Commitments of Traders (CoT) report

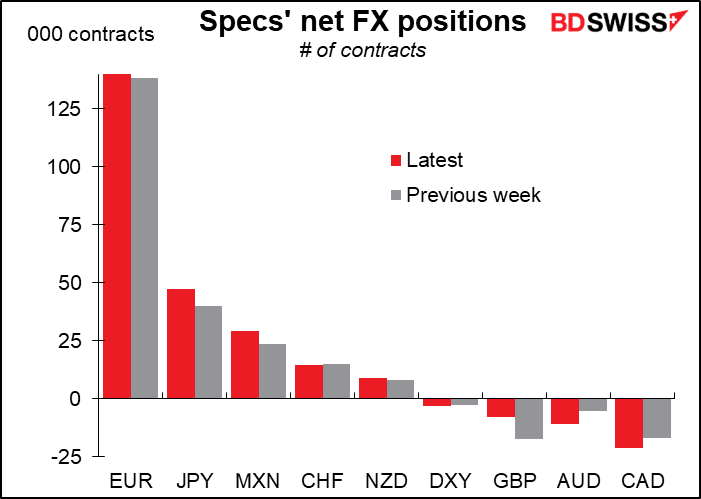

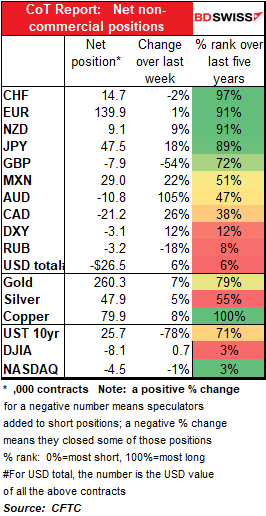

After eight weeks of largely reducing their USD shorts, speculators have been increasing those short USD positions for the last two weeks. In EUR, their largest position, they added 4.3k contracts two weeks ago (week to 24 November) and a further 1.6k contracts in the latest week (to 1 December). The biggest move in the latest week though was in JPY, where they added 7.3k contracts. The reduction in GBP shorts was also noticeable.

Against that, specs increased their AUD and CAD shorts, but increased their NZD longs a bit.

The moves seem somewhat contradictory. Short USD, long EUR is a “risk-on” position but increasing JPY longs and AUD & CAD shorts would be a typical “risk-off” position.

Leveraged funds were also bullish EUR – they flipped from short to long – and less bullish or more bearish the commodity currencies. They didn’t change their JPY positions notably, however. They too cut their GBP shorts.

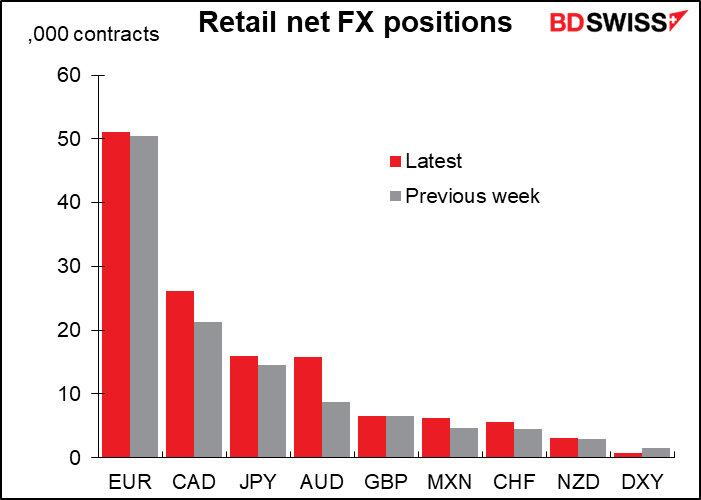

Retail investors basically sold the dollar against everything. Only their GBP position stayed largely unchanged.

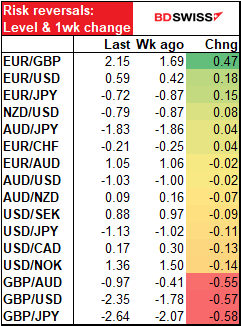

Risk reversals: caution around GBP

Rising GBP volatility was in focus last week. EUR/GBP RRs rose substantially, while the negative GBP/JPY, GBP/USD and GBP/AUD RRs all became more negative. Elsewhere with the exception of EUR/USD most of the other RRs cheapened (the positive ones became less positive, the negative ones became less negative).

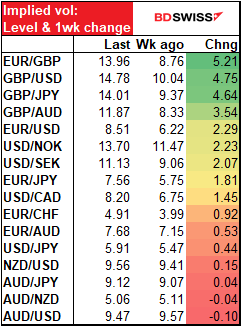

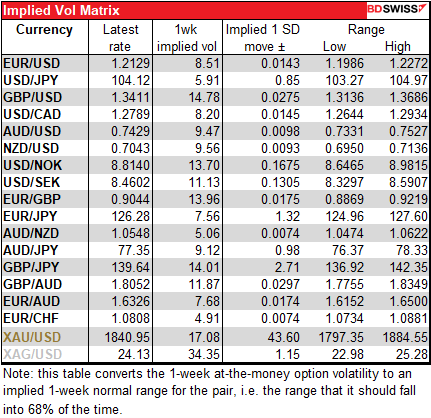

Implied Volatility: higher across the board, especially GBP

The implied volatility of nearly every pair I follow rose last week, AUD/USD being the sole exception. The implied vol of the GBP pairs rose particularly strongly, reflecting increased nervousness around Brexit.

