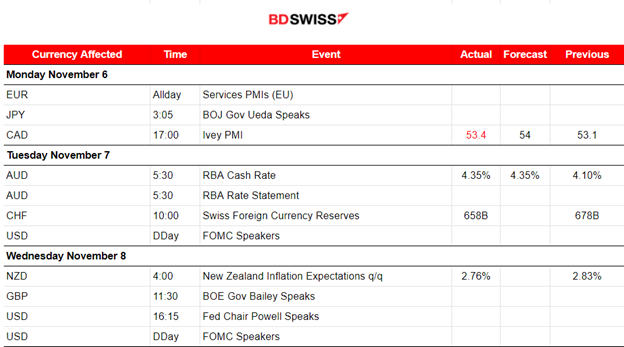

PREVIOUS WEEK’S EVENTS (Week 06 – 10 Nov 2023)

Announcements:

Eurozone Economy

The Eurozone business activity downturn accelerated last month due to demand weakness. The PMI data suggest a growing chance of a recession in the 20-country currency union. The economy contracted by 0.1% in the third quarter as per the PMI survey. Final PMIs are consistent with our forecast that euro-zone GDP might contract again in Q4.

Services activity in Germany, Europe’s largest economy, slipped back into contraction in October, while in France it shrank again. Italian services activity contracted for a third month running and at its fastest pace in a year.

U.S. Economy

The U.S. Jobless Claims figures were reported lower for last week even as the reports regarding the labour market show strong signs of cooling.

Unemployment benefits fell 3K to a seasonally adjusted 217K for the week ended Nov. 4 from an upwardly revised 220K in the prior week. The claims data adds to the case for the U.S. Federal Reserve to keep interest rates on hold for now, economists said.

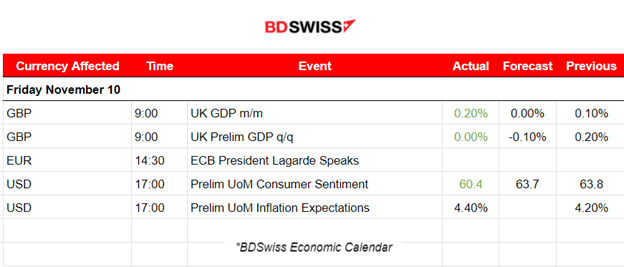

Inflation has fallen significantly to 3.4% but has made little further downward progress recently. The Fed meets once more this year, in mid-December and it is not expected that there will be a rise in rates. A sudden jump in the price of U.S. indices took place on Friday. All main indexes ended with big gains as they were boosted by heavyweight tech and growth stocks.

The reports from the University of Michigan showed that U.S. consumer sentiment fell for a fourth straight month in November and households’ expectations for inflation saw another increase.

The preliminary reading of its Consumer Sentiment Index dropped to 60.4, the lowest level since May, from October’s final reading of 63.8.

Consumers’ outlook for inflation in the year ahead rose for a second month to a seven-month high of 4.4%, “indicating that the large increase between September’s 3.2% reading and October’s 4.2% reading was no fluke,” Hsu said.

In the U.S. overall employment is back to record highs, jobless rates are near historic lows, wages have been rising faster than before the health crisis, and overall economic growth has been running well above trend.

Gasoline prices have fallen 12% from their highs of the year set in September and are now at their lowest since March, according to the U.S. Energy Information Administration.

_____________________________________________________________________________________________

Interest Rates

RBA

The Reserve Bank of Australia (RBA) raised interest rates to a 12-year high on Tuesday. It raised its cash rate by 25 basis points to 4.35%, saying recent data suggested inflation would remain higher for longer causing more risk.

Economic growth slowed to a two-year low of 2.1% and the RBA sees it approaching 1% in 2024 as the full impact of the higher rate takes full effect.

Consumer price inflation exceeded forecasts in the third quarter to run at 5.4%, well above the RBA’s long-term target range of 2-3%. A rate hike was essentially expected. The hike puts the RBA in the odd position of still following a policy tightening.

