PREVIOUS TRADING DAY EVENTS – 13 April 2023

Announcements:

The AUD has appreciated greatly at the time of the release causing an intraday shock to AUD pairs. With such numbers and growth, it is expected that the RBA will consider raising interest rates again. Policymakers paused hiking last week, however, economists’ expectations are that the cash rate will rise to 3.85%.

“The labour market is probably past its best but still very tight,” said Su-Lin Ong, chief economist for Australia at Royal Bank of Canada. “Today’s data likely reinforce the RBA’s tightening bias and we leave one more 25 basis-point hike in our profile.”

“Australia’s surprisingly-big surge in jobs growth in March raises the odds of a final 25-basis-point rate hike in May. The 1Q CPI report, due April 26, is the last major data point that could make or break the case for further tightening” — James McIntyre, economist.

The Federal Reserve will increase interest rates by another 25 basis points during its 2-3 policy meeting in May and this might be the last rate hike.

Applications for U.S. unemployment benefits increased to 239K, not far from the expected figure, which was 235K.

The data may signal that the market is starting to soften which is quite desirable by the Fed’s continuous rate hikes.

______________________________________________________________________

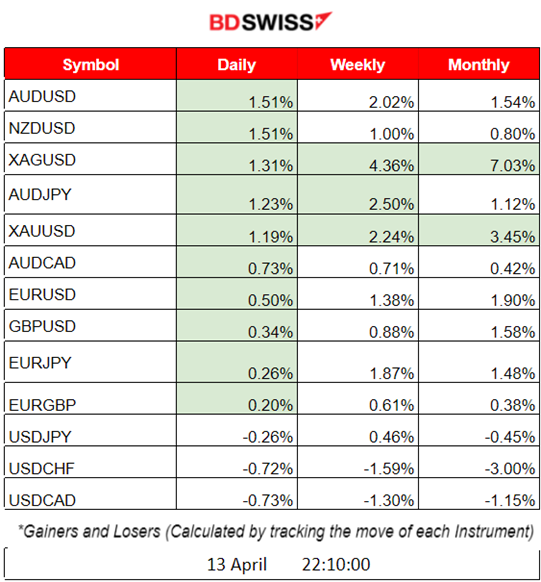

Summary Daily Moves – Winners vs Losers (13 April 2023)

- The USD depreciated greatly yesterday with the PPI data having the greatest impact. USD pairs with USD as the quote currency have been moving upwards. NZDUSD and AUDUSD gained the most yesterday with a 1.51% change.

- This week Silver is on top with 4.36% gain followed by AUDJPY and Gold (XAUUSD) with 2.5% and 2.24% gain respectively.

- This month Silver gained 7.03% followed by Gold with a 3.45% change.

______________________________________________________________________

News Reports Monitor – Previous Trading Day (13 April 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

At 4:30, Australia’s Employment Change and Unemployment Rate were released. The AUD/USD pair has climbed more than 25 pips since as the reports show the Australian economy added 53K jobs in March. The number is higher than the consensus of 20K but lower than the previous release of 64.6K. Additionally, the Unemployment Rate remained unchanged at 3.5% but lower than the 3.6% estimates.

- Morning – Day Session (European)

At 9:00, there was no significant impact on the GBP from the release of the monthly GDP figure which was reported to be 0%.

At 15:30 the U.S. PPI-related data and the U.S. Unemployment claims were released. At that time, the USD was greatly affected with depreciation. The DXY chart shows the fall at that time.

General Verdict:

FOREX MARKETS MONITOR

EURUSD 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

As the USD depreciates greatly following the recent figure releases regarding inflation and labour data the EURUSD moves further upward every day. Since the 11th of April, it has been on an upward trend.

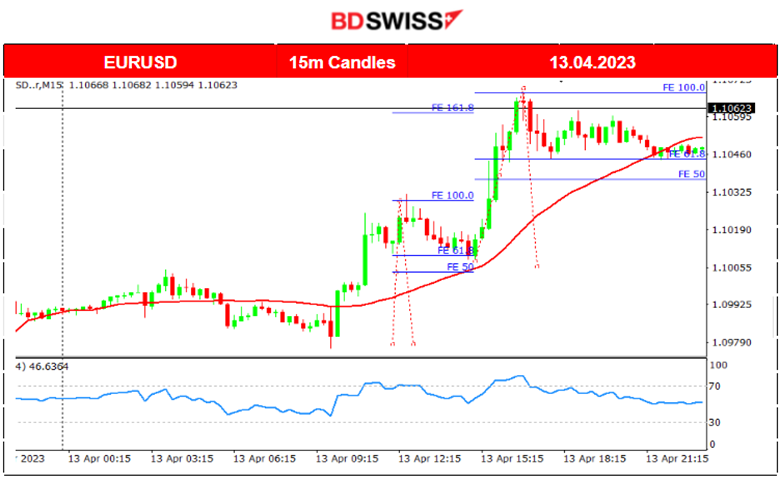

EURUSD (13.04.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

At 10:00, the pair started to move rapidly upwards. No scheduled release at that time. It retraced back to the mean afterwards.

