FX:

Commitments of Traders (CoT) report

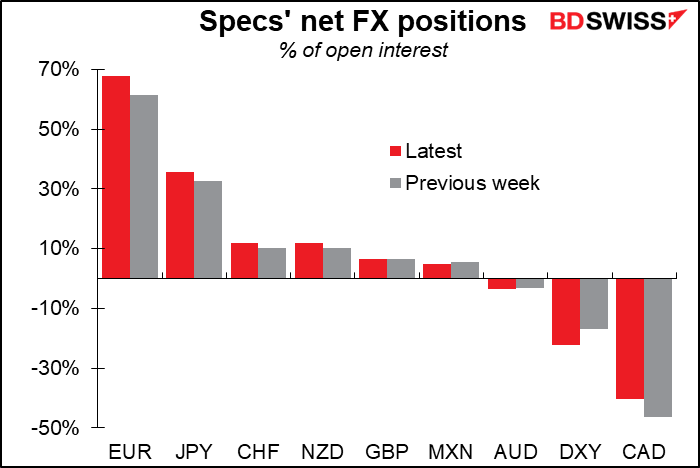

Speculators hit a record-long position in EUR this week. The position is not only long in terms of number of contracts, but also those contracts are heavily weighted toward the long side, as the “% of open interest” shows. A truly crowded trade that will take more news to push higher.

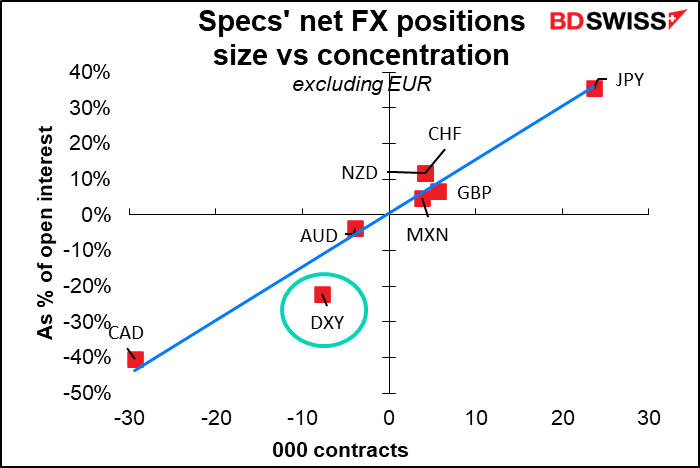

Concentration: At the same time, we can see the market’s pessimism about the dollar from the unusually high concentration of positions in the DXY index. The % of short open interest in the DXY is more concentrated than normal for the size of the outstanding position. What that means is that people are more negative toward the index than the number of contracts outstanding would indicate.

Aside from EUR, speculators increased longs in NZD and JPY while reducing longs in CHF, GBP and MXN. They added to AUD shorts but closed out CAD shorts.

It’s noticeable that their view on AUD is starting to become more pessimistic relative to the other two commodity currencies. Looking at the relative AUD and NZD positions, after being fairly flat for a few weeks, the market is starting to take a more bullish position toward NZD than AUD. But that hasn’t been reflected in the price of AUD/NZD yet.

Asset managers vs leveraged funds

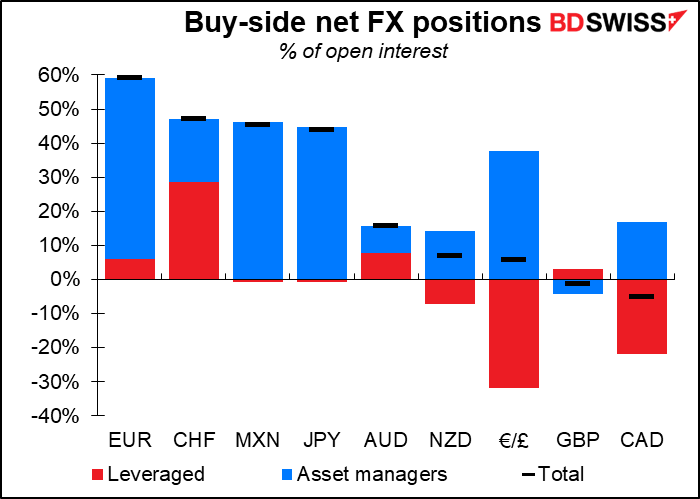

Both asset managers and leveraged funds are heavily long EUR and both are long CHF and AUD. But they have different opinions on other currencies. It’s hard to see but leveraged funds have small shorts in JPY whereas asset managers have large longs – good call! Their view also differs on NZD and CAD.

