Rates as of 04:00 GMT

Market Recap

Oil is at the forefront of markets today – Brent is up 15.6% and WTI up 13.1% from Friday morning’s levels after having what I think was the best day in oil history on Thursday.

Trump’s bizarre tweets last week about cutbacks in Saudi and Russian oil production were clearly incorrect, but they did create a flurry of activity. Lots of talk, little action though. And not all the talk was helpful – initially it looked like there might be an emergency OPEC+ meeting today, but after Saudi Arabia and Russia exchanged some not-nice comments about who was to blame for the oil glut, the OPEC+ meeting got delayed until Thursday. I guess these guys don’t observe Passover.

The problem is that the Saudis won’t cut unless the Russians do, and the Russians probably won’t cut unless the Americans do. Some US producers want the bodies that govern the US oil industry (the Texas Railroad Commission and the Oklahoma Corporation Commission) to mandate pro-rationing in order to avoid strain on pipeline and storage infrastructure and to prevent oil from being sold at levels that represent “economic waste.” However, there are questions about whether a coordinated US production cut would be legal under US anti-trust legislation. A representative of the Texas Railroad Commission was invited to participate in the OPEC+ talks but won’t. On the other hand, Canada (4.5mn b/d) has signalled it’s willing to cooperate and the Minister of Energy of Alberta, Canada’s main oil-producing province, will indeed participate in the talks.

As you can see, OPEC plus Russia together produce around 44mn barrels a day (b/d) of oil. Reuters reports that OPEC+ is discussing a cut of about 10mn b/d or 10% of global supply. But there’s no way OPEC+ is going to cut 25% of their output without the US (which produces 14mn b/d) going along. Especially with the global oil glut estimated at somewhere around 20mn – 30 mn b/d, they would just be making things easier for the US without really doing much to shore up prices – just slow the decline.

There were some more hopeful comments from both Russia and Saudi Arabia over the weekend that pushed oil prices higher. In particular, Saudi Aramco always announces its official selling prices by the fifth of the month, meaning it should’ve announced the price for May on Sunday. But it took the extraordinary step of delaying the announcement until the 10th so that it can take the outcome of the OPEC+ meeting into account. Aramco’s not only sets the price for Saudi crude but also in effect for several other Gulf producers as well, in total over 12mn b/d. The delay is important not only because of the price but also because contracts are based on these prices. Contracts can’t be signed until the prices are determined. Thus by delaying the price decision for May they are also delaying the volume decision for May. This leaves them with some flexibility to cut the amount that they sell if OPEC+ agrees on production curbs. It’s an optimistic sign.

One strong incentive for OPEC+ to come to an agreement: the FT reports that US and Canadian officials are discussing imposing tariffs on Saudi Arabian and Russian oil imports if the two don’t quickly reach a deal to end their price war. So like with the economic bailout etc., the Republican Party has shown once again that its belief in free markets only applies when the Democrats are in control, not when Republicans will have to take the fallout.

CAD (white line) has benefited from the rise in oil prices (orange line, inverted). I think it can still rally further in line with the big jump in oil, especially if it looks further like OPEC+ might come to an agreement. However, there’s no doubt that the Canadian economy has been badly affected by the coronavirus. Thursday’s Canadian employment data is expected to show the unemployment rate leaping from 5.6% to 7.5% as an unprecedented 500k people lose their jobs – more in one month than during the entire Global Financial Crisis.

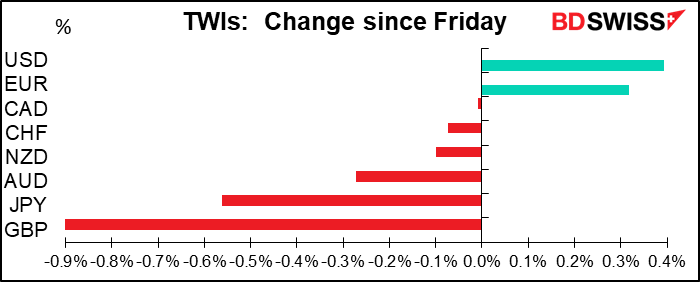

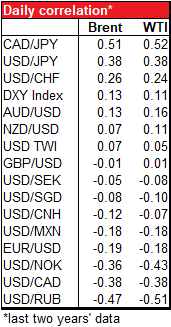

NOK and RUB should also benefit from higher oil prices. Surprisingly, USD/JPY is as sensitive to oil prices as USD/CAD is, but with the opposite sign. That makes CAD/JPY the best way to play oil prices in the FX market. (RUB/JPY and NOK/JPY are also highly correlated with oil, but I expect that spreads would be wider.)