At 15:30 it experienced an intraday shock due to the PPI news and moved higher due to the USD high depreciation. Then, retracement followed.

Trading Opportunities

The intraday shocks cause opportunities for catching retracements. Tricky though when there are no reversals. The price is moving on an intraday upward trend, so retracements might not take place. The Fibo tool identifies the 61.8% level that the price will probably return to as per the chart.

____________________________________________________________________

EQUITY MARKETS MONITOR

US30 (Dow Jones) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The index was moving upwards for days following an upward trend. Whenever the price went below the 30-period MA it showed resilience from falling. On the 12th of April, we notice again that the index moves downwards crossing the MA and signalling the end of this upward movement. However, on the 13th of April, it rapidly moves upwards.

Trading Opportunities

As per the RSI, the Price: higher highs, RSI: lower highs, technically speaking this indicates that at the NYSE opening, it would be good to look for support breaks and thus a drop during the trading day.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

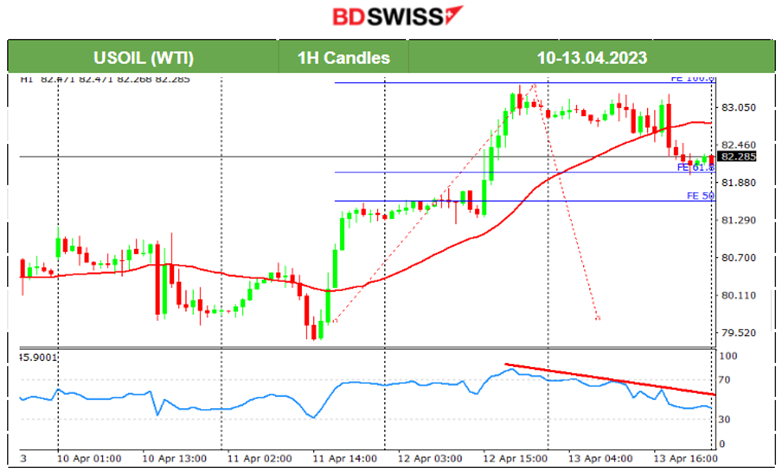

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The price of U.S. Crude oil started to show volatility again on the 11th of April, with rapid upward movement that continued to take place until the end of the trading day – the 12th of April. On the 13th of April, it was clear that it found resistance at 83.40 USD and eventually retraced back to the mean, the 30-period MA crossing it and moving even further downwards as it had broken important support levels.

Trading Opportunities

Since the price was moving upward for two consecutive days, it was anticipated that a rapid movement and retracement should follow after the price finds resistance. According to the chart, the Fibonacci expansion tool helps to identify the 61.8% retracement level.

Related Analysis on TradingView: https://www.tradingview.com/chart/USOIL/7NSycr9G-USOIL-coming-back-13-04-2023/

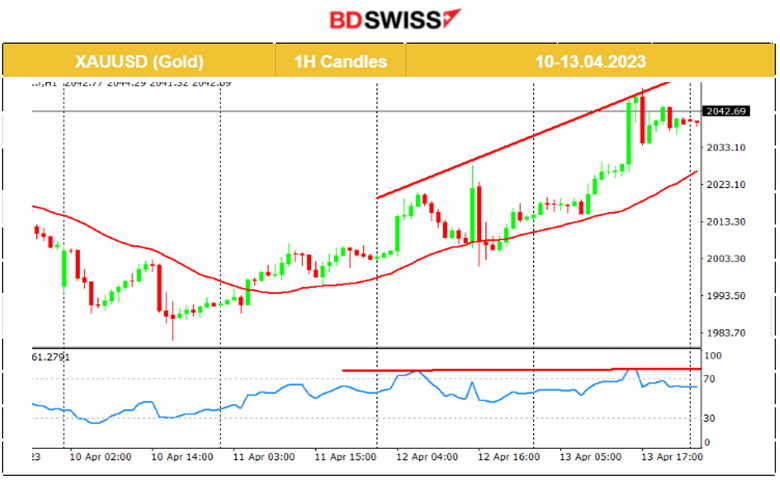

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

USD-related releases and the investor’s risk-off mood is pushing Gold higher. USD depreciates in general and Gold is reaching higher levels. It moves above the 30-period MA and continues to break resistances, especially yesterday, the 13th of April when we saw a rapid movement upwards intraday.

Trading Opportunities

The RSI roughly indicates that if Gold finds significant resistance then there will be a drop at least back to the mean. RSI highs are roughly lower, Price: higher highs.

______________________________________________________________

News Reports Monitor – Today Trading Day (14 April 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No significant news announcements and no important scheduled releases.

- Morning – Day Session (European)

At 15:30 the U.S. Retail sales figures are about to be released, probably causing an intraday shock for USD pairs.

The Preliminary UoM Consumer sentiment report is released at 17:00. There are 2 versions of this data released 14 days apart – Preliminary and Revised. The Preliminary release is the earlier and thus tends to have the most impact on the USD.

General Verdict:

______________________________________________________________