Retail investors cut most of their positions last week, including their long EUR positions although they remain extremely long. They are also bullish all the commodity currencies, including AUD – a difference of opinion vs the pros.

Risk reversals (RR)

While AUD remains the currency most insured against – the pair on the extreme left is EUR/AUD and the pair on the extreme right is AUD/JPY – it’s also noticeable that AUD/USD was the RR that increased most in price over the week, meaning that worries about AUD depreciating vs USD are falling. Other AUD pairs showed similar moves, although not to the same degree. In other words, concerns about a fall in AUD declined somewhat, as did NZD/USD, while the USD/CAD RR cheapened a little. It seems the market is getting more confident on global growth.

Nonetheless, the USD/JPY RR showed the biggest decline. That could be a reaction to Friday’s news about PM Abe resigning.

Gold & Silver

Exchange-traded funds (ETFs): ETFs were small buyers of both gold and silver this week – but “small” is the operative word.

Commitments of Traders (CoT) report

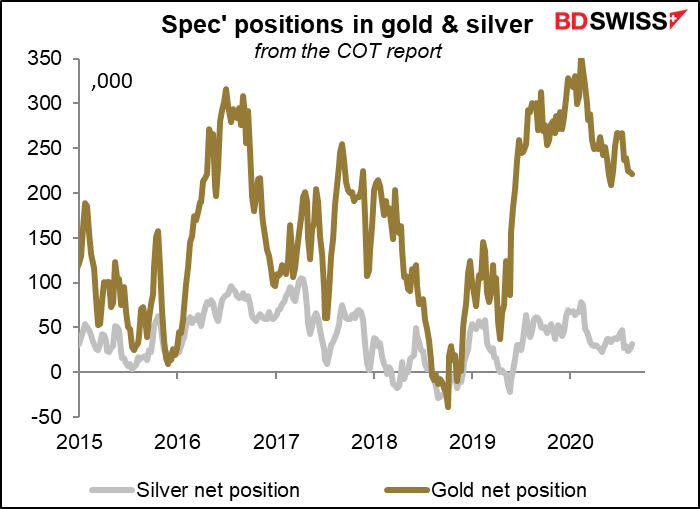

As we saw in the table above, speculators in the futures market reduced their net longs in gold but increased their holdings of silver during the week. Still, the silver position is relatively small.

Professional positioning

Gold: Managed money continues to reduce their gold position, while “other reportables” are picking up the slack (See “explanations and definitions” for explanations and definitions.)

It’s the opposite story in silver however as managed money increased their longs and “other reportables” went deeper into short.

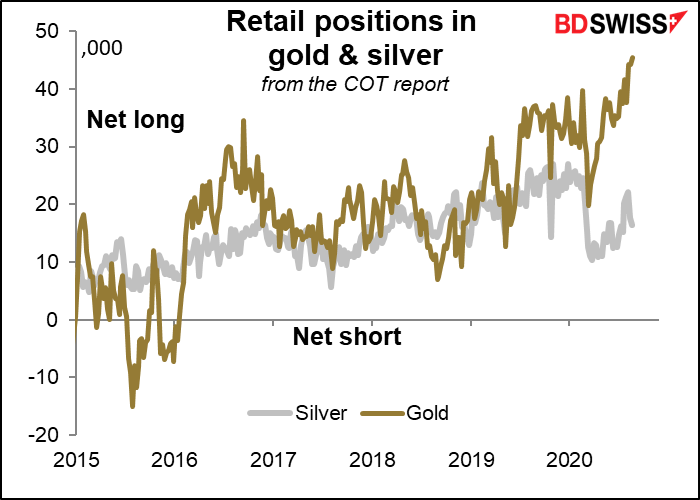

Retail positions: The retail trade is getting longer and longer gold, but having doubts about silver – purchases there have stalled.

Risk reversals

The RRs also suggest people continue to get less euphoric about silver. While the gold RR was down only slightly over the week (from 2.60 to 2.58), the silver RR fell further again to 4.58 from 5.49. It was 8.04 a week before that.

