FX: Commitments of Traders (CoT) report

Speculators

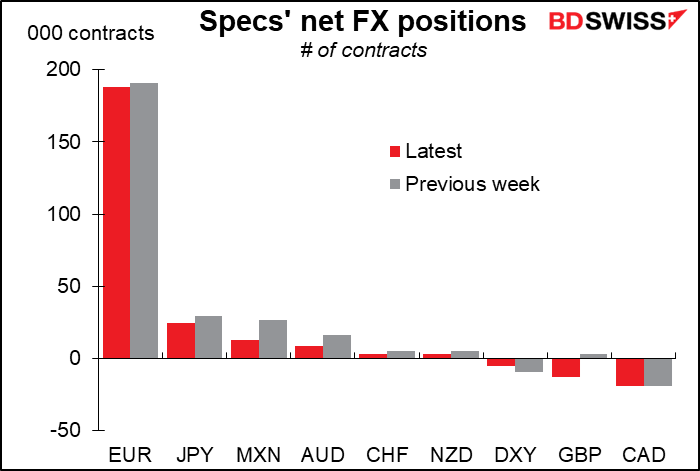

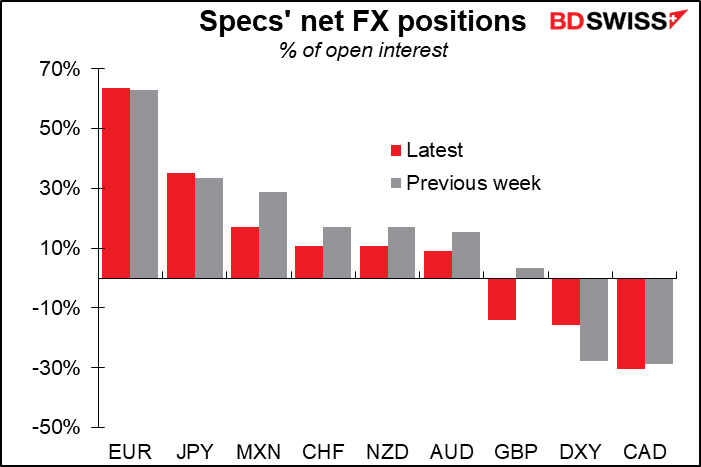

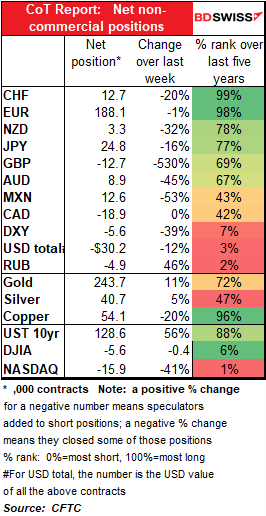

Speculators turned less bearish on the dollar in the latest week. The biggest change was in GBP, where they flipped from net long to net short for the first time in seven weeks. Second was a further reduction in EUR longs. After that, reduction in long JPY, AUD and CHF positions was about the same. CAD positions were barely changed and remain their biggest short. Elsewhere, they reduced their short DXY index position.