______________________________________________________________________

_____________________________________________________________________________________________

Currency Markets Impact – Past Releases (Week 06 – 10 Nov 2023)

Server Time / Timezone EEST (UTC+02:00)

PMI releases for the services sector in the Eurozone:

Spain PMI

The services sector is actually doing better in Spain with PMI reported in the expansion area and the figure is higher than the previous. The services economy expanded for a second successive month. Higher activity was attributed due to more hiring, amid some positivity about the future.

Italy PMI

A worse figure for Italy’s services sector in October. The PMI was reported to be 47.7 in contraction and lower than the previous figure. Both activity and new orders fell at their quickest rates in a year. Firms are facing uncertainty due to geopolitical events and faced a marked contraction in sales to non-domestic markets.

France PMI

French business activity across the service sector fell at a strong pace at the start of the fourth quarter. PMI was reported lower at the devastating figure of 45.2 points. A further marked reduction in demand for services from customers both domestically and internationally was a key factor that contributed to this contraction state.

Germany PMI

Germany’s PMI was reported at 48.2 points confirming contraction amid persistent weakness in demand. The labour market is stable with employment decreasing just fractionally. Firms’ expectations towards future activity remained subdued but confidence levels improved.

Eurozone PMI

The eurozone economy continued with contraction extending the current period of decline seen so far in the second half of 2023. In fact, the rate of decrease in business activity accelerated since September. The key factor is the weak level of demand for services. The PMI survey reported the same figure at 47.8.

_____________________________________________________________________________________________

FOREX MARKETS MONITOR

EURUSD

EURUSD experienced high volatility last week, however remained more on the sideways rather than moving in one direction significantly. The devastating PMI data for the Eurozone pushed the pair to the downside early but it later recovered moving above the 30-period MA on the 8th Nov. On the 9th Nov, the Fed’s Powell comments caused the USD to appreciate against the EUR causing the pair to drop and remain lower, below the MA. A retracement followed with the EURUSD testing again the support at near 1.06590 with no success of a breakout. It retraced back to the mean and is moving currently around 1.06750.

Dollar Index (US_DX)

The dollar index saw strength against other currencies last week. It moved early to the upside and mostly moved while being above the 30-period MA for the whole week. Fed’s Powell comments during a speech on the 9th Nov have pushed the dollar more to the upside.

CRYPTO MARKETS MONITOR

BTCUSD

Bitcoin started to gain ground and began a path to the upside that seemed to have an exponential pace. The price broke the 36000 resistance and jumped to the next level at near 36800. Then it surprisingly jumped to the strong resistance near 38000 before eventually reversing back fully to the mean and settling near 36500.

Bitcoin’s recent upswing is mainly due to “optimism around a near-term spot Bitcoin ETF approval and a resulting short-squeeze,” Brian Rudick, a senior strategist at crypto trading firm GSR, told Fortune. Bitcoin “continues to perform well as the market focuses on the U.S. spot ETF approval process,” sources say.

https://finance.yahoo.com/news/bitcoin-approaches-38-000-ethereum-165519468.html

As per the chart below, Bitcoin moved higher again after the mean reversal and volatility dropped to lower levels with the price moving sideways around the mean, being close to 37000 currently.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

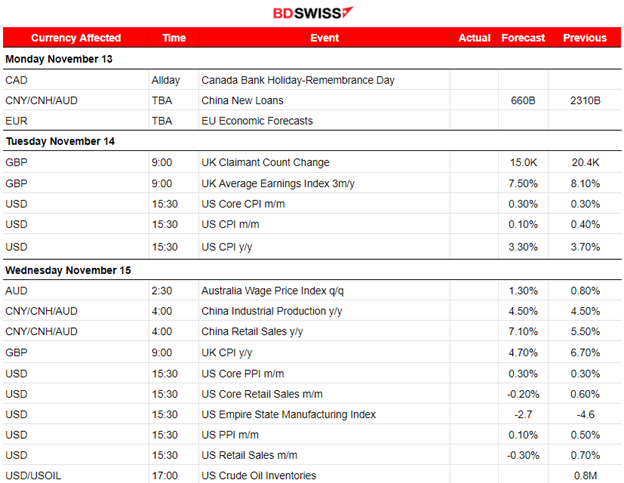

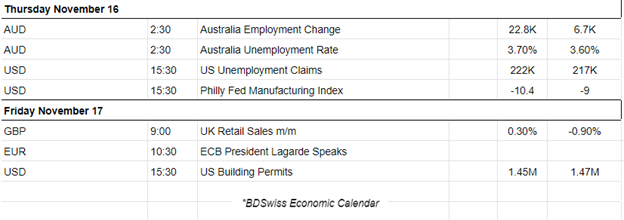

NEXT WEEK’S EVENTS (13-17.11.2023)

Eyes are on the inflation data that are going to be released this week for both the U.S. and the U.K.

