Previous Trading Day’s Events (04 Dec 2023)

“Holding the cash rate steady at this meeting will allow time to assess the impact of the increases in interest rates on demand, inflation and the labour market,” RBA Governor Michele Bullock said.

“The statement, in our view, was less hawkish than November’s and also less hawkish than we expected,” Barclays analysts said in a note to clients. “We continue to think the hiking cycle is over, though we do note the bank’s data-dependent approach means the possibility of another hike after the Q4 inflation print.” Those figures are due in late January, ahead of the next RBA meeting on Feb. 6.

According to the monthly inflation report for October, it fell by more than expected, insufficient to provide an update on services. Rates have now risen by 425 basis points since May last year.

Source:

Recent inflation data showed that inflation was subsiding in October, raising optimism that the Federal Reserve was probably done raising interest rates this cycle, with financial markets and economists even anticipating a rate cut in mid-2024.

“These data will be welcome news for policymakers,” said Rubeela Farooqi, chief U.S. economist at High Frequency Economics in White Plains, New York. “The data support our view that rates are at a peak and the Fed’s next move will be a rate cut, likely in the second quarter of 2024.”Job openings, a measure of labour demand, fell 617,000 to 8.733 million on the last day of October, the lowest level since March 2021, the Labor Department’s Bureau of Labor Statistics said. Data for September was revised lower to show 9.350 million job openings instead of the previously reported 9.553 million.

The Fed is expected to leave rates unchanged next Wednesday. Since March 2022, the central bank has raised its benchmark overnight interest rate by 525 basis points to the current 5.25%-5.50% range.

______________________________________________________________________

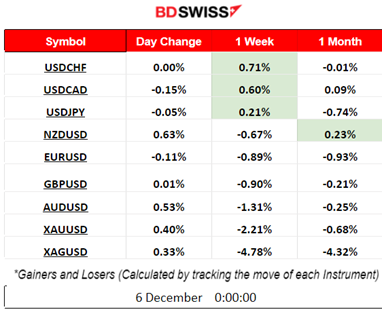

Winners vs Losers

______________________________________________________________________

______________________________________________________________________

News Reports Monitor – Previous Trading Day (05 Dec 2023)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

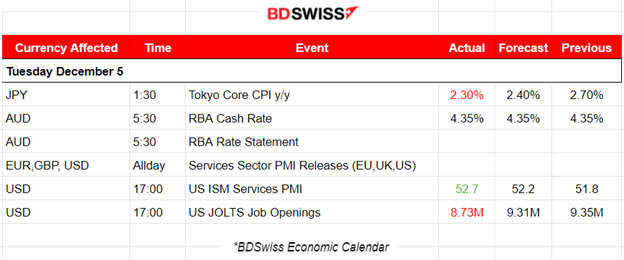

The Tokyo Core CPI yearly change was reported lower than expected at 2.3%. JPY experienced moderate depreciation at that time. USDJPY jumped near 30 pips before retracing to the mean following a volatile path around the MA near the time of the release.

The Reserve Bank of Australia (RBA) decided to leave rates unchanged. Cash Rate remains at 4.35%. The Mon. Report stated; “Whether further tightening of monetary policy is required to ensure that inflation returns to target in a reasonable timeframe will depend upon the data and the evolving assessment of risks”, further stating that they remain determined to return inflation to 2-3% target level. The market’s reaction was AUD depreciation. AUDUSD fell near 30 pips before retracing to the 30-period MA.

- Morning–Day Session (European and N. American Session)

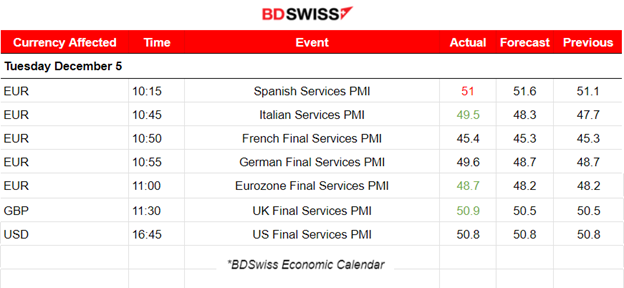

The PMI releases for the Services sector:

Eurozone Services PMIs

The Spanish PMI recorded a 51 points figure suggesting that the service sector’s moderate expansion was sustained in November. Extra capacity and employment growth were sustained as positive projections for activity were projected during the period.

