Rates as of 04:00 GMT

Market Recap

I’ve rarely seen such an astonishing turnaround in market sentiment – from “buy anything” to “sell everything” in just a day or two.

Typical of the “buy anything” mood is the performance of Hertz Global Holdings Inc’s share price – a stock that went from $0.40 to $6.25 in nine working days (26 May to 8 June) – that’s 15.5x appreciation. Today it’s back to $2.01 as the company yesterday filed to issue 246.8mn new shares and potentially raise up to $1bn at around the recent high point for the company’s shares. The kicker? The rent-a-car company is in Chapter 11 bankruptcy proceedings.

Sell everything? That was the market as a whole yesterday, as the S&P 500 opened down 2.5%, which proved to be the high for the day, and closed down 6.4%, the low for the day. This was the third consecutive down day and the sharpest decline since the initial selloff in March. The selloff was across the broad, with only one company in the index higher on the day (the supermarket Kroger, up +0.40%).

Markets in Asia are all down this morning as well, although not nearly as much as New York was. The declines range from -0.25% in Shenzhen to -2.4% in India.

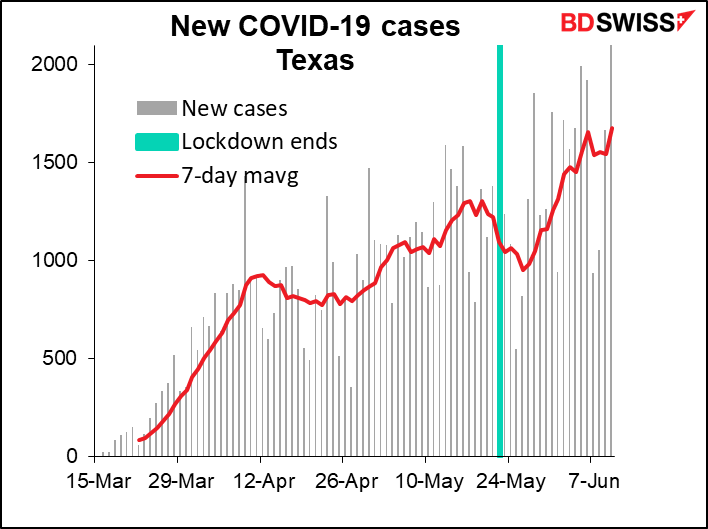

The cause of the turnaround is the growing evidence that the dreaded “second wave” of COVID-19 infections is indeed starting in the US as most states emerge from lockdown and people behave as if the virus had been wiped out. We’re seeing a spike in cases in several states a week or two after the lockdown ends. Typical of this is Texas, where new cases soared to their highest-ever level just a few weeks after the lockdown ended.

Almost half the country is now seeing a rise in new cases (that’s 24 out of 52 states & territories).