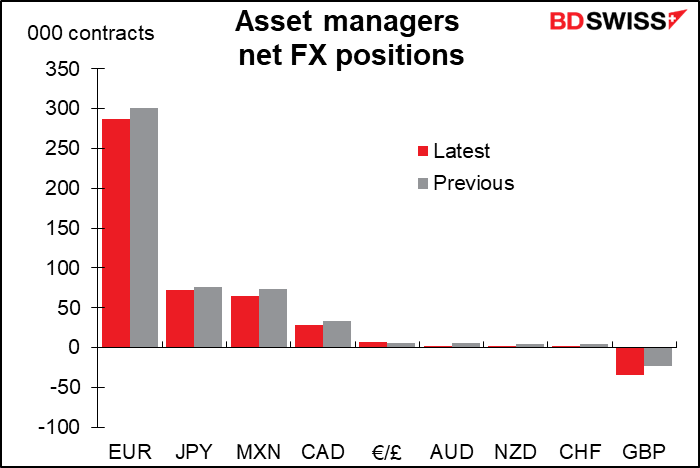

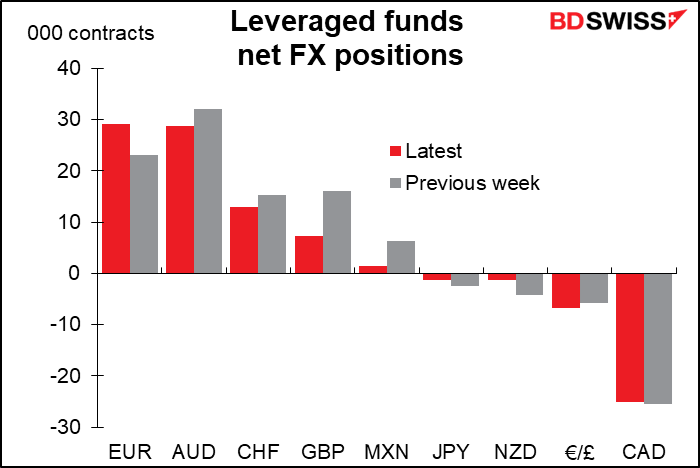

Asset managers vs leveraged funds: different strokes for different folks

Asset managers reduced their EUR holdings, but hedge funds increased theirs. They also differ on GBP and CAD – asset managers increased their GBP shorts, which are their biggest short positions, while they remain long CAD. Hedge funds on the other hand are still long GBP (although they reduced their positions noticeably) and heavily short CAD (which barely changed).

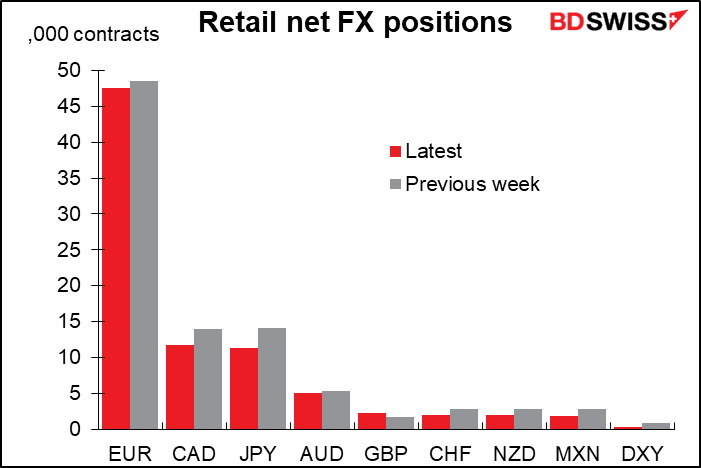

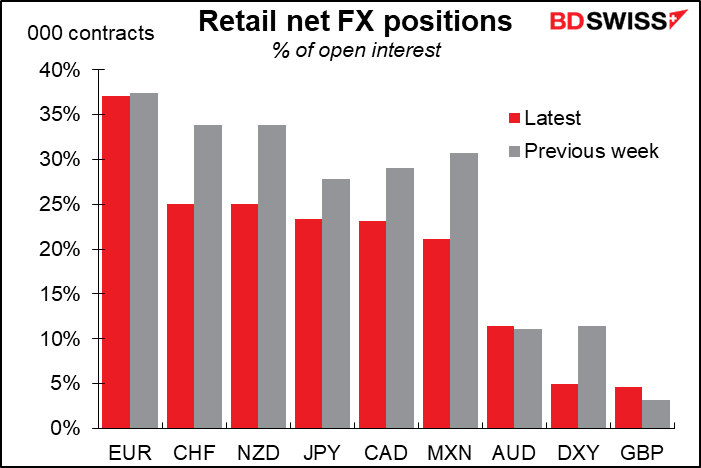

Retail investors: long everything

Retail investors are long everything, although generally speaking they cut their positions across the board in the latest week. They only increased their GBP positions, but those are tiny anyway.

