PREVIOUS TRADING DAY EVENTS – 23 May 2023

Announcements:

RBNZ Governor Adrian Orr said at a media conference that there were signs higher interest rates were already having the desired effect.

“It is quite nice to see some of the things we were hoping would already be here actually be here. And that is the lower surprise on GDP, the decline in inflation and all the indicators that suggest the interest-sensitive parts of the New Zealand economy are yielding,” he said.

New Zealand’s annual inflation is currently running just below a three-decade high of 6.7%, with expectations it will return to the central bank’s 1% to 3% target within two years.

At the time of the release, the NZD depreciated greatly causing the NZDUSD to drop more than 70 pips at that time, with the effect continuing during the trading day still.

Source: https://www.reuters.com/markets/rates-bonds/rbnz-raises-cash-rate-by-25-bps-55-2023-05-24/

“With inflation proving stickier than the Bank expected, it now seems all but certain that the Bank will raise interest rates from 4.50% to 4.75% in June and perhaps a bit further in the months after,” Paul Dales, chief UK economist at Capital Economics, said.

The high 2-digit inflation was causing a serious problem for Britain’s government as well as the BoE. Despite the measures taken, it was remaining quite sticky.

“Although it is positive that it (inflation) is now in single digits, food prices are still rising too fast,” finance minister Jeremy Hunt said in a statement. “We must stick resolutely to the plan to get inflation down.”

Source: https://www.reuters.com/world/uk/uk-inflation-rate-falls-87-april-ons-2023-05-24/

These data suggest labour market resilience once more for the U.S. However, most economists expect a recession in the second half of this year when taking into account the continuous rate hikes, tightening credit conditions and U.S. debt default risk with an upcoming debt ceiling rising.

“Whereas manufacturing prices spiked higher during the pandemic due to strong demand and deteriorating supply, it is now the service sector’s turn to be hiking prices amid resurgent demand and an inability to cope with order inflows due to a lack of capacity,” said Chris Williamson, the chief business economist at S&P Global Market Intelligence.

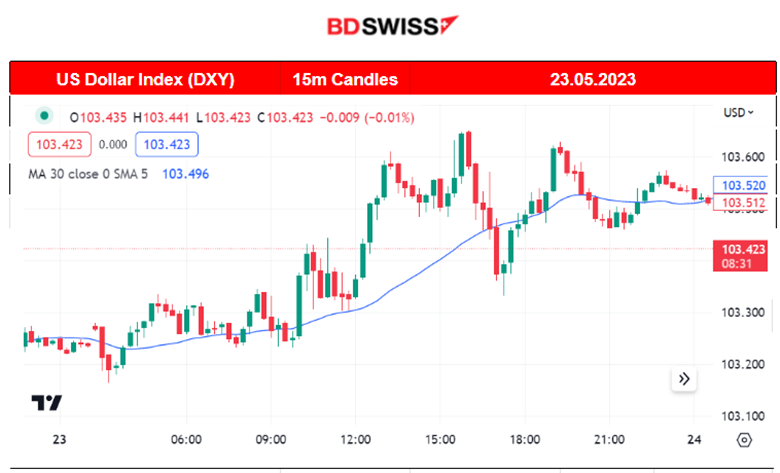

The survey’s Flash Services Sector PMI rose to 55.1, also a 13-month high, from 53.6 in April. The DXY (Dollar Index) increased overall yesterday.

______________________________________________________________________

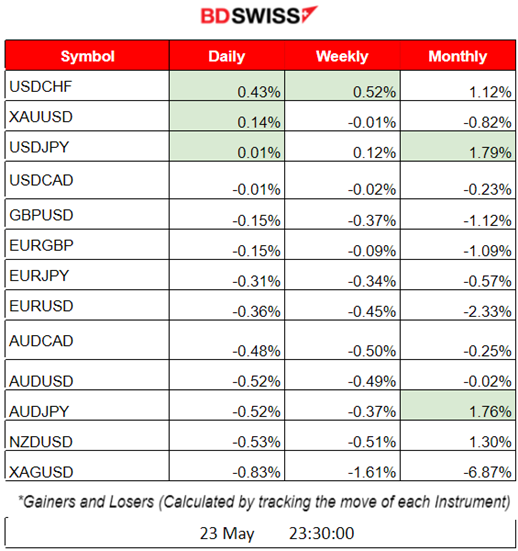

Summary Daily Moves – Winners vs Losers (23 May 2023)

- Yesterday, USDCHF moved significantly upwards reaching the top of the winners’ list with a 0.43% change. It also leads this week with a 0.52% change overall.

