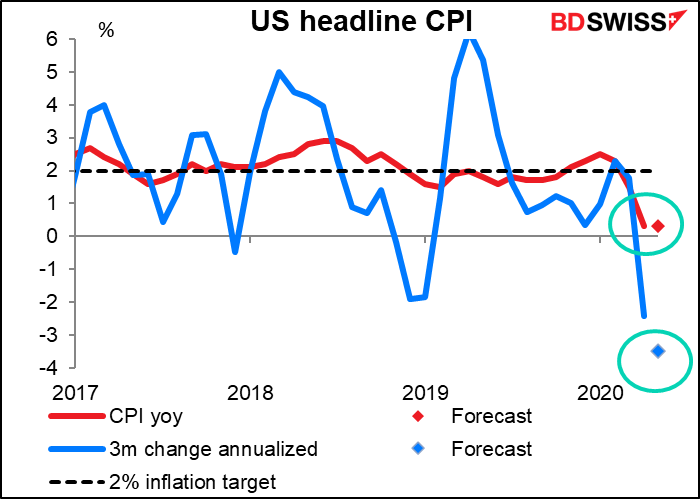

In normal times, today’s US consumer price index (CPI) would be the big indicator of the week, but that’s important because of its implications for Fed policy, and as we’ve just discussed the Fed is likely to keep rates around zero for the next several years anyway. Nonetheless, the headline rate of inflation is expected to be close to zero (+0.3% yoy).

If we take the three-month change in the CPI and annualize it, it would be a deep -3.5% yoy – well into deflationary territory. Data like this will tend to support the Committee members who are more worried about deflation than inflation and may lend a dovish – i.e., USD-negative – tone to their comments.

As mentioned above, the API shocked the oil market by announcing a fairly large build in crude oil inventories when a drop had been expected. What will the DoE announce? Stay tuned!

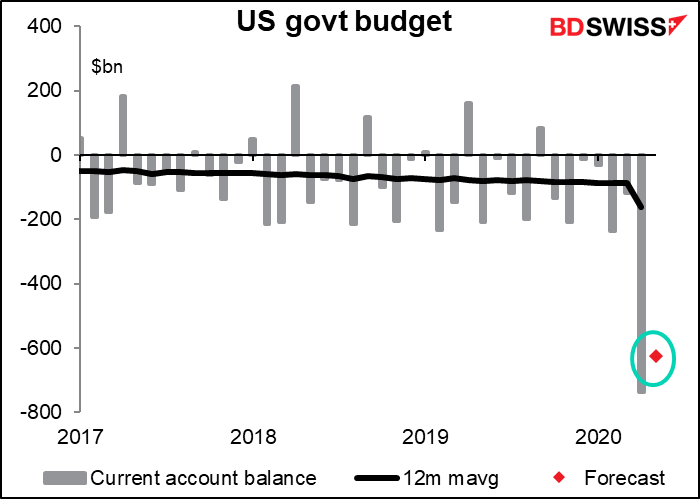

April was far and away the largest one-month US government budget deficit ever in nominal terms. May is supposed to be a little bit less, but still #2 in the all-time hit parade. As people in the bond world often say, “the bond crop never fails.”

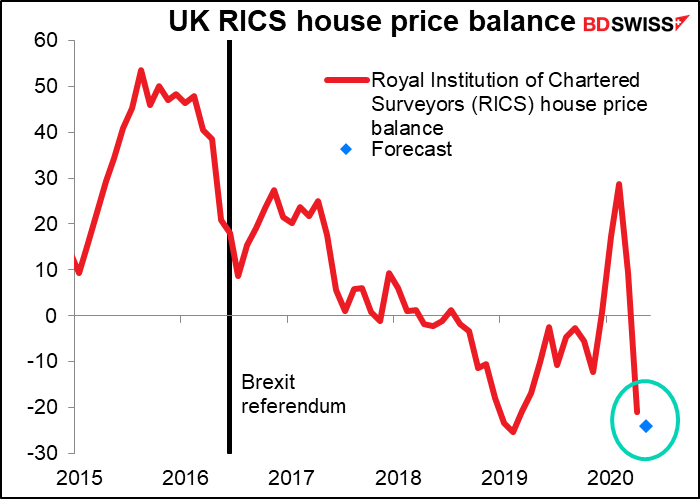

Overnight we get the RICS house price balance. I’m only surprised it’s not lower. Who was looking at houses in May anyway? Dominic Cummings was the only person allowed to leave his house, no?