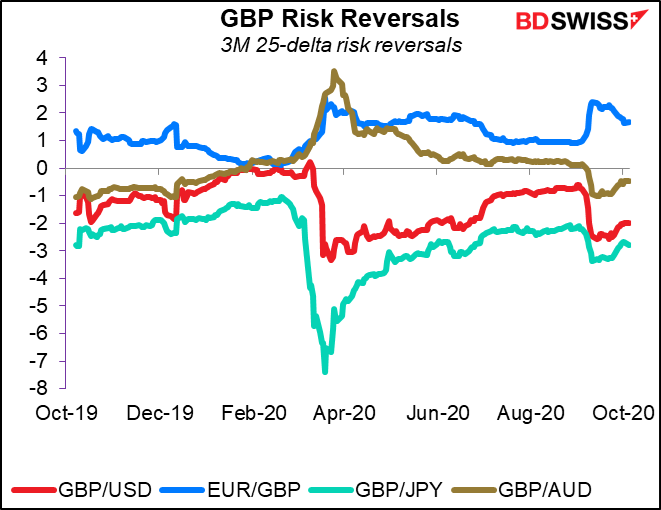

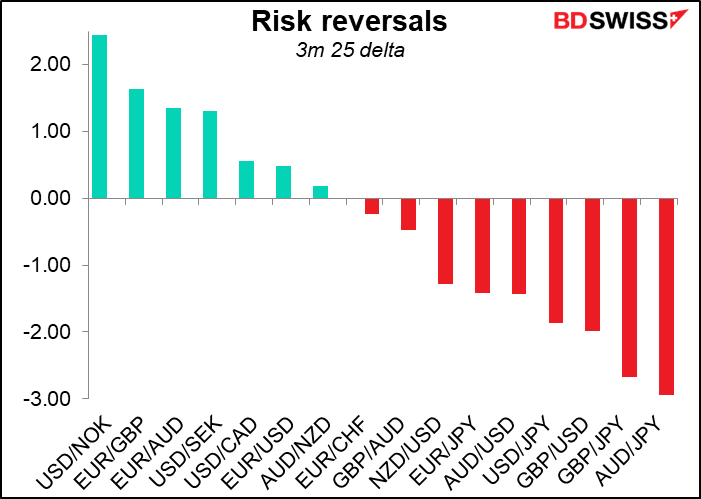

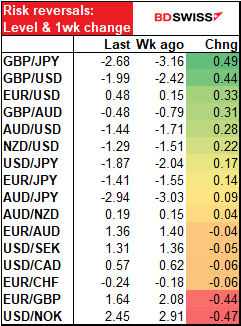

Risk reversals (RR): less bearish GBP

The key feature over the last week was the big drop in demand for GBP downside protection, or maybe it was the big increase in demand for GBP upside potential. Either way, GBP/JPY, GBP/USD and EUR/GPB all saw significant moves that indicated less concern about GBP falling. EUR/USD risk reversals, which were pretty much flat a week ago (0.15), moved further into positive territory (0.48).

The market still has the biggest downside price on AUD/JPY.