- This month’s top winners are USDJPY and AUDJPY with a 1.79% and 1.76% price change overall.

______________________________________________________________________

News Reports Monitor – Previous Trading Day (23 May 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

BOJ Core CPI Y/Y figure was released at 8:00 and was 3% versus the 2.9% previously reported figure.

- Morning – Day Session (European)

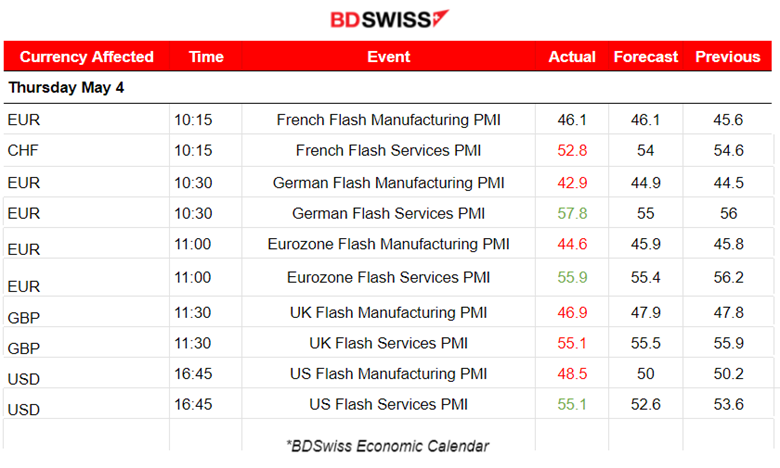

Flash PIM releases took place yesterday after the European Market’s opening. French, German and Eurozone PMI data were released first until 11:00. After those U.K. PMI data took place at 11:30 and the U.S. PMI data were released at 16:45 during the North America Session.

According to the Eurozone PMI data, it dropped in May due to manufacturing contraction. Less-than-expected figures caused a drop in pairs having EUR as the base currency. The U.K.s PMI figures also experienced a drop for both sectors. The U.S. PMI data were mixed. The Manufacturing sector worsened while the Services sector showed an improvement. USD appreciated after the release, reversing since it was previously dropping sharply. Overall growth in output was the fastest for just over a year. The expansion was led by service providers.

At 17:00, the U.S. reports regarding New Home Sales showed higher-than-expected figures and Richmond Manufacturing Index had a more negative figure than the previous one, showing worsening manufacturing activity in May.

General Verdict:

______________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (23.05.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

EURUSD started to drop with the European Markets opening. After 9:00, volatility started to increase and it moved below the 30-period MA. With the release of the Euro areas’ s PMI weak data, the pair moved rapidly downwards, finding support at 1.07600. It eventually retraced back to the mean and continued to test the support while volatility was easing.

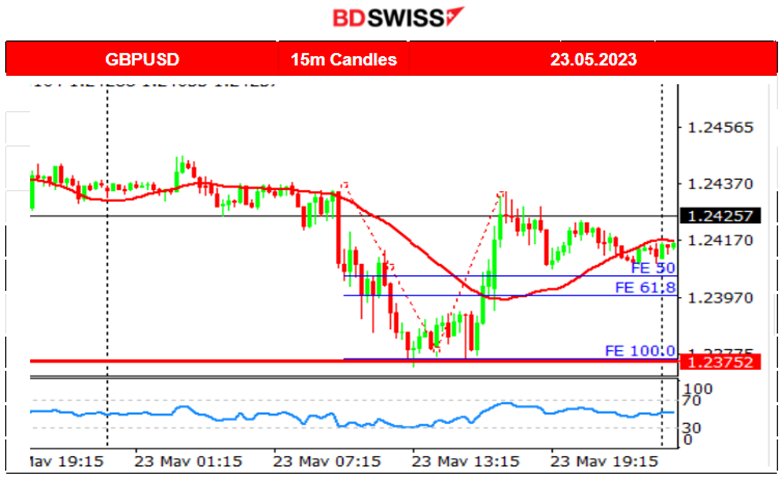

GBPUSD (23.05.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair also started to move significantly downwards during the European Session and further moved rapidly with the release of the PMI data at 11:30. It eventually found support at 1.23750 before experiencing a retracement back to the mean and beyond. It actually retraced 100%.