Gold & Silver

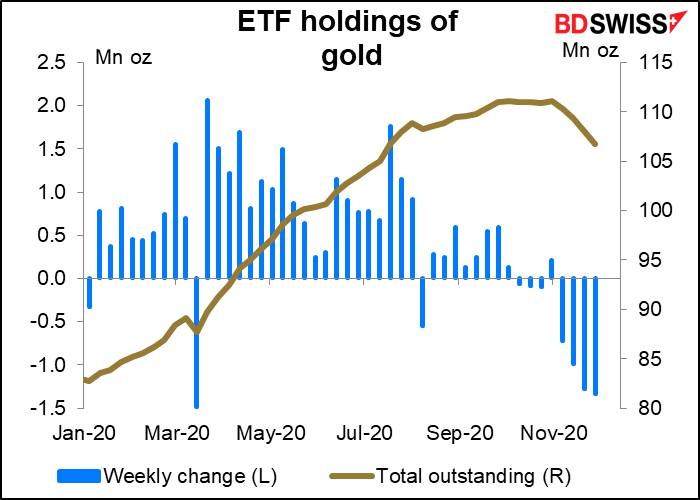

Exchange-traded funds (ETFs):

This was the fourth consecutive week of a reduction in ETF holdings of gold.

This is not by the way the longest or deepest sell-off of gold ETFs by any means. Back in 2013 there were 26 consecutive weeks of falling holdings.

Silver however showed a small increase.

Platinum holdings have risen for two weeks in a row.

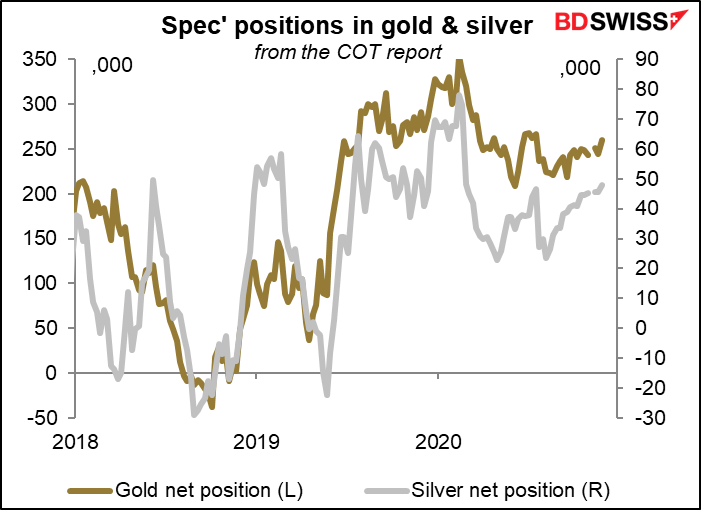

Specs’ positioning: adding to longs

Contrary to what happened in the ETF world, in the futures, speculators added to their long positions in both gold and silver.

Retail positioning

But retail traders reduced their longs.

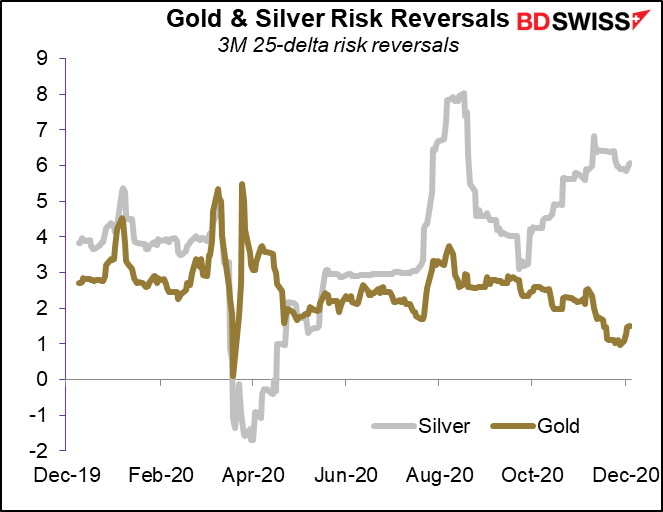

Gold & silver risk reversal

Gold and silver RRs both edged up a bit, indicating some increasing bullishness, but nothing that aggressive.

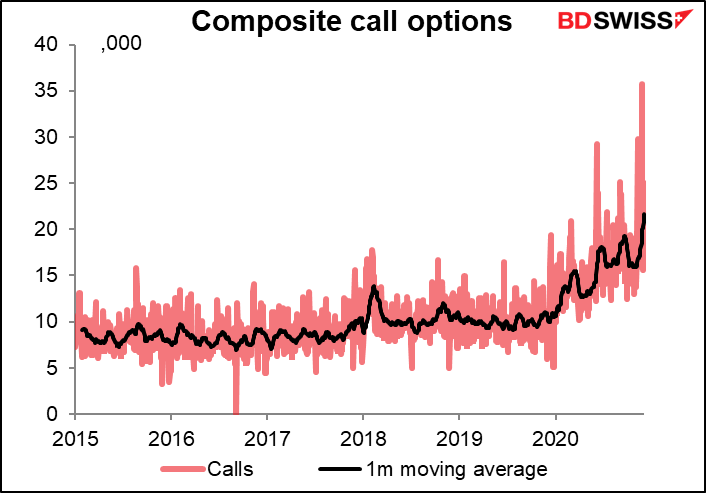

Equity positioning: Put/call ratio hits record low

The composite put/call ratio for the US stock markets recently hit the lowest level since January 2012 (0.37 on 24 November).

The bullishness in the market can be seen by the fact that the number of calls hit a record high that day. The number of put options on the other hand has remained relatively steady.

The put/call ratio backed up slightly in the last week, but remains unusually low.