Previous Trading Day’s Events (10.04.2024)

The latest labour market data showed that job growth accelerated in March, with the unemployment rate down to 3.8% from 3.9% in February.

“The data does not completely remove the possibility of Fed action this year, but it certainly lessens the chances the Fed is cutting the overnight rate in the next couple of months,” said Phillip Neuhart, director of market and economic research at First Citizens.

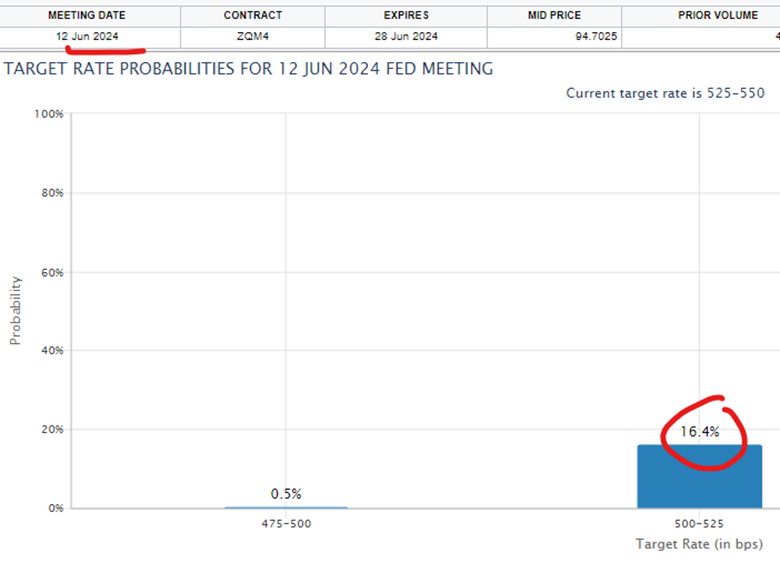

Financial markets pushed back their expectations for the first rate cut to September from June, according to CME’s FedWatch Tool. They now expect only two rate cuts instead of the three envisaged by Fed officials last month. A minority of economists see the window for rate cuts closing.

The central bank has kept its policy rate in the 5.25%-5.50% range since July. It has raised the benchmark overnight interest rate by 525 basis points since March 2022.

“The strong inflation data … should force the Fed to go back to the drawing board with regards to their monetary policy ambitions for the year,” said Charlie Ripley, senior investment strategist at Allianz Investment Management in Minneapolis.

Source: https://www.reuters.com/markets/us/us-consumer-prices-rise-more-than-expected-march-2024-04-10/

Inflation has been falling in recent months but at 2.8%, it is still above the bank’s 2% target.

“We just need to see it for longer to be confident that we are clearly on a path to 2% inflation and when we are at that point it will be appropriate to reduce our interest rate,” Macklem told reporters.

U.S. consumer prices increased more than expected in March by 0.4% after advancing by the same margin in February, pushing back hopes of a Fed rate cut further into the second half.

______________________________________________________________________

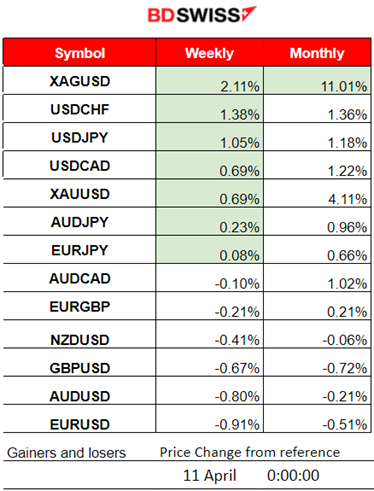

Winners vs Losers

Silver remains on the top of the week’s winners list with 2.11% gains while for the month has performed at 11.01%. The dollar strengthened significantly yesterday causing the USD pairs to jump to the top (base currency USD).

______________________________________________________________________

______________________________________________________________________

News Reports Monitor – Previous Trading Day (10.04.2024)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

RBNZ held the OCR at 5.50% in hopes of the return of the CPI inflation to the 1% to 3% target in 2024. NZD was affected by an overall appreciation of the currency. NZDUSD moved near 20 pips upwards.

- Morning – Day Session (European and N. American Session)

The U.S. inflation data (CPI) caused a shock as the figures surprised the markets by beating expectations. A higher-than-expected inflation caused a Dollar Index surge challenging expectations of an imminent rate cut. US Consumer Price Index (CPI) figures outpaced forecasts for the fourth consecutive month, reaching 3.5% over the 12 months to March. Now a June rate cut seems less likely after the hot CPI. Gold prices faced downward pressure amidst a strengthening U.S. Dollar.

The Bank of Canada has left the target for the overnight rate at 5%, in line with market expectations, and is continuing with its policy of quantitative tightening. The Bank expects the global economy to continue growing at a rate of about 3%, with inflation in most advanced economies easing. Recent data, including an unexpected slowdown in inflation and a stall in the jobs market, have increased expectations that they will begin to cut rates in June.

Source: https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

General Verdict:

__________________________________________________________________

__________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (10.04.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

After the start of the European session, the pair started to move slightly to the upside but no significant volatility was observed. Later after the higher-than-expected inflation figure for the U.S., the dollar experienced huge appreciation causing a heavy drop in the EURUSD until it found support at near 1.07250. Retracement was only some, not fully to the 61.8 Fibo level. That kept the pair low until the end of the trading day. Today we might experience some upward movement completing that retracement.