Equity positioning

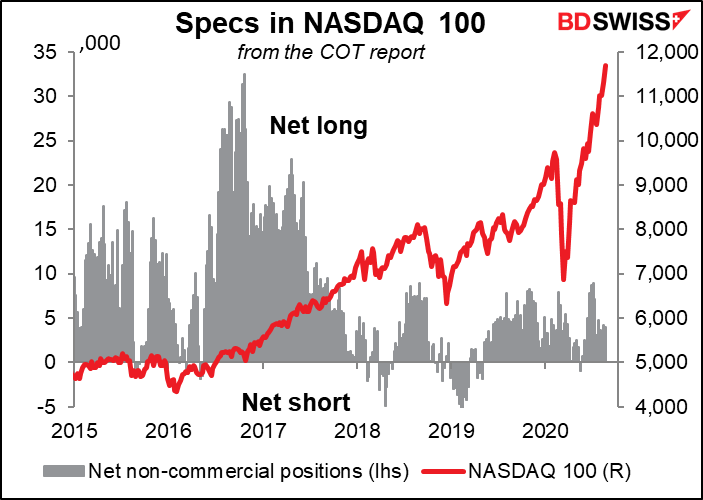

Speculators remained tiny shorts in the DJIA and tiny longs in the NASDAQ 100. It’s clear that the futures markets aren’t driving this rally.

Leveraged investors are long the DJIA but short the NASDAQ. I wonder if that’s hedging positions in the cash market.

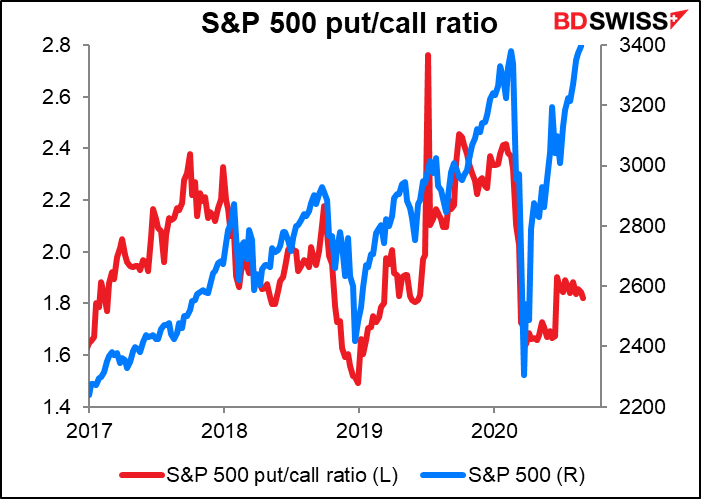

Put/call ratios: The put/call ratio in the S&P 500 is declining slowly. Unlike in 2019, people are not so actively buying insurance against a plunge in the market. I guess this would indicate some success on the part of the Fed – they think they have a “Powell Put” instead.

It’s a noticeable contrast with the DAX, where the put/call ratio has been climbing along with the index. No comparable “Lagarde Put” I guess.

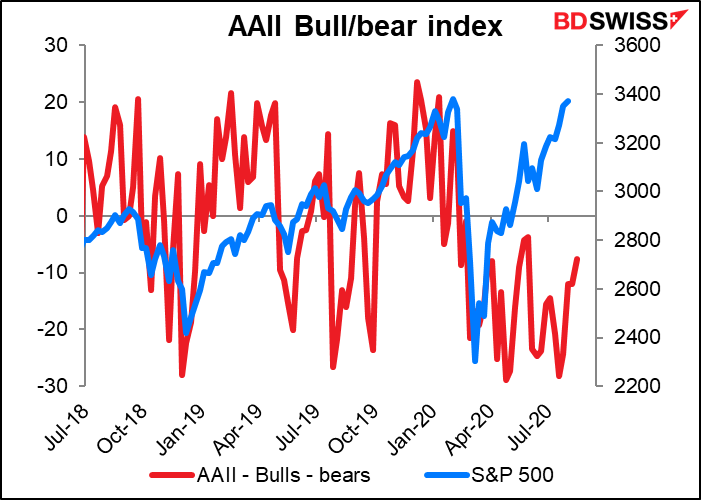

AAII “Bull/Bear” Index (see “Explanations and definitions” below)