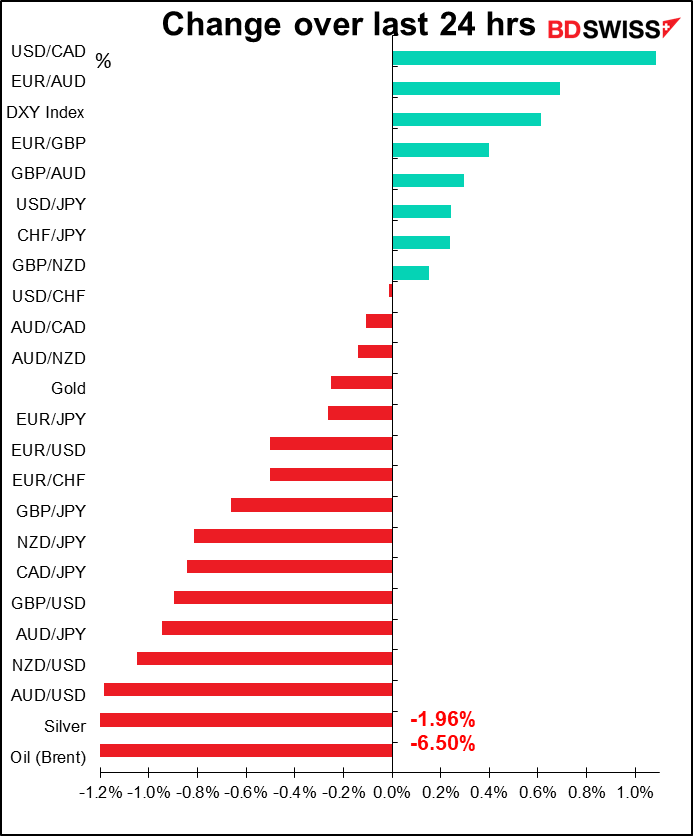

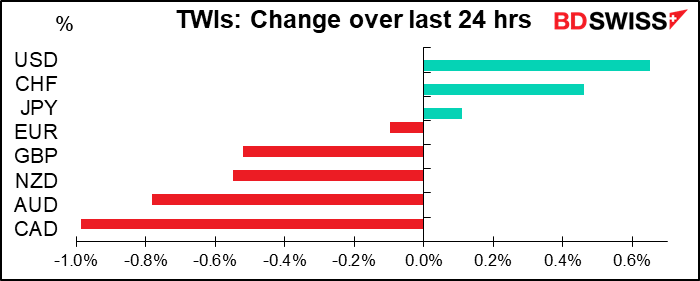

From the FX perspective, yesterday’s market was proof of the dollar’s “safe haven” characteristic. The immediate cause of the plunge in stock markets around the world is fear of further infections in the US, and yet the dollar was the best-performing currency. It reminds me of the 2008/09 Global Financial Crisis, when the collapse of the US housing market set off a global banking crisis and yet the dollar strengthened as a result. President Nixon’s Treasury Secretary, John Connally, famously said to a group of European finance ministers that “the dollar is our currency but your problem.” It appears that US problems are their currencies’ problems too.

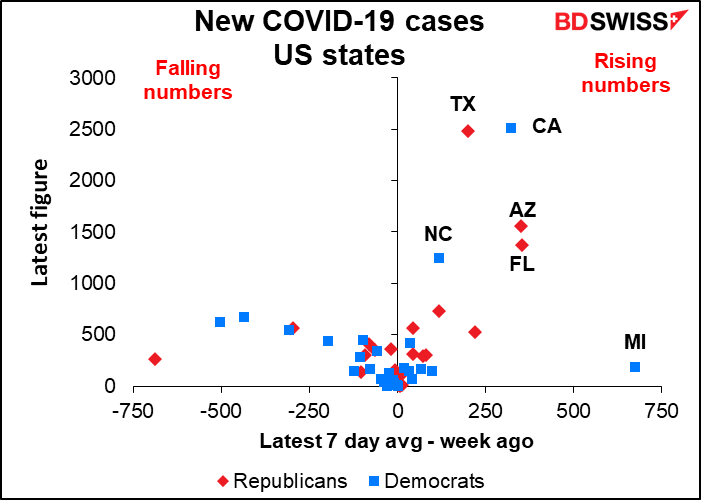

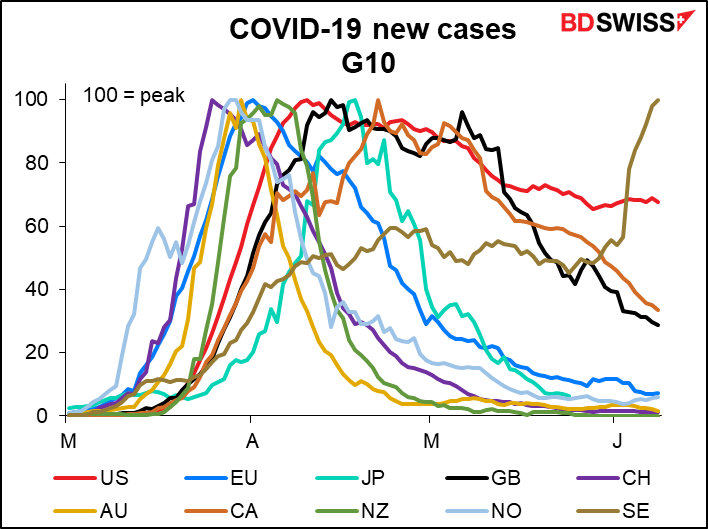

We can see what an outlier the US is among the G10 countries with regards to the virus. Only Sweden is in worse shape, and the population of Sweden is 10.2mn people, about one-third that of Texas alone (29mn).

Nonetheless, although the market’s immediate reaction may have been to buy dollars in these circumstances, I think the likelihood of a deadly “second wave” in the US is distinctly negative for the dollar in the near term. That’s because a) if the US has to go into lockdown again when the rest of the industrial world has already emerged, the growth differential is going to be simply insane, and b) a second wave would no doubt elicit a second wave of loosening from the Fed, including heaven-knows-what. A researcher at the St. Louis Fed has already argued that negative interest rates will be necessary to achieve a V-shaped recovery.

Longer-term though it could be good for the dollar if it helps to evict the current resident of 1600 Black Lives Matter Plaza in Washington, DC in November.

For a deeper discussion of the virus in the US and its potential impact on the dollar, please see my Weekly Outlook this week.