GBP is sharply lower this morning on news that UK PM Johnson has been hospitalized with the coronavirus. A statement from his office said he “has tonight been admitted to hospital for tests. This is a precautionary step, as the prime minister continues to have persistent symptoms of coronavirus 10 days after testing positive for the virus.” If Johnson becomes too sick to work, foreign secretary and first minister of state Dominic Raab is expected to fill in. But apparently there is no official succession order in the UK.

Otherwise, it’s hard to say whether we’re seeing a “risk on” or “risk off” market this morning. The stock market is saying “risk on.” Asian stock markets are mostly higher, except China and the constantly lower India (far and away the worst-performing market in Asia). S&P 500 futures are indicated up 3.4% at the time of writing. But in the FX market, JPY is down but AUD and NZD are both down too.

EUR is up this morning ahead of tomorrow’s Eurogroup meeting (the informal group of finance ministers of the Eurozone countries). Press reports suggest that the group will be debating proposals to give to the European Council for a centralized response to the virus. This is likely to consist of a healthcare funding plan, credit guarantees and an EU-wide unemployment scheme to support companies that keep workers on the payroll over this period. One of the reasons for EUR weakness recently has been the lack of a coordinated response, in contrast with the UK and the US (at least, in terms of fiscal & monetary policy). A package like this that presents a strong EU-wide policy could help to boost the euro.

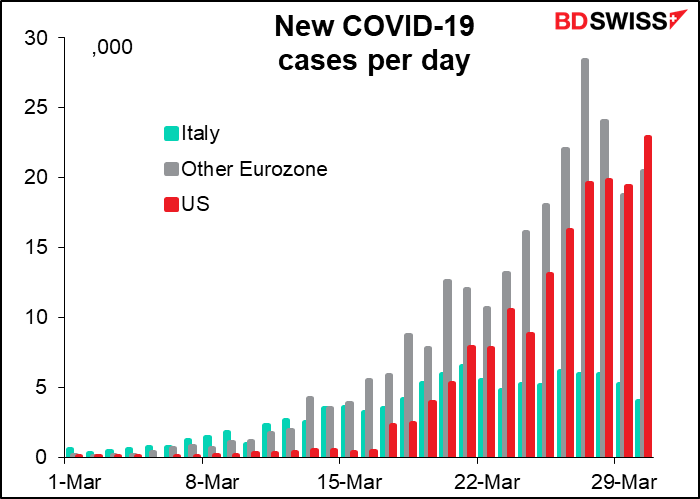

Similarly there is talk of a Japanese stimulus package. Press reports also suggest that PM Abe is set to announce a state of emergency, perhaps as early as today. The fiscal plans may help JPY, but admitting that the number of virus cases is rising sharply may dent Japan’s image, especially as cases in Europe seem to be leveling off. (But US cases seem to be accelerating.)

Commitments of Traders (CoT) report

The CoT report showed an interesting conflicting move: an increase in both long EUR positions and also an increase in long DXY (the USD index).

They reduced their long JPY and GBP and increased their short AUD, but the increase in long EUR and decrease in short CAD was enough to push their short USD position even shorter. So they are increasingly long DXY and increasingly short USD in terms of individual currencies.