USDCAD (10.04.2024) 15m Chart Summary

USDCAD (10.04.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

USDCAD was also moving sideways, slightly below the 30-period MA, before the U.S. inflation report release. After the release obviously the USD strengthening drove the pair to the upside. A shock caused the pair to reach the level near the first resistance at 1.36780. Later the BOC decision took place at 16:45, the central bank decided to leave the OR unchanged, but that did not have much impact on the market. The USDCAD continued towards the next resistance at near 1.37 before a slight retracement took place, keeping the pair high until the end of the trading day.

___________________________________________________________________

___________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) Chart Summary 1H

Server Time / Timezone EEST (UTC+02:00)

Price Movement

As mentioned in our previous analysis the price of Bitcoin was forming an upward wedge that eventually broke to the upside. This caused the price to jump to 72,700 USD resistance level. After that, the price eventually reversed to the downside. It seems that this drop is quite aggressive as it crosses the 30-period MA and stays below it giving a strong signal that the uptrend has stopped. A sideways path is currently in place. Bitcoin experiences high volatility and moves around the 30-period MA and the mean which should currently be around 70K USD.

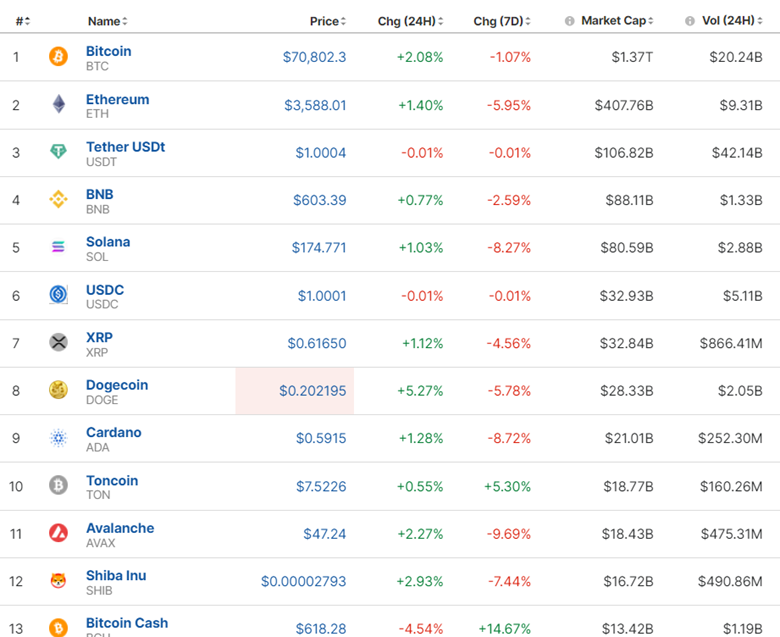

Crypto sorted by Highest Market Cap:

Crypto sorted by Highest Market Cap:

A volatile market at the moment but sideways. The most recent moves include a recovery to the upside thus the positive figures/gains for the last 24 hours.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

S&P500 (SPX500) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

It was apparent that volatility levels lowered as market participants were expecting the inflation report, in order to react greatly. A =n upward wedge was formed. Eventually, a breakout of the triangle/wedge formation took place as depicted below with the release of the higher-than-expected inflation figure for the U.S. This means that borrowing costs will remain high for a long time, causing this market reaction. All indices suffered a drop. The index found support near the 5,135 USD level before retracement took place.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

This week volatility levels for Crude oil fell and a triangle formation took place. The 30-period MA turned to the downside but the price action was volatile and around the MA. It seems that we currently have a breakout to the upside since the price jumped some hours after the U.S. inflation report was released yesterday and the U.S. inventories news showed a lot more barrels in inventories. It could be the case that the price will test higher levels in the near future, probably reaching the 86 USD, or even the 87 USD resistance level, purely technically speaking.

XAUUSD (Gold) 4-Day Chart Summary

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

It has been a long time now since Gold has experienced this uptrend. It is quite resilient to the downside even when we have news releases that cause the dollar to strengthen. The NFP data release did not manage to bring it down. The inflation report yesterday caused a heavy dollar strengthening and again Gold was not affected by a heavy drop but rather kept its resilience. However, the uptrend seems to have reached a halt for now. Will this be the turning point? The price is now below the 30-period MA. The level 2,325 USD/oz I would say it’s critical for the confirmation of a retracement back to the 2,300 USD/oz level.

______________________________________________________________

______________________________________________________________

News Reports Monitor – Today Trading Day (11 April 2024)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

China’s Consumer Price Index (CPI) rose 0.1% YoY in March, down from a 0.7% growth in February. The market forecast was for a 0.4% increase. Chinese CPI inflation came in at -1.0% over the month in March versus February’s 1.0% rise. China’s Producer Price Index (PPI) fell 2.8% YoY in March, compared with a 2.7% drop seen previously. No major impact was recorded at that time. USDCNH was following a slight intraday drop during the release.

- Morning – Day Session (European and N. American Session)

The European Central Bank (ECB) is deciding on rates as well at 15:15 and is expected to keep rates unchanged for now. The Eurozone economy suffered lately due to this tightening policy with business conditions deteriorating greatly. However, it has indeed helped dampen inflationary pressures. Inflation fell to 2.4% in March, pushing the ECB one step closer to cutting interest rates. Most ECB officials have pointed to a cut in June as the most likely scenario. EUR pairs are expected to see volatility and even intraday shock at the time of the release or even during the press conference at 15:45.

PPI data releases for the U.S. are taking place on the same day at 15:30. It is expected that the PPI data will be reported lower but that is unlikely. The labour market data and the PMIs are indicating strong business and economy. It would be surprising to see a significant drop in these numbers. A surprise increase will potentially cause USD to strengthen at the time of the release.

General Verdict:

______________________________________________________________