The Italian PMI figure was improved but again in the contraction area below 50. The Italian service providers experienced once again declining activity as demand weakness continued in Services. Contraction seems to ease though.

The French PMI figure was reported at 45.4. Another solid contraction. The released report indicates that demand for French services fell at the fastest pace in three years. The French expect weak growth expectations for the next 12 months and lay-offs were reported high, as firms tried to reduce costs. Output charge inflation ticked up to a four-month high as input cost pressures remained at historically high levels.

The German PMI figure was reported 49.6, close to 50 but again in contraction. Business activity fell marginally in November with a slower decline in new business, Employment once again showed little change. Service providers expected little growth in activity over the next 12 months. Latest data showed a rise in cost pressures across the service sector as rising wages drove the steepest increase in firms’ input prices for six months.

The Eurozone PMI was reported at 48.7 indicating that the eurozone’s economic activity continues to shrink with declines in new business and backlogs of work being sustained.

United Kingdom Services PMI

In the U.K. the business conditions improved slightly. The PMI figure was reported in the expansion area, 50.9, a modest rebound in business activity across the UK service sector in November. Rising output as new orders were higher, but no significant increase in demand and still low consumer confidence. Service providers suffered an increase in average cost, mainly due to wages and elevated inflationary pressures across the economy.

United States of America Services PMI

The PMI figure was recorded at 50.8, in the expansion area, as U.S. service sector firms signalled further growth in November. Output and new business expanded with a renewed increase in new orders.

Once again we see that the business activity in the services sector expands, even slightly, instead of contracting like the manufacturing sector when we focus outside the Eurozone, in the U.K. and the U.S.

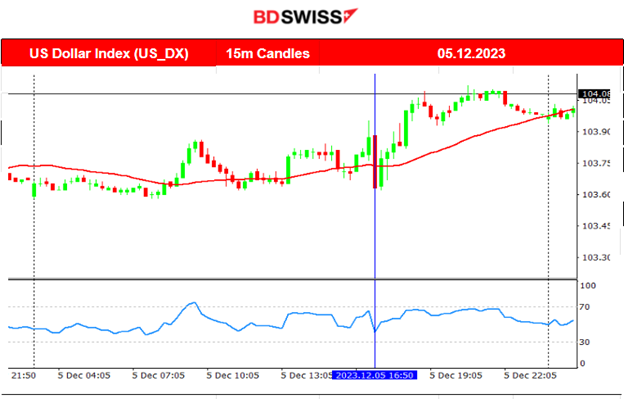

The ISM Services PMI figure was reported higher than expected at 17:00. Although new orders remained at the same levels and inflation fell significantly the November data are showing expansion in the sector. The market reacted with a moderate shock at that time experiencing an up-down effect that did not lead to a significant movement to one direction.

At the same time, the JOLTS Job Openings was released showing a way lower than expected figure, 8.7M more jobs vs the expected 9.3M, the lowest level since March 2021. The effects of high rates on labour are apparent. Federal Reserve policymakers watch the labour-related reports closely amid NFP to determine if elevated rates are still needed. Even though the dollar weakened momentarily after the report release it continued with a reversal soon after and on its way up during the rest of the trading day.

General Verdict:

____________________________________________________________________

____________________________________________________________________

FOREX MARKETS MONITOR

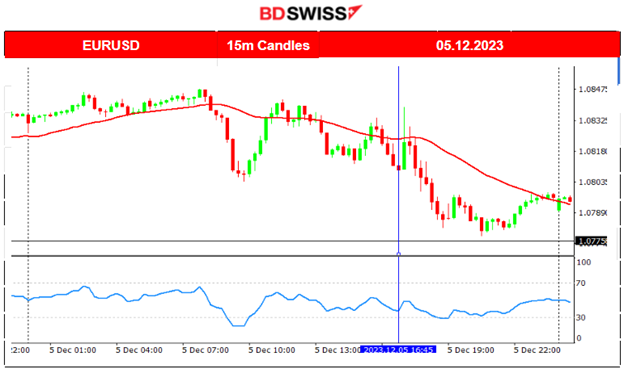

EURUSD (05.12.2023) Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The pair was showing higher volatility during the European session than typical because of the Services PMI releases. The PMIs were all reported in contraction and the EUR was losing ground against the USD. After 17:00 the ISM Services PMI and the JOLTS Job openings report had affected the USD with a moderate shock with the pair experiencing no significant deviation from the mean. The USD continued to appreciate against the EUR and the pair moved to the downside further until the end of the trading day.