____________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Lately, we see that the index has stopped moving upwards aggressively. It found significant resistance levels and reversed showing signs that the upward trend has ended. On the 23rd of May, it dropped significantly even though the USD experienced an appreciation against other major currencies. U.S. output growth was reported to have reached a 13-month high in May. As per the RSI, a bearish divergence was formed since Price: Higher Highs, RSI: Lower Highs, thus explaining the downward movement on the technical side of things.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

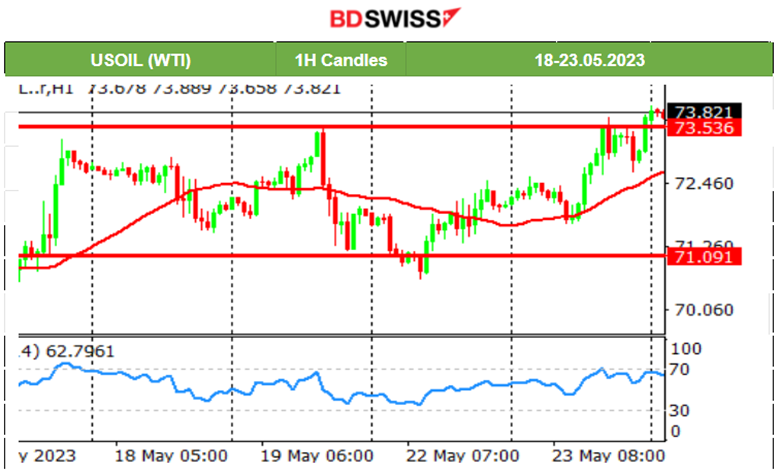

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Crude had settled near 72 USD/b as it was moving sideways and around the 30-period MA. Yesterday, it broke the 72.60 intraday resistance level and moved further upwards, breaking eventually the 73.50 resistance level. It was not showing any clear direction lately as it was moving sideways but yesterday with these breakouts it signals that it might move higher reaching even 76 USD/b in the coming days. However, its volatility and price path are greatly affected by fundamental announcements (i.e. OPEC+ news) so traders should be cautious.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Gold continues the sideways movement with high volatility. Deviations from the mean are near 10-15 USD. After testing the 1954 USD level yesterday, the 23rd of May, it eventually reversed and crossed the 30-period MA moving upwards. Important resistance might be the 1984 USD level. Breaking that might signal further push upwards.

______________________________________________________________

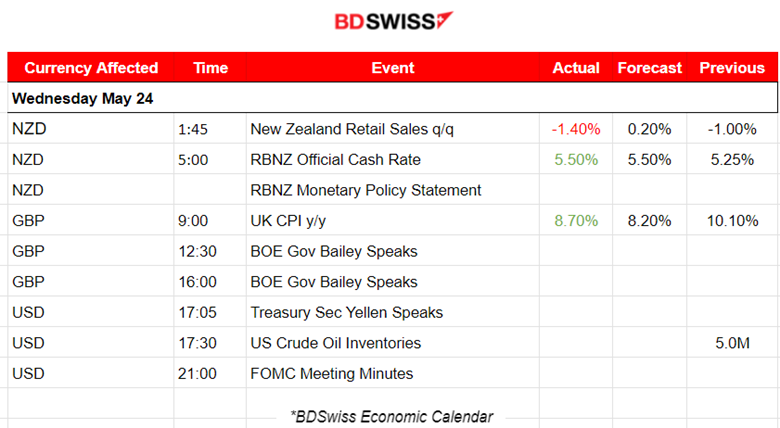

News Reports Monitor – Today Trading Day (24 May 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

New Zealand Retail Sales figures were weak, showing a more-than-expected reduction.

The New Zealand Reserve Bank increased the Official Cash Rate by 25 basis points as expected at 5:00. That caused high depreciation for the NZD pairs. NZDUSD dropped more than 70 pips. No retracement took place yet.

- Morning – Day Session (European)

At 9:00, the U.K. inflation figure was reported at 8.7%, lower than the previous 2-digit figure, of 10.10%, but higher than the expected 8.20%. For this reason, the GBP appreciated at the time of the release and later it steadily reversed.

BOE Governor will talk later at 12:30 and we expect more volatility to take place. He will probably refer to the fact that the Central Bank has achieved significantly lowering inflation with the decisions to rate hike.

Secretary of U.S. Treasury, Yellen, has a speech at 17:05 ahead of the FOMC meeting minutes that is taking place at 21:00. These could increase volatility and at night it is possible to experience a shock for the USD pairs.

General Verdict:

______________________________________________________________