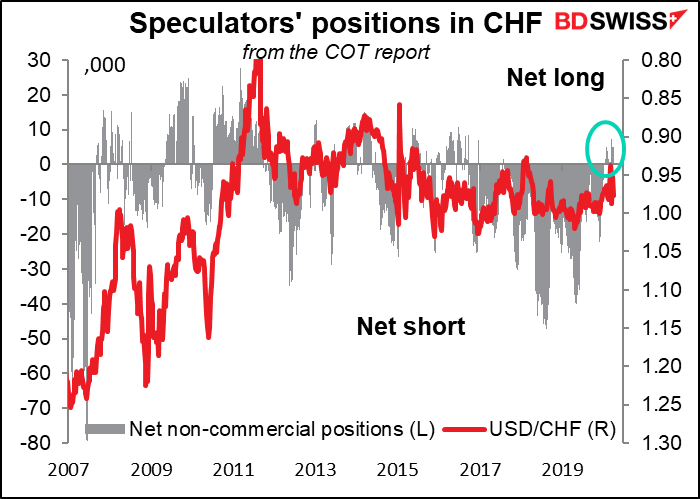

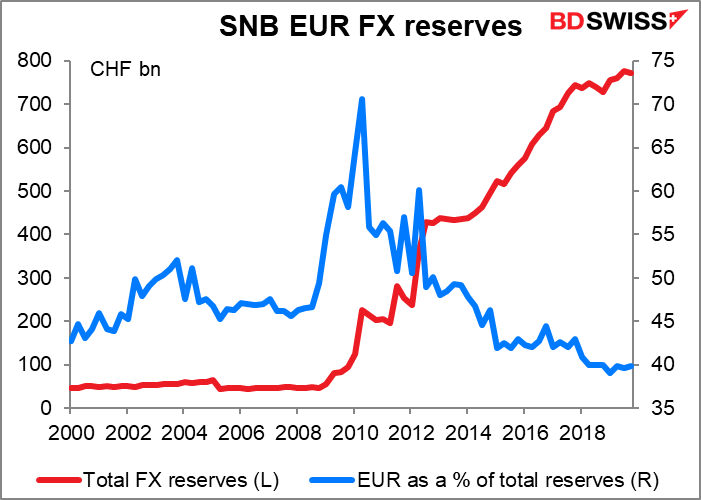

They only increased their long CHF position a bit. Nevertheless, it looks rather extended – it’s in the top 90% of the last five years. But that’s just because specs have largely been short CHF for the last five years. Looking back at 2008-2010, there seems to be plenty of room for them to increase their long CHF positions if they believe, as I do, that the Swiss National Bank is having to intervene more and more to keep the rate steady (see below). It’s possible that the SNB adjusts its EUR/CHF target down somewhat, or that it starts holding more of its reserves in EUR, and lets USD/CHF move.

Today’s market

There are only two items of market significance on the schedule today – the Swiss National Bank data on sight deposits this morning and the Reserve Bank of Australia meeting overnight. We’ll take them in that order, then discuss the other indicators.

Every Monday the Swiss National Bank (SNB) publishes data on sight deposits. These are a proxy for the SNB’s intervention in the FX market. When the SNB intervenes, it buys foreign currency from the banking system. It pays for that foreign currency by creating CHF and crediting its counterparty’s account at the SNB. The commercial bank then passes the CHF to the ultimate buyer, but at the end of the day the money remains in the Swiss banking system and remains as a liability on the books of the SNB.

It’s well worth watching this intervention nowadays, because it’s reached significant levels. Last week it was CHF 11.6bn, similar to the scale of the 2012 Euro crisis and the amount in the week or two preceding the collapse of the CHF floor in January 2015.

This large-scale intervention may be one reason for the weakness of the euro against the dollar. It’s likely that the SNB intervenes mostly in EUR/CHF to keep the EUR/CHF rate from declining too far (i.e., to prevent CHF from appreciating against EUR). Switzerland does 42% of its trade with the Eurozone, not to mention the constant back-and-forth of its citizens and EU citizens between the two currency zones. EUR is therefore by far the most important currency for Switzerland. However, for one reason or another – diversification of reserves? Limited availability of investment alternatives? – it doesn’t keep even the majority of its reserves in EUR. The share of reserves kept in EUR peaked in Q2 2010. It’s been fairly steady at around 40% since 2018 (more or less matching the percent of trade done with the Eurozone).

It’s noticeable that even as the country’s total reserves have been rising, the percent held in CHF has been falling. What do they do with the money? Around 34% of it goes into USD – almost as much as is in EUR.