___________________________________________________________________

___________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Bitcoin remains on the upside. It managed to pass through the 42K USD level and reached higher levels near the resistance of 44.5K USD. This sharp increase in values started on the 1st Dec and has been reaching new highs more frequently over the past several weeks as optimism grew around the likelihood of a spot bitcoin ETF approval in the U.S. Investors are also looking forward to the Bitcoin halving, which is expected to take place in spring 2024.

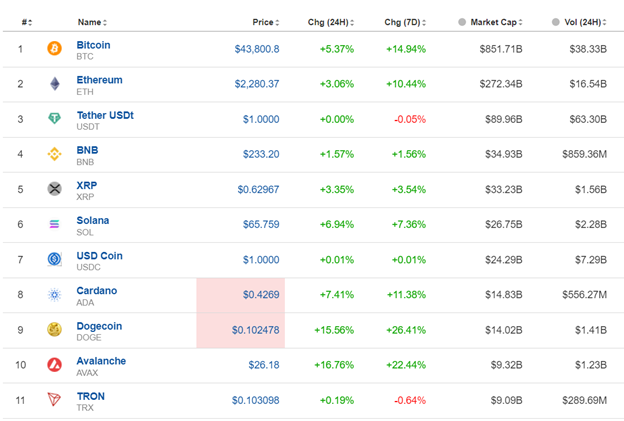

Crypto sorted by Highest Market Cap:

All Cryptos in the list experienced a surge as shown by the 24-hour column, meaning that the whole market is currently affected by fundamental factors.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4Hour Timeframe Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Even though the index this week broke the support of 15800 reaching the next support near 15700 it has not dropped significantly correcting for the recent upward movement to the upside. Indices remain resilient during this period and are pushed to remain at high levels. Currently, the index shows high volatility and moves sideways around the mean.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Price dropped sharply on the 30th Nov reaching the support near 75 USD/b, where it stayed in consolidation until experiencing the retracement back to the mean. It later experienced another drop on the 1st Dec breaking the support and reaching the next at nearly 74 USD/b. After breaking that too it reached the next at near 73 USD/b where it settled. The RSI was showing signals of a bullish divergence, however, yesterday Crude’s price showed its persistence to move lower, testing currently the support near 72 USD/b.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Gold experienced huge volatility at the beginning of this month, a surge on the 1st Dec and a reversal soon after with no complete retracement to follow on the 4th Dec. Currently Gold moves sideways keeping the path near the mean 2040 USD/oz. This was meant before the surge on the 1st Dec.

______________________________________________________________

______________________________________________________________

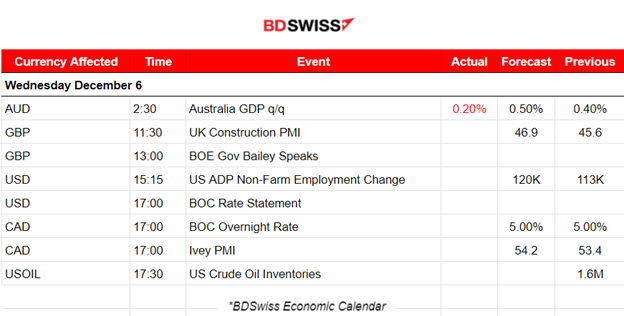

News Reports Monitor – Today Trading Day (06 Dec 2023)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

GDP in Australia was recorded lower than expected for the 3rd quarter. The impact on the market was minimal. Slight depreciation that soon faded.

- Morning–Day Session (European and N. American Session)

The ADP NF Employment change is expected to be reported higher, an optimistic figure regarding employment. However, we might see a surprise instead considering how negatively the labour market is currently affected by the elevated interest rates. Possible USD pairs intraday shock in this case at the time of the release at 15:15.

At 17:00 the Bank of Canada will decide on rates. It currently has a 5% figure and it is expected that it will keep it steady. The CAD pairs will probably see increased volatility at the time of the release and with no surprise, intraday shocks are not probable to take place.

General Verdict:

______________________________________________________________