There really isn’t much else necessary to explain the movement of currencies yesterday. USD and the safe-haven CHF and JPY were the main gainers. CHF probably outperformed JPY because of the sharp appreciation of JPY in the early part of the week – this was catch-up. CHF/JPY started the week at 114.04 and hit 112.61 on Tuesday. It’s back up to 113.50 this morning.

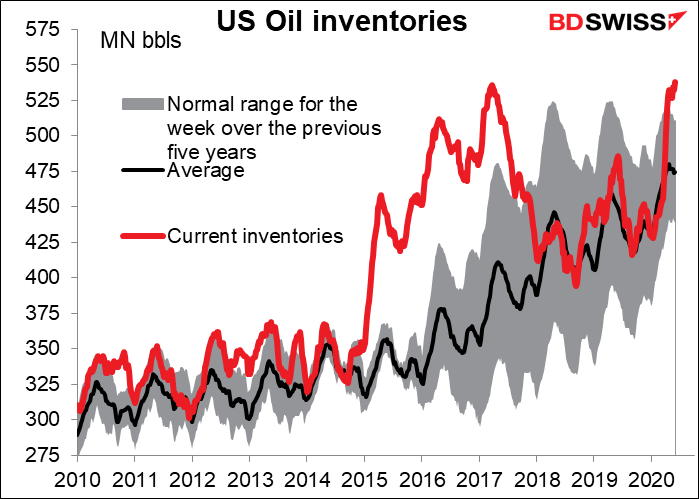

Naturally, the three commodity currencies were the big losers. Usually AUD is the commodity currency most sensitive to the risk-on, risk-off mood – in financial terms, the one with the highest beta to risk – but today it was CAD as oil prices plunged. Yesterday’s data from the US Department of Energy showed that US oil inventories unexpectedly rose in the latest reporting week to a record high despite the collapse in the number of oil rigs operating in the US to the lowest since records began in 1987 (see tonight’s Baker Hughes oil rig data).

I think we could see some mean reversion today in the FX market. As I mentioned above, Asian stocks aren’t showing the same sort of panic selling that the US saw. If indeed people calm down, they may get to thinking that yesterday’s moves were overdone and position for a reversal. Then again, it’s also possible that when the US opens up, the day traders who have been dominating market activity recently all panic and send stocks down further. That’s why I’d probably position for mean reversion during the European day but be careful around the US opening.

Today’s market

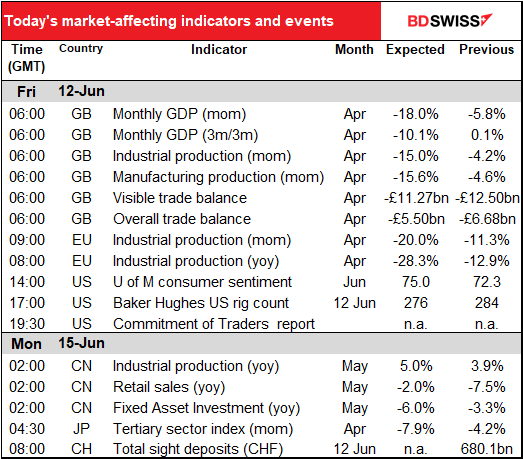

Most of today’s excitement is already over with the UK short-term economic indicators coming out at the break of day nowadays.

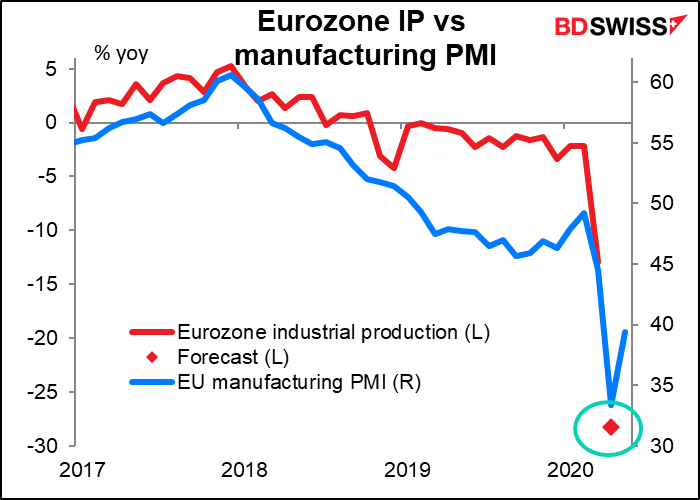

EU industrial production – all I have to say is that it’s for April and you know what’s coming. It’s terrible and it’s over. Besides, the Eurozone manufacturing PMI bottomed out at 33.4 in April and bounced back (if you can call it that) to 39.4 in May. Not much of a bounce, but it indicates that April was likely to be the trough. So I don’t think this disastrous figure will have that much of an impact on the market.