Interesting reports include the release of the labour data figures for Australia and WPI.

Other important figures include the jobless claims for the UK, Claimant Count Change data, and the U.S. Unemployment claims. In addition, retail sales figures for both the U.S. and the U.K. are also scheduled to be released this week.

Currency Markets Impact:

_____________________________________________________________________________________________

COMMODITIES MARKETS MONITOR

U.S. Crude Oil

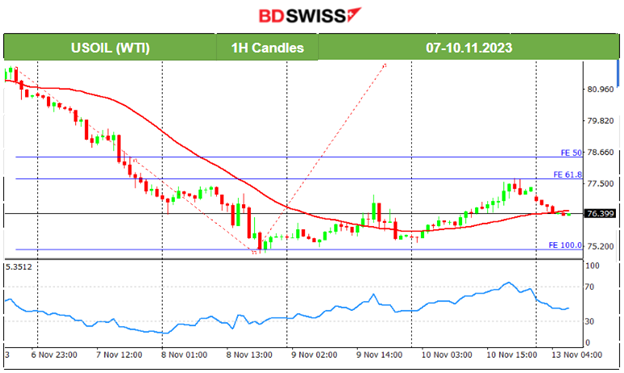

Crude movement was to the downside last week, following a short-term downward trend. It found strong support at 75 USD/b, after which the price eventually reversed to the upside, showing signs that the trend is over and confirming the bullish divergence signal. It eventually broke the 77 USD/b moving to the upside reaching near 78 USD/b in order to complete the retracement to the 61.8 Fibo level but soon later reversed back again to the 30-period MA.

Gold (XAUUSD)

We had a clear downward trend last week regarding Gold’s price.

The RSI showed signals of a bullish divergence (higher lows) while the price was showing lower lows. On the 9th Nov, the price reversed. It jumped higher crossing the 30-period MA, confirming the bull signal and retraced back to the mean after finding strong resistance.

It, however, reversed again on the 10th Nov, to the downside this time. Wall Street’s main indices ended with big gains on Friday, boosted by heavyweight tech and growth stocks as Treasury yields calmed. Metals lost ground instead. Gold broke the support near 1945 USD/oz and currently remains under the 30-period MA testing levels near 1935 USD/oz.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX)

Price Movement

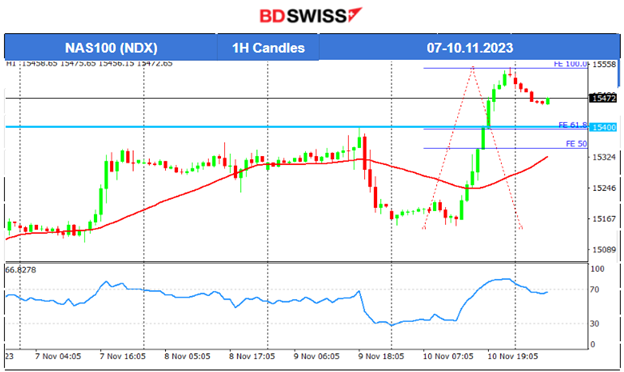

Instead of a retracement, the U.S. Stocks experienced a shock on Friday. We were expecting that the indices would break significant support levels and eventually trigger a retracement after a long and rapid movement to the upside. Instead, on friday, they jumped to higher and higher levels rapidly. The NAS100 broke the resistance at 15400 and moved higher until it reached levels near 15550 before retracing. The retracement is not completed yet technically, since the index did not reach apparently to the 61.8 Fibo level.

TradingView Analysis and Ideas:

https://www.tradingview.com/chart/NAS100/qdNfiDiR-NAS100-Retracement-13-11-2023/

______________________________________________________________