In short, the SNB first buys EUR against CHF to keep the CHF from appreciating vs EUR. It then sells some of the EUR for other currencies, notably USD, to diversify its reserves. This intervention will tend to weaken EUR vs USD and perhaps other currencies, such as JPY (9.6% of total reserves) and GBP (6.6%).

RBA meeting: don’t expect much

The Reserve Bank of Australia (RBA) meets overnight. I expect them to be on hold at this meeting. The RBA cut its cash rate by 25 bps at their regularly scheduled meeting 3 March and then held an emergency meeting on 19 March at which they

- cut the cash rate another 25 bps to 0.25%, effectively the bottom

- reinforced the impact of cut with aggressive forward guidance — promised to keep the cash rate at that level “until progress is being made towards full employment,” which in the current circumstances effectively means “indefinitely”

- instituted a form of Japan-style “yield curve control” by promising to target the yield on the benchmark 3-year Australian government bonds at around 0.25;

- introduced a term funding facility for the banking system with support for business credit, especially to small- and medium-sized businesses; and

- adjusted the interest rate on banking balances held at the RBA (a technical move).

RBA Gov. Lowe made a speech following the moves in which he made it clear that this is pretty much as far as the RBA wants to go. He said, “The term funding scheme and the three-year yield target are both significant policy developments that would not have been under consideration in normal times. They both carry financial and other risks for the Reserve Bank and they both represent significant interventions by the Bank in Australia’s financial markets.”

The shadow policy rates described above quantitatively corroborate Lowe’s view. According to the shadow policy rate calculations, the RBA’s new policy is the third-most aggressive among the central banks, after the ECB and the BoJ. That’s quite a rapid move for the Bank.

Accordingly, I would be very surprised if they announce any further measures at this meeting. I expect that they’ll review the measures, discuss how well they’re going, and wrap up with a statement about how the current measures “will support jobs, incomes and businesses through this difficult period and they will also assist the Australian economy in the recovery.”

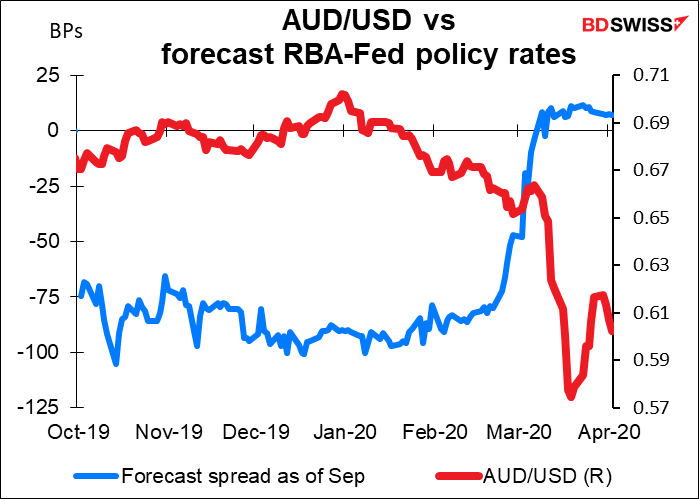

In any case, does it matter at this point for the FX market? Often currency pairs are driven by interest rate differentials, or more accurately by the expected change in interest rate differentials. In this case though AUD/USD has completely divorced from interest rates. The expected interest rate gap between Australia and the US this coming September – recently in favor of the US by 100 bps – has collapsed completely to the point where it’s now in favor of AUD by a couple of bps. Nonetheless, AUD/USD has collapsed. It appears that global economic conditions, rather than interest rate differentials, are driving AUD. We have to listen to the epidemiologists – not the central bankers – for the outlook for AUD.

Other indicators today

As I’ve said before, most indicators aren’t that important nowadays, because they relate to the liminal time when the Western world was just noticing the COVID-19 virus. They do not reflect the full impact of the countermeasures, most of which only went into place in the latter half of March. Accordingly they maybe can tell us what the world was like then, but they can’t shed much light on what the world is like now, much less on what it will be like in three months.