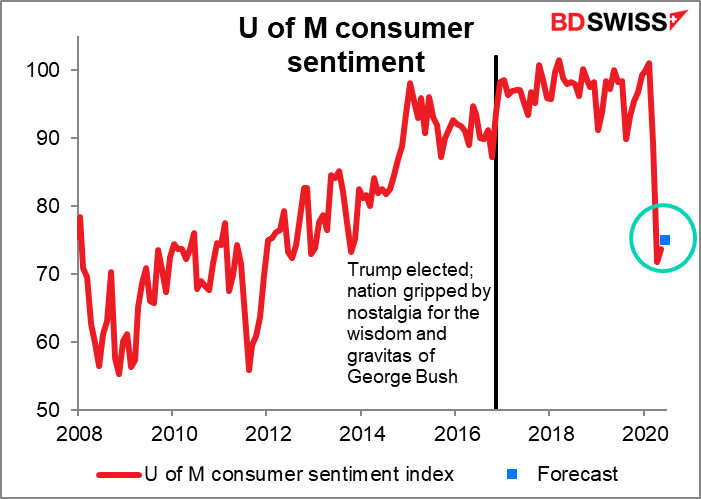

The University of Michigan consumer sentiment index is expected to continue to recover, but only slightly. The stock market has recovered a lot but conditions for the average worker remain grim – while things may be getting better, that doesn’t mean they’re good yet. The U-6 unemployment rate, which includes under-employment and people who’ve are too discouraged to look for a job, is over 20%, not far below the peak Depression unemployment level of 24.9%.

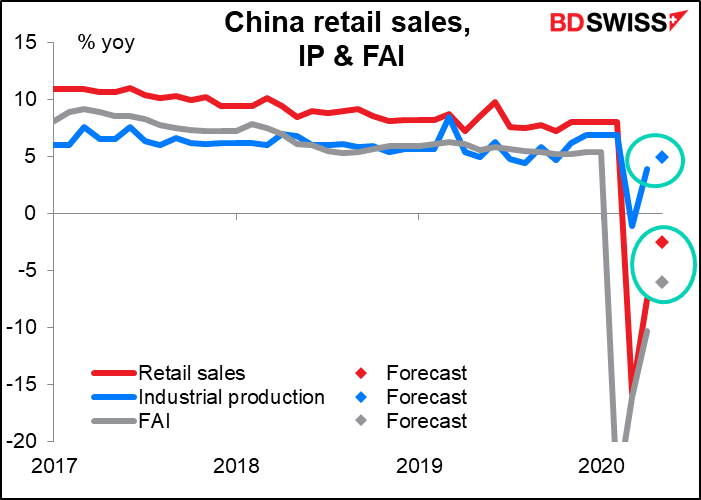

Then Monday morning Asia time, China announces its retail sales, industrial production and fixed asset investment (FAI). They’re all expected to continue to bounce back from the lockdown earlier in the year. This is a good sign for the world in general, because it suggests that while the initial shock to the economy is extraordinary, the journey back to normality is relatively quick. Their big lockdown was in February, so this is just three months later. It suggests the West might be getting close to normal again by July, which is much earlier than people had predicted (assuming of course no “second wave”).

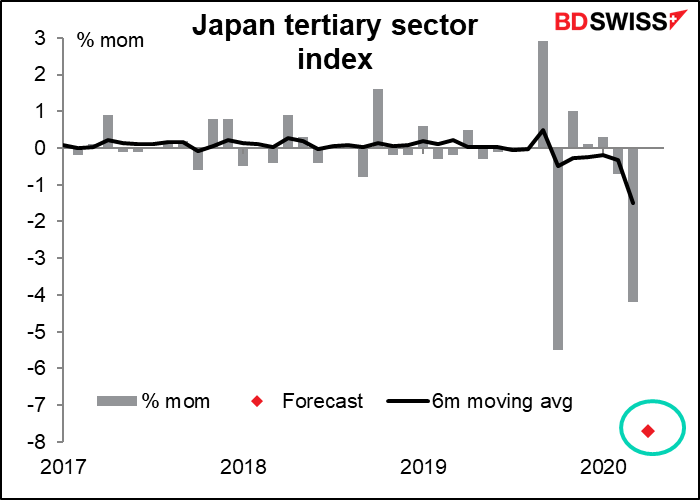

Japan’s tertiary sector index is of course expected to have plunged in April. Everything plunged in April.