PREVIOUS TRADING DAY EVENTS – 22 May 2023

Announcements:

Biden returned from his trip and resumed talks on Monday with the House Speaker, Kevin McCarthy. Despite the talks, no deal was reached about the debt limit. Treasury Secretary Janet Yellen had previously warned that it’s “highly likely” her department would run out of sufficient cash in early June and that default could come as soon as June 1st.

“The tone tonight was better than any other time we have had discussions,” McCarthy told reporters as he emerged from his meeting with the president. The two leaders, he said, “had a productive discussion. We don’t have an agreement yet.”

Source:

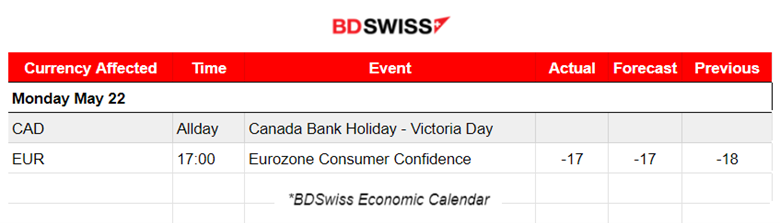

The Survey involves about 2,300 consumers in Eurozone countries which asks respondents to rate the relative level of past and future economic conditions. This month’s Flash CCI is calculated by taking into account data from 25 EU countries (all except Ireland and Romania), covering 97% (EU) and 98% (Euro area) of the total private final consumption expenditure.

In May 2023, the flash estimate of the consumer confidence indicator improved further in the EU (0.6 percentage points (pps.) up) while remaining broadly stable (0.1 pps. up) in the euro area (EA). At -18.3 (EU) and ‑17.4 (EA) pps., consumer confidence remains well below its long-term average.

Source:

https://economy-finance.ec.europa.eu/system/files/2023-05/Flash_consumer_2023_05_en.pdf

______________________________________________________________________

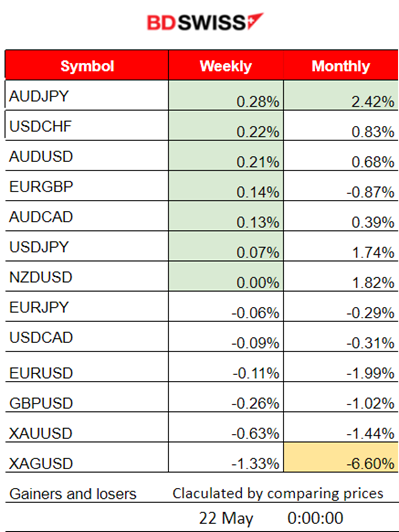

Summary Daily Moves – Winners vs Losers (22 May 2023)

- This week, the AUDJPY has been leading with 0.28% so far while it is the top gainer this month with a 2.42% price change overall.

- Metals are on the bottom this month, with Silver losing the most, having -a 6.6% change so far.

______________________________________________________________________

News Reports Monitor – Previous Trading Day (22 May 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news announcements, no scheduled releases.

- Morning – Day Session (European)

At 17:00, the Eurozone’s Consumer Confidence Index figure was released and it was as expected.

General Verdict:

______________________________________________________________________

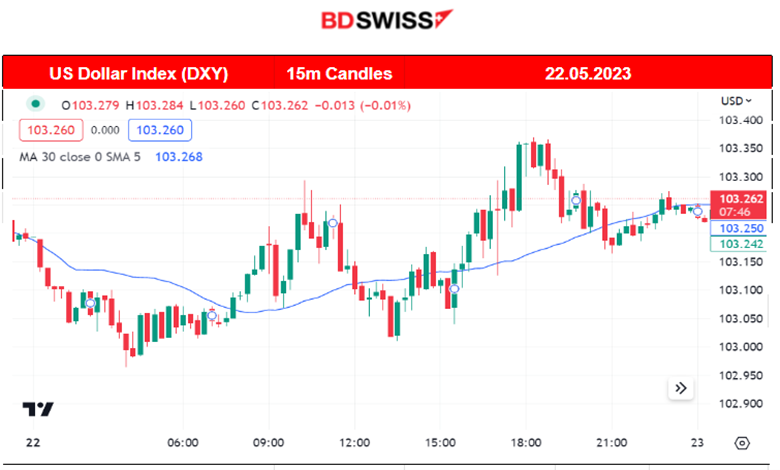

FOREX MARKETS MONITOR

EURUSD (22.05.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

EURUSD was experiencing low volatility as there was an absence of important scheduled releases. There was a 10-15 pips deviation from the mean as the pair was moving sideways. No shocks.

____________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On Friday, 19th of May, the index found strong resistance after a long 3-day upward path. The index eventually retraced on Friday but is refusing to drop further. It continued to move sideways, testing the resistance levels near 13900.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On Friday, 19th of May, oil dropped from its peak but also crossed the 30-period MA, moving further downwards, confirming a strong reversal. After finding significant support, it retraced back to the mean. There seems to be no clear direction, only high deviations from the mean around 10 USD, followed by reversals/retracements. It has currently settled near 72 USD/b.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Gold has been experiencing a downward trend recently as the USD was gaining ground due to rate hike expectations that were later revised. On Friday, 19th of May, Gold moved upwards, crossing the 30-period MA, signalling the end of the downward trend. The USD experienced a strong depreciation as talks regarding a rate hike pause are confirming the expectations. It continued its move sideways with high volatility until more data suggest the start of another trend. Breaking the supports, the 1956 USD and 1953 USD levels suggest that it will eventually drop further.

______________________________________________________________

News Reports Monitor – Today Trading Day (23 May 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news announcements, no scheduled releases.

- Morning – Day Session (European)

Flash PIM releases are taking place for many regions and are going to cause market turmoil after the start of the European Session.

At 17:00, the U.S. reports regarding New Home Sales and Richmond Manufacturing Index could have an impact on the USD pairs but no major shock is expected.

General Verdict:

______________________________________________________________