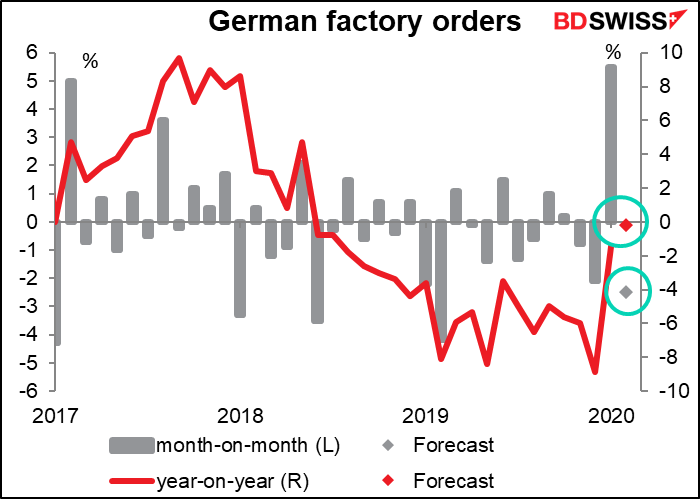

German factory orders are expected to be weak in February. The market looks for a 2.5% mom drop, which would be the steepest mom decline since -4.2% in the like year-earlier period (which is why the yoy comparison shows some improvement). It makes sense that as the virus progressed around the world, orders would slow.

Today’s German factory orders will as usual be followed tomorrow morning by German industrial production for the same month. That’s not expected to be particularly wonderful either, with production forecast to drop both on a mom basis and yoy.

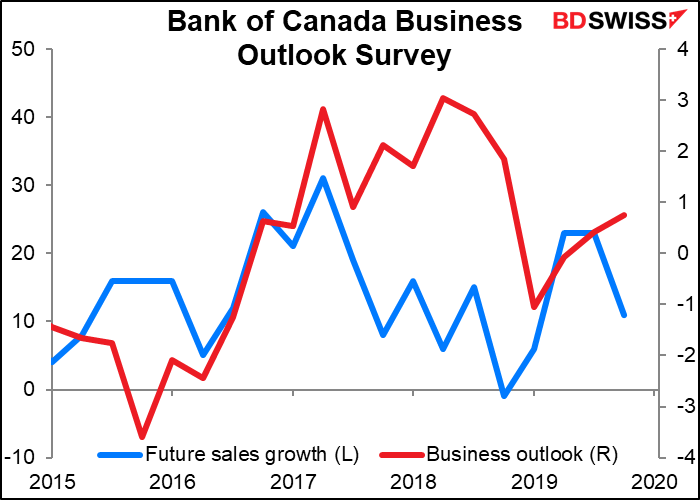

The Bank of Canada’s business outlook survey will give us a snapshot of business optimism going into this crisis. Ordinarily, the survey results are “part of the information that feeds into the monetary policy decision-making process,” according to the Bank of Canada, but of course people’s views are changing rapidly. The survey is done through in-person interviews “over a three-week period during each quarter,” according to a BoC paper describing the survey, but unfortunately it didn’t say exactly when during the quarter that period was. My guess is that it’s relatively recent, because the survey is probably aimed at informing next week’s BoC meeting (15 April). Nonetheless, things are changing rapidly and the outlook could change quickly. Furthermore, it’s questionable what else the BoC could or would do at this time – it’s probably more sensitive to medical surveys than business surveys.

Japan’s labor cash earnings are expected to go up 0.2% yoy. Funny, that was also what economists forecast last month. Maybe they’ve realized that this indicator isn’t going to affect the markets anyway and so they just submit the same forecast every month.

Australia’s trade data will be announced three hours before the RBA meeting. I wouldn’t dismiss this indicator completely – it could still be important, because it deals with February, the worst month of the crisis for China, which accounts for 39% of Australia’s exports. By comparison, the advanced economies take 41% (mostly Japan @ 17%). Therefore if the country maintained its trade surplus in February – as the market expects — it’s likely to hold up reasonably in the future as well – the recovery in China could offset some if not all of the decline in the advanced economies. (Although of course Chinese economic activity is affected by their trade with the advanced economies too, so there are second-round implications to consider.)