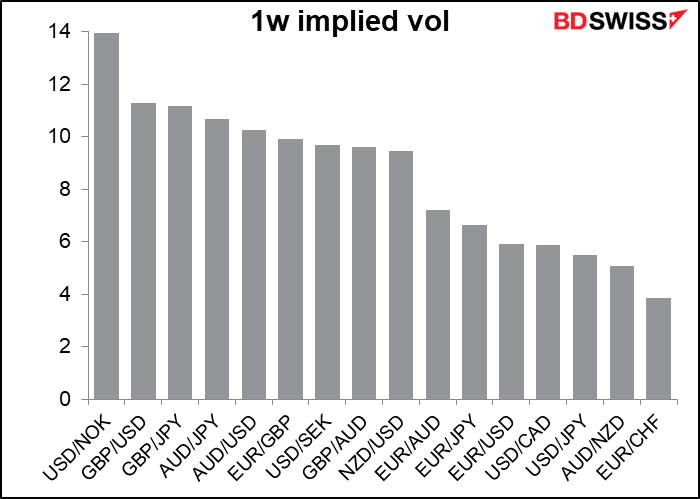

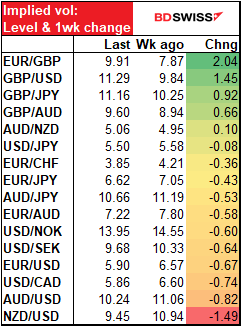

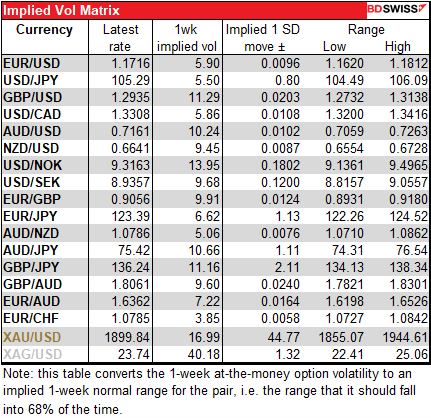

Implied volatility: GBP volatility increases

As with the risk reversals, we saw implied volatility increase for all the GB pairs. On the other hand, implied vol fell the most for the three commodity currencies: NZD/USD, AUD/USD and USD/CAD.

Gold & Silver

Commitments of Traders (CoT) report

Professional positioning

Specs’ net gold longs rose slightly last week, but remain within the recent range. It’s not a significant move.

Silver let longs continue to rise from the recent bottom, but there too they’re still a little below the level of July.

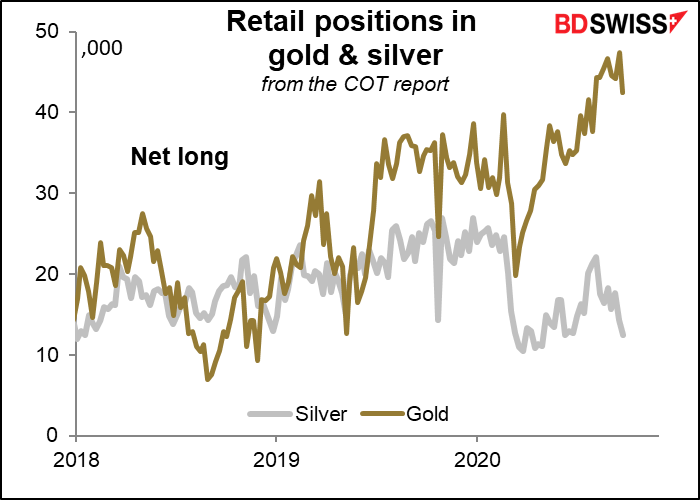

Retail positioning

Retail on the other hand cut their net longs in both metals.

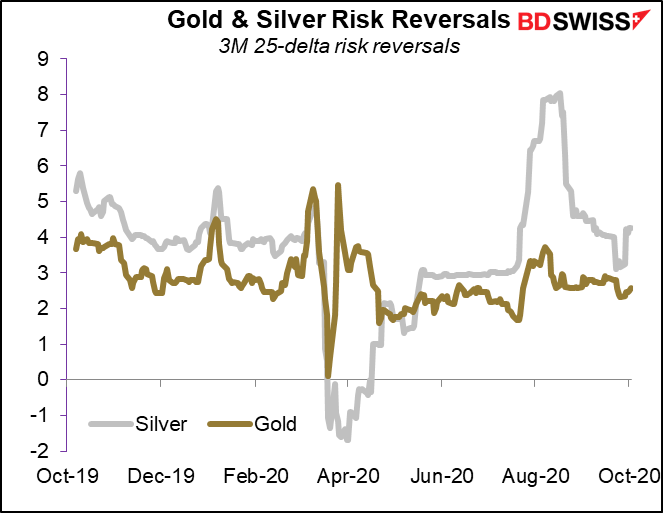

Risk reversals

The risk reversals in gold continue to move sideways with no trend. After a sudden decline, silver RR are moving back up, showing perhaps increased optimism about the metal.